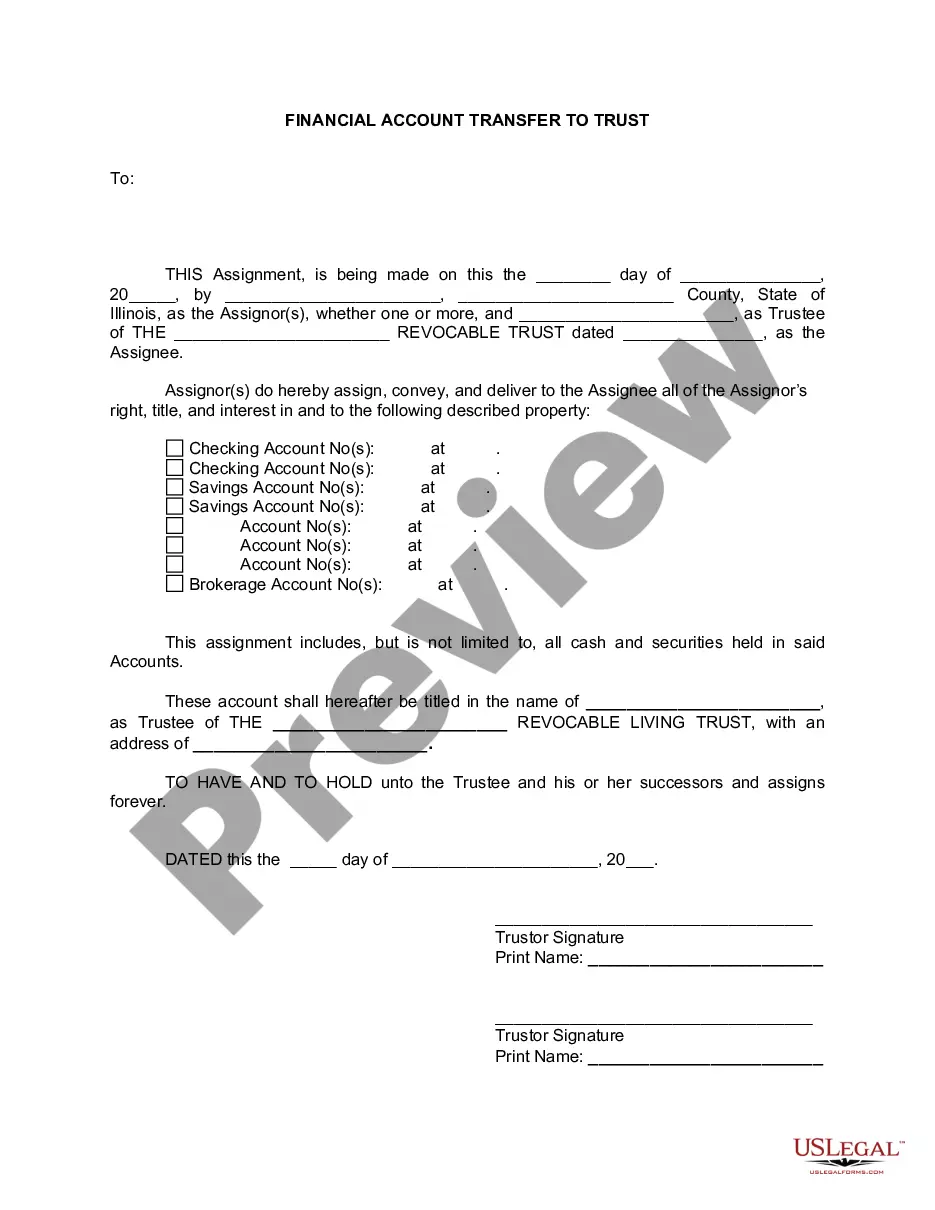

Chicago Illinois Financial Account Transfer to Living Trust refers to the process of transferring the ownership and control of one's financial accounts to a living trust in the state of Illinois. A living trust is a legal entity created to hold and manage assets during an individual's lifetime and to distribute them upon their death, without the need for probate. The transfer of financial accounts to a living trust in Chicago, Illinois, offers several advantages. First and foremost, it provides a seamless transition of control and ownership of financial accounts in the event of incapacity or death. By placing the accounts into a living trust, the individual appoints a trustee to manage and distribute the assets according to their instructions, ensuring the financial well-being of themselves and their beneficiaries. There are different types of Chicago Illinois Financial Account Transfer to Living Trust, including: 1. Checking and Savings Accounts: This involves transferring funds from individual checking and savings accounts into a trust account. By doing so, the assets are protected and managed by the trustee and can be utilized for the benefit of the trust's beneficiaries. 2. Investment and Retirement Accounts: This category encompasses the transfer of investment accounts, such as brokerage or mutual fund accounts, as well as retirement accounts like IRAs or 401(k)s, into the living trust. This ensures efficient management and potential growth of the invested assets while also providing tax advantages. 3. Real Estate Accounts: Real estate properties located in Chicago, Illinois, can also be transferred into a living trust. This process involves changing the property's title into the trust's name, allowing for seamless management and distribution of real estate assets according to the trust's terms. 4. Business Accounts: For individuals who own businesses or have ownership interests, the transfer of business accounts into a living trust can provide smooth succession planning and ensure the continuation of operations in the event of the owner's incapacity or death. To initiate the Chicago Illinois Financial Account Transfer to Living Trust, certain steps need to be followed. These may include identifying the accounts to be transferred, contacting the financial institutions to notify them of the trust, and completing the necessary paperwork or forms provided by each institution. Furthermore, it is recommended to consult with an experienced estate planning attorney who can guide individuals through the process and ensure compliance with relevant laws and regulations. In summary, the Chicago Illinois Financial Account Transfer to Living Trust involves the transfer of various financial accounts into a living trust entity. By doing so, individuals can protect and efficiently manage their assets, provide for their beneficiaries' financial well-being, and minimize the complexities and costs associated with probate.

Chicago Illinois Financial Account Transfer to Living Trust

Description

How to fill out Chicago Illinois Financial Account Transfer To Living Trust?

If you are looking for a valid form template, it’s impossible to choose a more convenient platform than the US Legal Forms site – one of the most considerable libraries on the web. With this library, you can get a large number of templates for business and personal purposes by types and states, or keywords. Using our high-quality search option, finding the newest Chicago Illinois Financial Account Transfer to Living Trust is as easy as 1-2-3. Furthermore, the relevance of each and every file is confirmed by a team of expert attorneys that regularly review the templates on our website and update them according to the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to receive the Chicago Illinois Financial Account Transfer to Living Trust is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the form you need. Look at its information and utilize the Preview function to check its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to discover the proper record.

- Confirm your selection. Click the Buy now option. Next, choose the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Chicago Illinois Financial Account Transfer to Living Trust.

Each form you add to your account has no expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to get an additional duplicate for editing or printing, you can return and save it again whenever you want.

Take advantage of the US Legal Forms extensive catalogue to get access to the Chicago Illinois Financial Account Transfer to Living Trust you were seeking and a large number of other professional and state-specific samples on one platform!