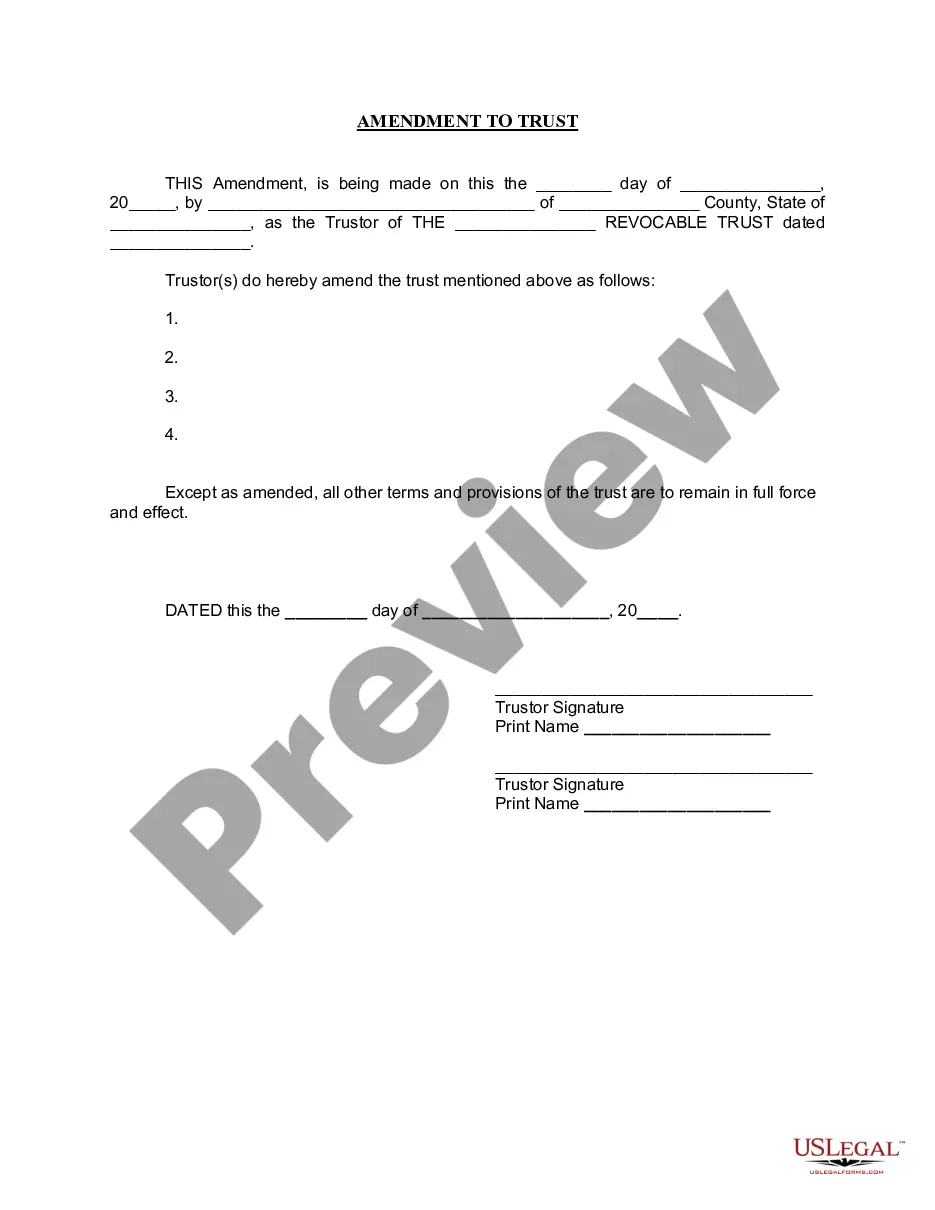

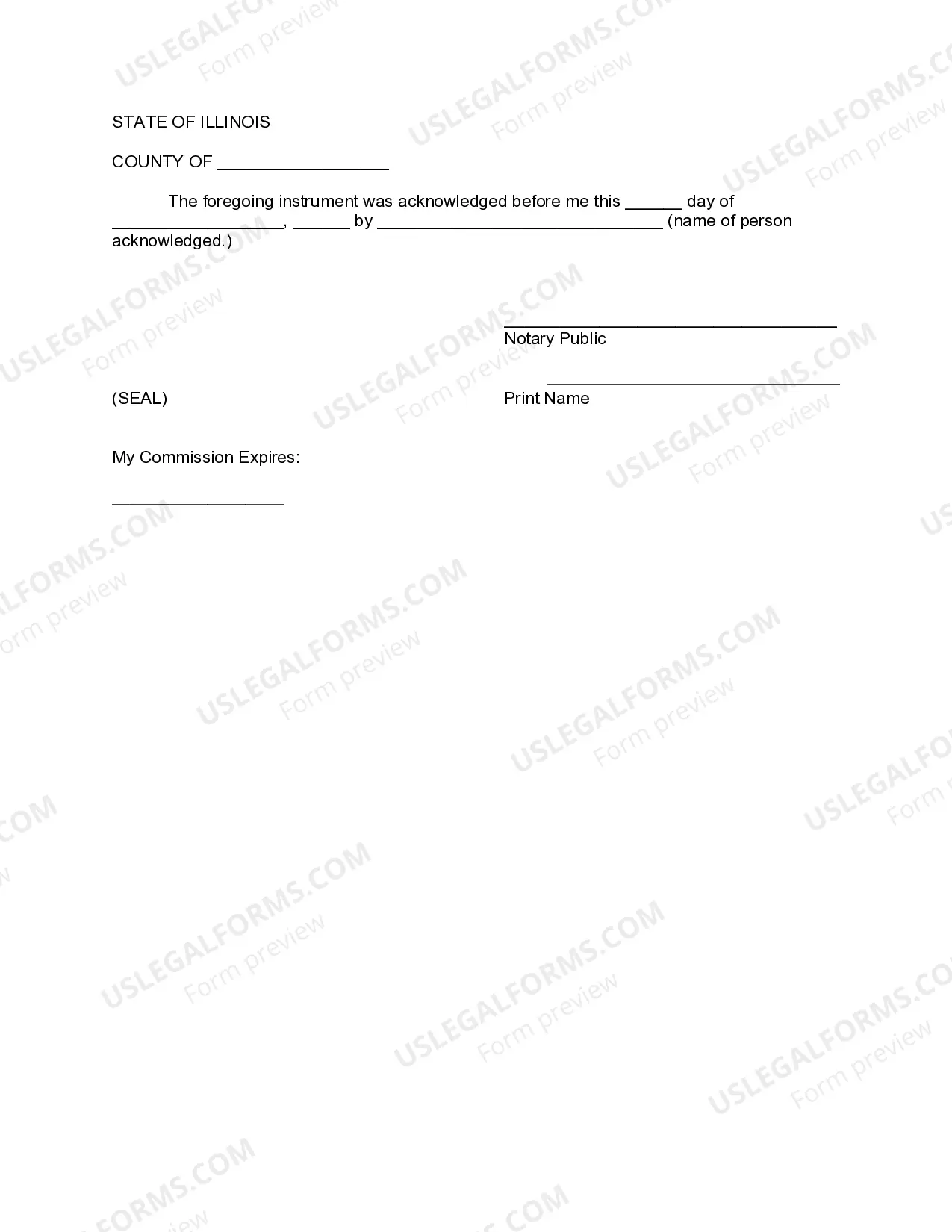

The Cook Illinois Amendment to Living Trust is a legal document that allows individuals residing in Cook County, Illinois, to make changes or modifications to their existing living trust. This amendment is crucial for individuals who wish to update their trust to reflect any significant life events or changes in their wishes regarding the distribution of their assets after their passing. The Cook Illinois Amendment to Living Trust provides a straightforward and legally binding method for making revisions to a living trust without the need to create an entirely new document. By utilizing this amendment, individuals can save time, costs, and avoid potential discrepancies that may arise from creating a new trust. The amendment allows for a wide range of changes to be made to the original trust document. Individuals can modify beneficiaries, add or remove assets, change the distribution percentages, alter trustee roles, or even update specific provisions related to healthcare or charitable donations, among other possibilities. It is essential to consider the various types of amendments available under the Cook Illinois Amendment to Living Trust. Some common types include: 1. Beneficiary Amendments: This modification allows individuals to change or add beneficiaries to their living trust. It enables individuals to ensure that their assets go to the intended individuals or organizations. 2. Asset Amendments: With this type of amendment, individuals can modify the assets included in their trust. They can add new assets they may have acquired over time or remove assets they no longer wish to include. 3. Distribution Amendments: This amendment type allows individuals to adjust the distribution percentages among their beneficiaries. Changes can be made to ensure that each beneficiary receives the desired amount or to reflect changes in personal circumstances. 4. Administrative Amendments: Individuals may need to make administrative changes, such as updating trustee roles or replacing an existing trustee. This type of amendment ensures that the trust's management aligns with the individual's current preferences. These various types of amendments make the Cook Illinois Amendment to Living Trust a versatile tool for individuals who wish to keep their trust up to date with their evolving life circumstances and intentions. In summary, the Cook Illinois Amendment to Living Trust is a legal tool that empowers individuals in Cook County, Illinois, to make modifications to their living trust. It offers flexibility by allowing for various types of amendments, including beneficiary, asset, distribution, and administrative amendments. By utilizing this amendment, individuals can ensure that their trust accurately reflects their wishes, minimizing potential complications and ensuring their assets are distributed according to their desires.

Cook Illinois Amendment to Living Trust

Description

How to fill out Cook Illinois Amendment To Living Trust?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal services that, as a rule, are very costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Cook Illinois Amendment to Living Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Cook Illinois Amendment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Cook Illinois Amendment to Living Trust is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!