Rockford, Illinois Amendment to Living Trust: A Detailed Description + Types In Rockford, Illinois, an amendment to a living trust is a legal document that allows the creator of a living trust to make changes or additions to specific provisions within the trust itself. This amendment serves as an essential tool for individuals who wish to modify their living trust according to evolving personal circumstances, changing tax laws, or updates in their financial situations. By utilizing a Rockford, Illinois Amendment to Living Trust, individuals can ensure that their trust remains up-to-date and aligned with their current wishes. There are different types of Rockford, Illinois Amendments to Living Trust that cater to specific needs and situations. Some of them include: 1. Beneficiary Amendment: — This type of amendment enables trust creators to add or remove beneficiaries from their living trust. It is commonly used when individuals want to update the list of beneficiaries due to marriage, divorce, birth of children, or changing relationships. 2. Asset Amendment: — An asset amendment allows individuals to modify the assets included in their living trust. This can be useful if trust creators want to add or remove certain properties, investments, or financial accounts from their trust. 3. Successor Trustee Amendment: — With a successor trustee amendment, trust creators can designate a new successor trustee to manage their trust in the event of their incapacity or passing. This type of amendment may be necessary if the initially appointed trustee becomes unavailable or if trust creators wish to update their chosen successor. 4. Administrative Amendment: — This amendment is utilized when revisions in administrative details of the living trust need to be made, such as changing the trust's name, address, or contact information. It ensures that the trust administration remains accurate and well-maintained. 5. Trustee Powers Amendment: — Trust creators may choose to amend their living trust to modify or expand the powers granted to their trustee. This type of amendment can be essential if trust creators want to provide their trustee with additional authorities or restrict certain powers. 6. Inheritance Tax Amendment: — An inheritance tax amendment allows trust creators to address changes in the inheritance tax laws specific to Rockford, Illinois. It ensures that the living trust complies with the latest tax regulations, potentially offering tax advantages to beneficiaries. By procuring the appropriate type of Rockford, Illinois Amendment to Living Trust, individuals can proactively adapt their trust documents to meet their ever-changing circumstances. However, it is crucial to involve legal professionals experienced in trust and estate planning to ensure that the amendments comply with Illinois state laws and are properly executed. Remember, to maintain the accuracy and effectiveness of a living trust, reviewing and updating it periodically is highly recommended.

Rockford Illinois Amendment to Living Trust

Description

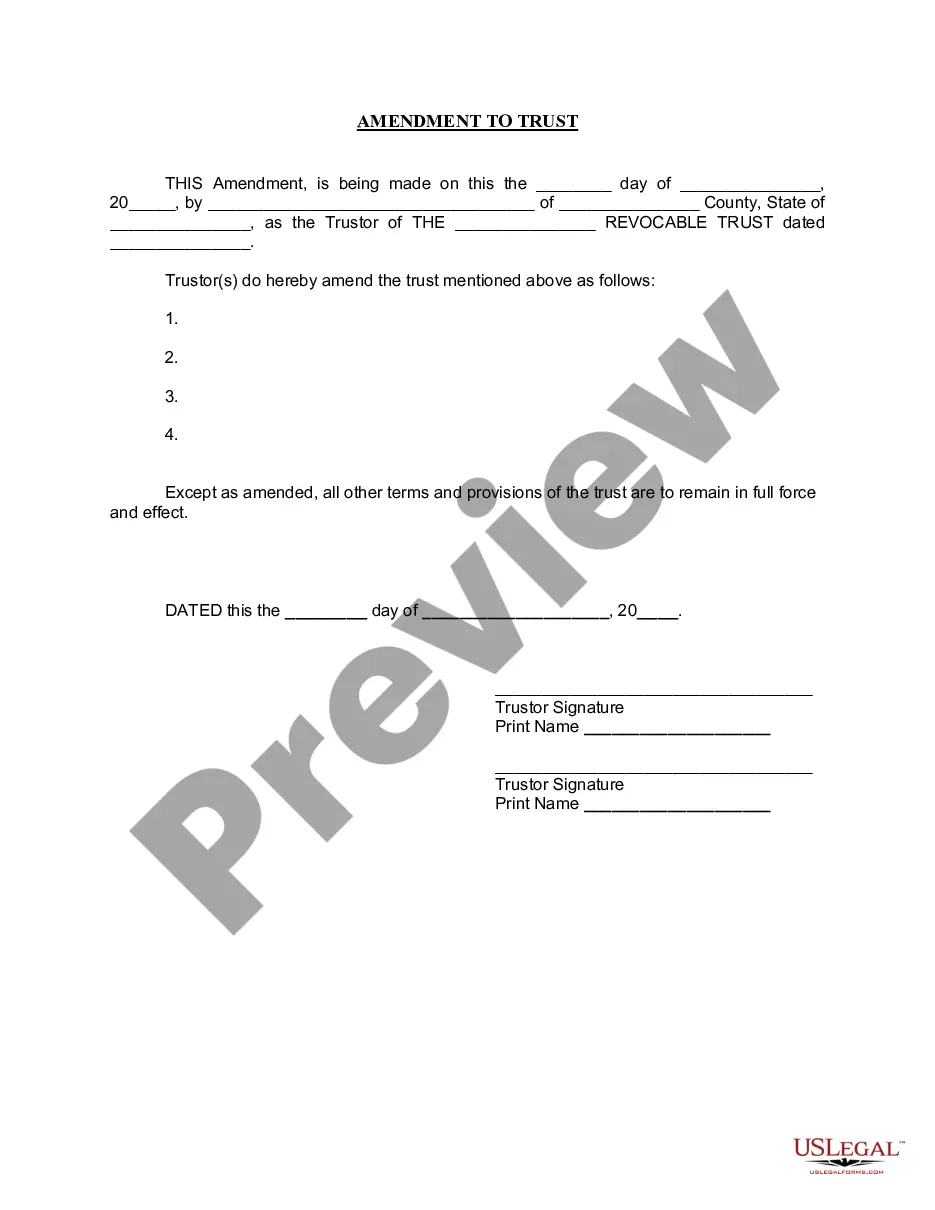

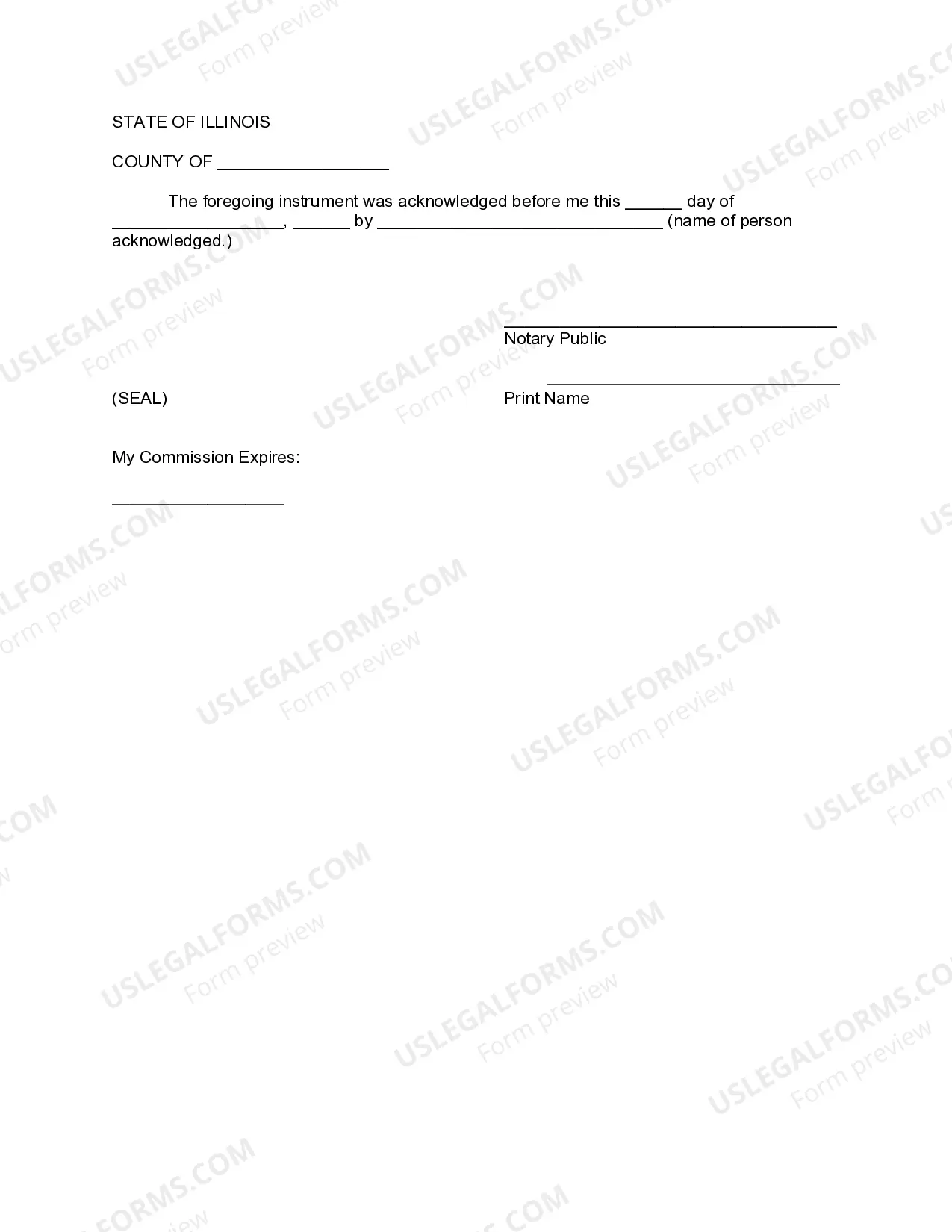

How to fill out Rockford Illinois Amendment To Living Trust?

Take advantage of the US Legal Forms and have instant access to any form you require. Our beneficial website with a large number of templates allows you to find and obtain almost any document sample you need. You can download, complete, and certify the Rockford Illinois Amendment to Living Trust in just a couple of minutes instead of browsing the web for many hours attempting to find an appropriate template.

Using our collection is a wonderful way to improve the safety of your form filing. Our professional attorneys regularly review all the records to make certain that the templates are relevant for a particular region and compliant with new acts and regulations.

How can you obtain the Rockford Illinois Amendment to Living Trust? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you view. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Open the page with the template you require. Make certain that it is the form you were seeking: check its name and description, and make use of the Preview feature when it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Pick the format to obtain the Rockford Illinois Amendment to Living Trust and change and complete, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy form libraries on the internet. Our company is always ready to help you in any legal process, even if it is just downloading the Rockford Illinois Amendment to Living Trust.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!