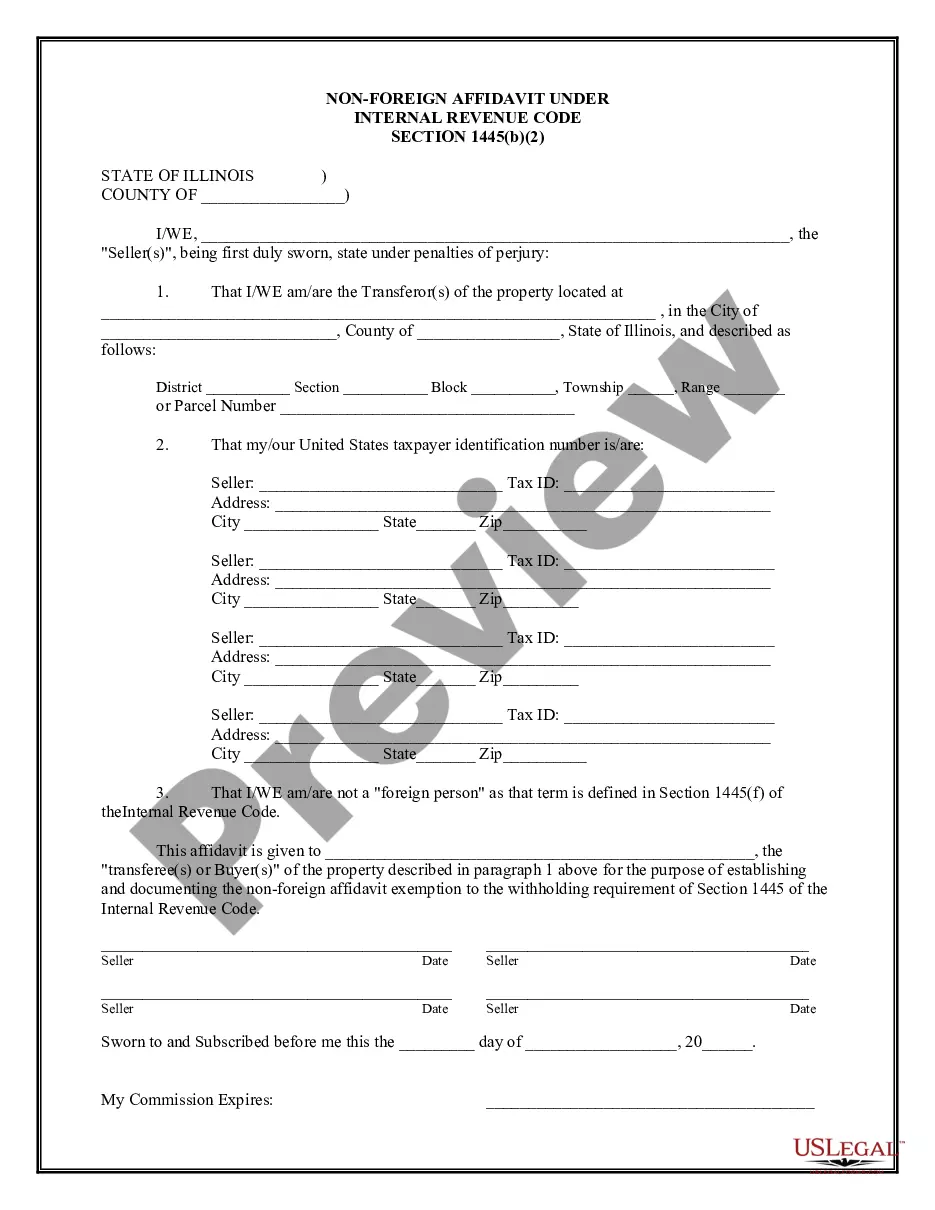

The Joliet Illinois Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions to determine the tax withholding obligations of a non-foreign seller. This affidavit is specifically used when a non-foreign seller transfers their interest in real property located in the United States. IRC 1445 refers to the Internal Revenue Code section that outlines the requirement for withholding tax on dispositions of U.S. real property interests by foreign persons. Although the term "Non-Foreign Affidavit" may sound contradictory, it is used to establish that the seller is indeed a non-foreign entity. The purpose of the Joliet Illinois Non-Foreign Affidavit Under IRC 1445 is to declare the seller's status as a non-foreign person and thus exempt from the withholding tax requirements enforced by the IRS. By completing the affidavit, the seller affirms that they are a U.S. citizen, resident alien, domestic corporation, or other eligible non-foreign entity, which enables the transferee (buyer) to proceed with the transaction without withholding any part of the purchase price. Different types of the Joliet Illinois Non-Foreign Affidavit Under IRC 1445 may vary based on the specific circumstances of the transaction or the parties involved. For example: 1. Individual Non-Foreign Affidavit: This type of affidavit is filled out by non-foreign individuals who are either U.S. citizens or resident aliens, confirming their status and exempting them from withholding tax requirements. 2. Corporate Non-Foreign Affidavit: Used when the seller is a domestic corporation, this affidavit verifies the corporation's non-foreign status, exempting it from withholding taxes. 3. Partnership/LLC Non-Foreign Affidavit: This affidavit type is relevant when a partnership or LLC (Limited Liability Company) is transferring the property. It proves the entity's non-foreign status. 4. Trust Non-Foreign Affidavit: In cases where the property is held in a trust, this affidavit is utilized to declare the trust's non-foreign status, ensuring no withholding tax is levied. It is crucial to accurately complete the Joliet Illinois Non-Foreign Affidavit Under IRC 1445 to avoid any complications or legal issues during the real estate transaction. Parties involved should consult legal professionals, such as real estate attorneys or tax experts, to ensure compliance with the applicable laws and regulations.

Joliet Illinois Non-Foreign Affidavit Under IRC 1445

Category:

State:

Illinois

City:

Joliet

Control #:

IL-CLOSE7

Format:

Word;

Rich Text

Instant download

Description

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Joliet Illinois Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions to determine the tax withholding obligations of a non-foreign seller. This affidavit is specifically used when a non-foreign seller transfers their interest in real property located in the United States. IRC 1445 refers to the Internal Revenue Code section that outlines the requirement for withholding tax on dispositions of U.S. real property interests by foreign persons. Although the term "Non-Foreign Affidavit" may sound contradictory, it is used to establish that the seller is indeed a non-foreign entity. The purpose of the Joliet Illinois Non-Foreign Affidavit Under IRC 1445 is to declare the seller's status as a non-foreign person and thus exempt from the withholding tax requirements enforced by the IRS. By completing the affidavit, the seller affirms that they are a U.S. citizen, resident alien, domestic corporation, or other eligible non-foreign entity, which enables the transferee (buyer) to proceed with the transaction without withholding any part of the purchase price. Different types of the Joliet Illinois Non-Foreign Affidavit Under IRC 1445 may vary based on the specific circumstances of the transaction or the parties involved. For example: 1. Individual Non-Foreign Affidavit: This type of affidavit is filled out by non-foreign individuals who are either U.S. citizens or resident aliens, confirming their status and exempting them from withholding tax requirements. 2. Corporate Non-Foreign Affidavit: Used when the seller is a domestic corporation, this affidavit verifies the corporation's non-foreign status, exempting it from withholding taxes. 3. Partnership/LLC Non-Foreign Affidavit: This affidavit type is relevant when a partnership or LLC (Limited Liability Company) is transferring the property. It proves the entity's non-foreign status. 4. Trust Non-Foreign Affidavit: In cases where the property is held in a trust, this affidavit is utilized to declare the trust's non-foreign status, ensuring no withholding tax is levied. It is crucial to accurately complete the Joliet Illinois Non-Foreign Affidavit Under IRC 1445 to avoid any complications or legal issues during the real estate transaction. Parties involved should consult legal professionals, such as real estate attorneys or tax experts, to ensure compliance with the applicable laws and regulations.

Free preview

How to fill out Joliet Illinois Non-Foreign Affidavit Under IRC 1445?

If you’ve already utilized our service before, log in to your account and download the Joliet Illinois Non-Foreign Affidavit Under IRC 1445 on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Joliet Illinois Non-Foreign Affidavit Under IRC 1445. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!