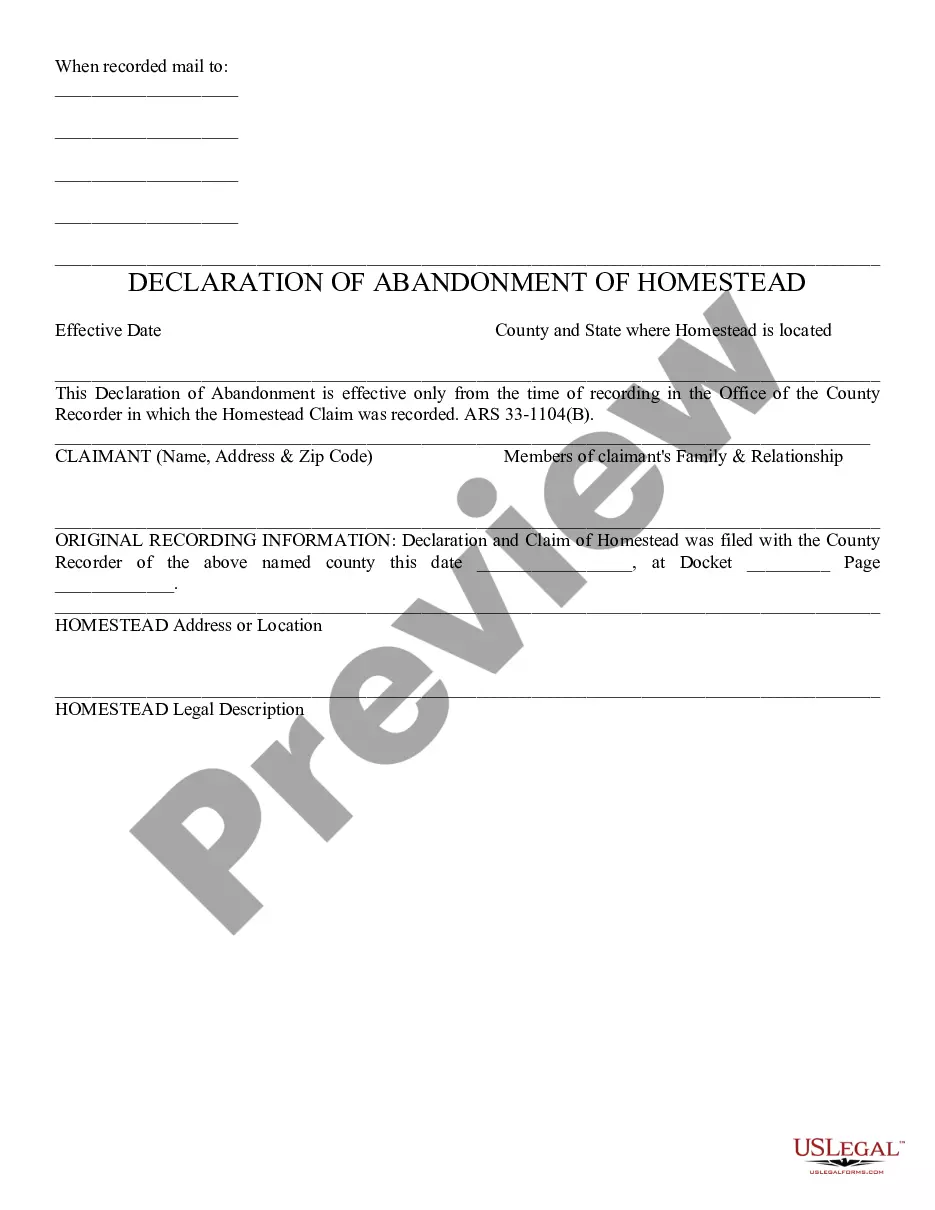

This form is used to provide notice to interested parties in an

estate that a petition has been filed requesting that an estate be

opened, and a foreign administrator appointed.

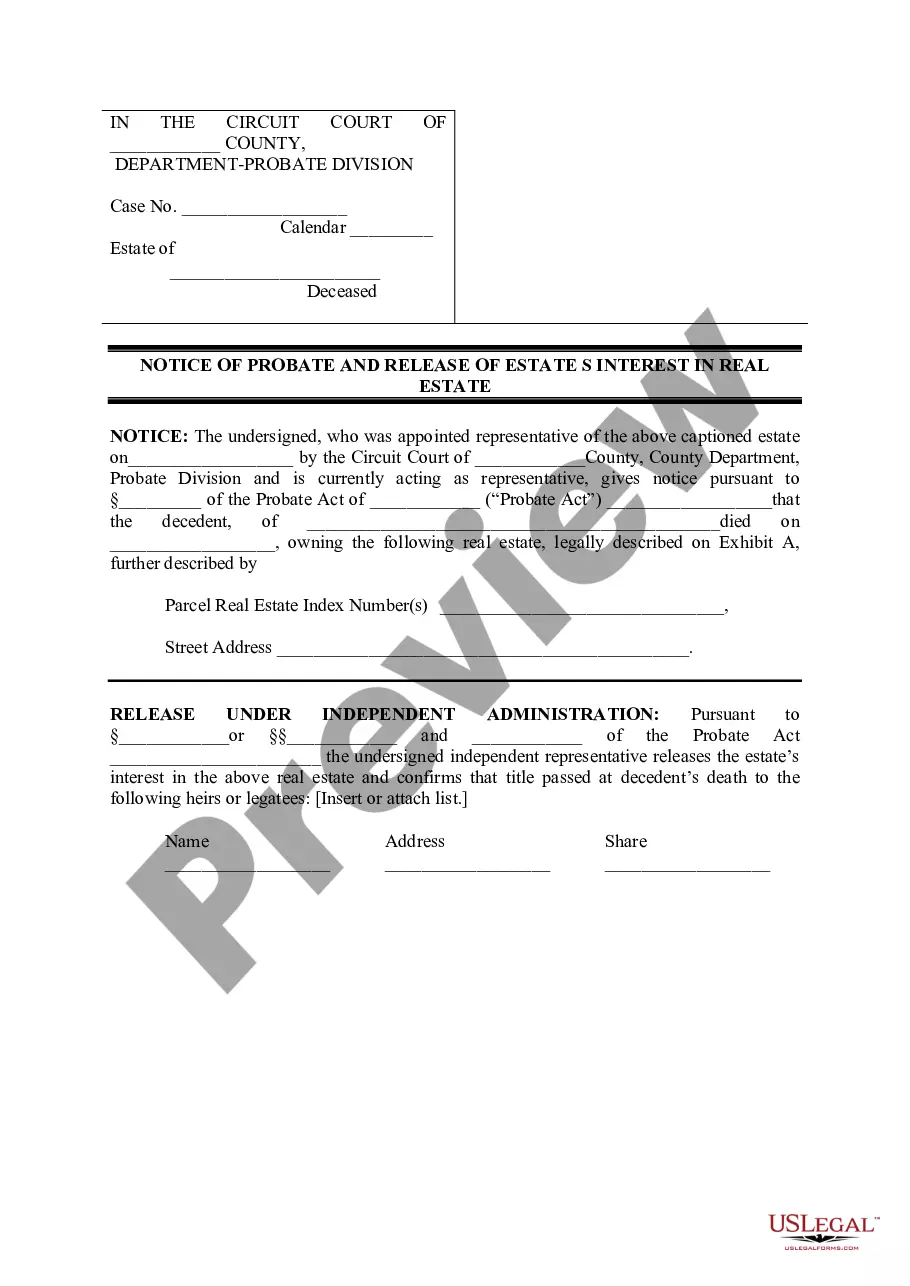

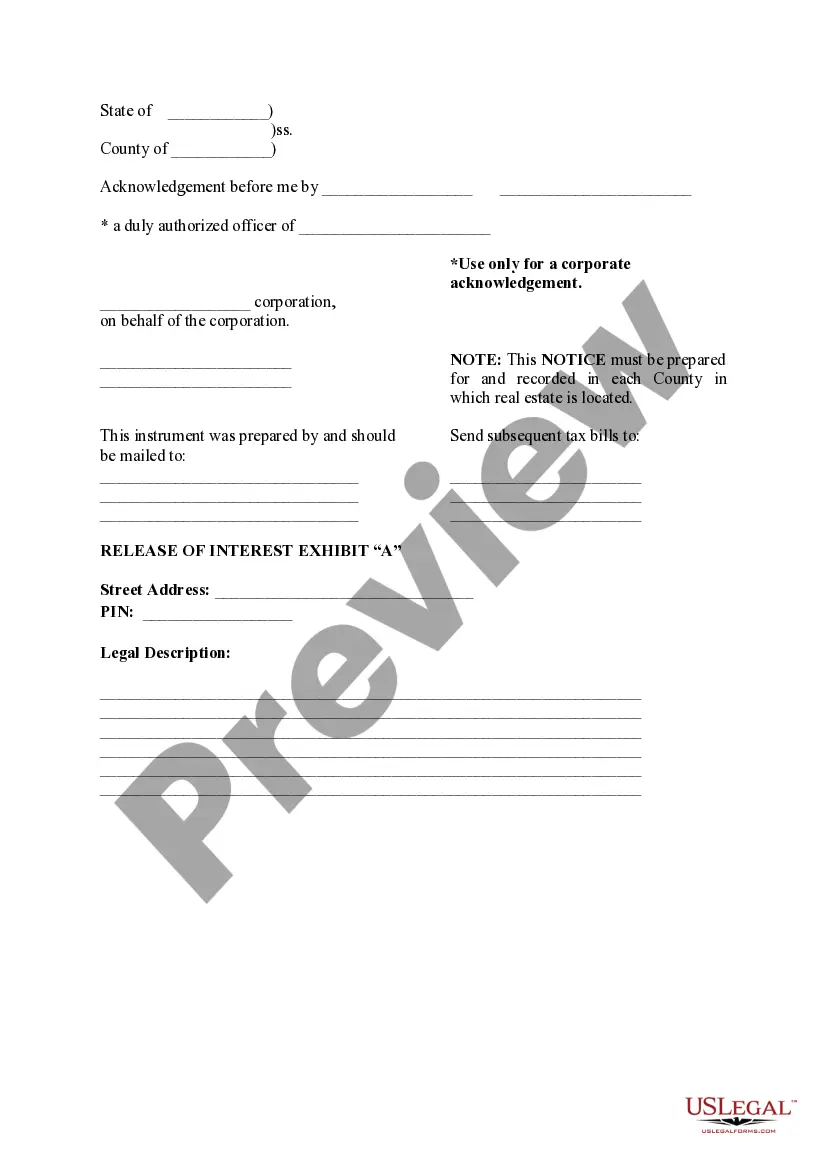

The Chicago Illinois Notice of Probate and Release of Estate Interest in Real Estate is a legal document that pertains to the probate process in the state of Illinois, specifically in the city of Chicago. This document serves as a notice to interested parties, such as heirs, beneficiaries, creditors, and other individuals with potential claims on the deceased person's estate. The Notice of Probate is typically filed by the executor or administrator of the estate, as appointed by the court, to notify these interested parties about the probate proceedings. It provides important information about the deceased person, such as their name, date of death, and the name of the court where the probate case has been filed. This notice is required to be published in a local newspaper to ensure that all potential claimants are made aware of the probate process. The Release of Estate Interest in Real Estate is an accompanying document that may be included in the probate proceedings if the deceased person had an interest in real estate property located in Chicago, Illinois. This release confirms that any claim or interest the estate may have had in the mentioned property has been legally resolved and transfers the ownership of the property to the rightful heirs or beneficiaries named in the deceased person's will or determined by the court. There are no specific different types of the Chicago Illinois Notice of Probate and Release of Estate Interest in Real Estate. However, the contents and details included in the notice may vary depending on the complexity of the probate case, the value and nature of the assets involved, and the specific requirements of the court. Keywords: Chicago Illinois, Notice of Probate, Release of Estate Interest, Real Estate, probate process, legal document, executor, administrator, deceased person, heirs, beneficiaries, creditors, potential claims, estate, probate proceedings, local newspaper, claimants, published, interest in real estate, property, ownership, will, court.