Title: Understanding Cook Illinois Dissolution Package to Dissolve Corporation: An In-Depth Look Introduction: In this article, we will provide a comprehensive overview of the Cook Illinois Dissolution Package, specifically designed to guide corporations through the process of dissolving their existence. We will explore the benefits, requirements, and steps involved in dissolving a corporation in Cook County, Illinois. Additionally, we will mention a few variations of the dissolution package available to cater to specific organizational needs. 1. Overview of Cook Illinois Dissolution Package: The Cook Illinois Dissolution Package is a comprehensive set of legal documents, forms, and guidelines specifically tailored for corporations seeking to dissolve their operations within Cook County, Illinois. It is a valuable resource provided by the government to facilitate the dissolution process. 2. Benefits of Utilizing the Cook Illinois Dissolution Package: By using the Cook Illinois Dissolution Package, corporations can experience the following benefits: — Legal Compliance: Ensure conformity with Cook County legal requirements concerning corporation dissolution. — Streamlined Process: Simplify the dissolution process through the help of readily available documents and guidelines. — Avoid Legal Consequences: Conclude all legal obligations, including tax filings and debt settlements, to minimize potential liabilities. 3. Essential Documents Included in the Cook Illinois Dissolution Package: The dissolution package typically consists of the following key documents: — Articles of Dissolution: Formal legal document that officially terminates the corporation's existence. — Notices and Filings: Required paperwork for giving notice to shareholders, creditors, employees, and other relevant parties. — Tax Forms: Documents necessary for fulfilling state, local, and federal tax obligations during the dissolution process. 4. Steps Involved in Dissolving a Corporation using Cook Illinois Dissolution Package: To dissolve a corporation using the Cook Illinois Dissolution Package, the following steps are generally followed: — Step 1: Board of Directors' Resolution: Obtain a board resolution approving the dissolution. — Step 2: Shareholder Approval: Secure shareholder approval for the dissolution in a meeting or written consent. — Step 3: File Articles of Dissolution: Properly complete and file the Articles of Dissolution with the appropriate authorities. — Step 4: Notify Stakeholders: Provide necessary notices to shareholders, creditors, employees, and other relevant parties. — Step 5: Fulfill Tax Obligations: Pay any outstanding taxes and file appropriate tax forms. — Step 6: Distribute Assets: Liquidate and distribute remaining corporate assets to shareholders as outlined in the dissolution plan. Variations of Cook Illinois Dissolution Packages: While the primary Cook Illinois Dissolution Package encompasses the general dissolution process, there may be specific variations catering to different organizational needs, such as: — Nonprofit Dissolution Package: Tailored for nonprofit corporations seeking to dissolve their operations in Cook County, Illinois. — Small Business Dissolution Package: Designed for small businesses wanting to dissolve as per Cook County's legal requirements. Conclusion: The Cook Illinois Dissolution Package serves as a comprehensive resource for corporations looking to dissolve within Cook County, Illinois. By utilizing the package, businesses can navigate the dissolution process smoothly, fulfill their legal obligations, and avoid potential legal consequences. Ensure you select the appropriate variation of the dissolution package that best suits your corporate structure, whether you are a nonprofit or small business seeking dissolution.

Cook Corporation

Description

How to fill out Cook Illinois Dissolution Package To Dissolve Corporation?

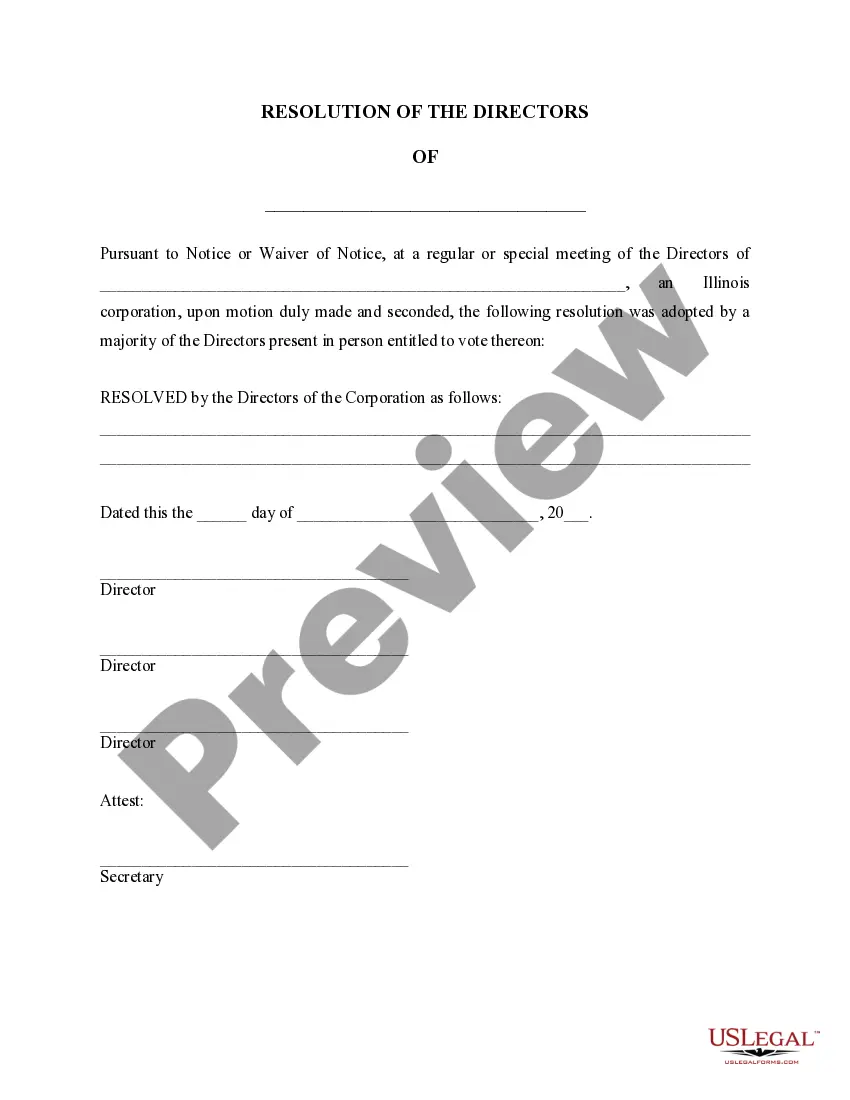

If you are looking for a relevant form, it’s difficult to choose a more convenient place than the US Legal Forms site – probably the most considerable online libraries. Here you can find a huge number of templates for company and individual purposes by types and regions, or key phrases. Using our advanced search function, discovering the latest Cook Illinois Dissolution Package to Dissolve Corporation is as elementary as 1-2-3. Furthermore, the relevance of each file is verified by a group of professional lawyers that on a regular basis check the templates on our platform and revise them according to the latest state and county regulations.

If you already know about our platform and have an account, all you need to receive the Cook Illinois Dissolution Package to Dissolve Corporation is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you need. Look at its information and utilize the Preview feature (if available) to see its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the appropriate file.

- Affirm your selection. Click the Buy now option. After that, choose the preferred subscription plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the form. Pick the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Cook Illinois Dissolution Package to Dissolve Corporation.

Each and every form you save in your user profile does not have an expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you want to have an additional version for editing or printing, you can come back and download it once more at any time.

Make use of the US Legal Forms extensive collection to get access to the Cook Illinois Dissolution Package to Dissolve Corporation you were seeking and a huge number of other professional and state-specific templates on a single website!