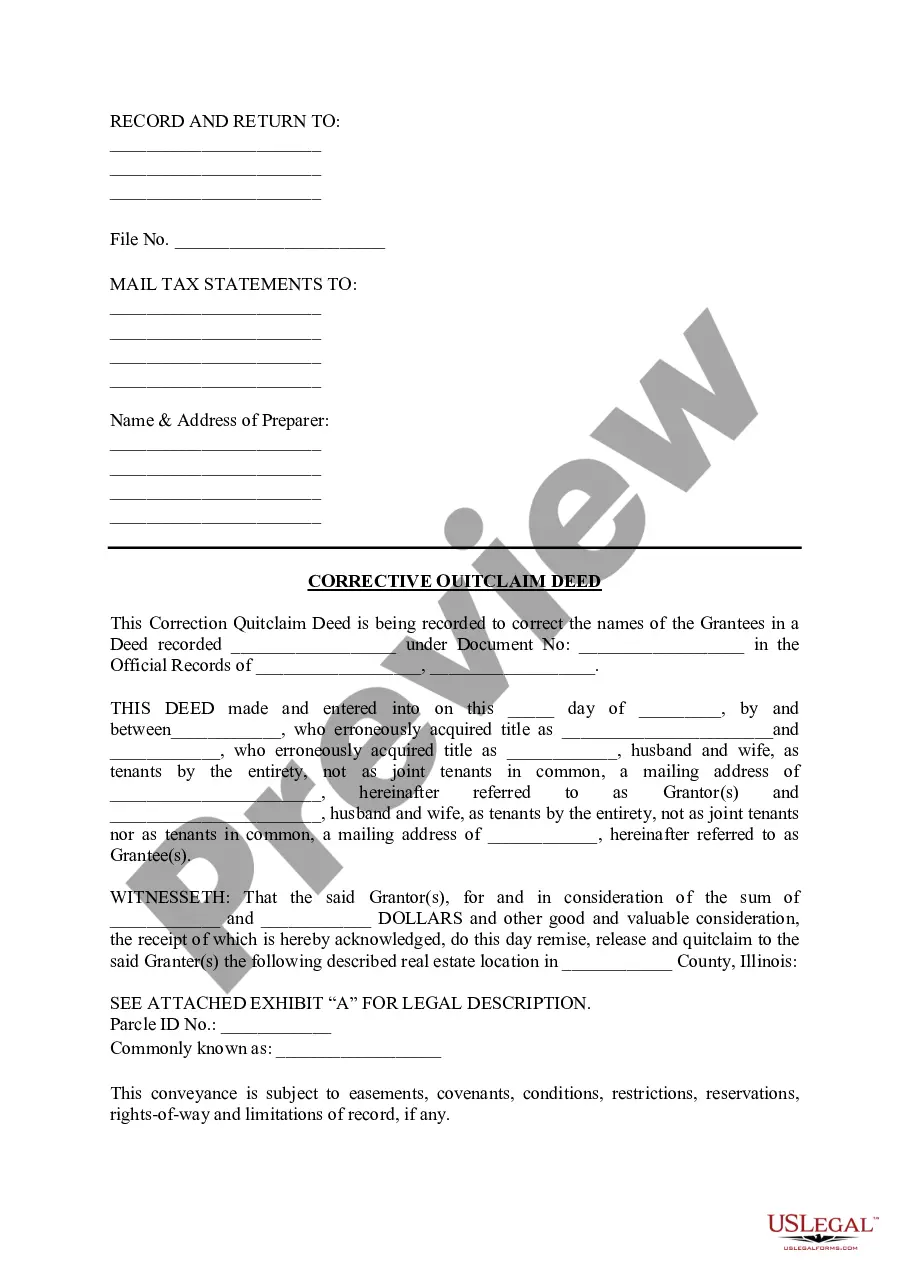

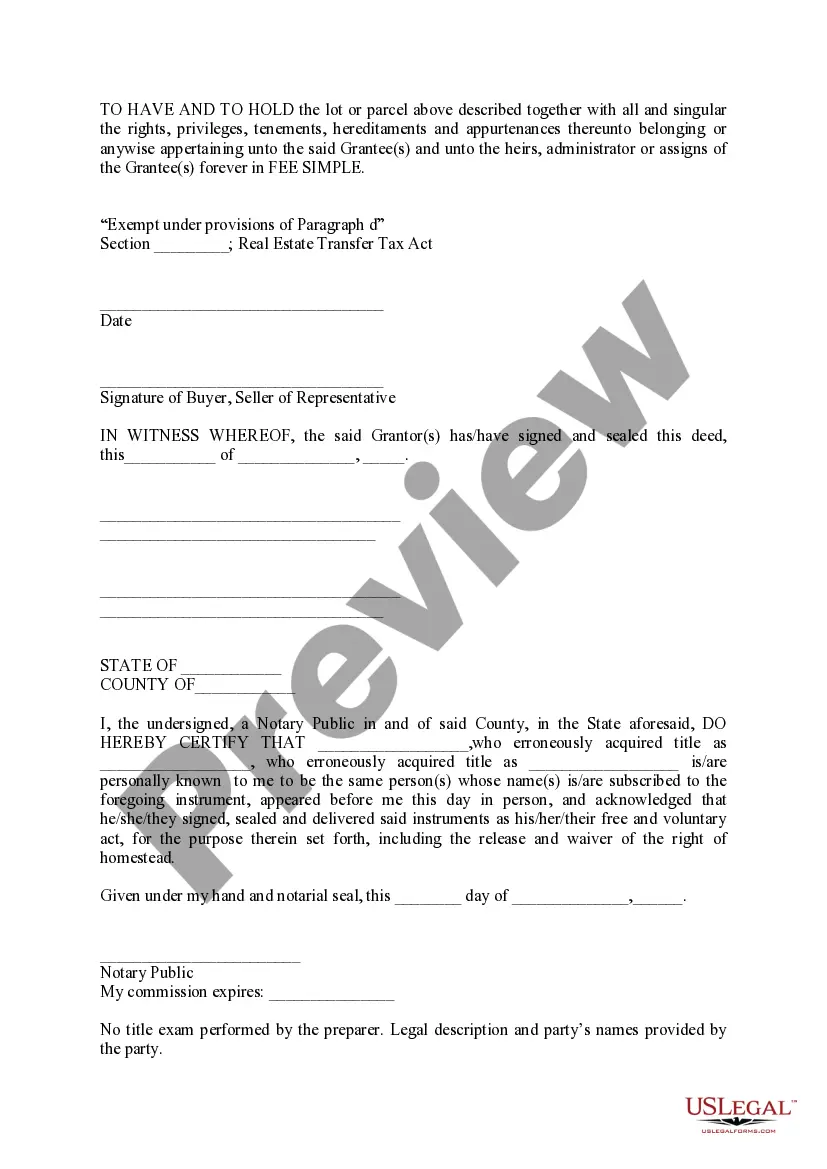

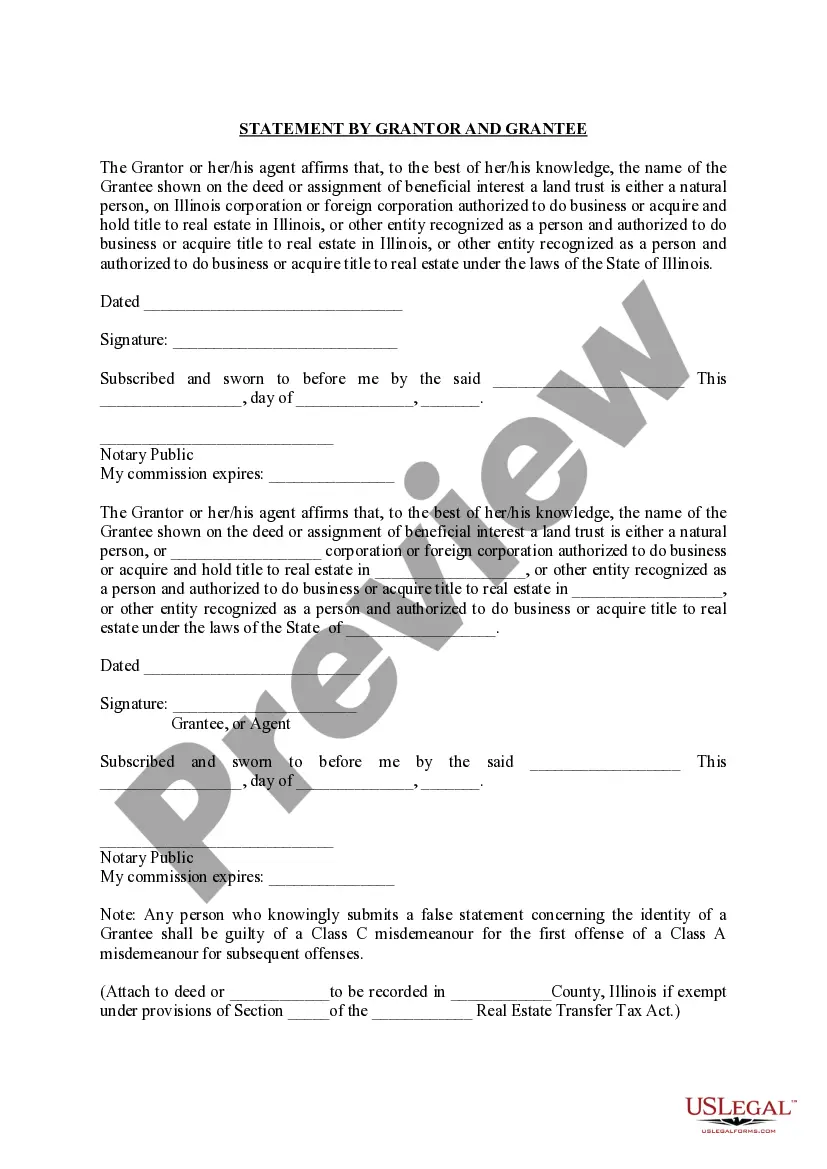

Elgin Illinois Corrective Quit Claim Deed is a legal document used to correct errors and clarify property ownership in Elgin, Illinois. It is commonly utilized to rectify mistakes made in the original quit claim deed or to update information related to the property transfer. Keywords: Elgin Illinois, Corrective Quit Claim Deed, legal document, errors, property ownership, clarify, mistakes, update, property transfer. Types of Elgin Illinois Corrective Quit Claim Deeds: 1. Simple Corrective Quit Claim Deed: This type of corrective quit claim deed is used to fix minor errors or omissions in the original quit claim deed. It may be necessary when there are misspellings, typographical errors, or incorrect legal descriptions. 2. Corrective Quit Claim Deed with Additional Parties: This form of corrective quit claim deed is utilized when there is a need to add or remove parties involved in the original quit claim deed. For example, if a new owner needs to be added or a previous owner's name needs to be removed due to a change in circumstances. 3. Corrective Quit Claim Deed for Boundary Disputes: This type of corrective quit claim deed is utilized when there is a disagreement or dispute regarding the boundaries of the property. It helps in resolving such disputes by clarifying the correct property lines through updated legal descriptions. 4. Corrective Quit Claim Deed for Name Change: This form of corrective quit claim deed is used when there is a change in the name of the property owner. It updates the legal document to reflect the new name accurately, which may arise due to marriage, divorce, or any other legal name change. 5. Corrective Quit Claim Deed for Tax Assessment Purposes: This type of corrective quit claim deed is utilized when there is a need to correct or update information related to property tax assessments. It helps in ensuring that the property tax assessments accurately reflect the ownership details and any changes that have occurred over time. In conclusion, Elgin Illinois Corrective Quit Claim Deed is a crucial legal document used to rectify errors, clarify property ownership, and update information in Elgin, Illinois. Various types of these deeds exist, such as simple corrections, adding/removing parties, resolving boundary disputes, updating for name changes, and ensuring accurate property tax assessments.

Elgin Illinois Corrective Quit Claim Deed

Description

How to fill out Elgin Illinois Corrective Quit Claim Deed?

Are you looking for a trustworthy and affordable legal forms provider to get the Elgin Illinois Corrective Quit Claim Deed? US Legal Forms is your go-to solution.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Elgin Illinois Corrective Quit Claim Deed conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to find out who and what the form is intended for.

- Restart the search if the template isn’t good for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Elgin Illinois Corrective Quit Claim Deed in any available format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online once and for all.