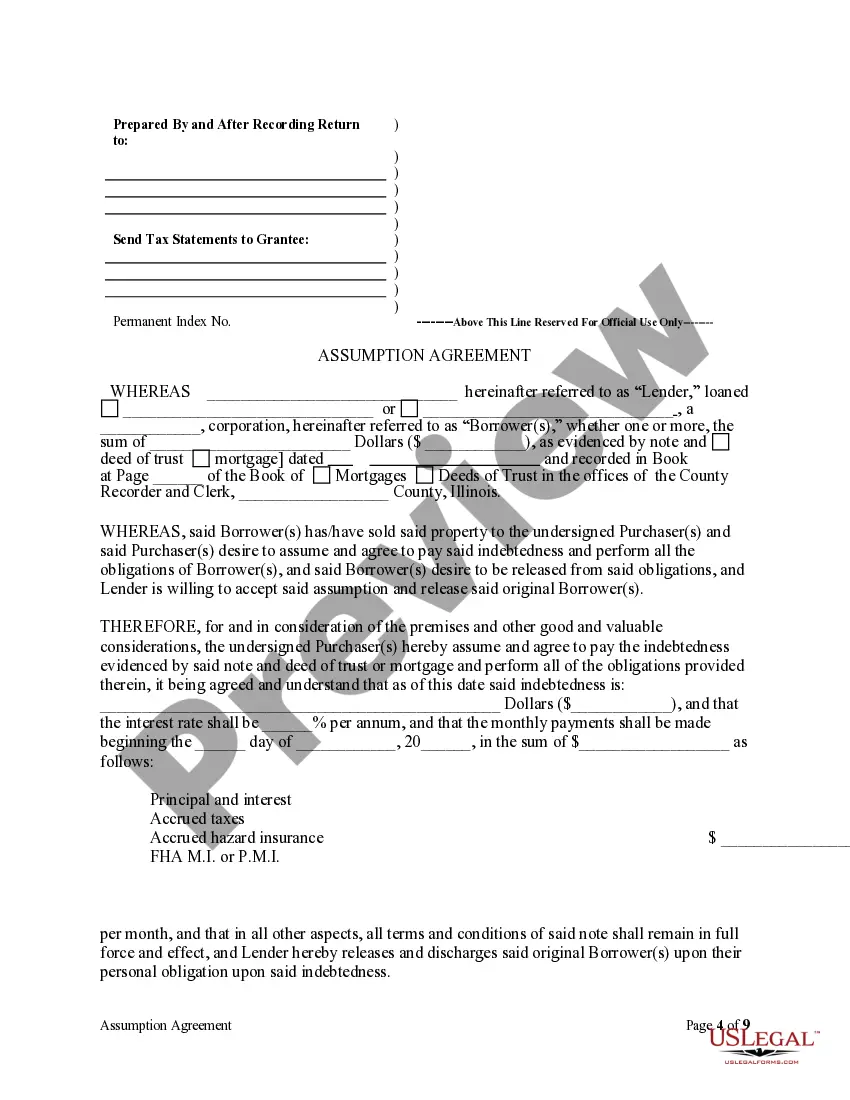

An Elgin Illinois Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the terms and conditions agreed upon when transferring a mortgage from the original mortgagors (the individuals currently responsible for the mortgage) to an assumed mortgagor (the party taking over the mortgage). This agreement is usually prepared when the original mortgagors sell or transfer the property to a new owner who agrees to assume both the rights and responsibilities of the existing mortgage. The Elgin Illinois Assumption Agreement of Mortgage and Release of Original Mortgagors serves as a legal protection for all parties involved, ensuring a smooth transfer of ownership and financial obligations. It typically includes important provisions such as the mortgage loan details (amount owed, interest rate, and payment terms), a description of the property, the identities of the original mortgagors and the assumed mortgagor, and any monetary considerations exchanged between the parties during the assumption process. There are several types of Elgin Illinois Assumption Agreements of Mortgage and Release of Original Mortgagors that may vary depending on the specific circumstances of the transaction. These can include: 1. Full Assumption Agreement: This agreement is executed when the assumed mortgagor takes over all aspects of the original mortgage, including both the financial responsibility and legal obligations associated with the property. 2. Partial Assumption Agreement: In certain cases, the parties may agree to a partial assumption where the assumed mortgagor assumes only a portion of the original mortgage. This type of agreement is often employed when the property has multiple units or sections and the new owner prefers to take responsibility for a specific portion only. 3. Subject-to Assumption Agreement: This agreement is commonly used when the assumed mortgagor takes over the mortgage payment and property ownership but does not formally assume the liability of the loan. The original mortgagors, in this case, stay responsible for the loan and retain their legal rights should the assumed mortgagor default on the mortgage. It is crucial to consult with an experienced attorney or mortgage professional while drafting or executing an Elgin Illinois Assumption Agreement of Mortgage and Release of Original Mortgagors to ensure compliance with state laws and regulations.

Elgin Illinois Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Elgin Illinois Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal services that, as a rule, are very costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to a lawyer. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Elgin Illinois Assumption Agreement of Mortgage and Release of Original Mortgagors or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Elgin Illinois Assumption Agreement of Mortgage and Release of Original Mortgagors adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Elgin Illinois Assumption Agreement of Mortgage and Release of Original Mortgagors would work for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!