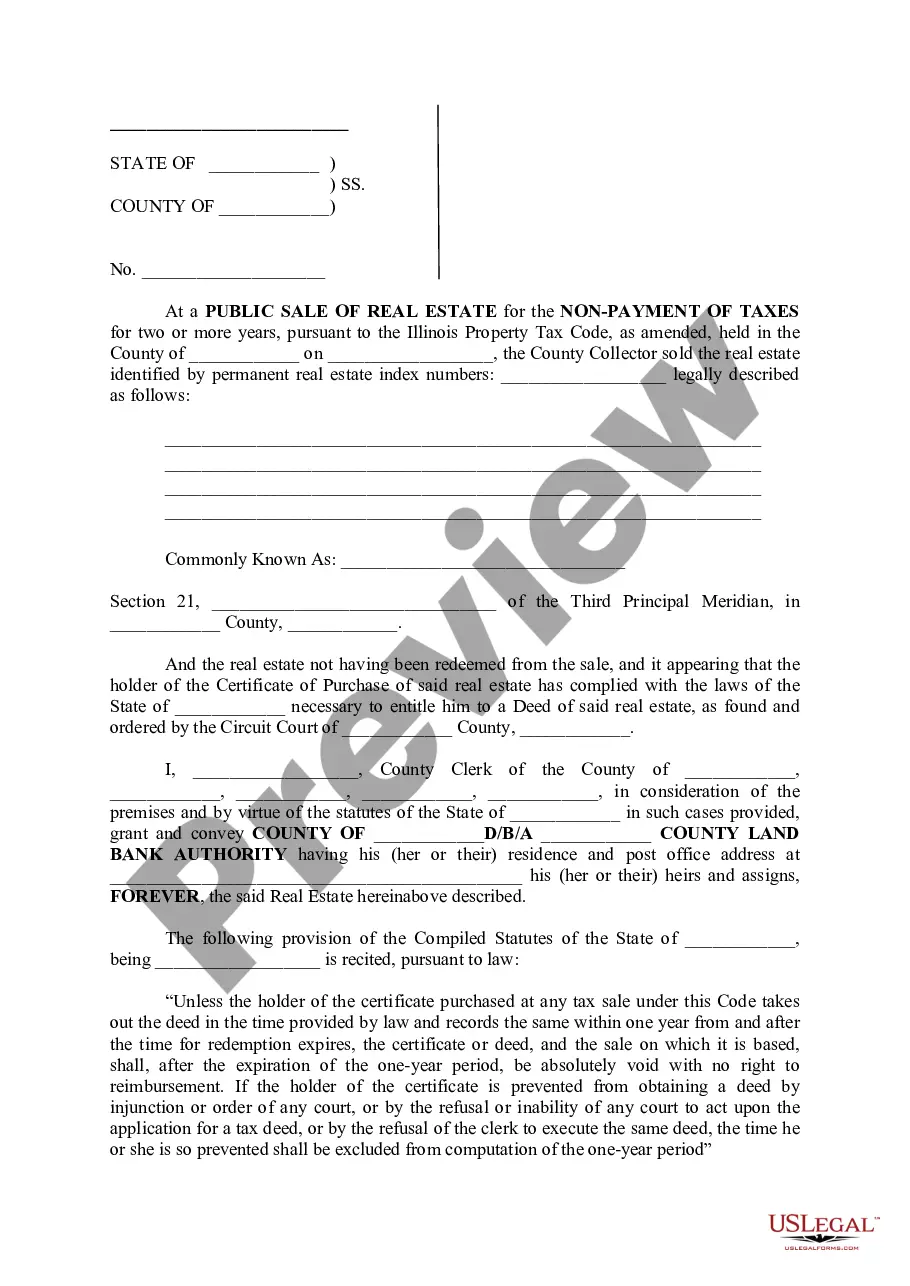

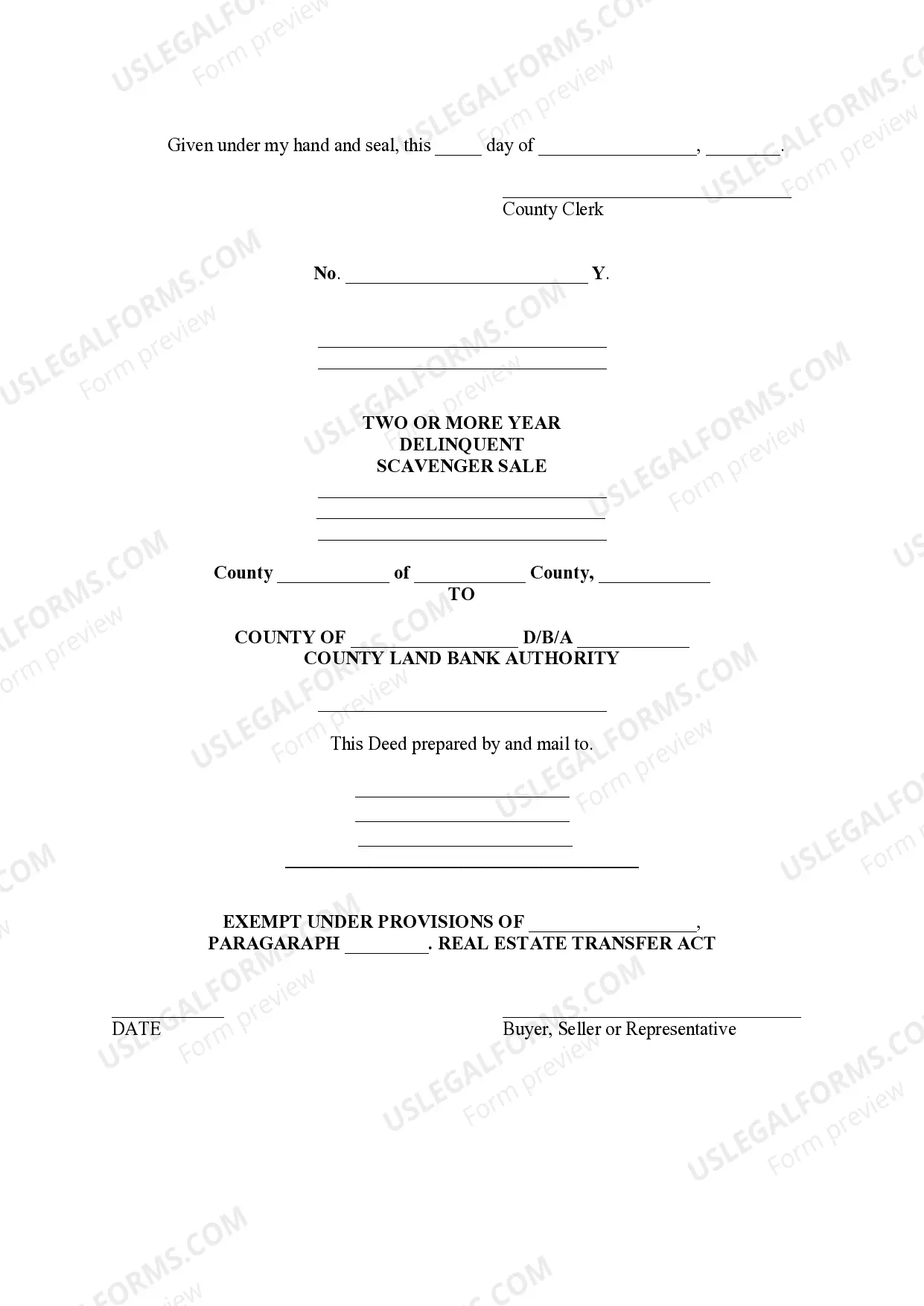

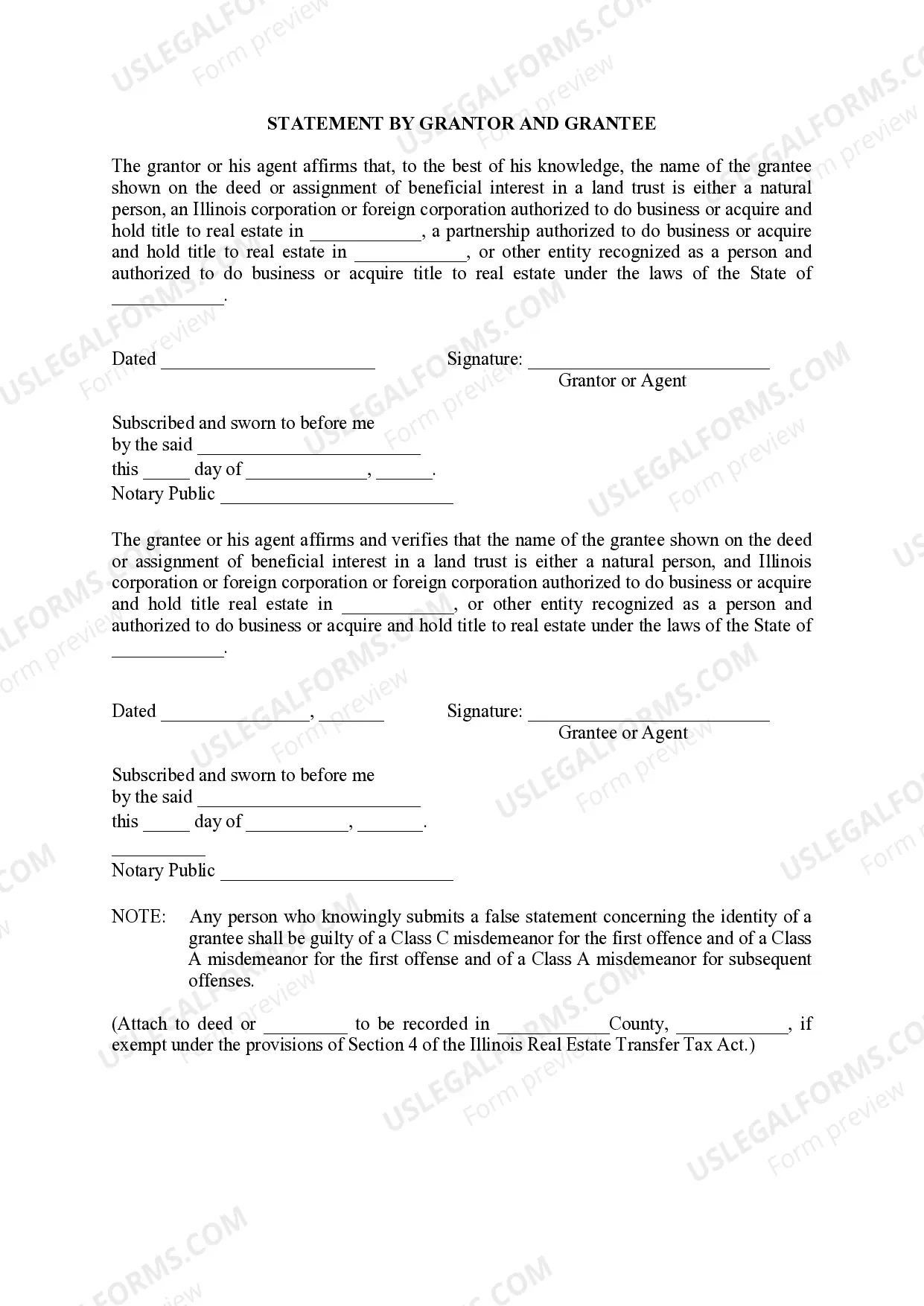

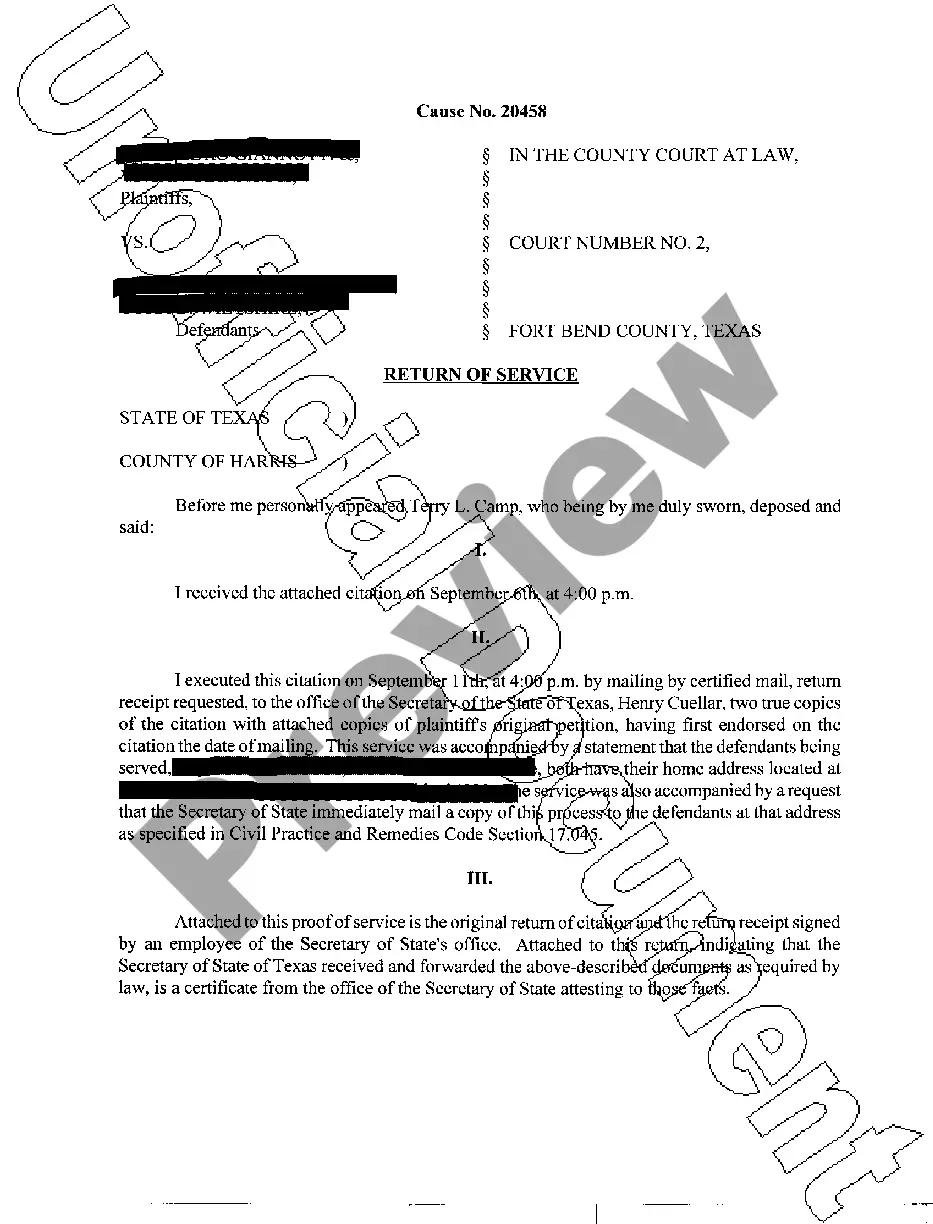

Chicago Illinois Public Sale of Real Estate for the Non — Payment of Taxes is a legal process in which properties are auctioned off by the city government due to unpaid property taxes. This auction is held to recover the taxes owed on these properties and provide a chance for potential buyers to acquire real estate at a discounted price. The public sale of real estate for non-payment of taxes is governed by the Illinois Property Tax Code. The code dictates that if property owners fail to pay their property taxes for a specific period of time, the county government can initiate tax liens on the property. Once the tax liens are placed, the county government has the right to sell the property at a public auction to recover the unpaid taxes. The Chicago Illinois Public Sale of Real Estate for the Non — Payment of Taxes typically has two main types: the tax lien sale and the tax deed sale. 1. Tax Lien Sale: In this type of sale, the county government sells the tax liens placed on delinquent properties. Investors can bid on these liens, and the highest bidder becomes the lien holder of the property. The property owner still has a set redemption period (usually around two years) to repay the delinquent taxes. If they fail to do so, the lien holder can start the process of obtaining a tax deed to acquire ownership of the property. 2. Tax Deed Sale: This type of sale occurs when the property owner has failed to redeem the tax lien within the redemption period. The county government, as the holder of the tax lien, can obtain a tax deed and sell the property at a public auction. Interested buyers can bid on the property, and the highest bidder becomes the new owner. The Chicago Illinois Public Sale of Real Estate for the Non — Payment of Taxes offers potential buyers the opportunity to purchase properties at a significantly discounted price. However, it is important to note that these properties are sold as is, meaning the buyer assumes any existing liens, mortgages, or other encumbrances on the property. Conducting thorough research and due diligence is crucial before participating in these auctions to avoid any unwanted surprises. Keywords: Chicago Illinois, public sale of real estate, non-payment of taxes, tax sale, tax lien sale, tax deed sale, Illinois Property Tax Code, tax liens, tax deed, redemption period, auction, delinquent properties, discounted price, encumbrances.

Chicago Estate

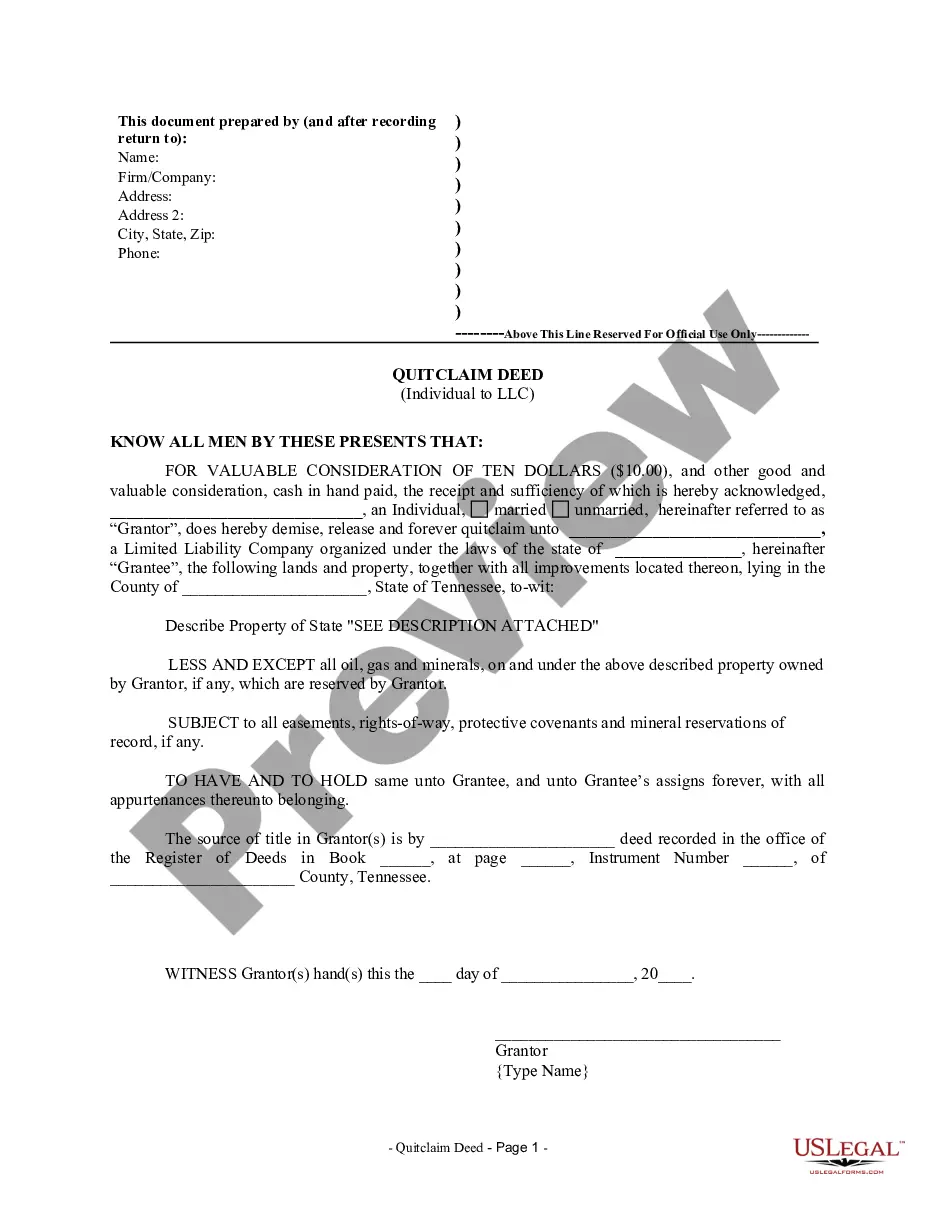

Description

How to fill out Chicago Illinois Public Sale Of Real Estate For The Non - Payment Of Taxes?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any law education to create such paperwork cfrom the ground up, mainly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Chicago Illinois Public Sale of Real Estate for the Non – Payment of Taxes or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Chicago Illinois Public Sale of Real Estate for the Non – Payment of Taxes quickly employing our reliable platform. If you are already a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before obtaining the Chicago Illinois Public Sale of Real Estate for the Non – Payment of Taxes:

- Ensure the template you have chosen is specific to your area because the regulations of one state or area do not work for another state or area.

- Preview the document and read a short description (if available) of scenarios the paper can be used for.

- In case the one you chosen doesn’t meet your needs, you can start over and search for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Chicago Illinois Public Sale of Real Estate for the Non – Payment of Taxes once the payment is done.

You’re good to go! Now you can proceed to print out the document or fill it out online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.