Joliet Illinois Assignment to Living Trust: A Comprehensive Overview for Estate Planning When it comes to estate planning in Joliet, Illinois, one imperative legal instrument to consider is the Assignment to Living Trust. This process allows an individual, referred to as a settler, to transfer their assets into a trust during their lifetime, ensuring smooth management and distribution of those assets to their beneficiaries after their passing. This article aims to provide a detailed description of what Joliet Illinois Assignment to Living Trust entails, covering its purposes, benefits, and potential types. Key Terms: Joliet Illinois, Assignment to Living Trust, estate planning, settler, assets, trust, beneficiaries. 1. Assignment to Living Trust — The Basics Assignment to Living Trust is a legal process for a Joliet, Illinois resident to establish a trust and transfer their assets, such as real estate, financial holdings, personal belongings, and more, into the trust. This trust, typically referred to as a Living Trust or Revocable Trust, is established for the settler's benefit during their lifetime and ultimately transitions to provide for their beneficiaries upon death. 2. Purposes of Assignment to Living Trust a. Asset Management: The primary purpose of a Living Trust is to enable efficient management of assets during the settler's lifetime. The trust is typically overseen by a trustee, who can be the settler themselves or a designated individual or institution, ensuring the assets are appropriately maintained and administered. b. Probate Avoidance: By assigning assets to a Living Trust, Joliet residents can potentially avoid the probate process. Probate is a court-supervised procedure for validating a will and distributing assets, which can be expensive, time-consuming, and public. Utilizing a Living Trust allows for the transfer of assets outside of probate, providing privacy, cost savings, and a faster distribution process. c. Flexibility and Control: A Living Trust provides flexibility, as it can be amended or revoked by the settler during their lifetime, allowing for changes in beneficiaries, trustees, or asset allocation. It also ensures continued control over the assets and their management while allowing for the smooth transition of asset ownership when the settler passes away. 3. Types of Living Trusts in Joliet, Illinois a. Individual Living Trust: This is the most common type, where a single person establishes and transfers their assets into the trust for their benefit during their lifetime, passing them to designated beneficiaries upon death. b. Joint Living Trust: For married couples in Joliet, an option is to establish a Joint Living Trust, allowing both spouses to transfer their assets into a shared trust. This provides convenience and unified management, simplifying distribution upon the death of either spouse. c. Testamentary Living Trust: Also referred to as a Will Trust or a Testamentary Trust, this type of Living Trust only becomes effective upon the settler's death. It is established within a will and allows assets to be assigned into the trust, providing for beneficiaries under specific conditions outlined in the will. In conclusion, the Joliet Illinois Assignment to Living Trust is a crucial estate planning tool that enables seamless asset management and distribution while avoiding probate. By establishing a Living Trust, residents of Joliet can enjoy privacy, flexibility, and maintain control over their assets even after their passing. Understanding the various types of Living Trusts available can assist individuals in choosing the most suitable structure for their specific needs and circumstances.

Joliet Illinois Assignment to Living Trust

Description

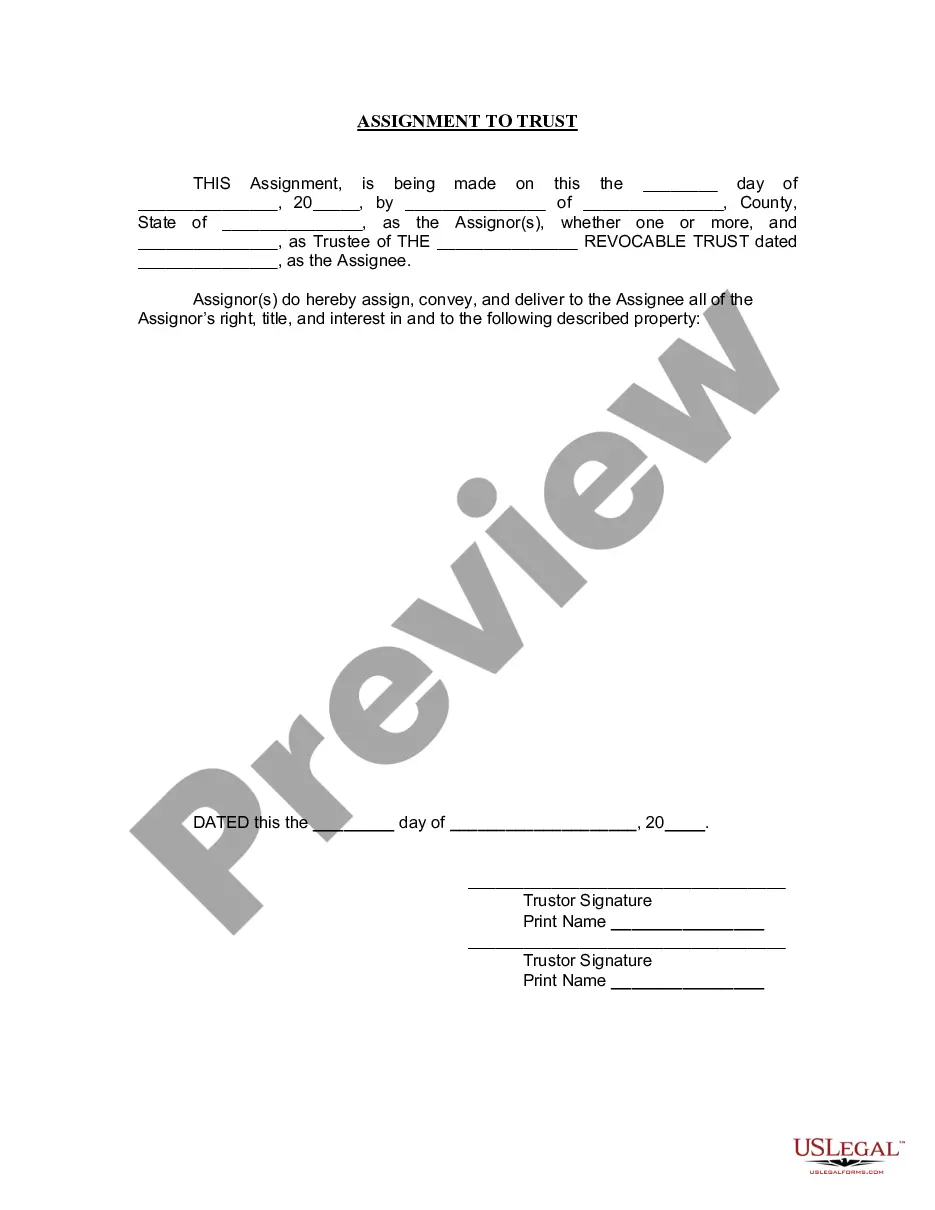

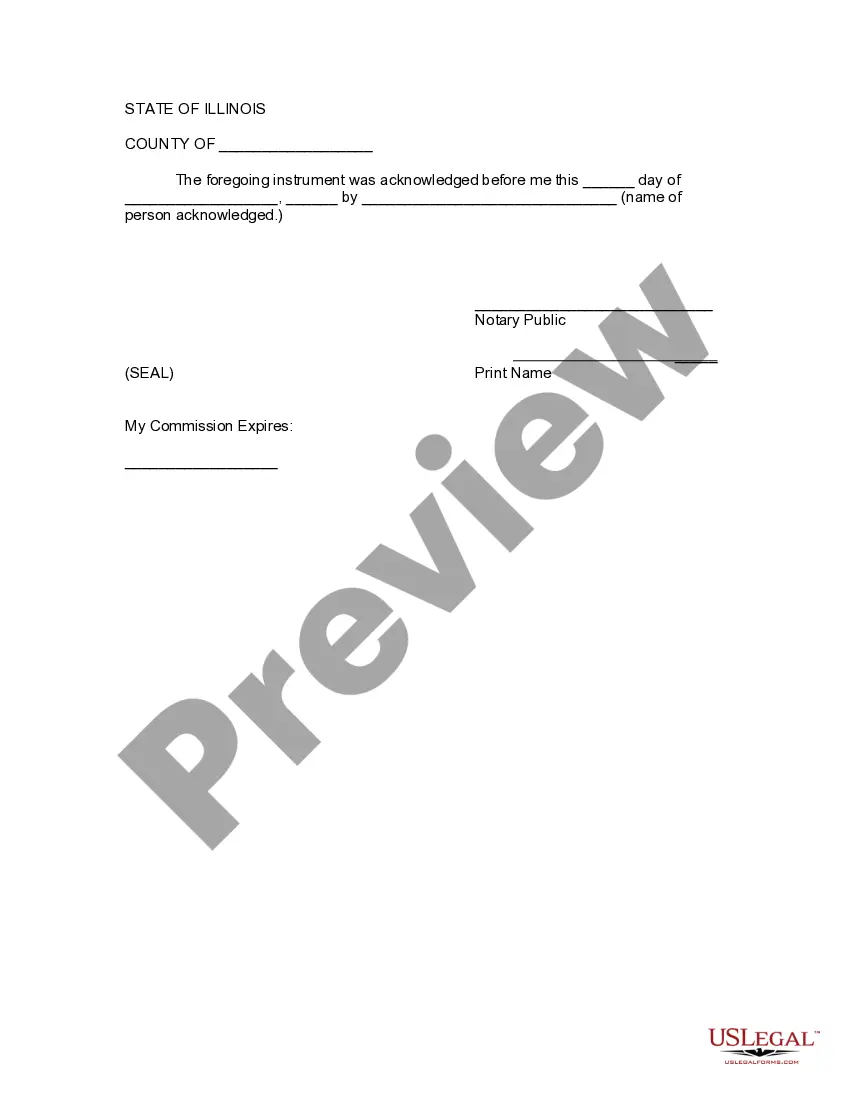

How to fill out Joliet Illinois Assignment To Living Trust?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal services that, as a rule, are extremely costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Joliet Illinois Assignment to Living Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Joliet Illinois Assignment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Joliet Illinois Assignment to Living Trust is proper for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!