Cook County, located in the state of Illinois, follows a legal process to handle default on mortgage payments leading to foreclosure. The Cook County Notice of Default and Foreclosure Sale is a crucial step in this process, serving as an official notice to the property owner and interested parties about the imminent auction of the property. The Notice of Default and Foreclosure Sale is typically initiated by the mortgage lender or creditor when the homeowner defaults on mortgage payments for an extended period. This notice aims to inform the property owner and interested parties, such as lien holders and potential buyers, about the foreclosure proceedings and the impending sale of the property. Within Cook County, there are various types of Notice of Default and Foreclosure Sale, including: 1. Judicial Foreclosure: Judicial foreclosure is a process where the lender files a lawsuit in court to foreclose on the property. During this process, the court oversees the entire foreclosure proceedings and ensures that all parties involved have an opportunity to present their case. The Notice of Default and Foreclosure Sale is issued as part of this judicial procedure. 2. Non-Judicial Foreclosure: Non-judicial foreclosure refers to the foreclosure process that occurs outside the court system. In Cook County, Illinois, non-judicial foreclosures are rare since the state primarily follows a judicial foreclosure process. As a result, the Notice of Default and Foreclosure Sale issued in Cook County is most commonly associated with judicial foreclosures. The Notice of Default and Foreclosure Sale includes key information such as the specific details of the property in question, the outstanding amount owed, the date and time of the foreclosure sale, and the location where the sale will take place. It is important for property owners to pay close attention to this notice as it provides them with an opportunity to address the default, negotiate with the lender, or explore alternatives, such as loan modification or short sale, to prevent the loss of their property. Keywords: Cook County, Illinois, Notice of Default, Foreclosure Sale, mortgage payments, property owner, auction, mortgage lender, creditor, foreclosure proceedings, lien holders, judicial foreclosure, non-judicial foreclosure, lawsuit, court system, outstanding amount, foreclosure sale, loan modification, short sale.

Cook Illinois Notice of Default and Foreclosure Sale

Description

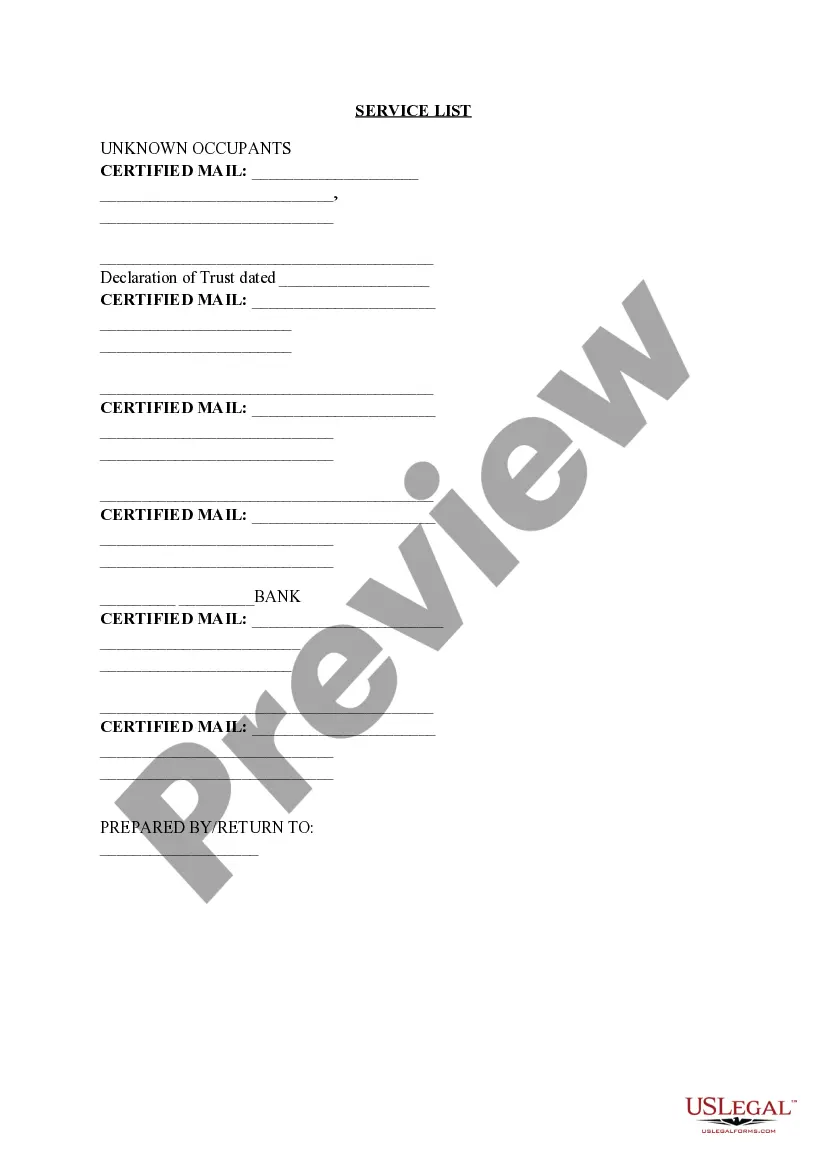

How to fill out Cook Illinois Notice Of Default And Foreclosure Sale?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal solutions that, usually, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Cook Illinois Notice of Default and Foreclosure Sale or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Cook Illinois Notice of Default and Foreclosure Sale complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Cook Illinois Notice of Default and Foreclosure Sale would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!