Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC: A Comprehensive Guide If you are seeking to dissolve a Limited Liability Company (LLC) in Rockford, Illinois, you'll need to familiarize yourself with the Rockford Illinois Dissolution Package. This package encompasses the necessary documentation and procedures required to legally dissolve your LLC in accordance with the state laws. This detailed description will provide you with insights into the Rockford Illinois Dissolution Package, its key components, and types of dissolution available. Types of Dissolution for Limited Liability Company LLC in Rockford, Illinois: 1. Voluntary Dissolution: Most LCS opt for voluntary dissolution, where members voluntarily decide to terminate the company's operations. This occurs when members agree that the purpose for which the LLC was formed has been accomplished, or when the LLC is no longer profitable or feasible to operate. Voluntary dissolution can be further categorized into two subtypes: member-initiated and manager-initiated dissolution. 2. Involuntary Dissolution: In certain cases, a Limited Liability Company may face involuntary dissolution. This happens when a court order or the state authorities determine that the LLC is operating unlawfully or in violation of its operating agreement, or if it fails to maintain compliance with specific legal obligations. Key Components of the Rockford Illinois Dissolution Package: 1. Articles of Dissolution: This document serves as official proof that the LLC is being dissolved. It includes essential information such as the LLC's name, the dissolution's effective date, and whether the dissolution is voluntary or involuntary. Additionally, it requires the signatures of the LLC's authorized representative(s). 2. Notice to Creditors: It is crucial to inform all known creditors about the LLC's dissolution. The notice to creditors should include information regarding the deadline to make claims against the LLC. By providing this notice, the LLC ensures transparency and gives creditors an opportunity to assert any outstanding claims. 3. Tax Clearance: Before the dissolution process is complete, the LLC must obtain a tax clearance from the Illinois Department of Revenue. This clearance certifies that the LLC has fulfilled its tax obligations, including taxes incurred during its operation. 4. Termination of Registered Agent: If the LLC appointed a registered agent to receive legal documents and communications on its behalf, it is necessary to formally terminate their appointment as part of the dissolution process. This ensures that the LLC's registered agent is no longer responsible for accepting any further legal notices. 5. Publication Requirement: In some cases, depending on the county in which the LLC is registered, it may be required to publish notice of its dissolution in a local newspaper. This offers an opportunity for any additional creditors to come forward with claims against the LLC. Conclusion: The Rockford Illinois Dissolution Package provides a comprehensive framework for dissolving a Limited Liability Company in Rockford, Illinois. Whether through voluntary or involuntary dissolution, LCS must adhere to the key components of the dissolution package, including filing Articles of Dissolution, notifying creditors, obtaining tax clearance, terminating the registered agent, and fulfilling any relevant publication requirements. By following these procedures, LLC owners can ensure a smooth and legally compliant dissolution of their business in Rockford, Illinois.

Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Rockford Illinois Dissolution Package To Dissolve Limited Liability Company LLC?

Do you need a reliable and inexpensive legal forms provider to get the Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC? US Legal Forms is your go-to choice.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is intended for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC in any available format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal paperwork online once and for all.

Form popularity

FAQ

Dissolving an LLC can have various tax implications that you should consider. Typically, the LLC will need to file a final tax return to report any income earned during its operation. Utilizing the Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC can help you understand these consequences and prepare accordingly. This ensures you handle all tax matters properly and avoid complications.

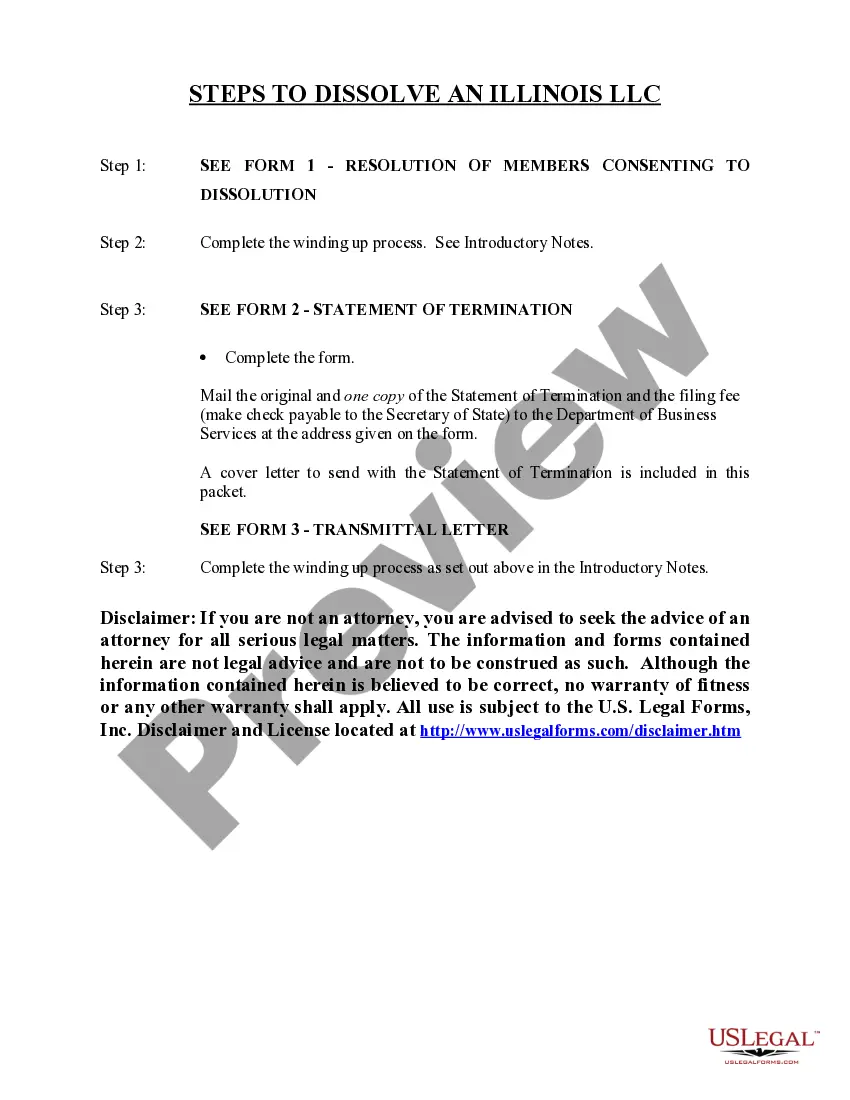

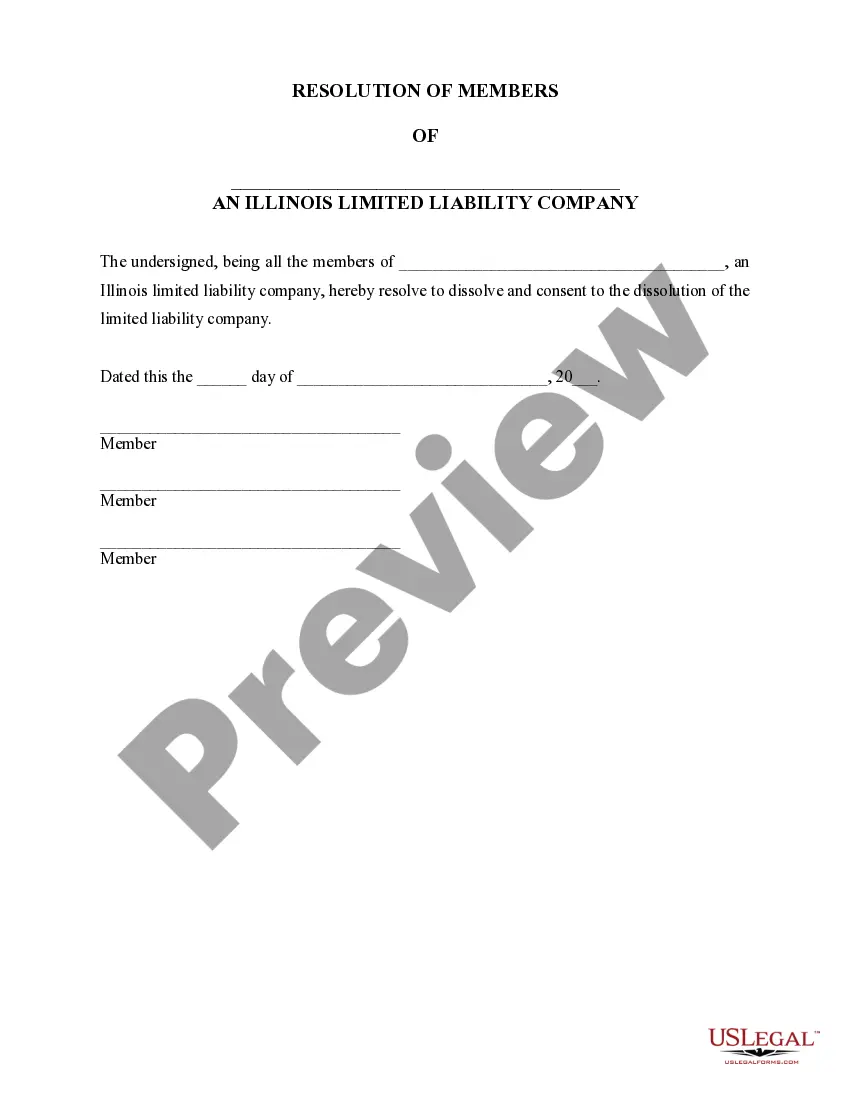

To file for the dissolution of an LLC in Illinois, you need to submit the Articles of Dissolution form to the Secretary of State. A well-structured Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC can streamline this process for you. Additionally, make sure to settle any debts and notify tax authorities. Following these steps ensures compliance and a smooth dissolution.

Dissolving an LLC can be straightforward if you follow the right steps. With the Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC, you can simplify the process. It involves filing specific documents and settling any outstanding obligations. This package provides clear guidance, making it easier for you to manage the dissolution effectively.

If you want to get your LLC undissolved, approach the state authority where your LLC was registered to understand the reinstatement process. In Rockford, Illinois, a Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC can assist by providing pertinent forms and instructions to navigate the reinstatement smoothly. Ensure you resolve any outstanding fees and comply with state requirements for a successful outcome.

To force an LLC to dissolve, you generally need to follow the procedures set out in your operating agreement and state law. This often requires a vote from members or a court action if there’s a dispute. In Rockford, Illinois, utilizing a Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC simplifies this process by providing the essential documents and guidance for compliance. It streamlines the dissolution steps and ensures timely resolution.

If you do not dissolve your LLC properly, it may continue to incur annual fees and taxes. This can result in tax liabilities accumulating over time, leading to potential fines or penalties. Additionally, unresolved business obligations may complicate your financial standing and affect your personal liability protection. Using a Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC can help you efficiently manage this process.

To get your LLC undissolved, you need to follow specific steps outlined by your state. In Rockford, Illinois, you can utilize a Rockford Illinois Dissolution Package to Dissolve Limited Liability Company LLC to ensure all necessary paperwork is filed correctly. First, check if your LLC is eligible for reinstatement by confirming that it has not been formally dissolved. Once you confirm this, submit the required documentation to the state office along with any outstanding fees.