Naperville Illinois Financial Account Transfer to Living Trust

Description

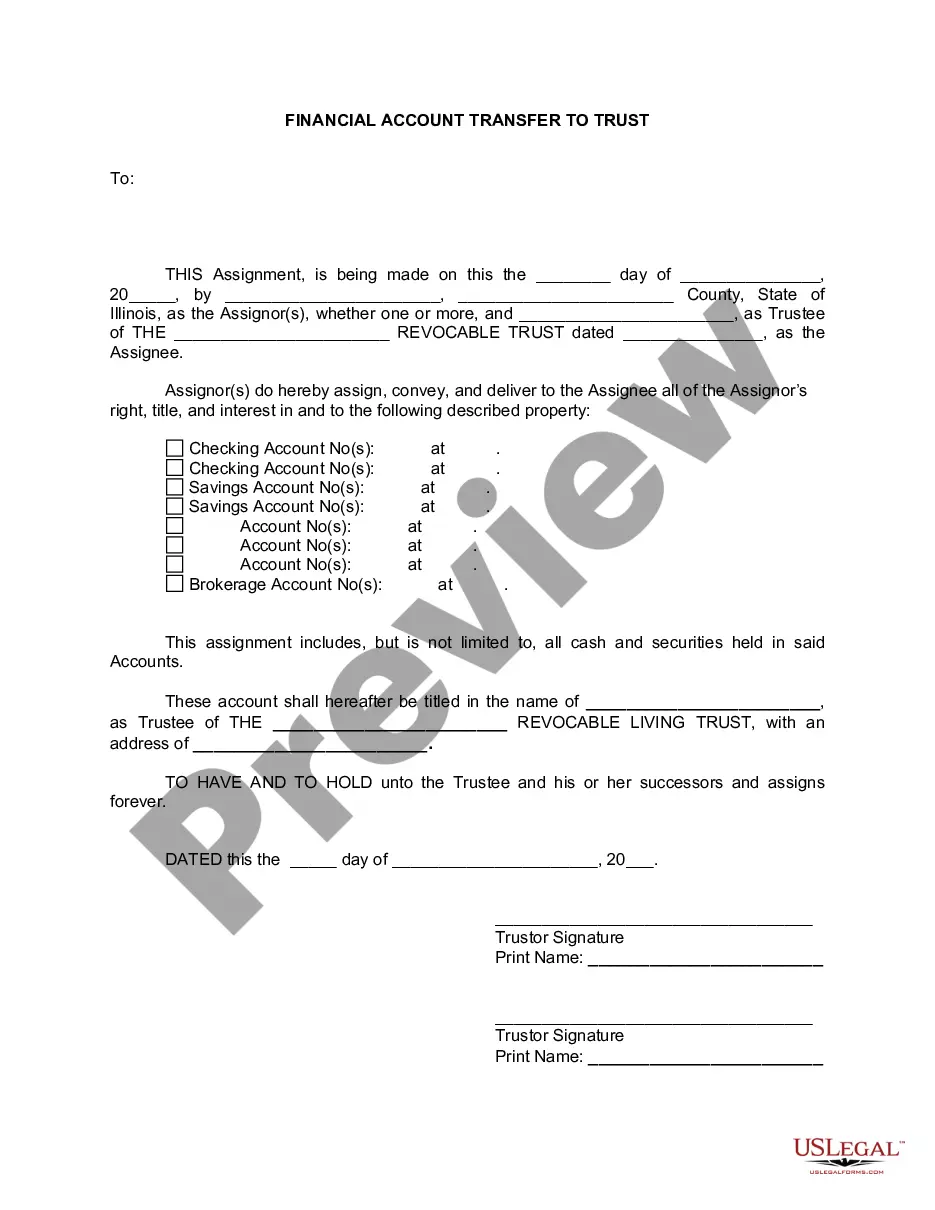

How to fill out Illinois Financial Account Transfer To Living Trust?

If you have previously accessed our service, Log In to your account and download the Naperville Illinois Financial Account Transfer to Living Trust onto your device by pressing the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial use of our service, follow these straightforward steps to acquire your file.

You have lifelong access to all documents you have purchased: you can find it in your account under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to easily find and download any template for your personal or business needs!

- Ensure you’ve located an appropriate document. Review the details and utilize the Preview option, if available, to confirm if it satisfies your needs. If it’s not suitable, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Obtain your Naperville Illinois Financial Account Transfer to Living Trust. Choose the file format for your document and store it on your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Deciding whether to put your house in a trust in Illinois depends on your specific circumstances and goals. A trust can provide benefits like avoiding probate and better managing your assets after death. However, it's essential to weigh the pros and cons, including costs and potential tax implications. Consulting resources for the Naperville Illinois Financial Account Transfer to Living Trust can help you make an informed decision.

Assets move into a trust through a process known as funding. You can transfer various assets, such as real estate, bank accounts, or investments by changing the title or ownership. For example, you might need to retitle your home in the name of the trust. Utilizing a service like USLegalForms can streamline the Naperville Illinois Financial Account Transfer to Living Trust process, making it easier for you.

Transferring property to a trust in Illinois involves a few essential steps. First, you will need to create the trust document, specifying the details of the trust, including the trustee and beneficiaries. Next, you will execute a deed to transfer the property title to the trust, which typically requires notarization. It's wise to consult a legal expert familiar with Naperville Illinois Financial Account Transfer to Living Trust to ensure all legal requirements are met.

Transferring your brokerage account to a living trust in Naperville Illinois involves several steps. First, you need to contact your brokerage firm to ask for their specific procedures and forms for the transfer. Typically, you will fill out a transfer request form and provide a copy of your trust document. By successfully completing this process, you secure your assets in the trust, making the Naperville Illinois Financial Account Transfer to Living Trust smooth and effective.

To transfer a bank account to your living trust, start by contacting your bank for their specific requirements for the account transfer. The bank might ask for the trust's name, date, and a copy of the trust document. Completing this transfer is essential for a successful Naperville Illinois Financial Account Transfer to Living Trust, allowing you to manage your financial assets efficiently.

One of the most common mistakes parents make is failing to fund their trust properly. Without transferring assets into the trust, the document remains ineffective. During your Naperville Illinois Financial Account Transfer to Living Trust, remember to adequately incorporate all important assets to ensure your family benefits from your estate plan.

Transferring property to a trust in Illinois involves drafting a new deed that names the trust as the new owner. You must also file this deed with the county where the property is located. This process is crucial for the Naperville Illinois Financial Account Transfer to Living Trust, as it ensures your assets are managed as you intended.

To transfer your checking account, you need to contact your bank and request the necessary paperwork to officially change the account ownership to the trust. This step is part of the Naperville Illinois Financial Account Transfer to Living Trust process and typically requires a copy of your trust document. Following through with your bank's instructions will help ensure a smooth transition.

Certain assets are not ideal for inclusion in a trust. For example, retirement accounts or life insurance policies should generally remain outside of a living trust to maintain their tax benefits. Additionally, personal items with sentimental value may complicate transfer processes, so consider them carefully during your Naperville Illinois Financial Account Transfer to Living Trust.

Yes, you can place a checking account in a trust as part of your estate planning strategy. This process, known as a Naperville Illinois Financial Account Transfer to Living Trust, helps manage your funds according to your wishes after your passing. It’s important that you work with a legal professional to ensure proper documentation and a smooth transfer.