In Cook County, Illinois, a Notice of Foreclosure, also known as Li's Pendent, is a legal document filed by a lender or creditor to announce their intent to foreclose on a property due to a delinquent mortgage or unpaid debt. This notice serves as a public record, alerting potential buyers and interested parties that the property is facing foreclosure. In this detailed description, we will cover the Cook Illinois Notice of Foreclosure (Li's Pendent) and its various types, providing relevant keywords for a comprehensive understanding. Keywords: Cook County, Illinois, Notice of Foreclosure, Li's Pendent, lender, creditor, foreclose, delinquent mortgage, unpaid debt, public record, potential buyers, interested parties. 1. What is a Cook Illinois Notice of Foreclosure (Li's Pendent)? The Cook Illinois Notice of Foreclosure (Li's Pendent) is a legal notice filed in Cook County, Illinois, indicating that a property is facing foreclosure. It is a public record that alerts potential buyers and interested parties about the pending foreclosure process. 2. Types of Cook Illinois Notices of Foreclosure (Li's Pendent): a) Residential Foreclosure Li's Pendent: This type of Li's Pendent applies to foreclosures on residential properties, such as single-family homes, condominiums, or townhouses, within Cook County, Illinois. Keywords: Residential, single-family homes, condominiums, townhouses. b) Commercial Foreclosure Li's Pendent: This type of Li's Pendent applies to foreclosures on commercial properties, including office buildings, retail spaces, industrial facilities, and other non-residential properties, located in Cook County, Illinois. Keywords: Commercial, office buildings, retail spaces, industrial facilities, non-residential properties. c) Tax Lien Foreclosure Li's Pendent: This type of Li's Pendent is specific to foreclosures caused by outstanding property tax debts in Cook County, Illinois. When property owners fail to pay their property taxes, the government may initiate a foreclosure process to recover the unpaid taxes. Keywords: Tax lien, property tax debts, government foreclosure. d) Judicial Foreclosure Li's Pendent: This type of Li's Pendent is associated with foreclosures initiated through a judicial process in Cook County, Illinois. When a lender or creditor files a lawsuit to foreclose on a property, a Judicial Foreclosure Li's Pendent is filed to notify interested parties of the pending legal action. Keywords: Judicial process, lawsuit, legal action. e) Non-Judicial Foreclosure Li's Pendent: This type of Li's Pendent is relevant when a lender or creditor initiates a foreclosure without involving the court system in Cook County, Illinois. Non-judicial foreclosures occur when the mortgage or deed of trust contains a "power of sale" clause, permitting the lender to sell the property to recover the outstanding debt. Keywords: Non-judicial process, power of sale, deed of trust.

Cook Illinois Notice of Foreclosure (Lis Pendens)

Category:

State:

Illinois

County:

Cook

Control #:

IL-LR042T

Format:

Word;

Rich Text

Instant download

This form is available by subscription

Description

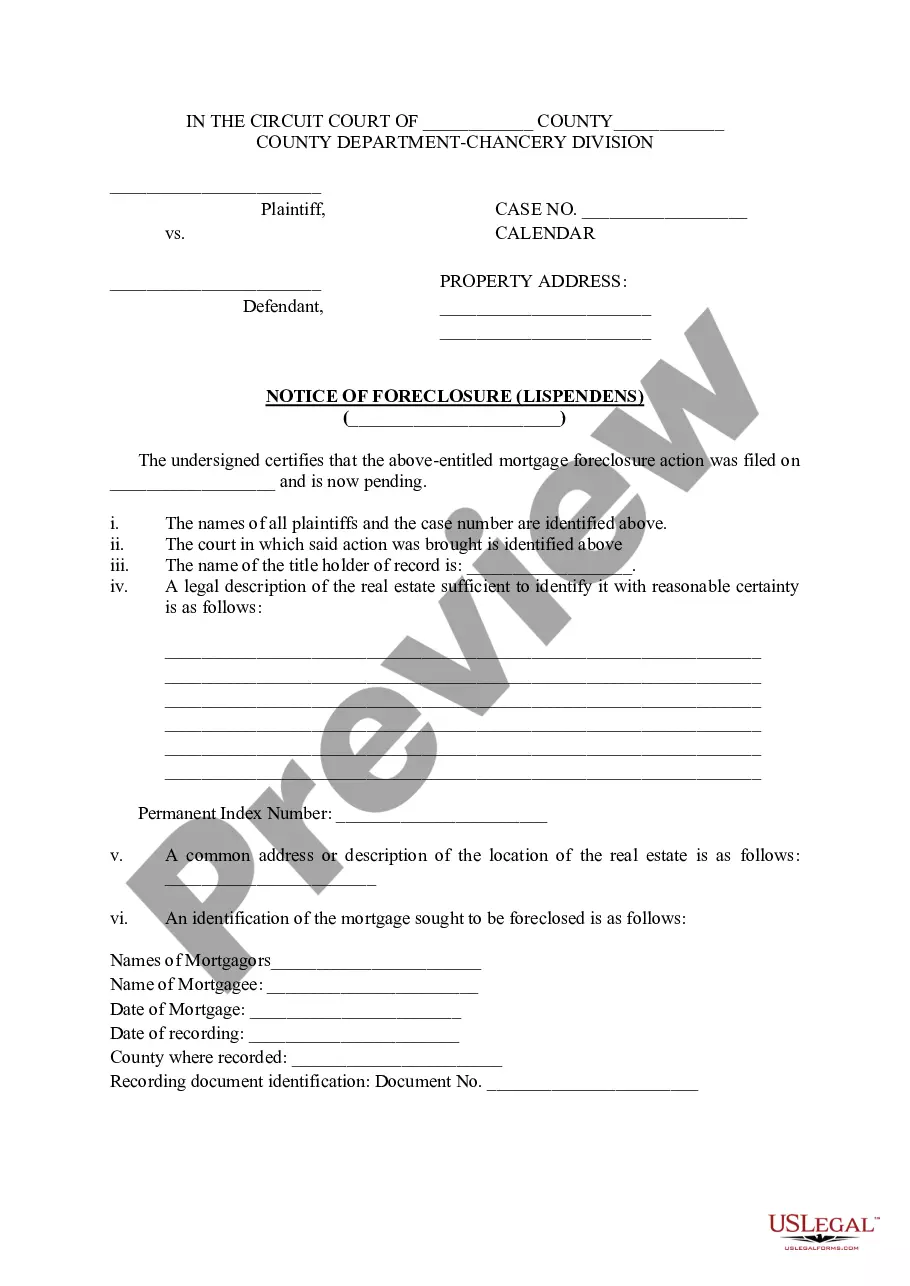

A Lis pendens is a written notice of a pending lawsuit involving property. This form is a notice of foreclosure.

A Lis pendens is a written notice of a pending lawsuit involving

property. This form is a notice of foreclosure.

A Lis pendens is a written notice of a pending lawsuit involving

property. This form is a notice of foreclosure.

A Lis pendens is a written notice of a pending lawsuit involving

property. This form is a notice of foreclosure.

In Cook County, Illinois, a Notice of Foreclosure, also known as Li's Pendent, is a legal document filed by a lender or creditor to announce their intent to foreclose on a property due to a delinquent mortgage or unpaid debt. This notice serves as a public record, alerting potential buyers and interested parties that the property is facing foreclosure. In this detailed description, we will cover the Cook Illinois Notice of Foreclosure (Li's Pendent) and its various types, providing relevant keywords for a comprehensive understanding. Keywords: Cook County, Illinois, Notice of Foreclosure, Li's Pendent, lender, creditor, foreclose, delinquent mortgage, unpaid debt, public record, potential buyers, interested parties. 1. What is a Cook Illinois Notice of Foreclosure (Li's Pendent)? The Cook Illinois Notice of Foreclosure (Li's Pendent) is a legal notice filed in Cook County, Illinois, indicating that a property is facing foreclosure. It is a public record that alerts potential buyers and interested parties about the pending foreclosure process. 2. Types of Cook Illinois Notices of Foreclosure (Li's Pendent): a) Residential Foreclosure Li's Pendent: This type of Li's Pendent applies to foreclosures on residential properties, such as single-family homes, condominiums, or townhouses, within Cook County, Illinois. Keywords: Residential, single-family homes, condominiums, townhouses. b) Commercial Foreclosure Li's Pendent: This type of Li's Pendent applies to foreclosures on commercial properties, including office buildings, retail spaces, industrial facilities, and other non-residential properties, located in Cook County, Illinois. Keywords: Commercial, office buildings, retail spaces, industrial facilities, non-residential properties. c) Tax Lien Foreclosure Li's Pendent: This type of Li's Pendent is specific to foreclosures caused by outstanding property tax debts in Cook County, Illinois. When property owners fail to pay their property taxes, the government may initiate a foreclosure process to recover the unpaid taxes. Keywords: Tax lien, property tax debts, government foreclosure. d) Judicial Foreclosure Li's Pendent: This type of Li's Pendent is associated with foreclosures initiated through a judicial process in Cook County, Illinois. When a lender or creditor files a lawsuit to foreclose on a property, a Judicial Foreclosure Li's Pendent is filed to notify interested parties of the pending legal action. Keywords: Judicial process, lawsuit, legal action. e) Non-Judicial Foreclosure Li's Pendent: This type of Li's Pendent is relevant when a lender or creditor initiates a foreclosure without involving the court system in Cook County, Illinois. Non-judicial foreclosures occur when the mortgage or deed of trust contains a "power of sale" clause, permitting the lender to sell the property to recover the outstanding debt. Keywords: Non-judicial process, power of sale, deed of trust.

Free preview

How to fill out Cook Illinois Notice Of Foreclosure (Lis Pendens)?

If you’ve already used our service before, log in to your account and save the Cook Illinois Notice of Foreclosure (Lis Pendens) on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Cook Illinois Notice of Foreclosure (Lis Pendens). Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!