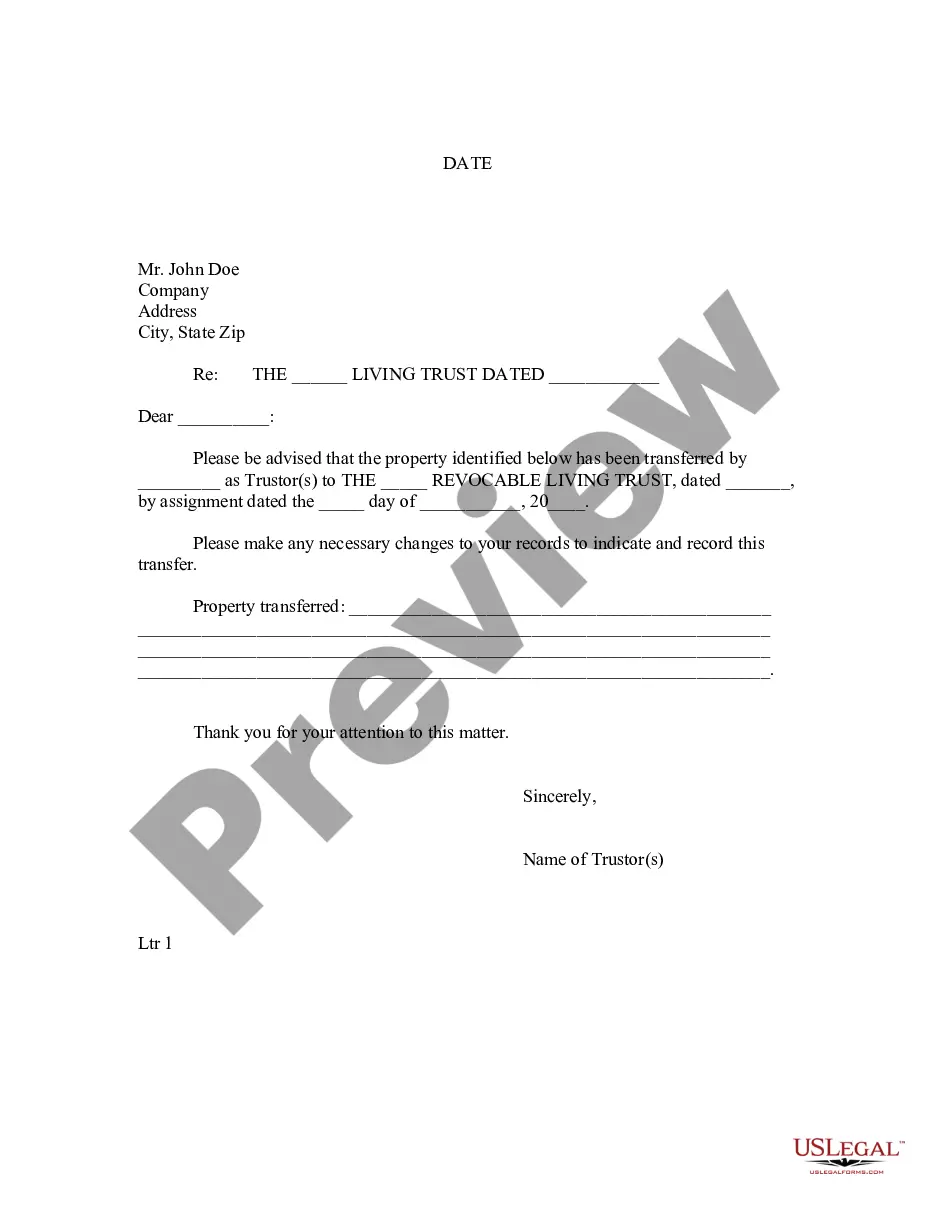

Elgin Illinois Letter to Lienholder to Notify of Trust

Description

How to fill out Illinois Letter To Lienholder To Notify Of Trust?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our advantageous website with a vast array of documents enables you to locate and acquire nearly any document sample you may require.

You can export, complete, and certify the Elgin Illinois Letter to Lienholder to Notify of Trust in just a few minutes instead of spending hours online searching for an appropriate template.

Employing our collection is an excellent method to enhance the security of your record filing.

Locate the template you need. Ensure that it is the document you were looking for: verify its title and description, and utilize the Preview feature when it is accessible. Otherwise, use the Search bar to find the necessary one.

Initiate the saving process. Click Buy Now and choose the pricing plan that suits you. Then, create an account and complete your order using a credit card or PayPal.

- Our skilled attorneys frequently examine all the documents to ensure that the templates are suitable for a specific area and comply with updated laws and regulations.

- How do you obtain the Elgin Illinois Letter to Lienholder to Notify of Trust.

- If you have a subscription, simply Log In to your account. The Download button will show up on all the samples you examine.

- Moreover, you can locate all the previously saved documents in the My documents section.

- If you don't have an account yet, follow these steps.

Form popularity

FAQ

To find liens on property in Illinois, start by checking the county clerk's office for public records. You can also search online through various databases that list liens. If you're transferring your property to a trust, an Elgin Illinois Letter to Lienholder to Notify of Trust can also help you clarify any existing liens with your lienholder, giving you peace of mind.

To transfer property to a trust in Illinois, you must execute a deed that clearly states the property is now held in trust. After the deed is signed, you should file it with the county recorder's office to ensure it's legally recognized. For this process to run smoothly, consider using an Elgin Illinois Letter to Lienholder to Notify of Trust, which informs your lienholder of the property transfer.

Placing your house in a trust can involve upfront costs and ongoing management fees, which can be a disadvantage for some. Additionally, your access to the property may be limited, especially if you wish to refinance or sell. Importantly, it is crucial to communicate with your lienholder using an Elgin Illinois Letter to Lienholder to Notify of Trust, ensuring they understand the changes in ownership and any implications.

Yes, Illinois does utilize deeds of trust, although mortgages are more common. A deed of trust in Illinois creates a three-party agreement between the borrower, lender, and a trustee. If you decide to use a trust in your transactions, consider sending an Elgin Illinois Letter to Lienholder to Notify of Trust to properly notify relevant lienholders about your trust's status.

Several states in the U.S. use a deed of trust instead of a mortgage to secure real estate loans. States like California, Texas, and Washington actively employ this instrument for various transactions. If you're dealing with property in Illinois, remember that an Elgin Illinois Letter to Lienholder to Notify of Trust can help ensure your trust is recognized within the transactional framework.

A deed of trust is commonly utilized by lenders and borrowers during real estate transactions. It serves as a security instrument that allows lenders to initiate foreclosure if borrowers default on their loans. If you're looking to protect your interests, using an Elgin Illinois Letter to Lienholder to Notify of Trust can also clarify the trust's role in the transaction, assuring all parties involved.

To transfer a deed to a trust in Illinois, you typically need to prepare a new deed that designates the trust as the property owner. This process often involves completing a warranty or quitclaim deed and filing it with the county recorder's office. Using an Elgin Illinois Letter to Lienholder to Notify of Trust may help communicate essential changes to any lienholders associated with the property.

Creating a trust can be beneficial for many homeowners in Illinois. It allows for a smoother transfer of assets, potentially avoiding probate and ensuring your wishes are followed after your passing. By using an Elgin Illinois Letter to Lienholder to Notify of Trust, you can inform relevant parties about your trust status, providing clarity and legal backing to the ownership transition.

To file a notice of lien in Illinois, you must prepare the appropriate documentation and submit it to the local recorder of deeds. Ensure you include all necessary information, such as the debt amount and property details. After filing, it’s crucial to send copies to the involved parties to inform them of your claim. For easy access to forms and guidance on this process, check out US Legal Forms.

Writing a letter of intent for a lien involves outlining essential details about the debt and relevant parties. Start with a clear statement of your intent to file a lien, include the amount owed, and provide property information. Establishing a transparent line of communication can lead to resolving the issue amicably. To create a professionally tailored letter, utilize resources from US Legal Forms to guide you.