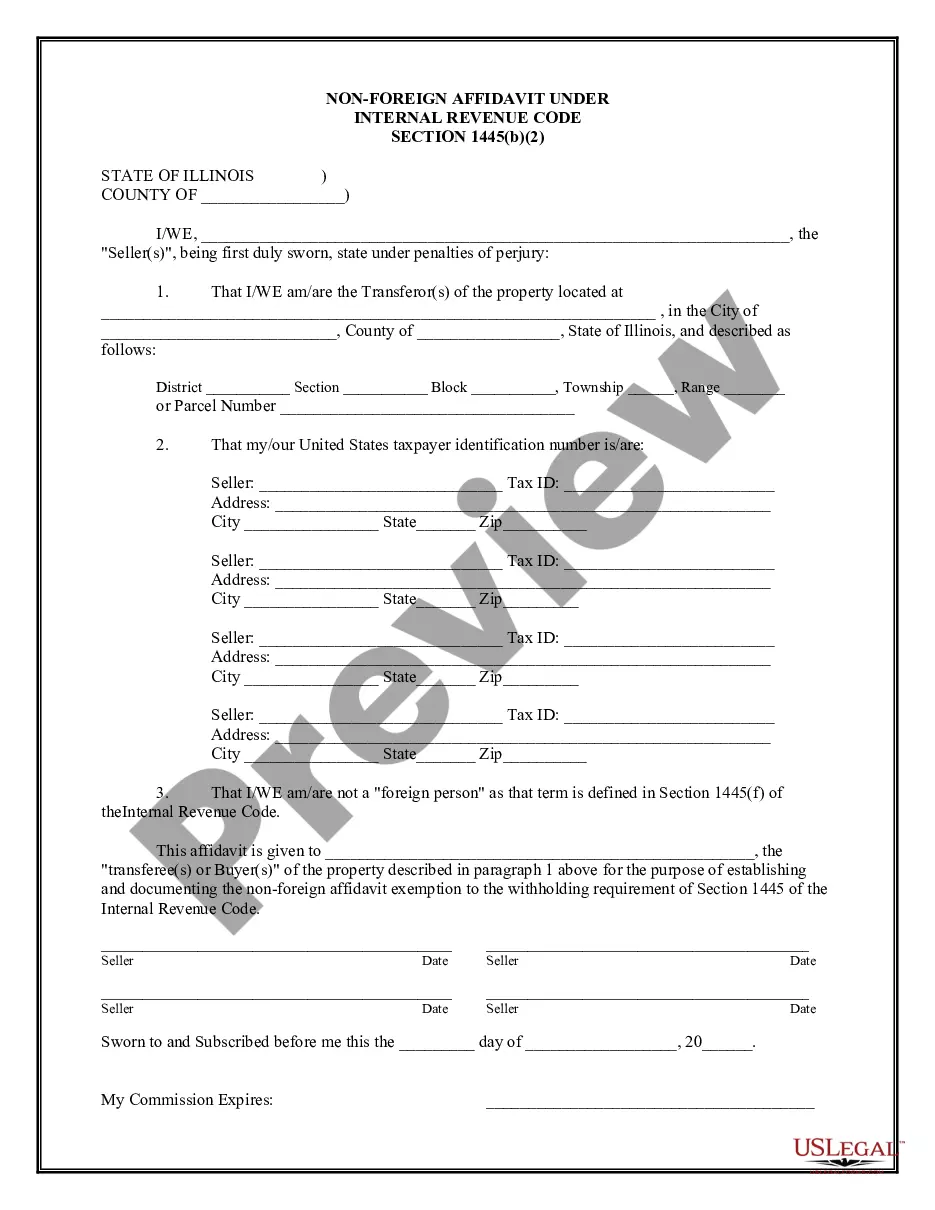

Rockford Illinois Non-Foreign Affidavit Under IRC 1445 is a legal document required in real estate transactions involving the sale or transfer of property by a foreign person. This affidavit is needed to ensure compliance with the Internal Revenue Code (IRC) Section 1445, which deals with withholding tax obligations for non-U.S. citizens selling U.S. real property interests. When a foreign person sells or transfers a property interest located in the United States, the buyer or transferee is required to withhold a certain amount of the purchase price and remit it to the Internal Revenue Service (IRS). However, if the seller provides a Non-Foreign Affidavit Under IRC 1445, the buyer is relieved from the withholding obligation. The Rockford Illinois Non-Foreign Affidavit Under IRC 1445 is used specifically in transactions involving properties located within the jurisdiction of Rockford, Illinois. It certifies that the seller is not a foreign person for tax purposes, and thus exempts the buyer from withholding any funds. There are no specific types or variations of the Rockford Illinois Non-Foreign Affidavit Under IRC 1445. However, it is important to note that this affidavit is just one component of the overall process for complying with IRC 1445 requirements. Other documents and regulations may also need to be considered, such as the FIR PTA (Foreign Investment in Real Property Tax Act) regulations. To complete the Rockford Illinois Non-Foreign Affidavit Under IRC 1445, the seller must provide accurate personal information, including their name, address, and taxpayer identification number (TIN). They must also declare under penalties of perjury that they are not a foreign person as defined by the IRC, providing any necessary supporting documentation or proof of residency. It is crucial for both the buyer and seller to consult with qualified legal or tax professionals to ensure compliance with all applicable laws and regulations. Failing to adhere to the IRC 1445 requirements could result in penalties or other legal consequences. In conclusion, the Rockford Illinois Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions involving foreign sellers within the jurisdiction of Rockford, Illinois. It serves as proof that the seller is not a foreign person according to the IRC, relieving the buyer from withholding any funds. Professional guidance is highly recommended navigating the complexities of this legal process successfully.

Rockford Illinois Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Rockford Illinois Non-Foreign Affidavit Under IRC 1445?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone without any legal background to draft such paperwork from scratch, mostly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Rockford Illinois Non-Foreign Affidavit Under IRC 1445 or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Rockford Illinois Non-Foreign Affidavit Under IRC 1445 quickly employing our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are new to our library, ensure that you follow these steps prior to downloading the Rockford Illinois Non-Foreign Affidavit Under IRC 1445:

- Ensure the form you have chosen is good for your area since the regulations of one state or area do not work for another state or area.

- Review the document and go through a short description (if available) of scenarios the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start again and search for the suitable form.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account login information or register for one from scratch.

- Pick the payment method and proceed to download the Rockford Illinois Non-Foreign Affidavit Under IRC 1445 once the payment is through.

You’re all set! Now you can proceed to print the document or fill it out online. Should you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.