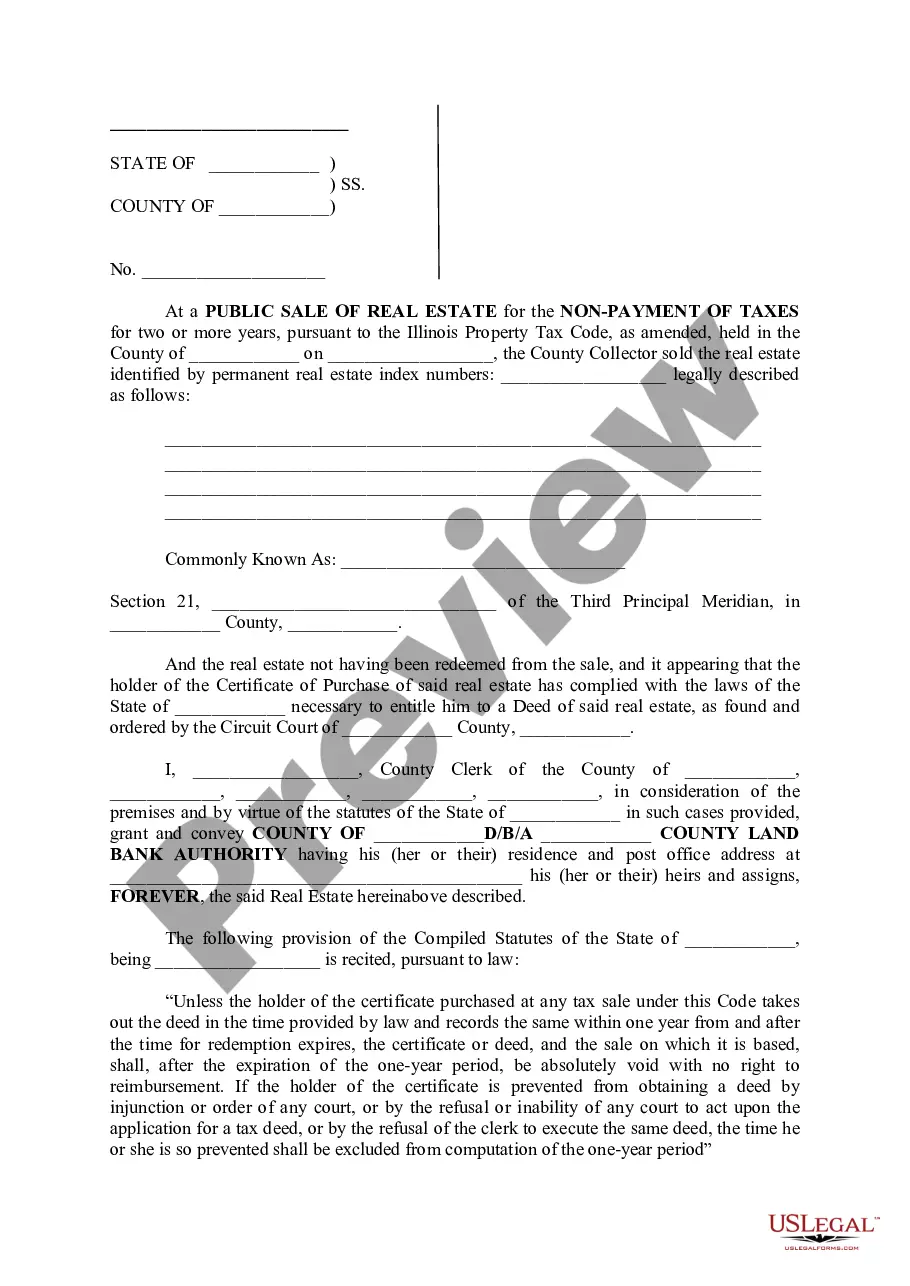

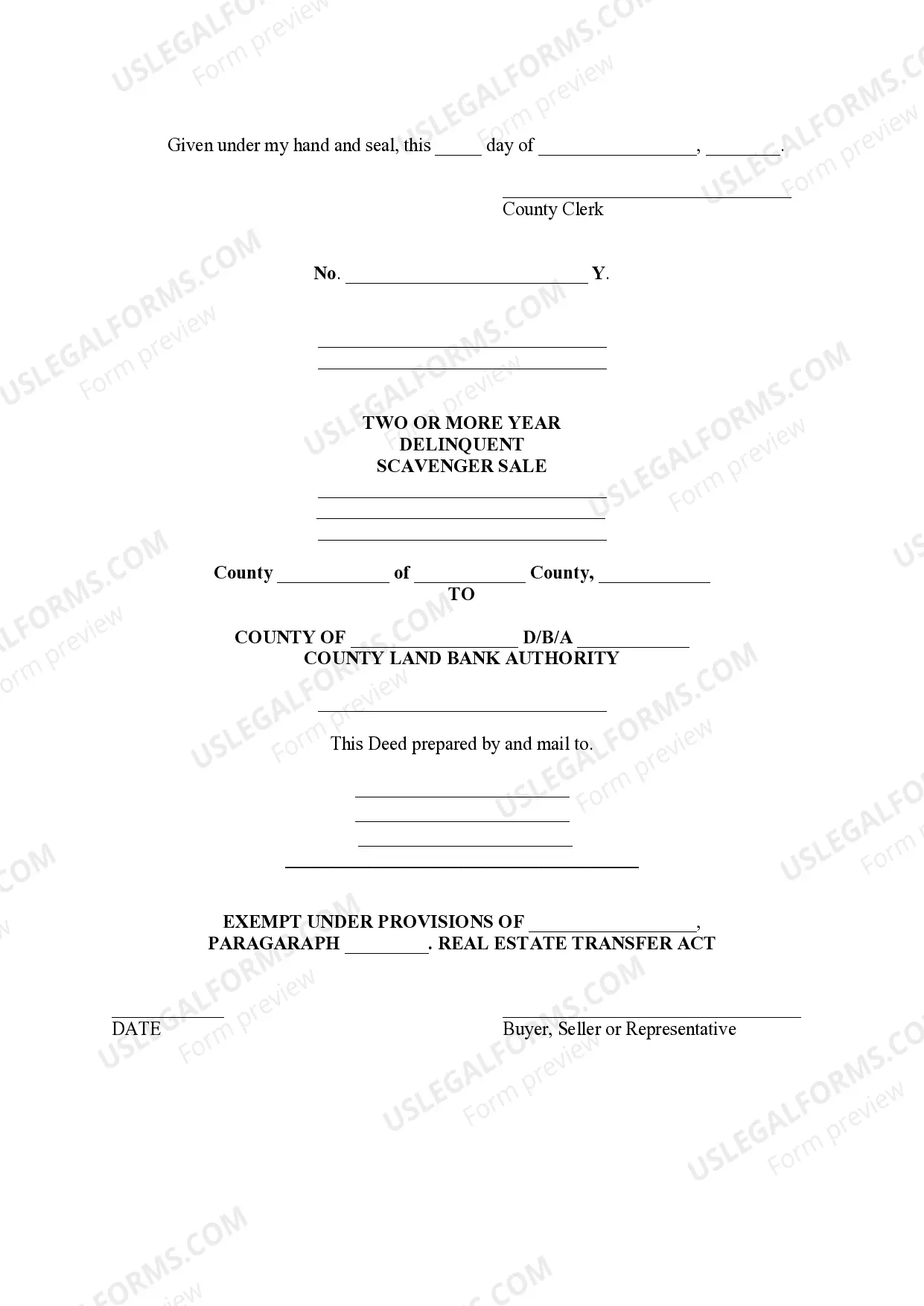

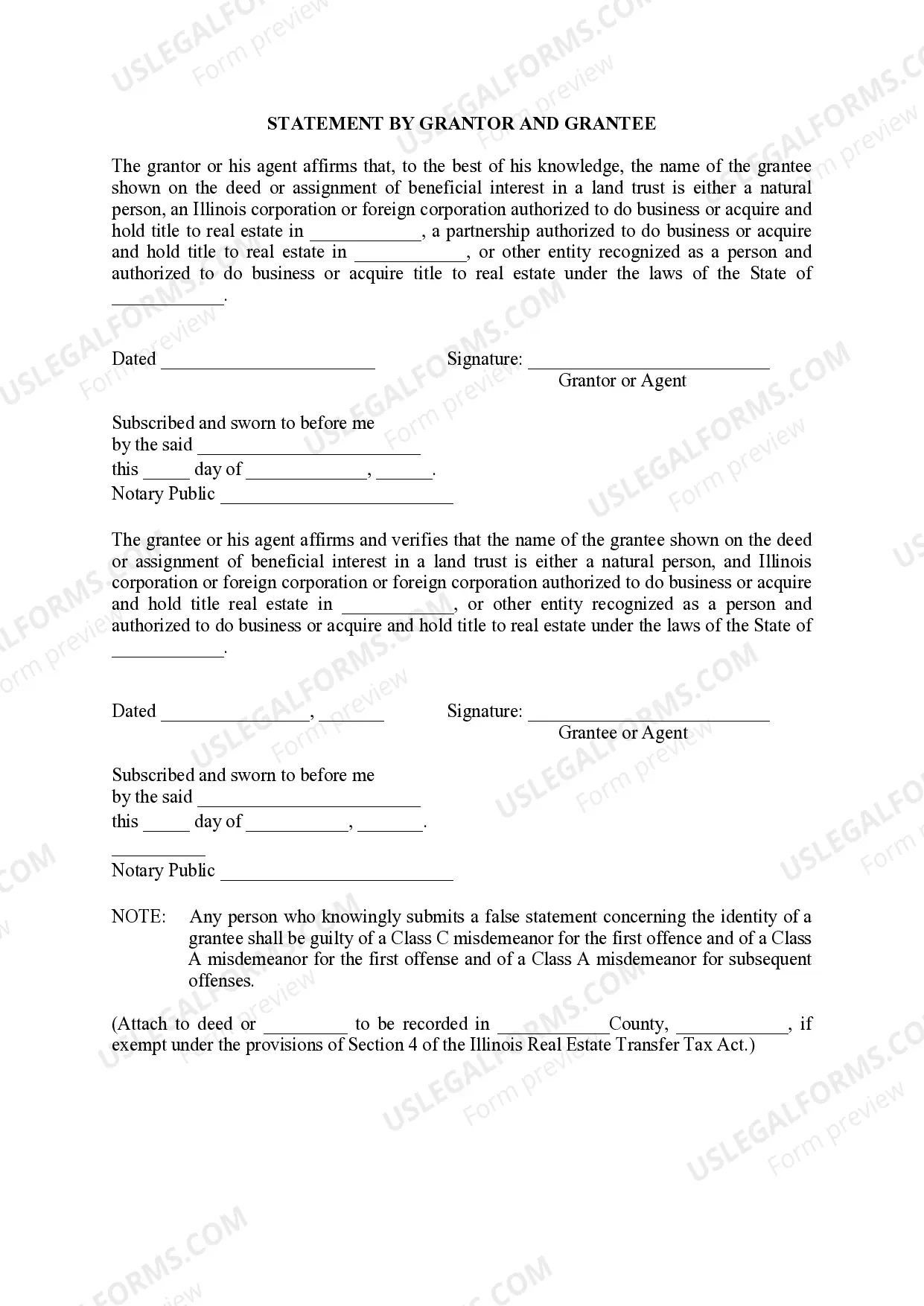

The Rockford Illinois Public Sale of Real Estate for the Non-Payment of Taxes is a legal process aimed at recovering unpaid property taxes by auctioning off the properties to the highest bidders. This sale is conducted by the Rockford County Treasurer's Office in order to collect the outstanding taxes owed by property owners within the jurisdiction. During the Rockford Illinois Public Sale of Real Estate for Non-Payment of Taxes, the properties subject to foreclosure are publicly advertised and listed in various channels, such as newspapers, websites, and community bulletins. Interested buyers have the opportunity to bid on these properties, with the highest bidder winning the auction and acquiring the property. There are different types of Rockford Illinois Public Sales of Real Estate for Non-Payment of Taxes, including: 1. Annual Tax Sale: This type of sale takes place once a year and includes properties whose owners have failed to pay their property taxes for a specific period of time. The auction aims to recover the outstanding tax amount while allowing new owners to take possession of the properties. 2. Tax Lien Auction: In certain cases, instead of auctioning off the actual property, the county may sell the tax liens associated with the properties. This allows the successful bidder to hold a lien against the property and collect the overdue taxes with interest. 3. Tax Deed Sale: If the property remains unsold during the annual tax sale or has been offered in previous sales, it may proceed to a tax deed sale. In this type of sale, the county directly transfers ownership of the property to the highest bidder, freeing it from any liens, mortgages, or other encumbrances. 4. Scavenger Sale: The scavenger sale occurs when properties have previously failed to sell in multiple tax sales. The properties are then offered for auction with discounted prices, often with the aim of encouraging bidders to acquire properties that have remained delinquent for an extended period. Participating in the Rockford Illinois Public Sale of Real Estate for Non-Payment of Taxes offers potential investors and buyers the opportunity to acquire properties at discounted prices, provided they thoroughly research and understand the risks and requirements involved. It is essential to consult with legal professionals and conduct due diligence on the properties of interest before participating in any auction.

Rockford Illinois Public Sale of Real Estate for the Non - Payment of Taxes

Description

How to fill out Rockford Illinois Public Sale Of Real Estate For The Non - Payment Of Taxes?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Rockford Illinois Public Sale of Real Estate for the Non – Payment of Taxes becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Rockford Illinois Public Sale of Real Estate for the Non – Payment of Taxes takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Rockford Illinois Public Sale of Real Estate for the Non – Payment of Taxes. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!