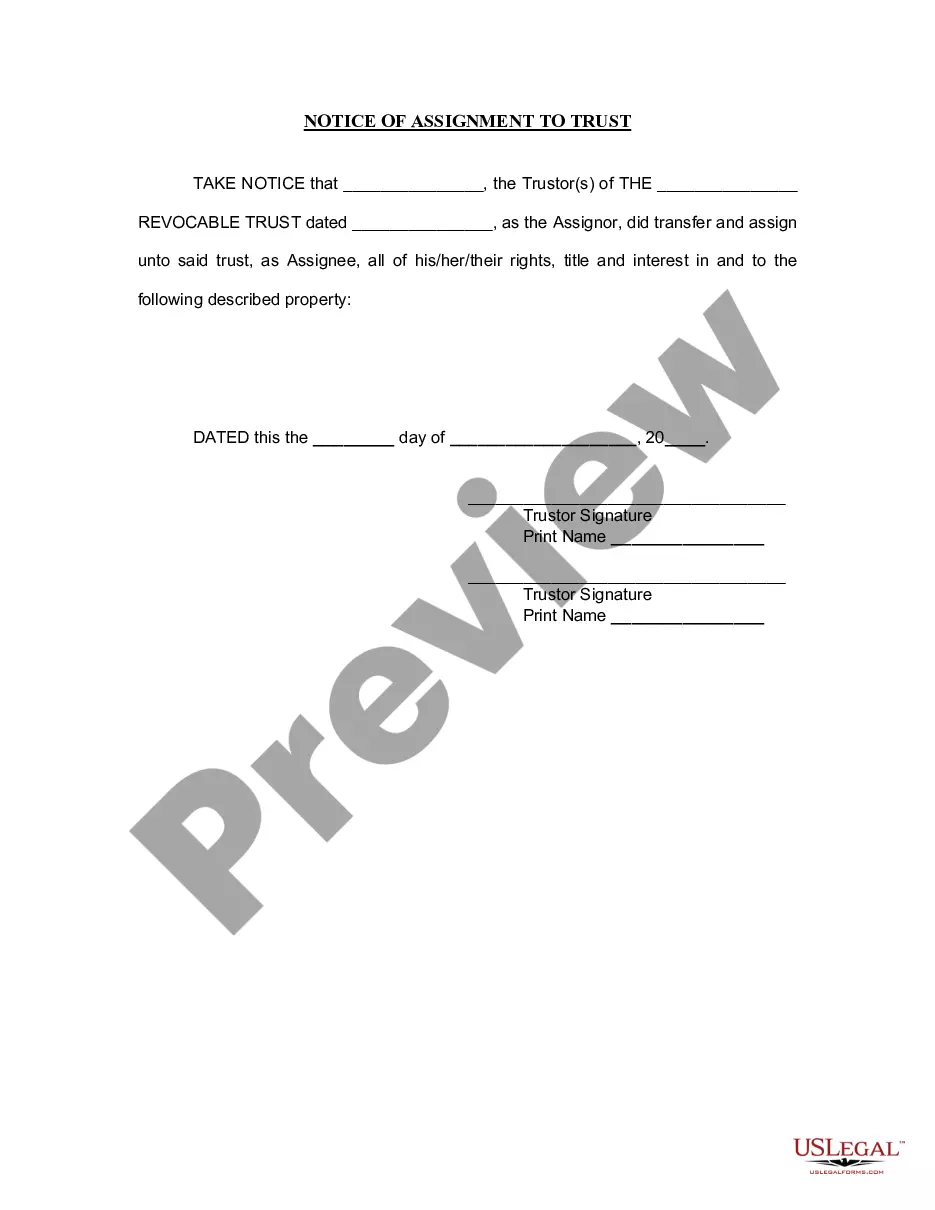

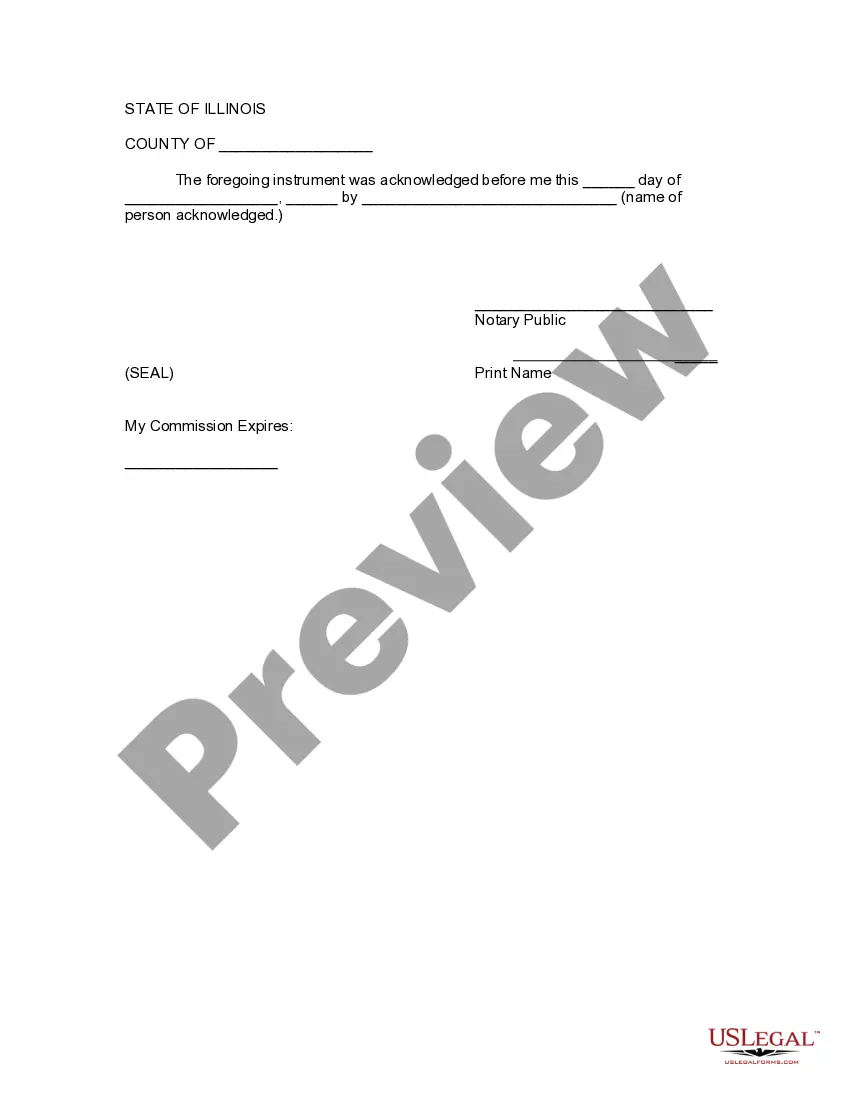

A Naperville Illinois Notice of Assignment to Living Trust is a legal document used in estate planning where an individual designates their assets to be transferred to a living trust. This notice serves as notification to both the trustee and beneficiaries of the trust about the assignment of specific assets. In Naperville, Illinois, there are various types of Notice of Assignment to Living Trust that individuals may utilize to ensure the seamless transition of assets to their chosen beneficiaries. These include: 1. Real Estate Assignment: This type of assignment involves transferring one's residential or commercial properties located in Naperville, Illinois, to the living trust. By doing so, the properties are protected and managed in accordance with the trust's provisions. 2. Financial Account Assignment: Individuals may use this specific notice to assign their financial accounts, such as bank accounts, investment portfolios, or retirement funds, to the living trust. By designating these assets, individuals ensure that their beneficiaries can easily access these financial resources when necessary. 3. Personal Property Assignment: This category encompasses the assignment of personal belongings, including vehicles, jewelry, artwork, furniture, and other valuable possessions. The Naperville Illinois Notice of Assignment to Living Trust for personal property serves as a legal document that specifies the transfer of these assets. 4. Business Assignment: For Naperville residents who own businesses, a specialized notice can be created to assign their business assets or shares to the living trust. This not only guarantees the smooth operation of the business after the individual's passing but also ensures the continuation of their entrepreneurial legacy. It is important to consult with an experienced estate planning attorney in Naperville, Illinois, to understand the legal requirements and drafting specifics of the Notice of Assignment to Living Trust. By precisely documenting the assignment of assets, individuals can have peace of mind knowing that their assets will be handled in accordance with their wishes and efficiently transferred to their chosen beneficiaries.

Naperville Illinois Notice of Assignment to Living Trust

Description

How to fill out Naperville Illinois Notice Of Assignment To Living Trust?

Make use of the US Legal Forms and obtain instant access to any form template you need. Our useful website with a huge number of documents simplifies the way to find and obtain virtually any document sample you need. You can export, fill, and certify the Naperville Illinois Notice of Assignment to Living Trust in a few minutes instead of browsing the web for many hours looking for the right template.

Using our library is a wonderful strategy to increase the safety of your document submissions. Our experienced legal professionals on a regular basis check all the documents to make certain that the forms are relevant for a particular region and compliant with new laws and regulations.

How can you get the Naperville Illinois Notice of Assignment to Living Trust? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instructions below:

- Find the template you need. Make certain that it is the template you were looking for: verify its headline and description, and make use of the Preview feature if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order with a credit card or PayPal.

- Save the document. Indicate the format to get the Naperville Illinois Notice of Assignment to Living Trust and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy document libraries on the web. We are always ready to help you in any legal process, even if it is just downloading the Naperville Illinois Notice of Assignment to Living Trust.

Feel free to take advantage of our platform and make your document experience as convenient as possible!