Chicago Illinois Living Trust for Husband and Wife with No Children

Description

How to fill out Illinois Living Trust For Husband And Wife With No Children?

If you are looking for an authentic form, it's incredibly difficult to find a superior platform than the US Legal Forms website – one of the most extensive libraries available online.

With this collection, you can discover thousands of document samples for both business and personal uses categorized by types and states, or keywords.

With our enhanced search feature, locating the latest Chicago Illinois Living Trust for Husband and Wife with No Children is as simple as 1-2-3.

Complete the payment procedure. Use your credit card or PayPal account to finalize the registration process.

Download the template. Choose the file format and store it on your device.

- Additionally, the accuracy of each record is validated by a team of experienced attorneys who regularly evaluate the templates on our site and update them according to the most recent state and county laws.

- If you are already familiar with our system and possess a registered account, all you need to access the Chicago Illinois Living Trust for Husband and Wife with No Children is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

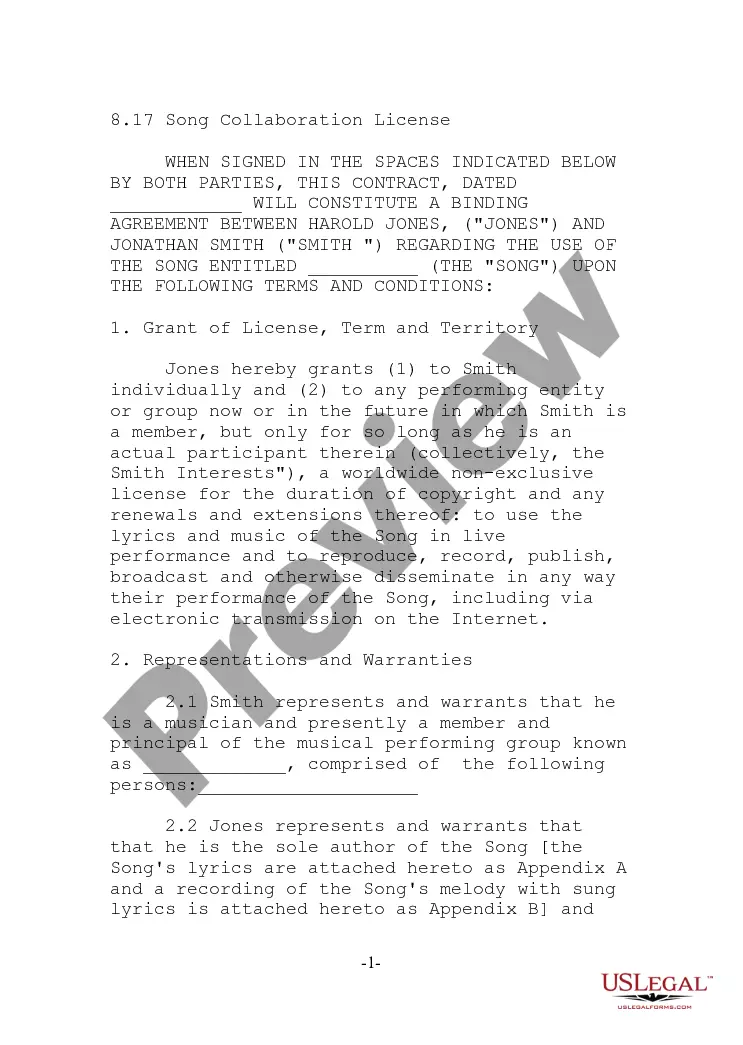

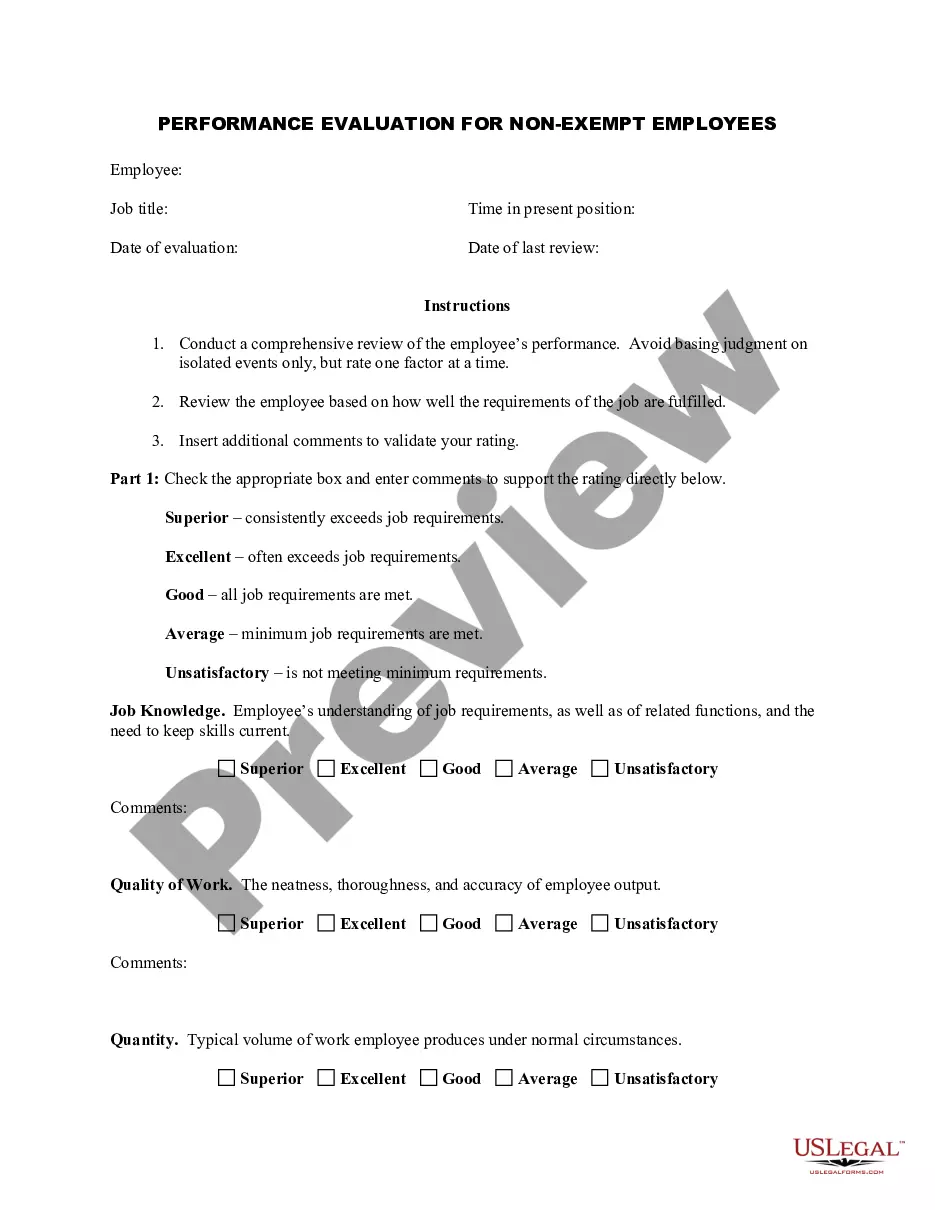

- Ensure you have opened the sample you need. Review its description and utilize the Preview feature to examine its contents. If it doesn’t meet your requirements, use the Search option at the top of the screen to find the suitable document.

- Confirm your selection. Press the Buy now button. Following that, choose the desired subscription plan and enter the details to register an account.

Form popularity

FAQ

Spouses in Illinois Inheritance Law If you have no living descendants, your spouse gets all of the intestate property. If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance.

Deceased person is survived by descendants and no spouse: the descendants receive the entire property. Deceased person is only survived by parents or siblings: the parents and siblings equally inherit the estate; however, if one parent is deceased, the other parent receives a double share of the estate.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

Under Hindu law, a wife gets an equal share of the assets of the deceased husband divided between other Class I heirs, the children and mother. This applies only if the man dies intestate. If there are no children and other claimants, the wife is entitled to the total property.

In Illinois, if you are married and you die without a will, what your spouse gets depends on whether or not you have living descendants -- children, grandchildren, or great-grandchildren. If you don't, then your spouse inherits all of your intestate property.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Generally, a surviving spouse is entitled to receive a ?spouse's award? of $20,000, plus an additional $10,000 for each dependent child living with the spouse. (Note that a dependent child may be a minor or an adult.)

Spouses in Illinois Inheritance Law If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance. However, grandchildren will only receive a share if their parents are not alive to receive their share.

You can choose to use a program on the internet, which will likely run a few hundred dollars or less. If you choose to use an attorney, the attorney's fees will determine the price you'll pay. You could end up paying more than $1,000 to create a living trust with the help of an attorney.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.