Elgin, Illinois Notice of Default and Foreclosure Sale: Understanding the Process to Protect your Property In Elgin, Illinois, the Notice of Default and Foreclosure Sale serves as a crucial legal notification that property owners need to be aware of to protect their assets. This comprehensive guide aims to provide a detailed understanding of the Elgin, Illinois Notice of Default and Foreclosure Sale, highlighting its significance, process, and various types to help property owners navigate through potential challenges. A Notice of Default is issued by a lender when a borrower fails to make mortgage payments within a specified period. It marks the initial step in the foreclosure process, indicating the borrower's delinquency and providing them an opportunity to rectify the default. This notice is typically sent through certified mail and includes important details, such as the amount owed, the actions required to cure default, and a timeframe to do so. Understanding and promptly responding to a Notice of Default is crucial to avoid foreclosure proceedings. If the borrower fails to address the default within the given timeframe, the lender proceeds with foreclosure actions. This leads to the issuance of the Notice of Foreclosure Sale. It is a formal announcement to the public that the property will be sold at a public auction to recover the outstanding debt owed by the borrower. The Notice of Foreclosure Sale typically includes essential information, such as the date, time, and location of the auction, along with the terms of the sale. Within Elgin, Illinois, there are several types of foreclosure sales that property owners should be aware of: 1. Judicial Foreclosure Sale: This type of foreclosure sale is initiated through a lawsuit filed in a court of law. The judicial process involves legal proceedings where the court oversees the sale to ensure fairness and adhere to specific legal requirements. 2. Non-Judicial Foreclosure Sale: In contrast to judicial foreclosure, a non-judicial foreclosure sale follows a streamlined process without court involvement. This method is possible if the mortgage contract contains a "power of sale" clause, allowing the lender to sell the property without litigation. 3. Sheriff's Sale: During a Sheriff's Sale, the property is auctioned off at the county courthouse. This type of sale is typically conducted as part of the judicial foreclosure process and overseen by the county sheriff or an appointed official. To safeguard their property and rights, property owners facing default or foreclosure should consider seeking professional legal advice promptly. Legal experts well-versed in Illinois foreclosure laws can offer guidance, explore alternatives such as loan modification or repayment plans, or represent the owner's interests during legal proceedings. While facing a Notice of Default and Foreclosure Sale can be daunting, being aware of the process and seeking professional assistance helps property owners make informed decisions to navigate this challenging situation successfully. Remember, timely action is crucial to preserving your property and protecting your investment in Elgin, Illinois.

Elgin Illinois Notice of Default and Foreclosure Sale

Description

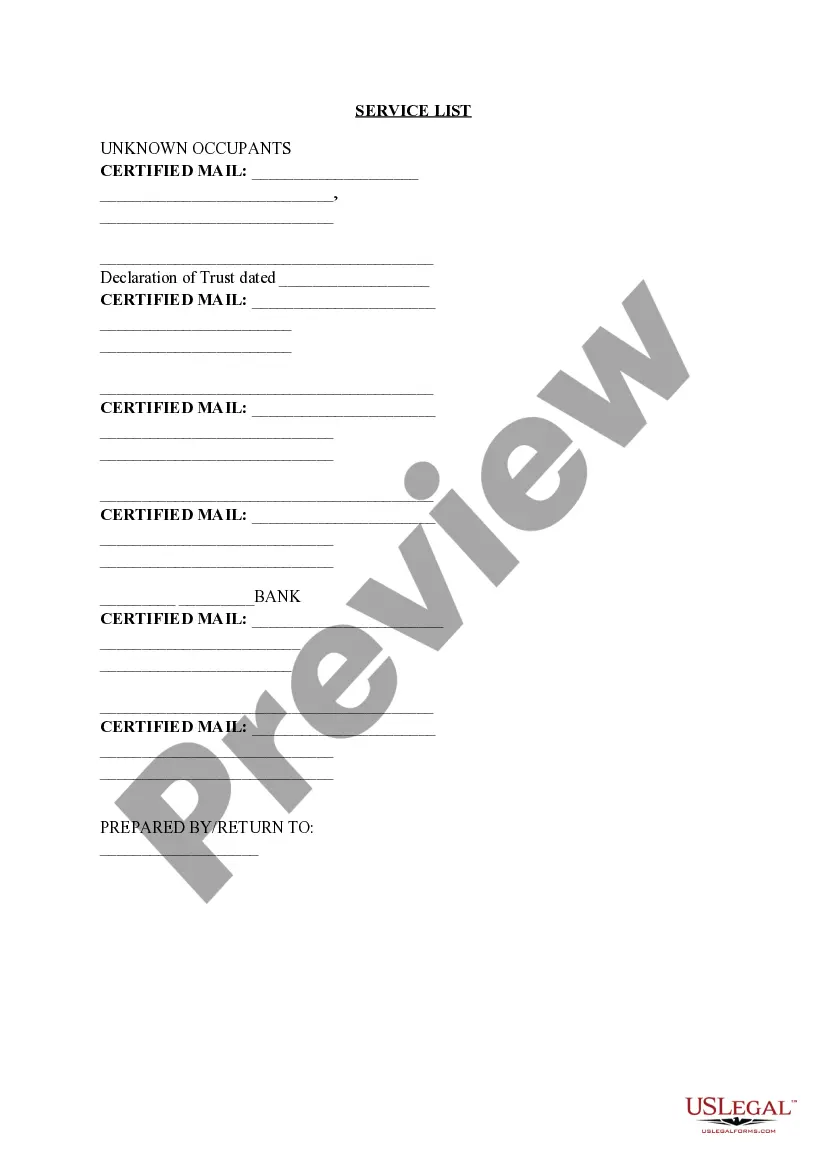

How to fill out Elgin Illinois Notice Of Default And Foreclosure Sale?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, as a rule, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Elgin Illinois Notice of Default and Foreclosure Sale or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Elgin Illinois Notice of Default and Foreclosure Sale complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Elgin Illinois Notice of Default and Foreclosure Sale would work for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!