Cook Illinois Subordination of Lease is a legal document that outlines the agreement and relationship between a landlord, tenant, and a third party lender. This document is crucial in the real estate industry and serves to protect the rights and interests of all parties involved. When a landlord wishes to lease their property to a tenant, they might seek financing from a financial institution or lender. In such cases, the lender might require the tenant to sign a subordination of lease agreement, often referred to as the Cook Illinois Subordination of Lease. This agreement ensures that the lender's lien on the property takes priority over the tenant's lease rights. There are several types of Cook Illinois Subordination of Lease, depending on the specific circumstances and parties involved. Some common types include: 1. Subordination of Lease to a Mortgage: In this type of subordination, the tenant agrees to subordinate their lease rights to the mortgage rights of the lender. This means that if the landlord defaults on the mortgage, the lender has the right to terminate the lease and take possession of the property. 2. Subordination of Lease to a Deed of Trust: Similar to the subordination to a mortgage, this type of subordination ensures that the lender's rights in a deed of trust take priority over the tenant's lease rights. The lender can exercise its rights if the landlord fails to fulfill their obligations. 3. Subordination of Lease to a Security Agreement: This subordination type allows the lender, who has extended a loan secured by assets of the landlord, to have superior rights to the tenant's lease. In case of default, the lender can seize the assets, including the property subject to the lease. 4. Subordination of Lease to a Financing Statement: In this scenario, the tenant agrees that the lender's financing statement, usually filed with the appropriate authorities, takes priority over their lease rights. If the landlord defaults on the loan, the lender can take actions without interference from the tenant. Cook Illinois Subordination of Lease agreements typically outline the responsibilities, obligations, and rights of each party involved. It typically includes clauses related to property use, rent payment, termination, default, and remedies. The agreement can also include provisions relating to notice requirements, insurance, waivers, and other relevant terms specific to the agreement. Overall, a Cook Illinois Subordination of Lease is a necessary legal document that establishes the hierarchy of rights between a tenant and a lender when a landlord requires financing. It ensures that the lender's interests are safeguarded in the event of default or foreclosure while providing a clear framework for all parties involved in the lease agreement.

Cook Illinois Subordination of Lease

Description

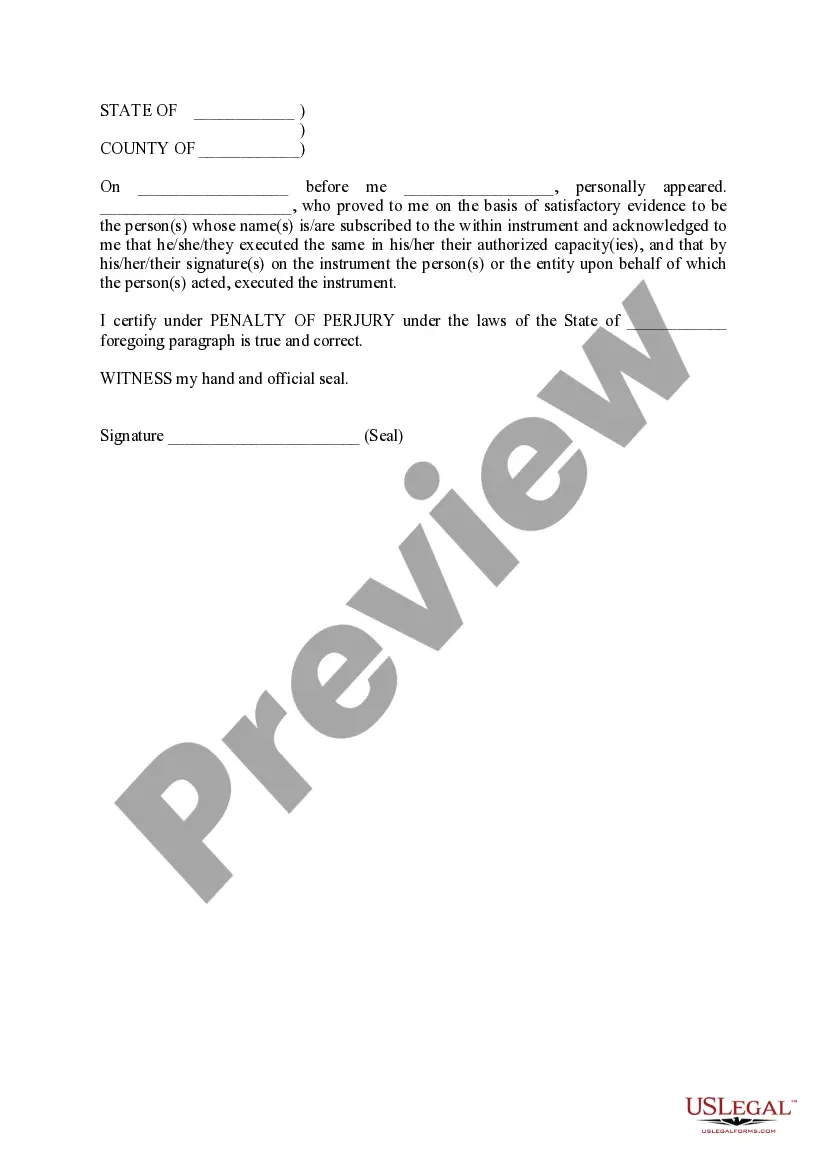

How to fill out Cook Illinois Subordination Of Lease?

Take advantage of the US Legal Forms and get immediate access to any form template you want. Our useful platform with thousands of templates makes it simple to find and obtain virtually any document sample you will need. You can save, fill, and sign the Cook Illinois Subordination of Lease in just a couple of minutes instead of surfing the Net for hours attempting to find an appropriate template.

Utilizing our library is an excellent strategy to increase the safety of your record filing. Our experienced legal professionals on a regular basis review all the documents to make sure that the templates are appropriate for a particular state and compliant with new laws and polices.

How do you get the Cook Illinois Subordination of Lease? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Furthermore, you can get all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Open the page with the template you require. Ensure that it is the template you were hoping to find: verify its title and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the document. Select the format to get the Cook Illinois Subordination of Lease and change and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable form libraries on the web. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Cook Illinois Subordination of Lease.

Feel free to take full advantage of our service and make your document experience as efficient as possible!