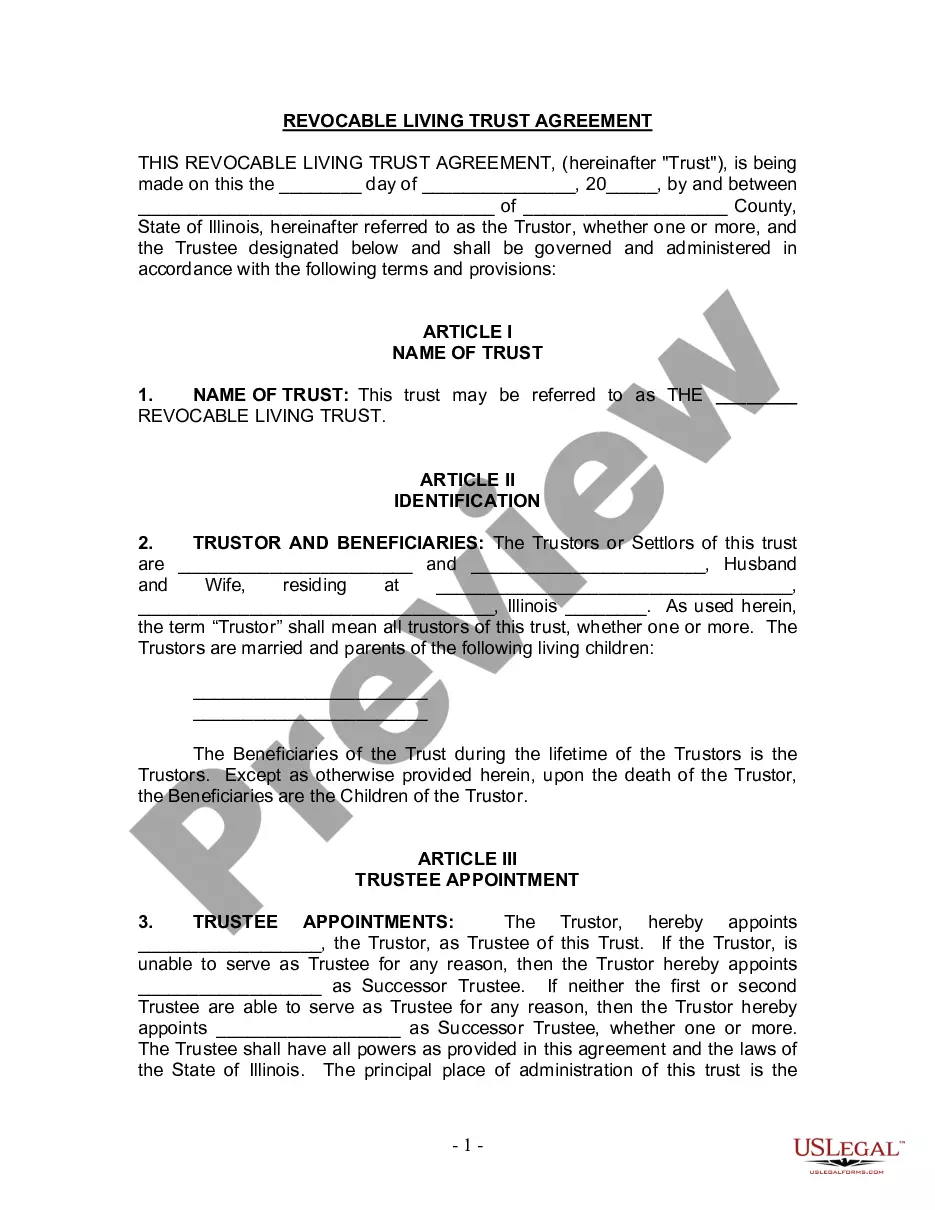

A Naperville Illinois Living Trust for Husband and Wife with Minor and/or Adult Children is a legal document that enables married couples residing in Naperville, Illinois, to protect their assets, provide for their children's well-being, and ensure the orderly distribution of their estate upon their passing. This type of living trust is designed to address the specific needs of couples who have both minor and adult children. It allows them to establish guidelines and instructions for the management and distribution of their assets during their lifetime and after their death. Here are a few key features and types of Naperville Illinois Living Trust for Husband and Wife with Minor and/or Adult Children: 1. Revocable Living Trust: A revocable living trust is a commonly chosen option that offers flexibility and control to the creators (husband and wife) during their lifetime. It can be easily modified or revoked if circumstances change. This type of trust allows for the transfer of assets to the designated beneficiaries without the need for probate. 2. Testamentary Trust: A testamentary trust is established within a will and becomes effective upon the testator's (husband or wife) death. It can be used to provide for minor children by appointing a trustee or a custodian, managing and distributing assets, and ensuring their welfare and education. This type of trust is especially useful when there are minor children involved. 3. Irrevocable Living Trust: An irrevocable living trust is a type of trust that cannot be modified or revoked once established unless all beneficiaries and trustees provide consent. It can serve as an effective tool for reducing estate taxes, protecting assets from creditors, and ensuring the proper distribution for both minor and adult children. 4. Special Needs Trust: If a couple has a child with special needs, they may consider a special needs trust to protect the child's eligibility for government benefits while providing additional financial support. This type of trust ensures the child's quality of life by allowing the trustee to manage the assets and make distributions accordingly. 5. Charitable Remainder Trust: For couples who wish to leave a lasting legacy and support charitable causes, a charitable remainder trust can be established. This trust allows them to provide income for their spouse and children during their lifetime while benefiting a designated charity or non-profit organization upon death. In conclusion, a Naperville Illinois Living Trust for Husband and Wife with Minor and/or Adult Children is a comprehensive estate planning tool that offers couples a range of options to protect their assets, provide for their children's well-being, and ensure the smooth transfer of their estate. Each type of trust mentioned above caters to different needs and circumstances, offering customization and control over wealth distribution. Seeking the advice of an experienced estate planning attorney is crucial to determine the most suitable trust or combination thereof based on individual circumstances and goals.

Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Illinois Living Trust For Husband And Wife With Minor And Or Adult Children?

We consistently aim to reduce or avert legal harm when engaging with intricate law-related or financial matters.

To achieve this, we enlist legal options that are often quite costly.

However, not every legal issue is equally intricate.

Many of them can be managed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children or any other document promptly and securely.

- US Legal Forms is an internet repository of current DIY legal paperwork spanning everything from wills and power of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to manage your own affairs without recoursing to a lawyer's services.

- We provide access to legal document templates that are not always readily available in the public domain.

- Our templates are specific to each state and locality, greatly enhancing the search process.

Form popularity

FAQ

The primary risk with a trust fund is that it can be mismanaged if proper care is not taken. A poorly constructed Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children can lead to family disputes or unintended consequences. Additionally, it's essential to keep the trust updated with current laws and individual needs to mitigate potential risks. Regular reviews can help maintain its effectiveness.

One major mistake is failing to fund the trust properly after its creation. Without transferring assets into a Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children, the trust remains ineffective. Additionally, not reviewing the trust regularly can lead to outdated instructions that do not reflect current wishes. Proper funding and maintenance are key to a successful trust.

Yes, placing assets in a trust can provide your parents with better control over their estate. A Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children can minimize probate costs and protect assets for beneficiaries. It also allows them to lay out specific instructions about asset distribution. Encourage your parents to consider their options carefully.

In many cases, it makes sense for a husband and wife to have a joint living trust. A Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children benefits from combining assets, making management easier. However, separate trusts might be beneficial if one partner has significantly more assets or from prior relationships. Consult an attorney to evaluate your unique circumstances.

Yes, you can create your own living trust in Illinois. However, establishing a Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children can be complex. Using a professional service can ensure you cover all legal requirements and make the process smoother. Platforms like uslegalforms provide templates and guidance tailored for your situation.

Placing your house in a trust in Illinois can offer significant advantages. It helps avoid probate, making the transition smoother for your loved ones. A Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children can specifically address housing assets while also providing protection for your family. To explore this option effectively, consider using platforms like USLegalForms for guidance and assistance.

The best living trust for a married couple often depends on their specific circumstances. However, a joint living trust can be a strong option as it simplifies management of assets and ensures both spouses are covered. For those in Naperville, a Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children can help streamline estate planning. Consulting with legal experts can further customize the trust to meet family needs.

One downside of a living trust is that it does not provide tax benefits like some estate planning options. Additionally, setting up a living trust can be more costly initially due to legal fees. It's essential to consider these factors when deciding on a Naperville Illinois Living Trust for Husband and Wife with Minor and or Adult Children. Despite these downsides, many families find that the benefits of avoiding probate far outweigh the initial costs.

Interesting Questions

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.