Rockford Illinois Living Trust for individuals who are Single, Divorced, Widow, or Widower with Children Introduction: A Rockford Illinois Living Trust is a legal mechanism that allows individuals to plan and control the distribution of their assets during their lifetime and after their demise. For individuals who are single, divorced, widowed, or widowers with children, a living trust provides an effective way to ensure the financial security and proper management of their assets. Let's explore the different types of Rockford Illinois Living Trusts available for these individuals. 1. Single Living Trust: A Single Living Trust is designed for individuals who are unmarried or choose to keep their assets separate. It allows the single person to maintain control over their assets during their lifetime and designates beneficiaries for the assets upon their passing. 2. Divorced Living Trust: A Divorced Living Trust is tailored for individuals who have gone through a divorce. This trust helps to ensure that their assets are managed and distributed according to their wishes, bypassing the ex-spouse. It also provides protection for children from previous marriages or relationships, guaranteeing their financial stability. 3. Widow Living Trust: A Widow Living Trust is specifically created for individuals who have lost their spouse. This trust safeguards the widow's assets, allowing them to avoid probate while ensuring a smooth transfer of property to their chosen beneficiaries. It also offers provisions to manage any assets left to minor children, establishing guidelines for their financial well-being. 4. Widower with Children Living Trust: A Widower with Children Living Trust addresses the specific needs of a widowed individual who is now the sole guardian of their children. This trust offers the widower control over how their assets are managed during their lifetime, ensuring that both their own and their children's needs are met even after they have passed away. 5. Supplemental Needs Trust: A Supplemental Needs Trust is an additional type of Rockford Illinois Living Trust that can be beneficial for individuals with disabilities or special needs children. It allows the trustee to provide the necessary funds for the supplemental needs of these individuals without affecting their eligibility for government benefits. Conclusion: Rockford Illinois Living Trusts provide numerous benefits for single, divorced, widowed, or widower individuals with children. They grant control over asset distribution, protect beneficiaries, and ensure financial stability. The specific types mentioned above—Single Living Trust, Divorced Living Trust, Widow Living Trust, Widower with Children Living Trust, and Supplemental Needs Trust—cater to the unique circumstances and requirements of each individual. Consulting with an experienced attorney in Rockford, Illinois, is crucial to creating a personalized living trust that aligns with one's specific goals and wishes.

Rockford Illinois Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

Description

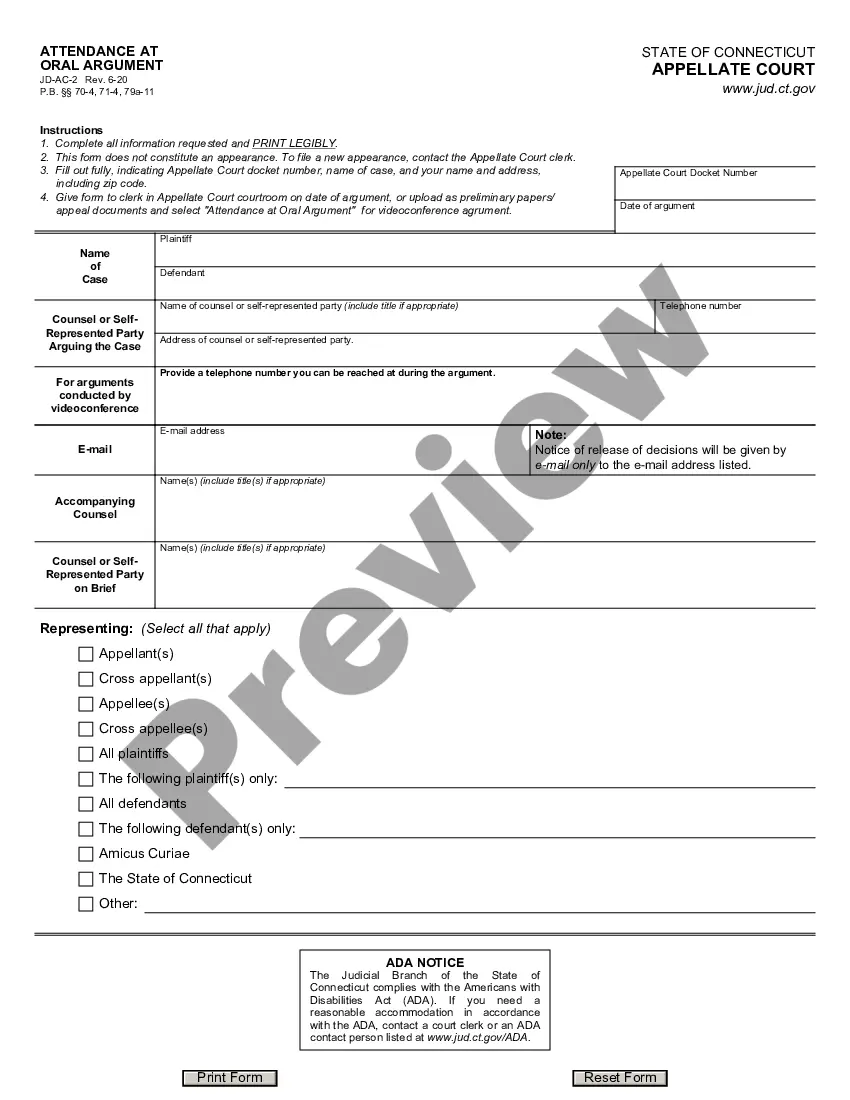

How to fill out Illinois Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

If you are looking for a suitable form template, it's exceptionally challenging to find a better site than the US Legal Forms platform – one of the largest collections available online.

Here you can discover a vast array of form samples for business and personal use categorized by topics and regions, or keywords.

With our excellent search feature, locating the most current Rockford Illinois Living Trust for an individual, who is Single, Divorced or a Widow or Widower with Children is as simple as 1-2-3.

Carry out the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and save it to your device.

- Moreover, the pertinence of each document is confirmed by a team of experienced attorneys who routinely examine the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Rockford Illinois Living Trust for an individual, who is Single, Divorced or a Widow or Widower with Children is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have found the template you require. Review its description and use the Preview option to explore its content. If it doesn’t meet your needs, employ the Search field at the top of the page to discover the suitable document.

- Verify your choice. Select the Buy now button. Then, select your desired subscription plan and provide the necessary credentials to create an account.

Form popularity

FAQ

In the case of a Rockford Illinois Living Trust for individuals who are single, divorced, or widowed with children, the trust typically continues to operate even when one spouse passes away. The surviving spouse usually remains the trustee, ensuring a seamless management of assets for any children. However, it is important to review the trust’s terms and potentially make updates, as this can affect how assets are handled moving forward.

While a Rockford Illinois Living Trust for individuals who are single, divorced, or widowed with children offers many benefits, there are some downsides to consider. Setting up a living trust requires time and legal expenses that some might find burdensome. Additionally, it's crucial to keep the trust updated; failing to do so can lead to confusion and unintended consequences for beneficiaries.

When a wife loses her husband, she should first locate the will and any estate planning documents, including a Rockford Illinois Living Trust for individuals who are single, divorced, or widowed with children. She then needs to contact an attorney who specializes in estate matters to guide her through the process of settling the estate. Importantly, understanding the terms of any living trust is vital, as it often dictates how assets will be distributed and managed for the children.

Filing a living trust in Illinois involves several steps, but it typically does not require formal court filing. To establish a Rockford Illinois Living Trust for individuals who are single, divorced, or widows or widowers with children, you must first create the trust document, outlining your assets and beneficiaries. Then, you transfer ownership of your assets into the trust, which can be done using a simple change in titles or deeds. For guidance throughout this process, you may find platforms like USLegalForms helpful for templates and legal advice.

In Illinois, a trust does not need to be filed with the court to be valid. This means you can create a Rockford Illinois Living Trust for individuals who are single, divorced, or widows or widowers with children without needing court approval. However, certain assets placed in the trust may still require you to file paperwork to change their ownership. If you're unsure, consider consulting a legal expert to navigate these details.

Filling out a Rockford Illinois Living Trust for an individual who is single, divorced, or a widow or widower with children generally involves gathering information about assets and beneficiaries. You should clearly list all assets, including real estate and bank accounts, and specify how you wish them to be distributed after your passing. Platforms like uslegalforms provide comprehensive resources and templates to help you navigate this process seamlessly.

Using a Rockford Illinois Living Trust for an individual who is single, divorced, or a widow or widower with children does come with certain risks. Mismanagement of trust assets or failing to adhere to the trust terms can lead to complications, potentially resulting in legal disputes. Moreover, hidden costs associated with setting up and maintaining the trust may arise, so it's crucial to remain informed and seek guidance.

If your parents aim to provide a secure future for their children, establishing a Rockford Illinois Living Trust for an individual who is single, divorced, or a widow or widower with children could be a wise choice. A trust facilitates the efficient distribution of assets and helps avoid probate delays. It's essential for your parents to discuss options with a legal expert to ensure their choices align with their goals.

A common mistake parents make with a Rockford Illinois Living Trust for an individual who is single, divorced, or a widow or widower with children is failing to fund the trust properly. Without transferring assets into the trust, it cannot serve its purpose of protecting and managing wealth. Furthermore, neglecting to update the trust as circumstances change can lead to unintended consequences for your children.

In a Rockford Illinois Living Trust for an individual who is single, divorced, or a widow or widower with children, the trust continues to operate after one spouse's death. The surviving spouse typically retains control over the assets and can manage them according to the trust's terms. This process avoids probate, ensuring that the deceased spouse's wishes are honored smoothly and efficiently.