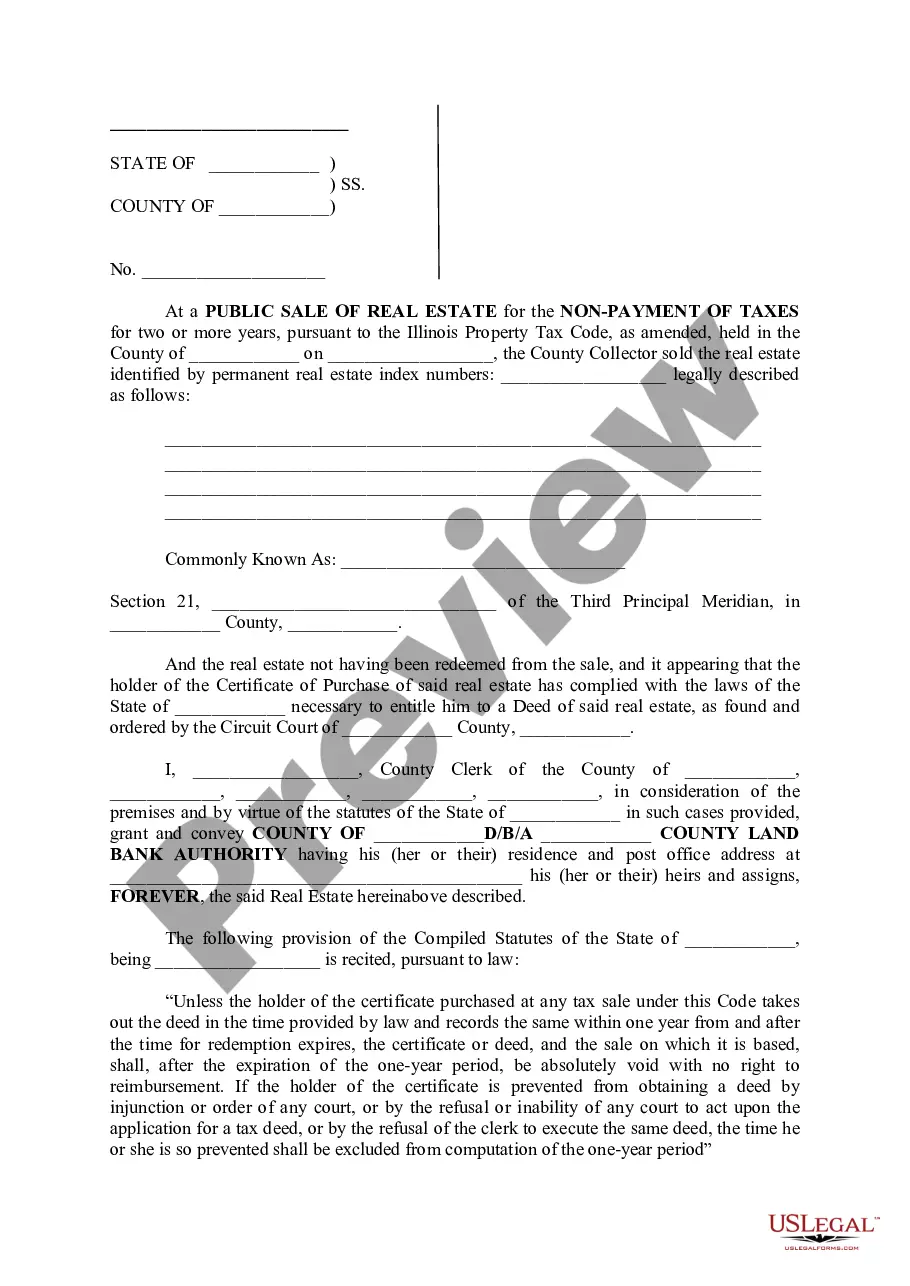

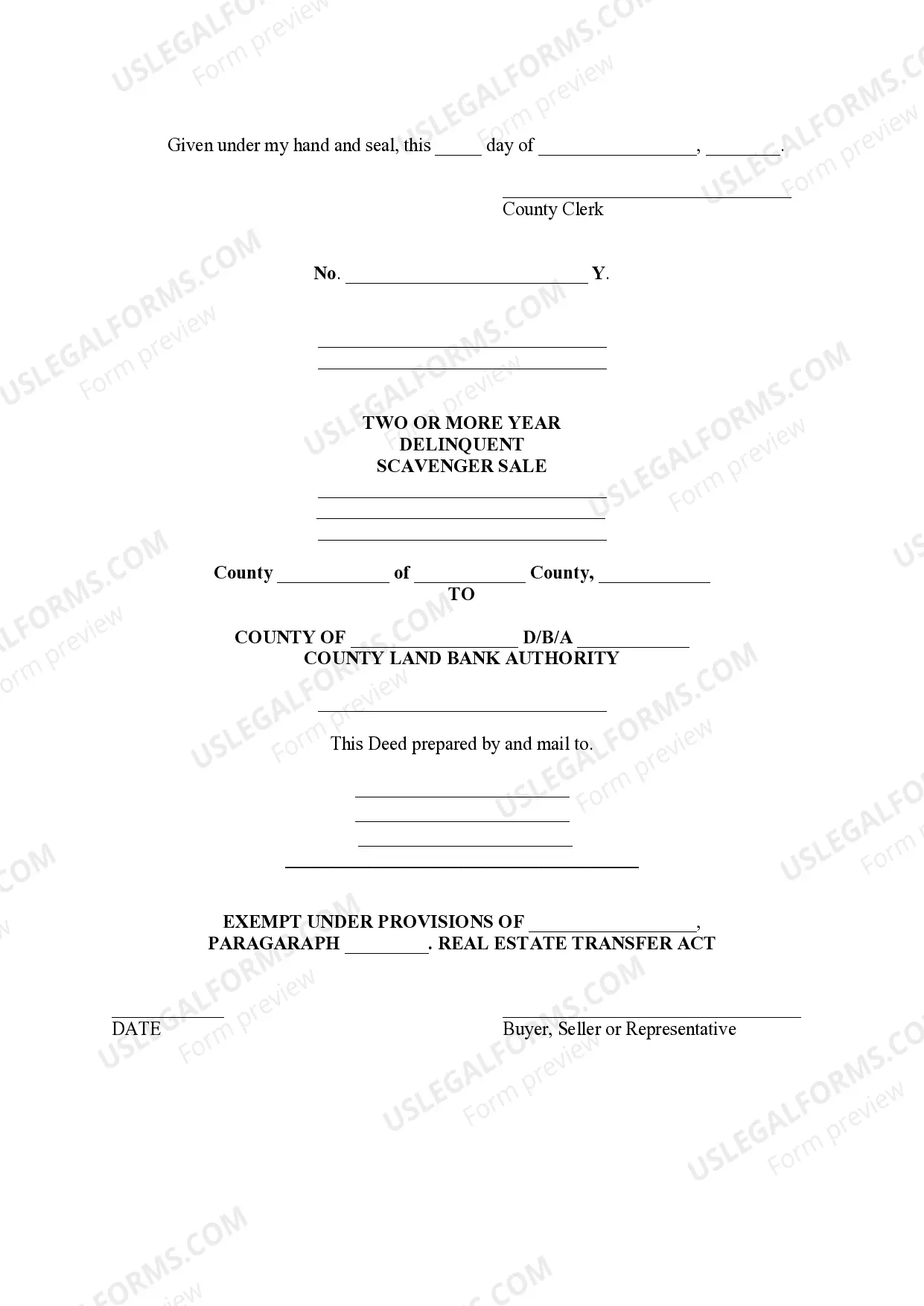

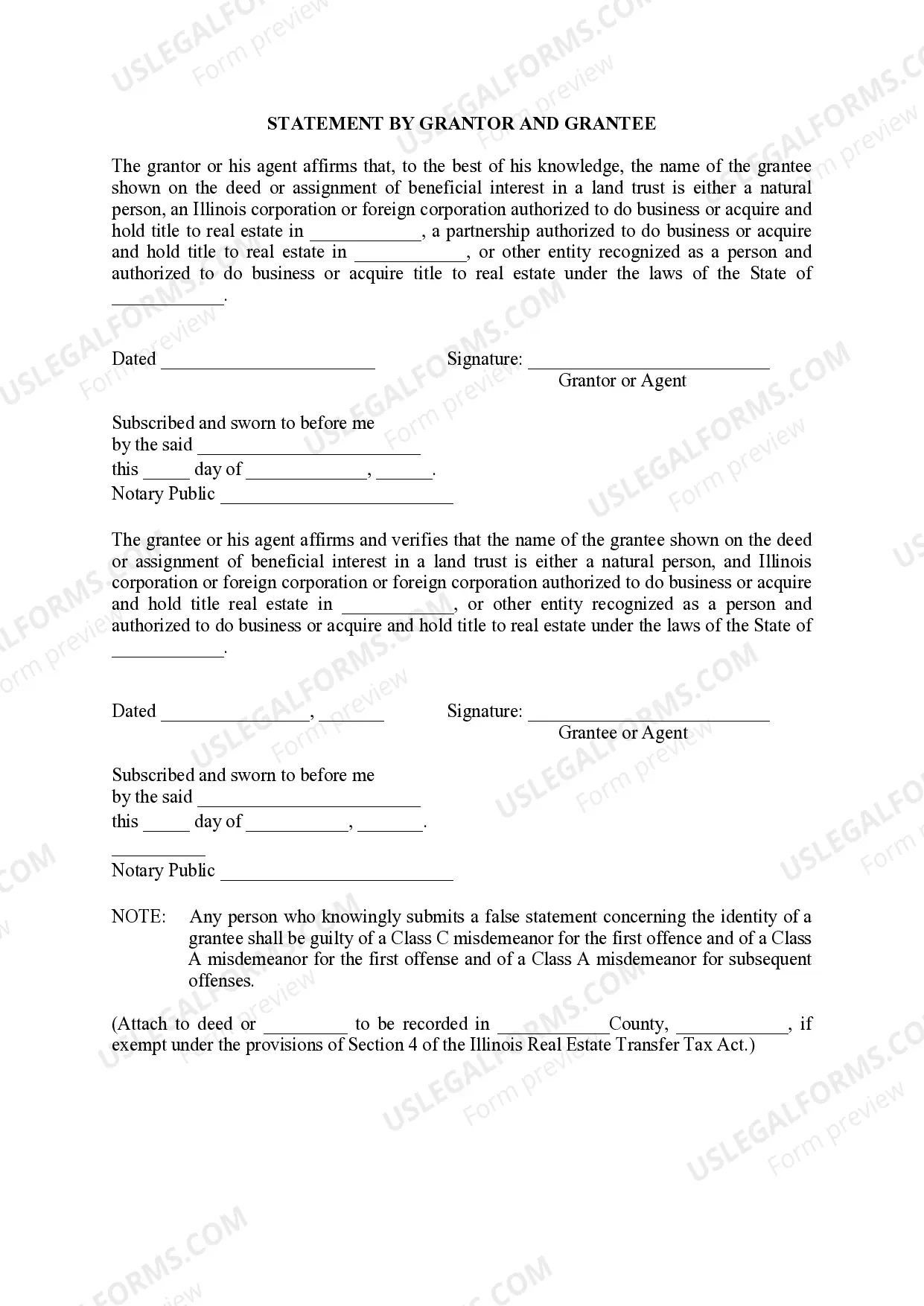

Cook County's Public Sale of Real Estate for the Non-Payment of Taxes is a legal process in which properties are sold by the county government due to unpaid property taxes. This public auction provides an opportunity for interested buyers to acquire real estate at potentially discounted prices. The Cook County Treasurer's Office conducts these sales to recoup unpaid taxes and ensure the proper funding of vital public services. The Cook Illinois Public Sale of Real Estate for the Non–Payment of Taxes offers various types of properties that have become tax delinquent. These may include residential homes, commercial properties, vacant land, and even multi-unit buildings. It is important for potential buyers to carefully research and evaluate each property before participating in the auction. During the Cook County public tax sale, interested real estate investors and individuals bid on tax delinquent properties. The highest bidder secures the right to purchase the property by paying the outstanding taxes owed. The county then transfers the property's ownership to the successful bidder, who must adhere to all legal obligations, including resolving any outstanding liens or encumbrances. Participating in a Cook County public tax sale can be a lucrative opportunity for investors. These sales often attract experienced real estate buyers seeking distressed properties at below-market prices. However, it is crucial to thoroughly research the properties and understand the risks associated with tax-sale properties before bidding. Due diligence, including a title search and property inspection, is strongly recommended ensuring a wise investment decision. Potential buyers can find detailed information about the Cook Illinois Public Sale of Real Estate for the Non-Payment of Taxes on the Cook County Treasurer's Office website or by contacting the office directly. The website provides the auction schedule, property lists, bidding instructions, and other essential information needed to participate in the tax sale. In summary, Cook County's Public Sale of Real Estate for the Non-Payment of Taxes is a legal process through which the county recovers unpaid property taxes by auctioning off tax delinquent properties. This offers interested buyers an opportunity to acquire various types of properties at potentially discounted prices. However, due diligence and thorough research are crucial to make informed investment decisions in the Cook County tax sales.

Cook Illinois Public Sale of Real Estate for the Non - Payment of Taxes

Description

How to fill out Cook Illinois Public Sale Of Real Estate For The Non - Payment Of Taxes?

Do you need a trustworthy and affordable legal forms supplier to get the Cook Illinois Public Sale of Real Estate for the Non – Payment of Taxes? US Legal Forms is your go-to option.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the needed form, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Cook Illinois Public Sale of Real Estate for the Non – Payment of Taxes conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Cook Illinois Public Sale of Real Estate for the Non – Payment of Taxes in any provided file format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal papers online for good.