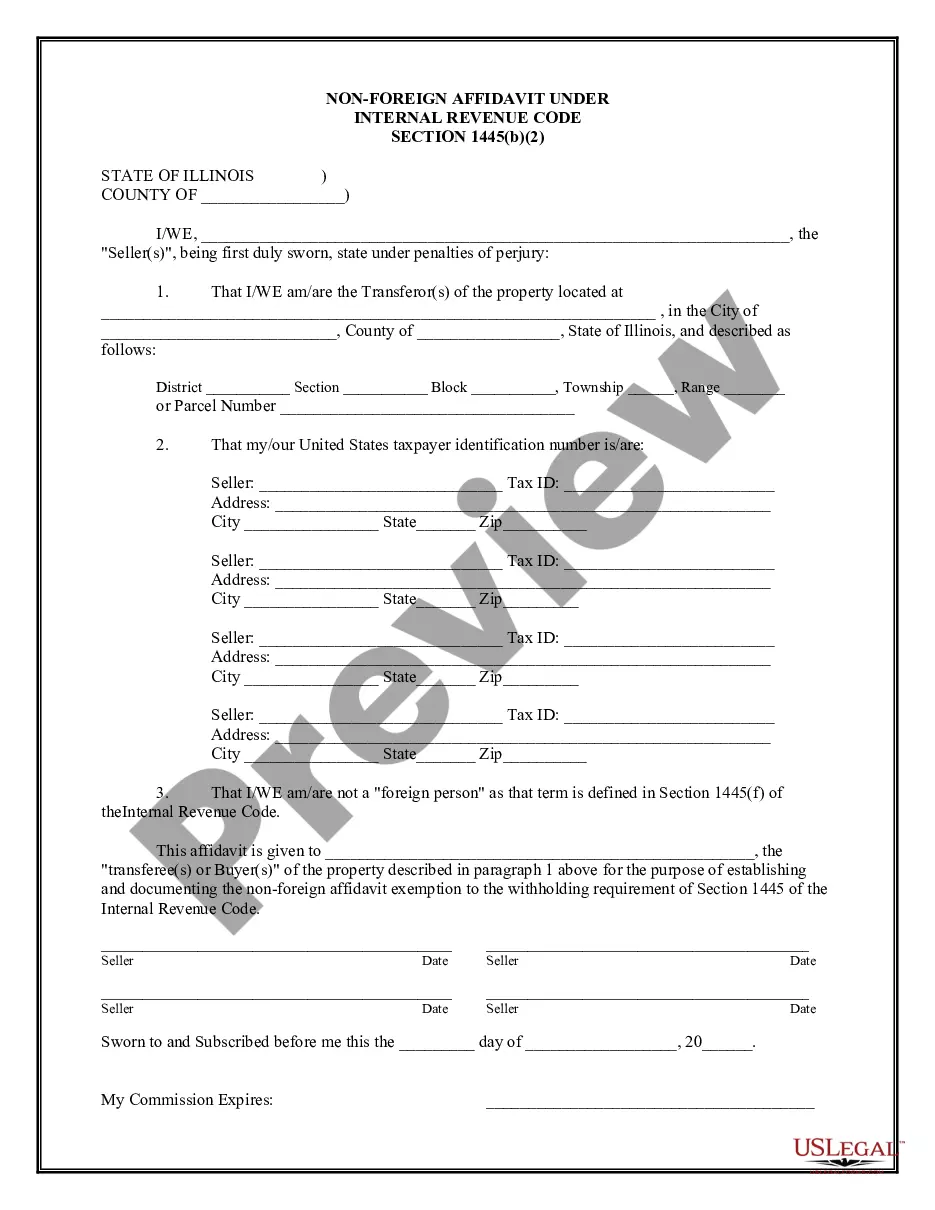

Cook Illinois Non-Foreign Affidavit Under IRC 1445 is a legal document that relates to the transfer of real estate property in Cook County, Illinois, involving non-foreign individuals or entities. It provides a way to certify that the transferor is not a foreign person as defined by the Internal Revenue Code (IRC) section 1445. The affidavit is an important requirement during the process of selling or transferring property, as it ensures compliance with federal tax laws and regulations. By completing the Cook Illinois Non-Foreign Affidavit, the transferor confirms their non-foreign status, which exempts them from the withholding tax normally applicable to foreign sellers. The affidavit must contain specific information, including the name, address, and taxpayer identification number (TIN) of the transferor(s). It should clearly state that the transferor is not a foreign person or entity. Additionally, it should include details about the property being transferred, such as the address, legal description, and purchase price. Cook Illinois Non-Foreign Affidavit Under IRC 1445 comes in different versions, tailored to specific situations: 1. Individual Transferor Affidavit: This affidavit is used when the transferor is an individual and not a foreign person. It requires the individual's personal information, such as their full name, social security number, and current address. 2. Corporate Transferor Affidavit: This affidavit is applicable when the transferor is a corporation, and it affirms that the corporation is not considered a foreign person. It includes details about the corporation's name, employer identification number (EIN), and principal place of business. 3. Trust Transferor Affidavit: This type of affidavit is used when the transferor is a trust or other similar entity. It verifies that the trust or entity is not a foreign person. It typically requires information regarding the trust, such as its name, EIN, and the name of the trustee. By submitting a Cook Illinois Non-Foreign Affidavit Under IRC 1445, transferors can comply with the IRS regulations and avoid any potential withholding tax obligations related to real estate property transfers in Cook County, Illinois. It is essential to accurately complete the affidavit to ensure a smooth and legally compliant transfer process.

Cook Illinois Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Cook Illinois Non-Foreign Affidavit Under IRC 1445?

Are you looking for a reliable and affordable legal forms supplier to get the Cook Illinois Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your go-to option.

Whether you need a simple agreement to set rules for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and area.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Cook Illinois Non-Foreign Affidavit Under IRC 1445 conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is good for.

- Start the search over if the template isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Cook Illinois Non-Foreign Affidavit Under IRC 1445 in any available file format. You can return to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal paperwork online once and for all.

Form popularity

FAQ

The FIRPTA affidavit is required when you are dealing with the local sellers of the United States. The FIRPTA affidavit is for all those local sellers who are not foreigners.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests. A disposition means ?disposition? for any purpose of the Internal Revenue Code. This includes but is not limited to a sale or exchange, liquidation, redemption, gift, transfers, etc.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

IRS Notice 1445 is a relatively newer notice that notifies taxpayers of their ability to receive tax help in other languages. It lays out the steps needed to receive this help, to ensure that anyone can process their taxes promptly and accurately.

April 30, 2018 (revised). FIRPTA (The Foreign Investment in Real Property Tax Act) Withholding When the Seller is a Foreign Person: Under federal law, a buyer of real estate is obligated to withhold 15% of the purchase price and forward that amount to the Internal Revenue Service IF the seller is a foreign person.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

Interesting Questions

More info

Go to the Documents Library and look for the form that is not already listed. You can either take it with you through the secure website that we built for you or save it locally and open on your phone or with another app. If you cannot find the form you need, check for the exact form number, and you can also create a new document and select the page you need in the file list. Fill out the documents, fill it out carefully, and save it on paper or the cloud service, so you will not forget it. You can then take this with you wherever you go! Why you want to file your own paperwork online There are many reasons to file on the go. I'm running out of time. My employer thinks I have no time for extra paperwork. I can't find the correct form online. I'm tired and need a break from all the extra work.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.