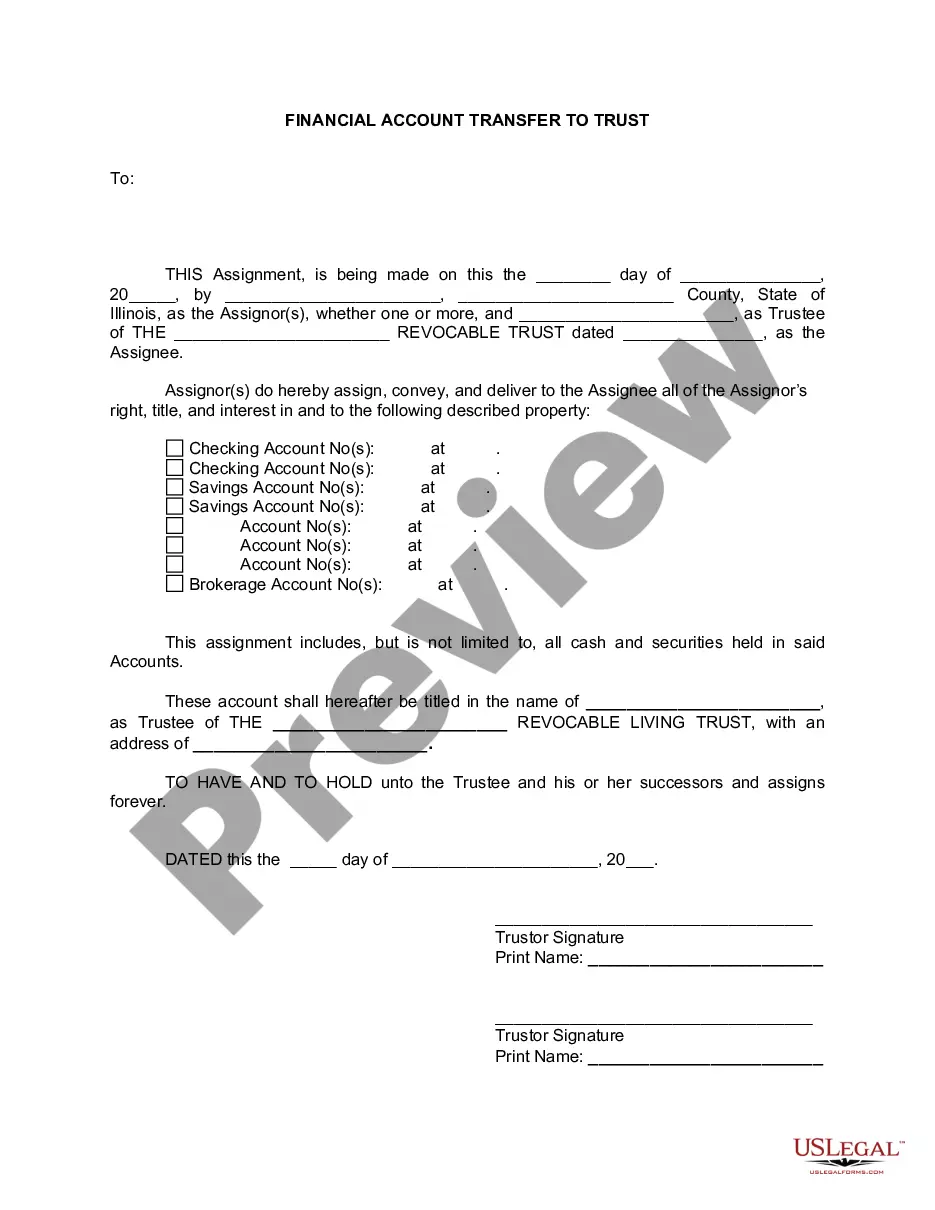

Elgin, Illinois Financial Account Transfer to Living Trust: In Elgin, Illinois, transferring financial accounts to a living trust has become an essential step for many individuals and families seeking to protect their assets and plan for the future. A living trust offers numerous benefits, including ensuring privacy, avoiding probate, and providing for a seamless transfer of assets to beneficiaries upon the granter's incapacity or death. The process of transferring financial accounts to a living trust in Elgin, Illinois involves several key steps. First, it is crucial to establish a revocable living trust, which serves as a legal entity that holds ownership of assets and designates beneficiaries. By forming a living trust, individuals or couples become the granters and retain full control of their assets during their lifetime. Next, the granter must identify the financial accounts they wish to transfer into the trust. These accounts can include bank accounts, investment portfolios, retirement accounts, stocks, bonds, mutual funds, and other assets held at financial institutions. It is important to take note of all account numbers, financial institutions, and contact information to streamline the transfer process. Once the accounts have been identified, the granter must inform their financial institutions about their intent to transfer ownership to the living trust. This usually involves completing specific forms, provided by each financial institution, to change the ownership and beneficiary designation of the accounts. Additionally, a letter of instruction may be required to guide the institution through the transfer process accurately. During the account transfer process, it is advisable to work closely with an experienced estate planning attorney in Elgin, Illinois, who specializes in living trusts. The attorney can ensure that all legal requirements are met, review the transfer documents, and provide guidance on any potential tax implications or other considerations. It's worth mentioning that there are various types of financial account transfers to a living trust in Elgin, Illinois, each catering to specific needs and situations. Some common types include: 1. Bank Account Transfer: This involves transferring ownership of checking, savings, money market, and certificate of deposit (CD) accounts held at various banks or credit unions into the living trust. 2. Investment Account Transfer: This encompasses moving investment-related accounts such as brokerage accounts, stocks, bonds, mutual funds, and exchange-traded funds (ETFs) into the living trust. 3. Retirement Account Transfer: Granters with Individual Retirement Accounts (IRAs), 401(k)s, or other retirement accounts can transfer these assets into the living trust to ensure a smooth transfer to designated beneficiaries. 4. Trust-to-Trust Account Transfer: In cases where individuals already have an existing living trust but wish to create a new one or consolidate multiple trusts, this transfer type allows for the seamless movement of assets between trusts. It's important to note that financial account transfer to a living trust in Elgin, Illinois, should be done in conjunction with a comprehensive estate plan. This typically includes drafting a pour-over will, healthcare directives, and powers of attorney to address various aspects of end-of-life decisions, incapacity, and asset distribution. In conclusion, transferring financial accounts to a living trust in Elgin, Illinois provides individuals and families with a robust estate planning tool designed to protect assets, ensure privacy, and enable seamless asset transfer to beneficiaries. By working with an experienced attorney and completing the necessary steps, individuals can create a solid foundation for their financial future and leave a lasting legacy.

Elgin Illinois Financial Account Transfer to Living Trust

Description

How to fill out Elgin Illinois Financial Account Transfer To Living Trust?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no legal education to create such paperwork cfrom the ground up, mainly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our service offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Elgin Illinois Financial Account Transfer to Living Trust or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Elgin Illinois Financial Account Transfer to Living Trust quickly employing our trusted service. If you are presently an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, in case you are a novice to our library, make sure to follow these steps prior to obtaining the Elgin Illinois Financial Account Transfer to Living Trust:

- Be sure the form you have chosen is good for your location considering that the rules of one state or county do not work for another state or county.

- Preview the document and go through a quick description (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Choose the payment method and proceed to download the Elgin Illinois Financial Account Transfer to Living Trust once the payment is through.

You’re all set! Now you can go on and print out the document or complete it online. Should you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.