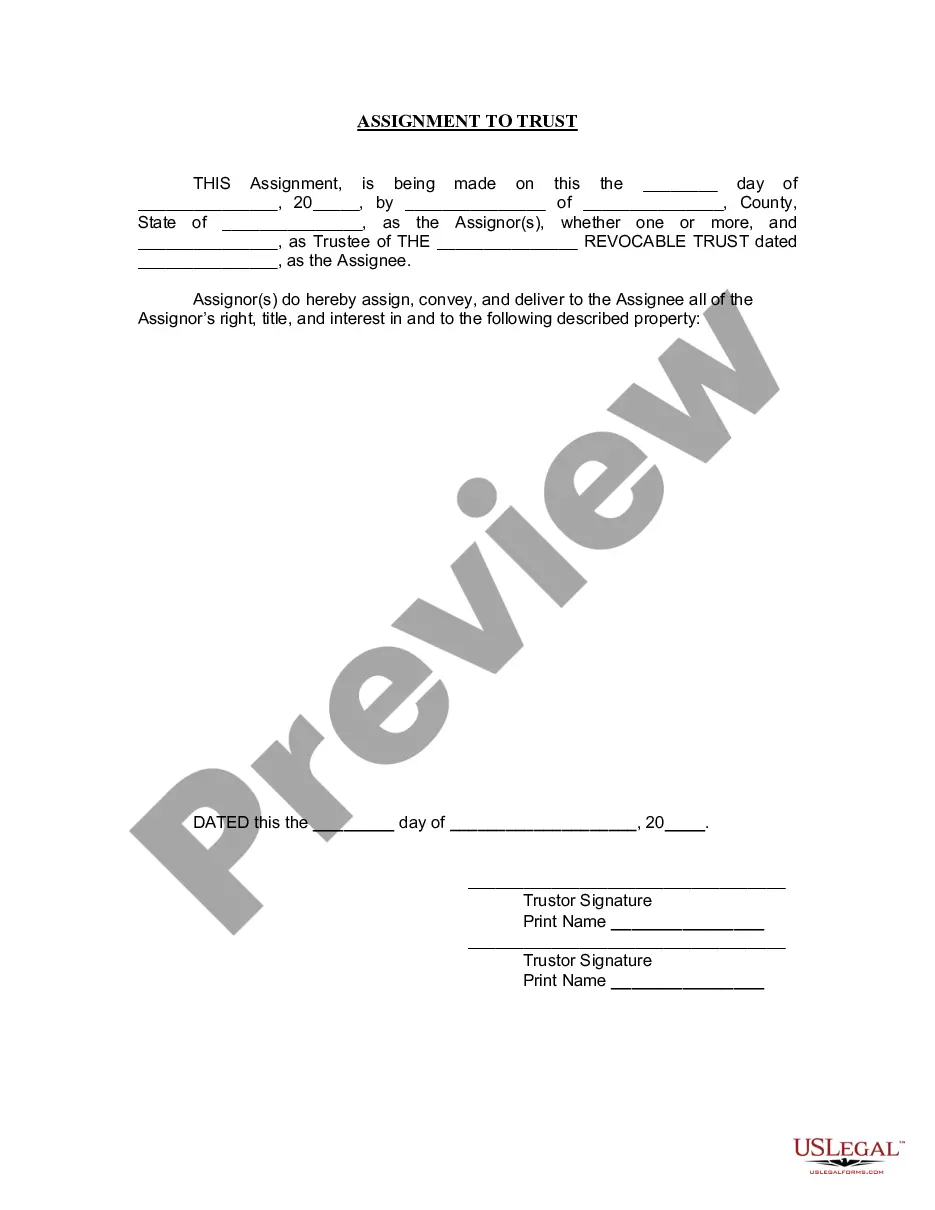

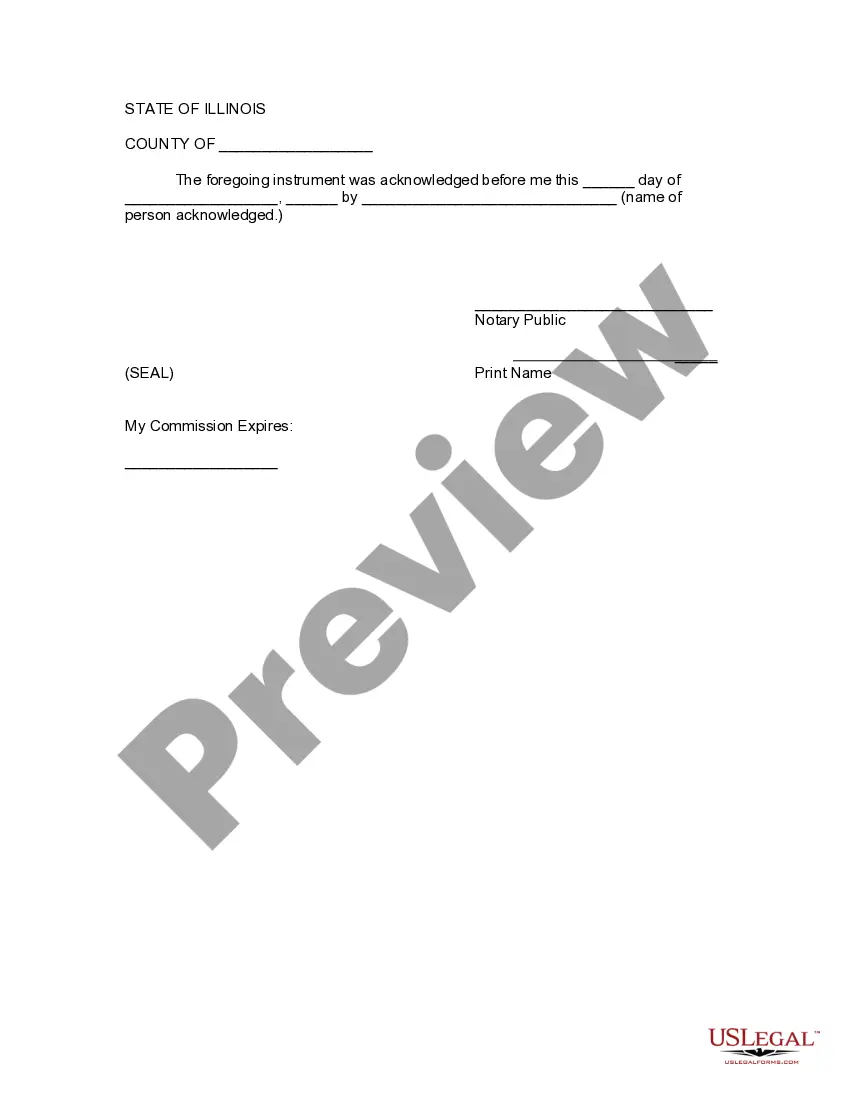

Elgin Illinois Assignment to Living Trust: A Comprehensive Guide Living trusts are an integral part of estate planning, aiming to protect and distribute assets efficiently according to one's wishes. In Elgin, Illinois, the concept of an assignment to a living trust is widely recognized and adopted. This detailed description delves into the significance, process, and various types of Elgin Illinois Assignment to Living Trust, providing readers with a comprehensive understanding of this essential aspect of estate planning. What is Elgin Illinois Assignment to Living Trust? Elgin Illinois Assignment to Living Trust refers to the legal process of transferring ownership of assets from an individual to a living trust based in Elgin, Illinois. An assignment to a living trust ensures that assets are protected and managed as per the trust or's instructions during their lifetime and even after their demise. This arrangement entrusts the responsibility of handling, distributing, and managing assets to a trustee, who acts in the best interest of the beneficiaries. Process of Elgin Illinois Assignment to Living Trust: 1. Establishing a Living Trust: The first step in the assignment process is creating a valid living trust document. This legally binding document outlines the trust or's wishes, designates a trustee, and lists the beneficiaries. The trust or retains control over their assets during their lifetime. 2. Identifying Assets: The trust or identifies the assets they wish to assign to the living trust. These assets can include real estate, bank accounts, investments, personal belongings, and any other valuable possessions. 3. Preparing Assignment Documents: An assignment document, also known as an Assignment of Assets, is drafted to transfer ownership of the identified assets into the living trust. This document must be executed properly according to Illinois and Elgin state laws. 4. Executing the Assignment: The trust or and trustee sign the Assignment of Assets document, officially transferring ownership of the identified assets to the living trust. The assignment should be notarized for added legal validity. 5. Updating Asset Titles: The trust or must ensure that the titles of assets are appropriately updated to reflect their assignment to the living trust. This ensures clarity in ownership and makes the asset distribution process smoother in the future. Types of Elgin Illinois Assignment to Living Trust: 1. Revocable Living Trust: A revocable living trust allows the trust or to make modifications, amendments, or even revoke the trust entirely during their lifetime. This type of trust provides flexibility and control. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of all involved parties. This type of trust is often beneficial for tax planning and asset protection. 3. Testamentary Trust: A testamentary trust is established within a will and comes into effect upon the trust or's demise. This type of trust allows for maximum flexibility during the trust or's lifetime. 4. Special Needs Trust: A special needs trust is designed to protect the needs of individuals with disabilities. It ensures that assets assigned to the trust do not interfere with their eligibility for public benefits. In summary, Elgin Illinois Assignment to Living Trust is a vital component of estate planning in Elgin, Illinois. It involves transferring ownership of assets into a living trust to protect and manage them according to the trust or's wishes. With various types of living trusts available, individuals in Elgin can choose the most suitable option based on their unique circumstances and objectives. Seeking guidance from an experienced estate planning attorney is strongly recommended ensuring a smooth and legally compliant assignment process.

Elgin Illinois Assignment to Living Trust

Description

How to fill out Elgin Illinois Assignment To Living Trust?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Elgin Illinois Assignment to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Elgin Illinois Assignment to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Elgin Illinois Assignment to Living Trust would work for your case, you can select the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!