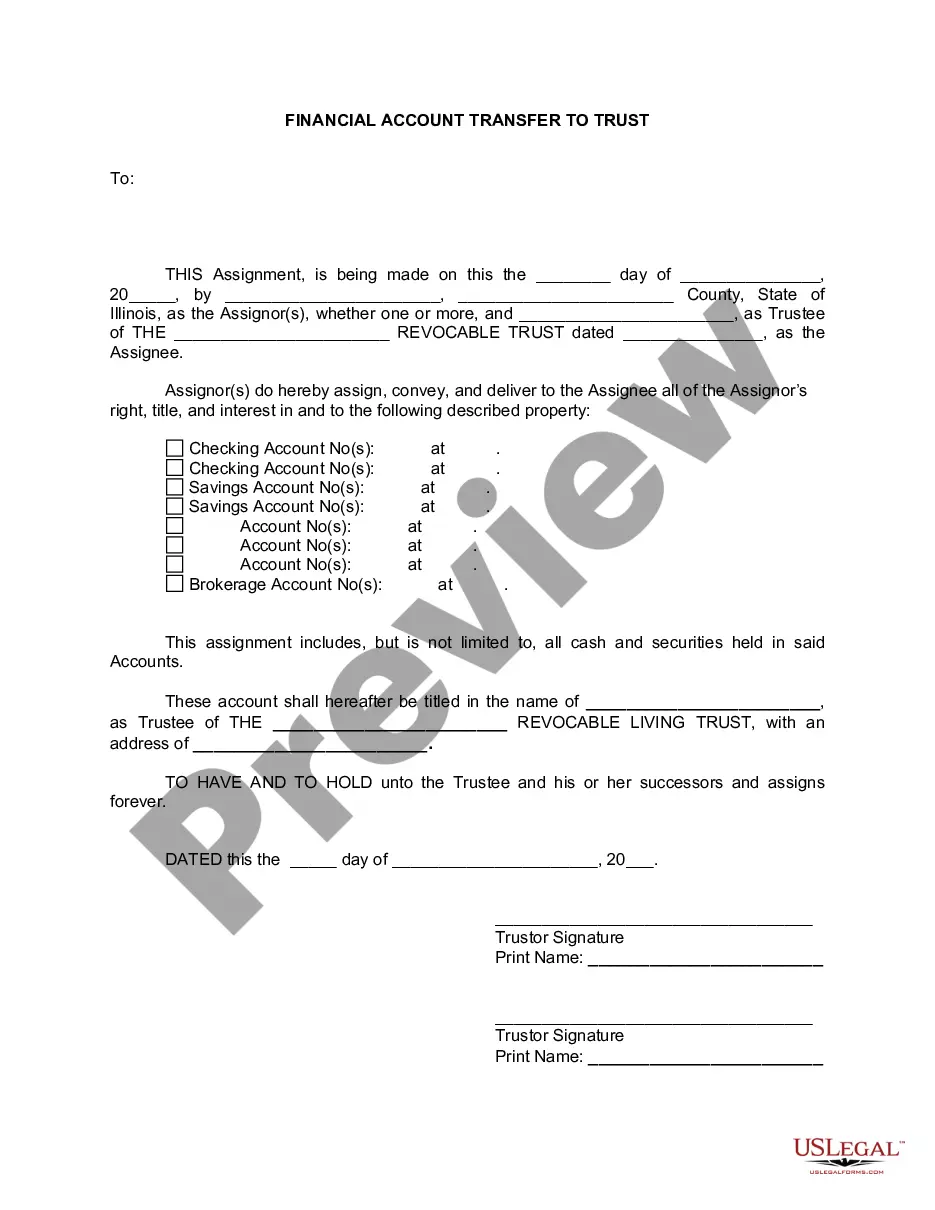

Title: Exploring Rockford, Illinois Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: Rockford, Illinois residents looking to safeguard their financial assets and ensure a smooth transfer of wealth to loved ones may consider the option of transferring financial accounts to a living trust. In this article, we will delve into the specifics of Rockford Illinois Financial Account Transfer to Living Trust, outlining its importance, benefits, and various types available for individuals seeking to protect their hard-earned assets. 1. What is a Living Trust? A living trust, commonly referred to as an inter vivos trust, is a legal tool that allows individuals to transfer ownership of their assets into a trust during their lifetime. Unlike a will, a living trust ensures the seamless transfer of financial accounts, property, and other assets to beneficiaries without the need for probate. 2. Importance of a Living Trust in Rockford, Illinois: A. Probate Avoidance: By transferring financial accounts to a living trust, Rockford residents can bypass probate, a potentially costly and time-consuming legal process. This helps beneficiaries avoid extended delays in accessing funds after the individual's passing. B. Privacy Protection: Living trusts offer a higher level of privacy compared to wills since trust documents don't become public records upon the granter's death. C. Incapacity Planning: In the event of incapacity, a living trust enables a designated successor trustee to take over management of the financial accounts seamlessly, preventing potential financial chaos. 3. Types of Rockford Illinois Financial Account Transfer to Living Trust: A. Revocable Living Trust: This is the most common type of living trust. It allows the granter to maintain control and make changes to the trust during their lifetime, including adding or removing financial accounts as needed. B. Irrevocable Living Trust: Once established, an irrevocable living trust cannot be altered or revoked, typically used for more specific purposes such as tax planning or protecting assets from creditors. C. Testamentary Trust: Unlike revocable living trusts created during the granter's lifetime, a testamentary trust is established through the granter's will and only takes effect upon their passing. This type of trust can be used to transfer financial accounts to a trust for the benefit of minor children or individuals with special needs. 4. Process of Rockford Illinois Financial Account Transfer to Living Trust: A. Consultation with an Attorney: It is advisable to seek guidance from an experienced estate planning attorney in Rockford who can tailor a living trust to fit individual needs. B. Asset Evaluation: Evaluate all financial accounts, including bank accounts, investment portfolios, retirement accounts, and real estate, to determine which should be transferred to the living trust. C. Updating Beneficiary Designations: Ensure that beneficiary designations on accounts, such as life insurance policies or retirement plans, are updated to align with the living trust. D. Drafting the Trust Document: The attorney will draft the living trust document, customizing it to include specific instructions for the transfer of financial accounts and other assets. E. Funding the Trust: Transfer ownership of financial accounts to the living trust by changing the account title and beneficiary designations. Conclusion: Rockford Illinois Financial Account Transfer to Living Trust provides residents with an effective estate planning strategy to protect their assets and ensure a seamless transfer to their loved ones. By understanding the various types of living trusts available and following the necessary steps to transfer financial accounts, individuals can establish financial security for their families while avoiding probate and ensuring privacy. Seeking professional advice from a well-versed estate planning attorney in Rockford is crucial to crafting a living trust suited to personal needs and goals.

Rockford Illinois Financial Account Transfer to Living Trust

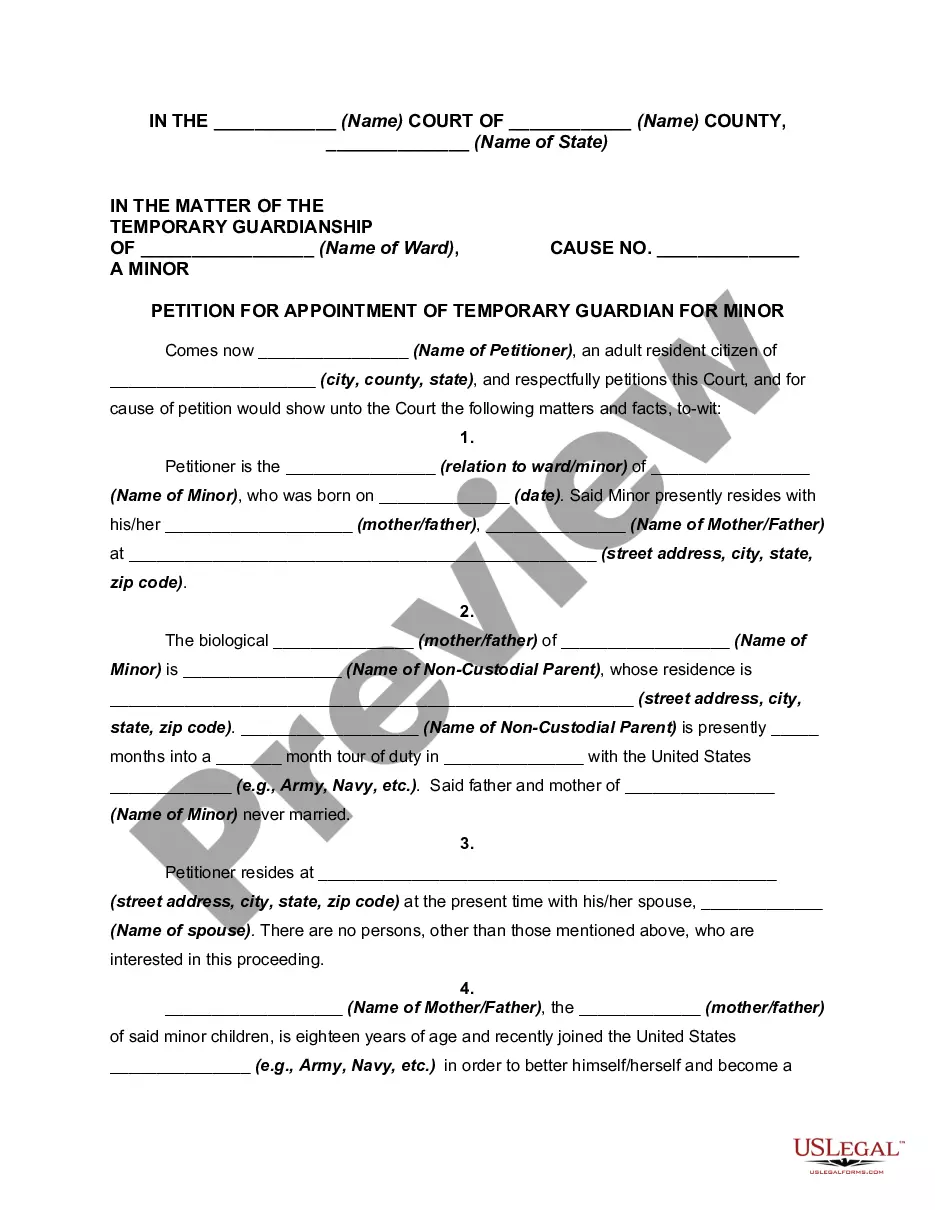

Description

How to fill out Rockford Illinois Financial Account Transfer To Living Trust?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any legal education to draft such papers cfrom the ground up, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our platform provides a huge collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Rockford Illinois Financial Account Transfer to Living Trust or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Rockford Illinois Financial Account Transfer to Living Trust quickly employing our trustworthy platform. If you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps before obtaining the Rockford Illinois Financial Account Transfer to Living Trust:

- Ensure the form you have found is specific to your area since the rules of one state or area do not work for another state or area.

- Preview the form and go through a quick description (if available) of cases the document can be used for.

- In case the one you selected doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account login information or create one from scratch.

- Select the payment method and proceed to download the Rockford Illinois Financial Account Transfer to Living Trust as soon as the payment is done.

You’re good to go! Now you can proceed to print out the form or complete it online. In case you have any problems getting your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.