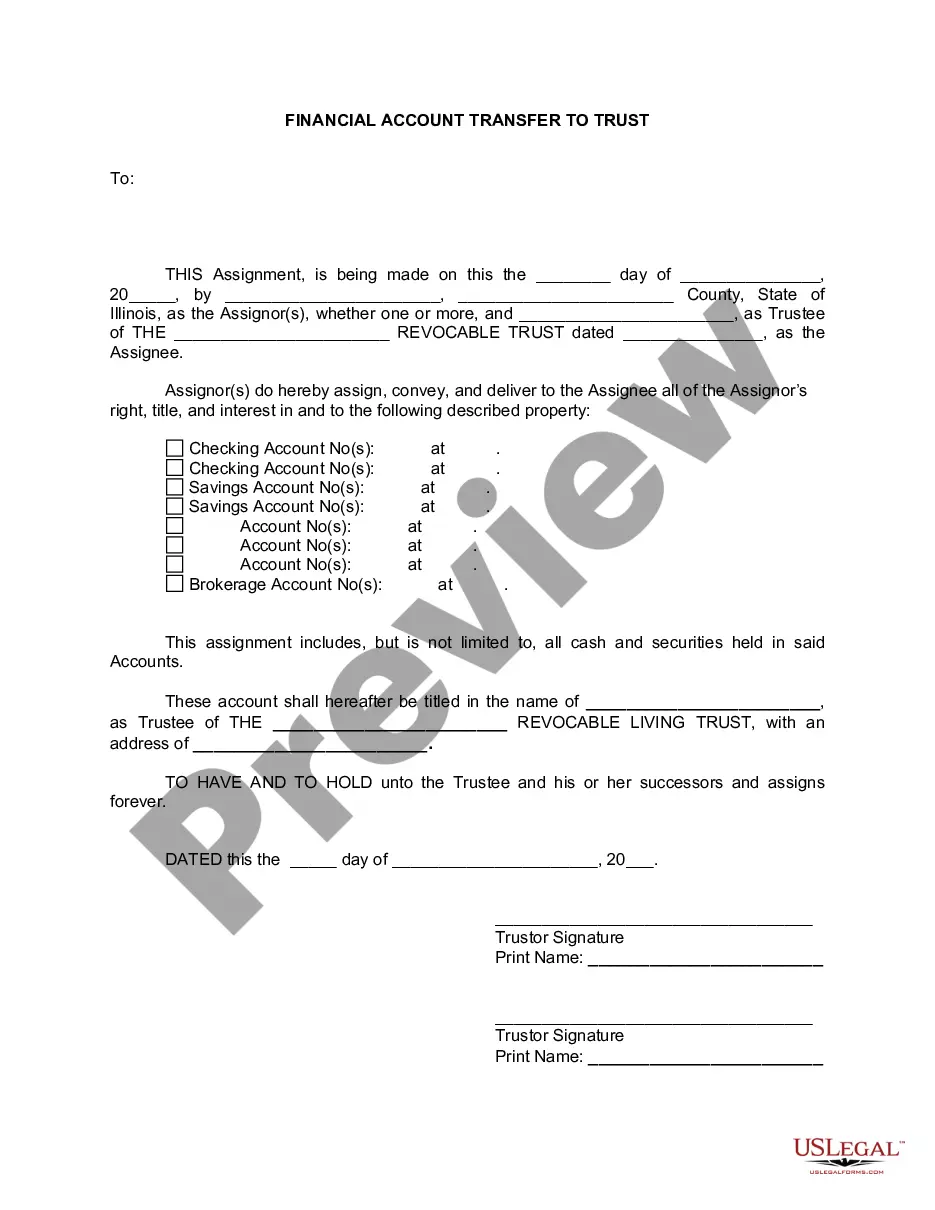

Cook Illinois Financial Account Transfer to Living Trust is a process that involves transferring financial accounts owned by an individual or a company to a living trust. A living trust is a legal arrangement where assets, including financial accounts, are placed for the benefit and management by a designated trustee. This type of transfer ensures that the assets held in the financial accounts are protected and managed according to the wishes of the granter even after their incapacity or death. There are various types of Cook Illinois Financial Account Transfer to Living Trust, namely: 1. Bank Account Transfer: This involves transferring existing bank accounts, such as checking, savings, or money market accounts, to a living trust. By doing so, the granter ensures that the funds held in these accounts are effectively managed and distributed according to the trust's instructions. 2. Investment Account Transfer: This refers to the transfer of investment accounts, such as brokerage accounts and mutual funds, into a living trust. It allows the granter to have control over the investment decisions and distribution of assets held in these accounts, even in the event of their incapacitation or death. 3. Retirement Account Transfer: This type of transfer involves moving retirement accounts, such as IRAs (Individual Retirement Accounts) or 401(k)s, into a living trust. By doing so, the granter ensures that their retirement funds are managed and distributed according to their desired beneficiaries' interests while also providing potential tax advantages. 4. Insurance Policy Transfer: Cook Illinois Financial Account Transfer to Living Trust may also include transferring life insurance policies or annuity contracts. By placing these policies within the living trust, the granter can designate the trust as the beneficiary, ensuring the proceeds are distributed as intended and potentially avoiding probate. 5. Real Estate Account Transfer: In some cases, the transfer of real estate owned by an individual or a company may also be included in Cook Illinois Financial Account Transfer to Living Trust. Transferring properties, such as residential homes or commercial buildings, ensures seamless management and avoids potential disputes or challenges upon the granter's incapacity or death. In conclusion, Cook Illinois Financial Account Transfer to Living Trust encompasses various types of transfers involving different financial accounts owned by individuals or companies. These transfers help ensure the effective management, protection, and distribution of assets in accordance with the granter's wishes, providing peace of mind for both the individual and their beneficiaries.

Cook Illinois Financial Account Transfer to Living Trust

Description

How to fill out Cook Illinois Financial Account Transfer To Living Trust?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone without any law background to draft such papers from scratch, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform offers a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Cook Illinois Financial Account Transfer to Living Trust or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Cook Illinois Financial Account Transfer to Living Trust in minutes employing our reliable platform. In case you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

However, in case you are new to our library, ensure that you follow these steps prior to downloading the Cook Illinois Financial Account Transfer to Living Trust:

- Be sure the template you have found is good for your location considering that the regulations of one state or county do not work for another state or county.

- Review the form and go through a brief outline (if provided) of scenarios the document can be used for.

- In case the one you chosen doesn’t suit your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your login information or create one from scratch.

- Select the payment method and proceed to download the Cook Illinois Financial Account Transfer to Living Trust as soon as the payment is completed.

You’re all set! Now you can go ahead and print out the form or fill it out online. In case you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

Retirement accounts definitely do not belong in your revocable trust ? for example your IRA, Roth IRA, 401K, 403b, 457 and the like. Placing any of these assets in your trust would mean that you are taking them out of your name to retitle them in the name of your trust. The tax ramifications can be disastrous.

Most banks prefer that you and your spouse come to a local branch of the bank and complete their trust transfer form. Typically this is a one or two page document that will ask you to list the name of your trust, the date of the trust and who the current trustees are.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

A trust can hold a variety of different assets, including stocks, mutual funds, ETFs (exchange-traded funds), REITs (real estate investment trusts), cash, real estate, and other property.

In short, YES, you can designate a trust as the future beneficiary of your 401(k) retirement account. Leaving your inheritance in a trust allows you to control where and how your assets are divided after your death.

Retirement plans themselves cannot be transferred into a trust; those assets must be distributed from the plan first, which triggers income tax on the distribution. If you are older than 72 when you die, money generally must come out of your retirement plan according to the schedule that was required before your death.

Some of your financial assets need to be owned by your trust and others need to name your trust as the beneficiary. With your day-to-day checking and savings accounts, I always recommend that you own those accounts in the name of your trust.

Mechanism of Transfer Real estate is transferred through the execution of the appropriate deed transferring the real estate property to the Trust. You or your attorney must then record the deed with the Recorder of Deeds for your county.

More info

You may be qualified if you pay federal income or state income taxes, and you can prove ownership of your residence for five years or less. Qualified homesteads include you, your spouse, or your dependents. If you owned your home or place of business for most of the last ten years, but you stopped making payments to the bank, you have paid more into the bank than you received for it, then you may be eligible. This is not an admission of guilt; just an acknowledgment of the facts. You may qualify for the exemption if the value of your home or business is 5,000 or less. Qualified homesteads also include the principal home of a qualifying disabled person, qualified military veterans, and qualified persons who live in other homesteads for a significant portion of the year. Learn more at For information about the eligibility of other homesteads, contact your local county clerk's office.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.