The Naperville Illinois Public Sale of Real Estate for the Non-Payment of Taxes is a legal process in which properties with outstanding property tax payments are auctioned off to the highest bidder. This type of sale is conducted by the local government to recover the unpaid taxes and ensure the proper functioning of the community. In Naperville, Illinois, there are two types of public sales of real estate for non-payment of taxes: the Annual Tax Sale and the Scavenger Sale. 1. Annual Tax Sale: This type of sale occurs once a year and includes properties that have unpaid property taxes for the previous year. The sale is typically conducted by the County Treasurer's Office, and interested bidders have the opportunity to bid on these properties. The highest bidder becomes the new owner of the property, but the original property owner still has the chance to redeem the property by paying the outstanding tax amount, along with any accrued penalties and fees within a specified redemption period. 2. Scavenger Sale: The Scavenger Sale is a more extensive version of the Annual Tax Sale, occurring every two years. It includes properties that have unpaid taxes for a longer duration (usually three or more years). The purpose of this sale is to sell properties that have not been redeemed during the Annual Tax Sale. The properties offered at the Scavenger Sale are typically in a more distressed condition and may require significant rehabilitation. Similarly, the highest bidder at this sale will become the new owner, but the original property owner still has the right to redeem the property within a specified redemption period. Both types of sales offer an opportunity for bidders to potentially acquire properties at lower prices but come with certain risks and considerations. It is important for interested bidders to thoroughly research the properties and understand the redemption process before participating in the public sale. Naperville's Public Sale of Real Estate for the Non-Payment of Taxes serves as a mechanism to ensure fair and efficient tax collection while cleaning up the local tax rolls. This process helps maintain the financial stability of the community and encourages property owners to fulfill their tax obligations promptly.

Naperville Illinois Public Sale of Real Estate for the Non - Payment of Taxes

Category:

State:

Illinois

City:

Naperville

Control #:

IL-LR018T

Format:

Word;

Rich Text

Instant download

Description

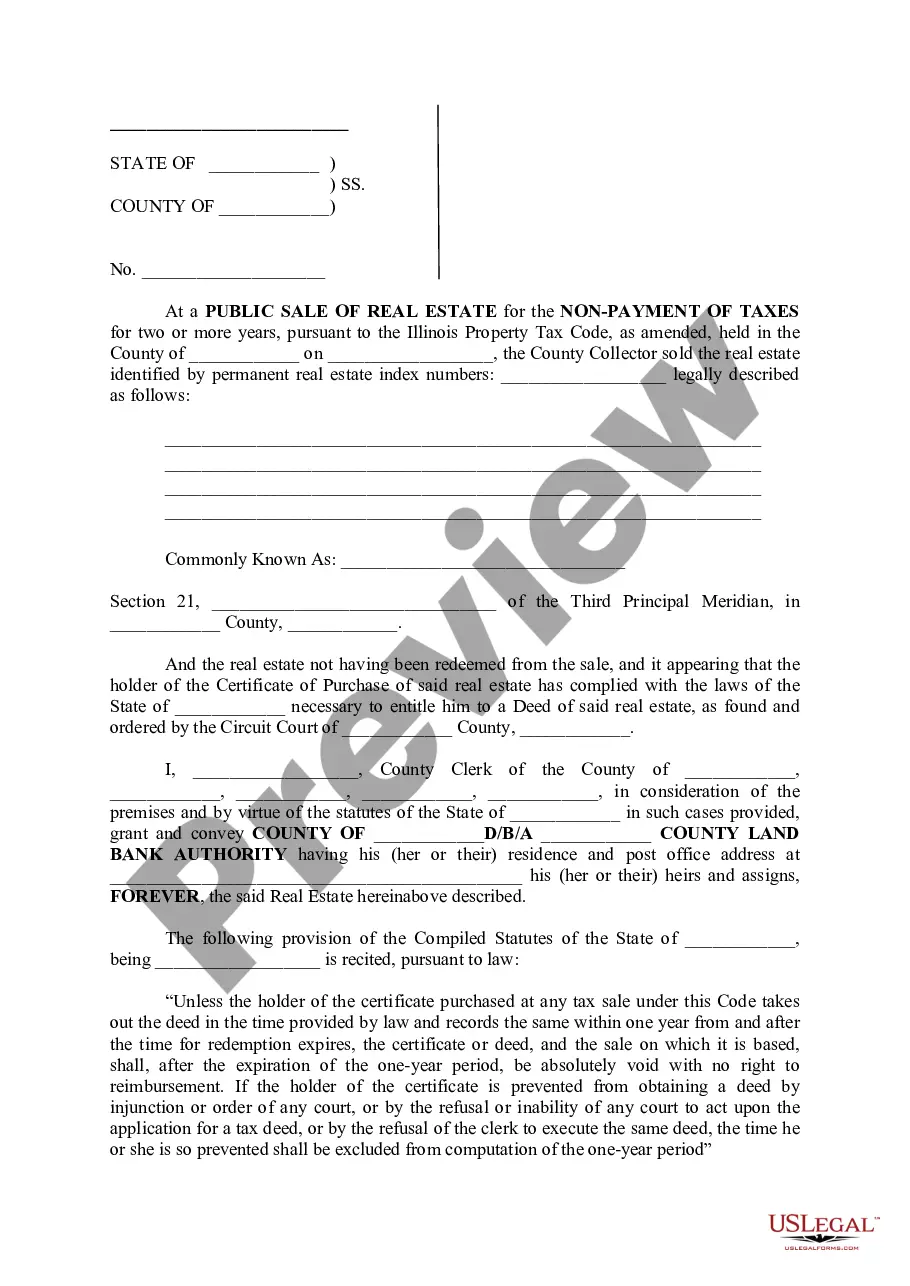

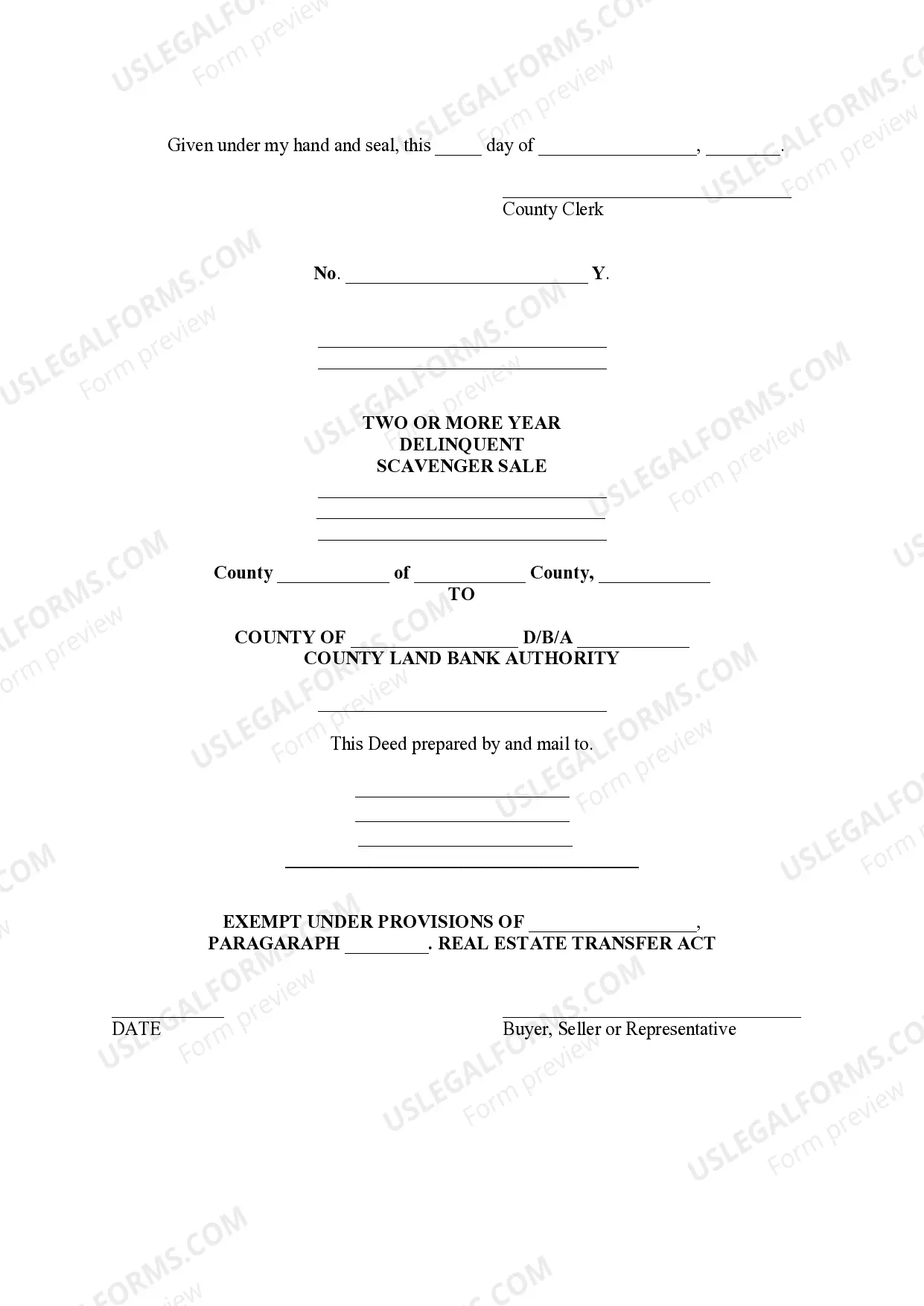

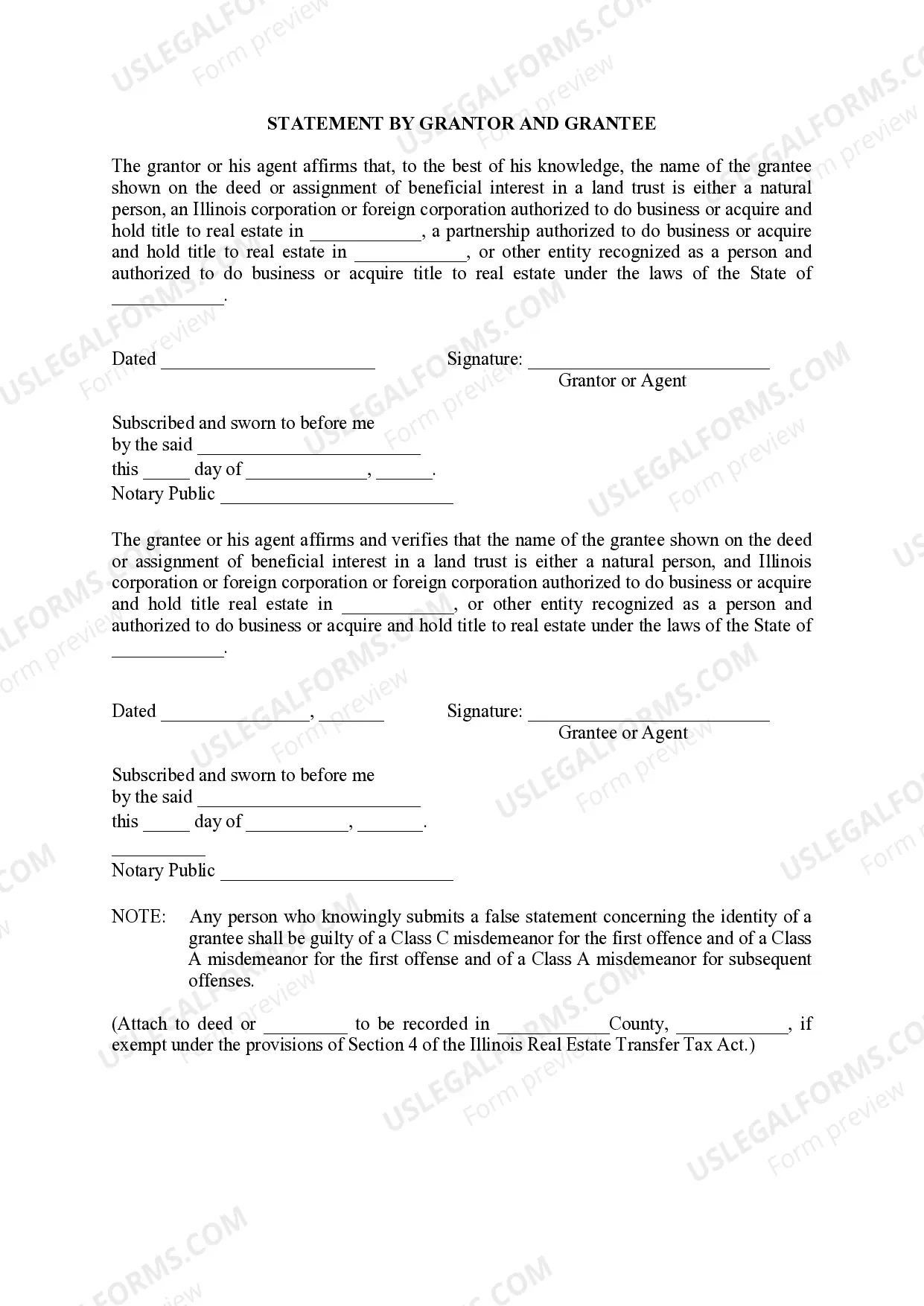

Nonpayment of Taxes for two or more years, pursuant to the State of Illinois Property Tax Code, County Collector sold Real Estate at public sale.

The Naperville Illinois Public Sale of Real Estate for the Non-Payment of Taxes is a legal process in which properties with outstanding property tax payments are auctioned off to the highest bidder. This type of sale is conducted by the local government to recover the unpaid taxes and ensure the proper functioning of the community. In Naperville, Illinois, there are two types of public sales of real estate for non-payment of taxes: the Annual Tax Sale and the Scavenger Sale. 1. Annual Tax Sale: This type of sale occurs once a year and includes properties that have unpaid property taxes for the previous year. The sale is typically conducted by the County Treasurer's Office, and interested bidders have the opportunity to bid on these properties. The highest bidder becomes the new owner of the property, but the original property owner still has the chance to redeem the property by paying the outstanding tax amount, along with any accrued penalties and fees within a specified redemption period. 2. Scavenger Sale: The Scavenger Sale is a more extensive version of the Annual Tax Sale, occurring every two years. It includes properties that have unpaid taxes for a longer duration (usually three or more years). The purpose of this sale is to sell properties that have not been redeemed during the Annual Tax Sale. The properties offered at the Scavenger Sale are typically in a more distressed condition and may require significant rehabilitation. Similarly, the highest bidder at this sale will become the new owner, but the original property owner still has the right to redeem the property within a specified redemption period. Both types of sales offer an opportunity for bidders to potentially acquire properties at lower prices but come with certain risks and considerations. It is important for interested bidders to thoroughly research the properties and understand the redemption process before participating in the public sale. Naperville's Public Sale of Real Estate for the Non-Payment of Taxes serves as a mechanism to ensure fair and efficient tax collection while cleaning up the local tax rolls. This process helps maintain the financial stability of the community and encourages property owners to fulfill their tax obligations promptly.

Free preview

How to fill out Naperville Illinois Public Sale Of Real Estate For The Non - Payment Of Taxes?

If you’ve already used our service before, log in to your account and download the Naperville Illinois Public Sale of Real Estate for the Non – Payment of Taxes on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Naperville Illinois Public Sale of Real Estate for the Non – Payment of Taxes. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!