Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children

Description

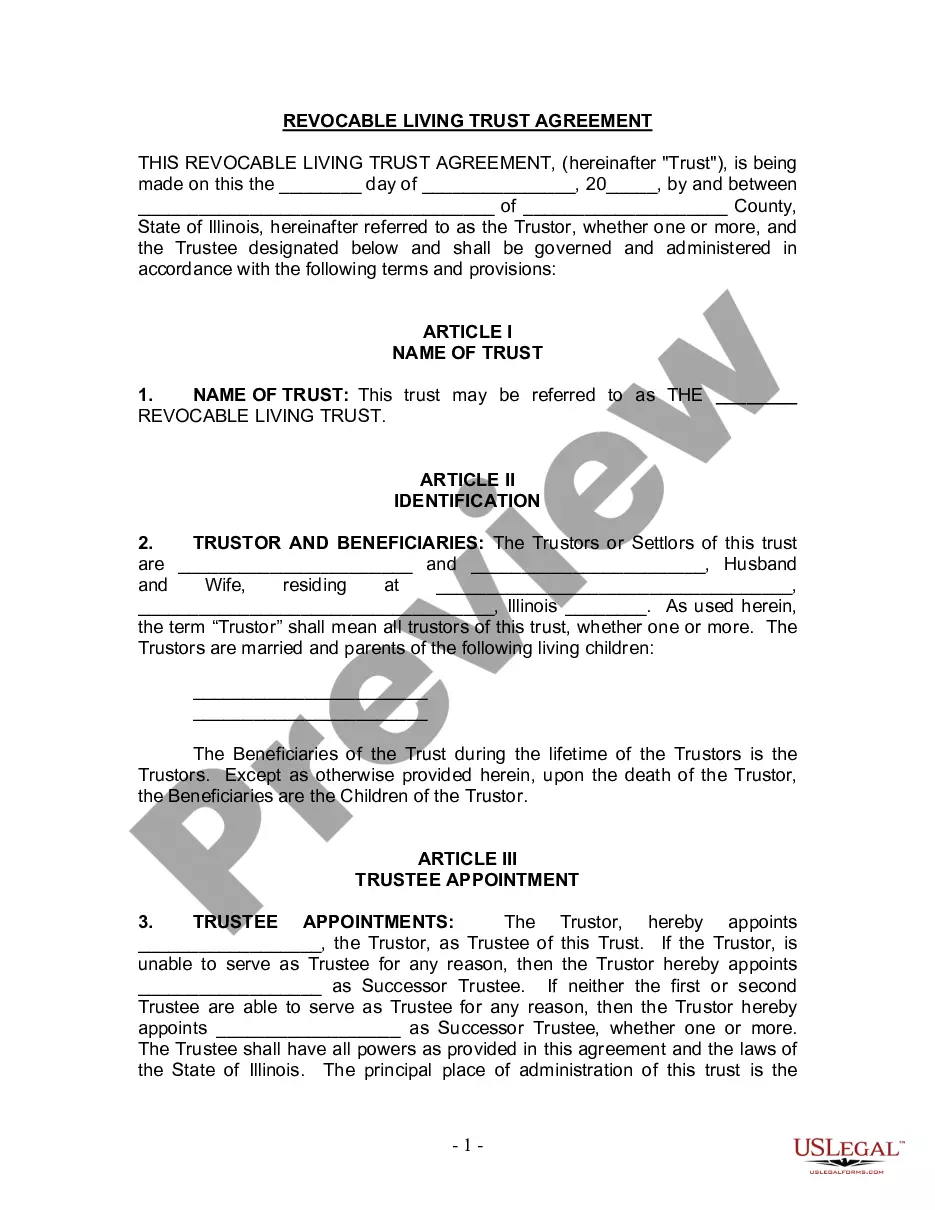

How to fill out Illinois Living Trust For Husband And Wife With Minor And Or Adult Children?

If you are searching for an authentic form template, it’s difficult to find a superior site than the US Legal Forms platform – one of the largest collections online.

Here you can discover numerous form samples for both business and personal needs categorized by type and state, or keywords.

With the enhanced search feature, locating the most up-to-date Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children is as simple as 1-2-3.

Complete the purchase. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Specify the file format and download it to your device.

- Moreover, the validity of every document is assured by a team of expert attorneys who continuously assess the templates on our site and refresh them to align with the latest state and county standards.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children is to Log In to your user account and click the Download button.

- If this is your first experience using US Legal Forms, simply follow the instructions below.

- Ensure you have located the form you need. Review its description and make use of the Preview feature (if available) to examine its content. If it doesn’t fit your requirements, use the Search function at the top of the page to find the suitable document.

- Verify your selection. Click on the Buy now button. Then, select your desired pricing option and provide information to create an account.

Form popularity

FAQ

In Illinois, a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children does not need to be filed with the court. This means that the terms of the trust remain private, unlike a will, which goes through probate. However, it is essential to manage your trust accurately to ensure that everything functions as intended without unnecessary legal complications.

While a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children can provide security, there are risks to consider. One risk is the possibility of disputes among beneficiaries, particularly if the terms of the trust are unclear. Moreover, inadequate management of the trust or failure to fund it correctly can lead to complications in asset distribution.

Considering a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children can be a wise decision for your parents. This approach can help them manage their assets efficiently, provide for minor or adult children, and avoid the probate process. Evaluate their specific financial situation and goals to determine if a trust aligns with their needs.

To establish a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children, you need to create a trust document that outlines the terms and conditions. While you do not need to file the trust with the court, you must fund the trust by transferring assets into it. You can use platforms like US Legal Forms to simplify the process and ensure that you comply with state requirements.

A Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children can offer many benefits, but it also has drawbacks. One common issue is the potential complexity involved in managing the trust. Additionally, if not properly funded, your trust may not serve its purpose, leading to delays in asset distribution. It’s essential to consider these factors to ensure your estate planning goals are met.

Certain assets, such as retirement accounts and life insurance, typically cannot be placed directly in a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children. Instead, you might need to name the trust as a beneficiary to ensure proper asset distribution. Furthermore, assets like vehicles or specific personal property may require careful consideration before transferring them. Consulting with an expert can help you navigate these complexities effectively.

One of the major pitfalls of a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children is the need for proper planning and maintenance. Failing to fund the trust correctly or update it as circumstances change can lead to complications. Additionally, while a living trust helps avoid probate, it does not provide tax benefits that other estate planning tools might offer. Understanding these factors is vital for effective estate planning.

While a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children offers many advantages, there are potential downsides. Establishing a trust can involve upfront costs for drafting and funding, which some families may find burdensome. Additionally, any assets not transferred into the trust may not be protected and can lead to delays in asset distribution upon death. Therefore, it's crucial to evaluate all aspects before proceeding.

When considering a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children, it is essential to determine your unique needs. In many cases, spouses benefit from a joint living trust because it simplifies management and provides seamless transfer of assets. However, separate trusts may better serve families with diverse financial situations or specific goals. Always consult with a legal professional to explore the best options for your scenario.

While a Joliet Illinois Living Trust for Husband and Wife with Minor and or Adult Children offers many benefits, placing your home in a trust can have drawbacks. For example, it may affect your property tax assessments and complicate home refinancing. Before making this decision, it's wise to consider the specific implications and consult an expert to make an informed choice.