Rockford Illinois Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children A Rockford Illinois Living Trust is a legal document that allows an individual who is single, divorced, or a widow/widower with no children to effectively manage and distribute their assets upon their passing. By creating a living trust, individuals can ensure that their wishes are carried out and their assets are protected. There are several types of Rockford Illinois Living Trusts that cater to the specific needs of single individuals, divorced individuals, or those who have become widows or widowers, and have no children. Let's explore some of these types: 1. Single Individual Living Trust: This type of living trust is designed for individuals who are not married and have no children. It provides a comprehensive plan for the management and distribution of assets, including financial accounts, real estate, personal property, and any other assets an individual may own. 2. Divorced Individual Living Trust: For individuals who have gone through a divorce, having a living trust can be crucial. A divorced individual living trust allows them to dictate how their assets should be handled after their passing. It provides the flexibility to update beneficiaries and specify which assets should go to whom, ensuring that the assets are distributed according to their wishes. 3. Widow or Widower Living Trust: This living trust type is specifically designed for individuals who have lost their spouse and are now single with no children. It allows them to outline their wishes regarding asset management and distribution. With a widow or widower living trust, individuals can provide for family members or name charitable organizations as beneficiaries if they so choose. Regardless of the type of Rockford Illinois Living Trust, some common benefits include: 1. Avoiding probate: A living trust helps bypass the probate process, saving time and money for beneficiaries. 2. Privacy: Unlike a will, a living trust is not a public record, so the distribution of assets remains private. 3. Incapacity planning: A living trust allows individuals to appoint a trusted person to manage their assets in case of incapacity, ensuring their financial affairs are taken care of. Whether you are single, divorced, or a widow/widower with no children, establishing a Rockford Illinois Living Trust provides peace of mind knowing that your assets will be distributed according to your wishes. Consulting with an experienced estate planning attorney in Rockford can help you navigate the process and choose the best type of living trust for you.

Rockford Illinois Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Category:

State:

Illinois

City:

Rockford

Control #:

IL-E0175

Format:

Word;

Rich Text

Instant download

Description

This Living Trust for Individual Who is Single, Divorced or Widow(er) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Rockford Illinois Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children A Rockford Illinois Living Trust is a legal document that allows an individual who is single, divorced, or a widow/widower with no children to effectively manage and distribute their assets upon their passing. By creating a living trust, individuals can ensure that their wishes are carried out and their assets are protected. There are several types of Rockford Illinois Living Trusts that cater to the specific needs of single individuals, divorced individuals, or those who have become widows or widowers, and have no children. Let's explore some of these types: 1. Single Individual Living Trust: This type of living trust is designed for individuals who are not married and have no children. It provides a comprehensive plan for the management and distribution of assets, including financial accounts, real estate, personal property, and any other assets an individual may own. 2. Divorced Individual Living Trust: For individuals who have gone through a divorce, having a living trust can be crucial. A divorced individual living trust allows them to dictate how their assets should be handled after their passing. It provides the flexibility to update beneficiaries and specify which assets should go to whom, ensuring that the assets are distributed according to their wishes. 3. Widow or Widower Living Trust: This living trust type is specifically designed for individuals who have lost their spouse and are now single with no children. It allows them to outline their wishes regarding asset management and distribution. With a widow or widower living trust, individuals can provide for family members or name charitable organizations as beneficiaries if they so choose. Regardless of the type of Rockford Illinois Living Trust, some common benefits include: 1. Avoiding probate: A living trust helps bypass the probate process, saving time and money for beneficiaries. 2. Privacy: Unlike a will, a living trust is not a public record, so the distribution of assets remains private. 3. Incapacity planning: A living trust allows individuals to appoint a trusted person to manage their assets in case of incapacity, ensuring their financial affairs are taken care of. Whether you are single, divorced, or a widow/widower with no children, establishing a Rockford Illinois Living Trust provides peace of mind knowing that your assets will be distributed according to your wishes. Consulting with an experienced estate planning attorney in Rockford can help you navigate the process and choose the best type of living trust for you.

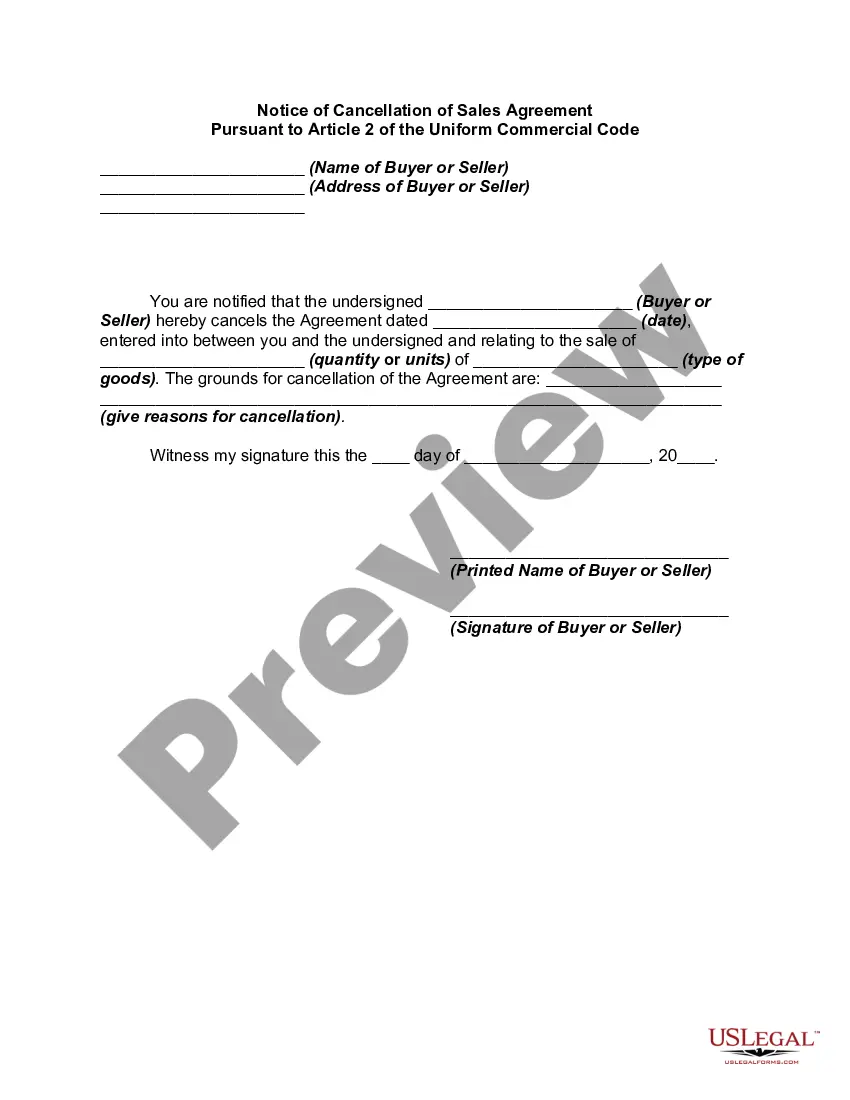

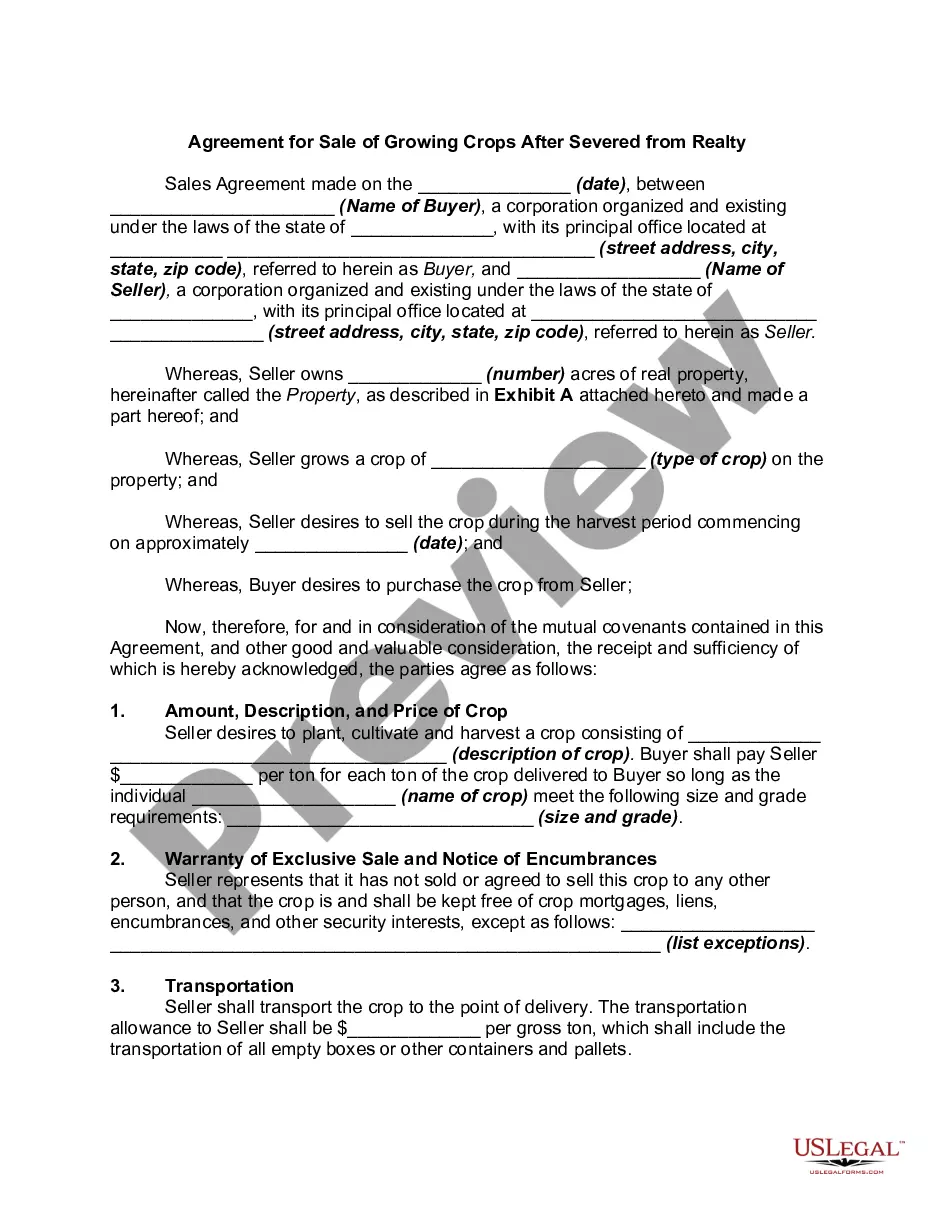

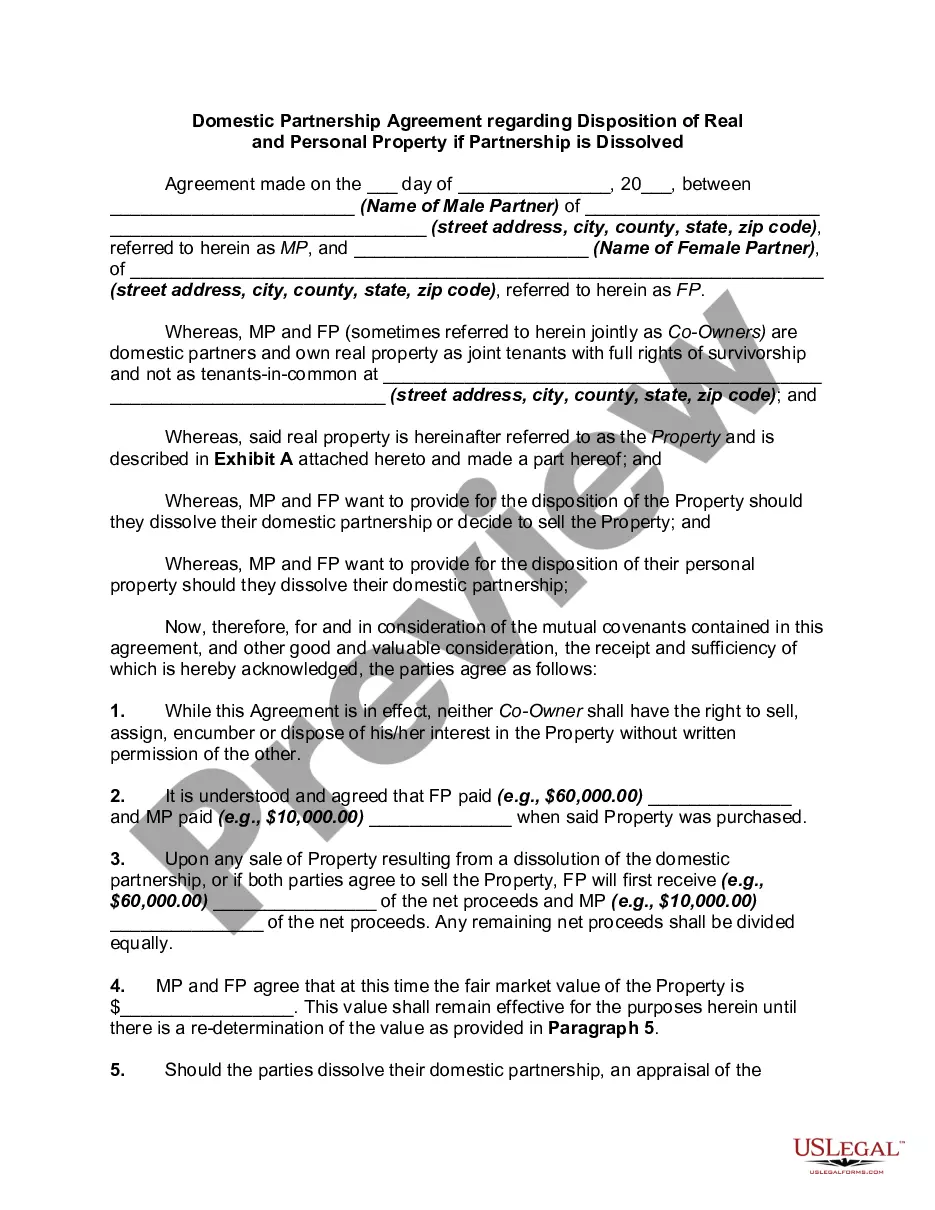

Free preview

How to fill out Rockford Illinois Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

If you’ve already used our service before, log in to your account and save the Rockford Illinois Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Rockford Illinois Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!