Naperville, Illinois Assignment to Living Trust: A Comprehensive Guide In Naperville, Illinois, an assignment to a living trust is a crucial legal document that enables individuals to transfer their assets, properties, and estate into a trust during their lifetime. A living trust, also known as a revocable trust, allows individuals to maintain control over their assets while avoiding the probate process and ensuring a smooth transfer of assets to beneficiaries upon their passing. By creating an assignment to a living trust in Naperville, individuals can safeguard their assets, provide for their loved ones, and minimize the legal complexities that often arise after death. This legal arrangement offers considerable advantages, including privacy, flexibility, and the potential to reduce estate taxes. Types of Naperville, Illinois Assignment to Living Trust: 1. Revocable Living Trust: The most common type of assignment to a living trust in Naperville, Illinois, is the revocable living trust. It allows individuals to maintain control over their assets during their lifetime while providing for the efficient transfer of assets to beneficiaries upon their passing. The granter (the individual creating the trust) can modify or terminate the trust at any time, as their circumstances and preferences change. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked by the granter once it is established. This type of trust is often utilized to protect assets from estate taxes, creditors, or to preserve government benefits. While it limits the granter's control, it offers certain tax advantages, asset protection, and enhances the granter's ability to mediate inheritance. 3. Testamentary Trust: Although not a living trust, a testamentary trust is worth mentioning as it becomes effective after the granter's death through their last will and testament. This type of trust allows individuals to designate specific instructions on how their assets should be distributed to beneficiaries. It is created within a will and undergoes probate, unlike a living trust. Benefits and Considerations of Naperville, Illinois Assignment to Living Trust: i. Avoiding Probate: Assigning assets to a living trust helps bypass the probate process, which can be time-consuming, expensive, and subject to public record. This allows the granter's beneficiaries to receive their inheritance more efficiently. ii. Privacy: Unlike a will, a living trust does not become part of the public record, ensuring the granter's financial affairs remain confidential. iii. Incapacity Planning: A living trust allows for a smooth transfer of assets during times of incapacity, ensuring that a designated trustee can manage the assets on behalf of the granter. iv. Flexibility: With a revocable living trust, the granter can make changes to beneficiaries, assets, or terms as needed during their lifetime. v. Potential Tax Savings: A well-structured living trust may help reduce estate taxes, ensuring maximal wealth preservation for the granter's beneficiaries. In conclusion, an assignment to a living trust in Naperville, Illinois provides individuals with a powerful tool to protect their assets, streamline the inheritance process, and safeguard their family's financial future. Whether choosing a revocable, irrevocable, or testamentary living trust, seeking professional legal advice is vital to ensure the assignment aligns with one's specific objectives and provides maximum benefits.

Naperville Illinois Assignment to Living Trust

Description

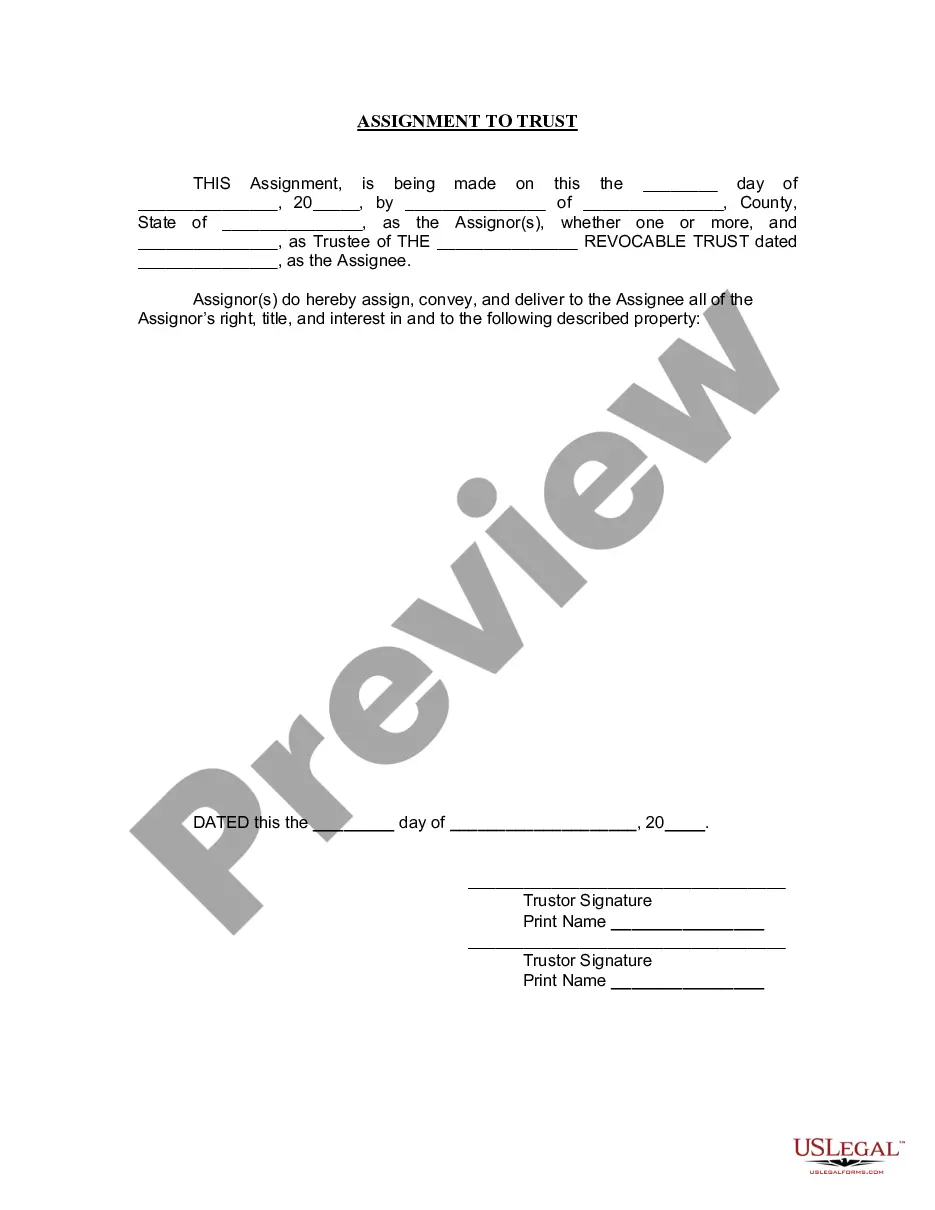

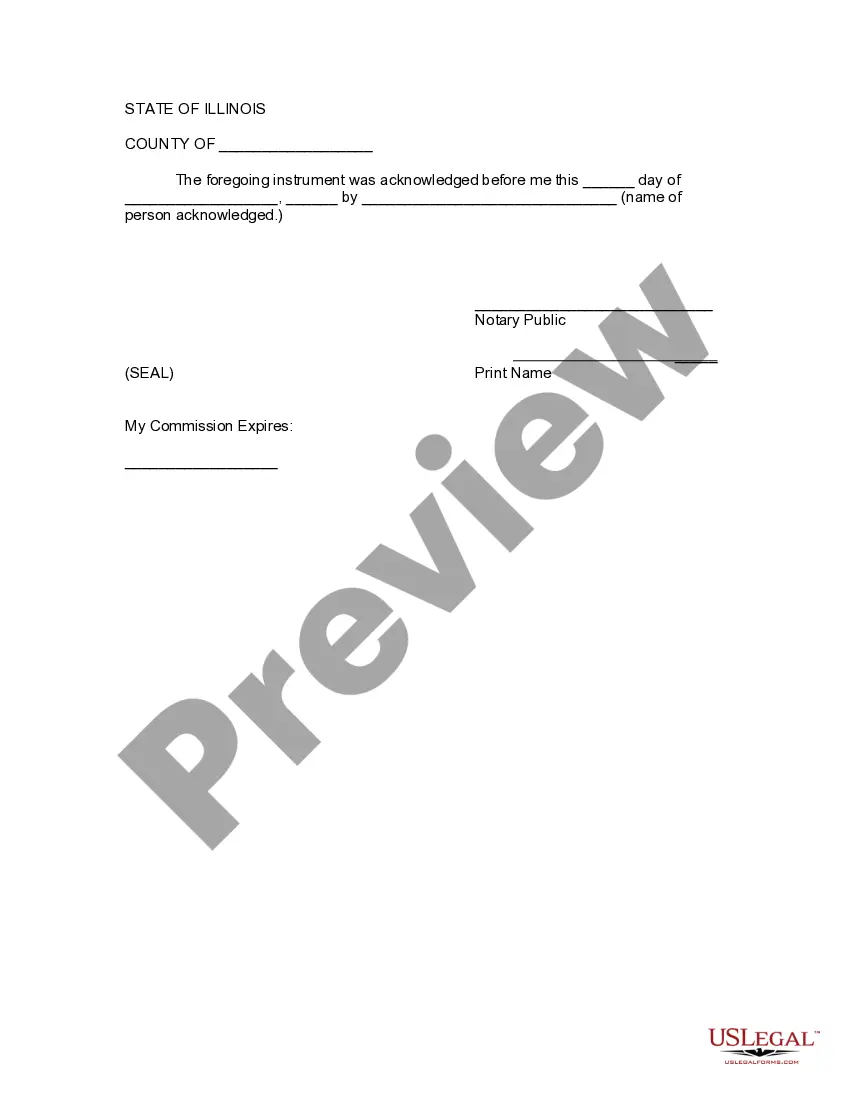

How to fill out Naperville Illinois Assignment To Living Trust?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no law background to create such papers from scratch, mainly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a massive library with more than 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you want the Naperville Illinois Assignment to Living Trust or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Naperville Illinois Assignment to Living Trust in minutes using our reliable service. If you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

However, in case you are new to our library, make sure to follow these steps prior to obtaining the Naperville Illinois Assignment to Living Trust:

- Be sure the template you have chosen is good for your area since the rules of one state or area do not work for another state or area.

- Preview the form and go through a short description (if provided) of cases the document can be used for.

- If the form you picked doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Naperville Illinois Assignment to Living Trust once the payment is completed.

You’re all set! Now you can go on and print out the form or fill it out online. Should you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.