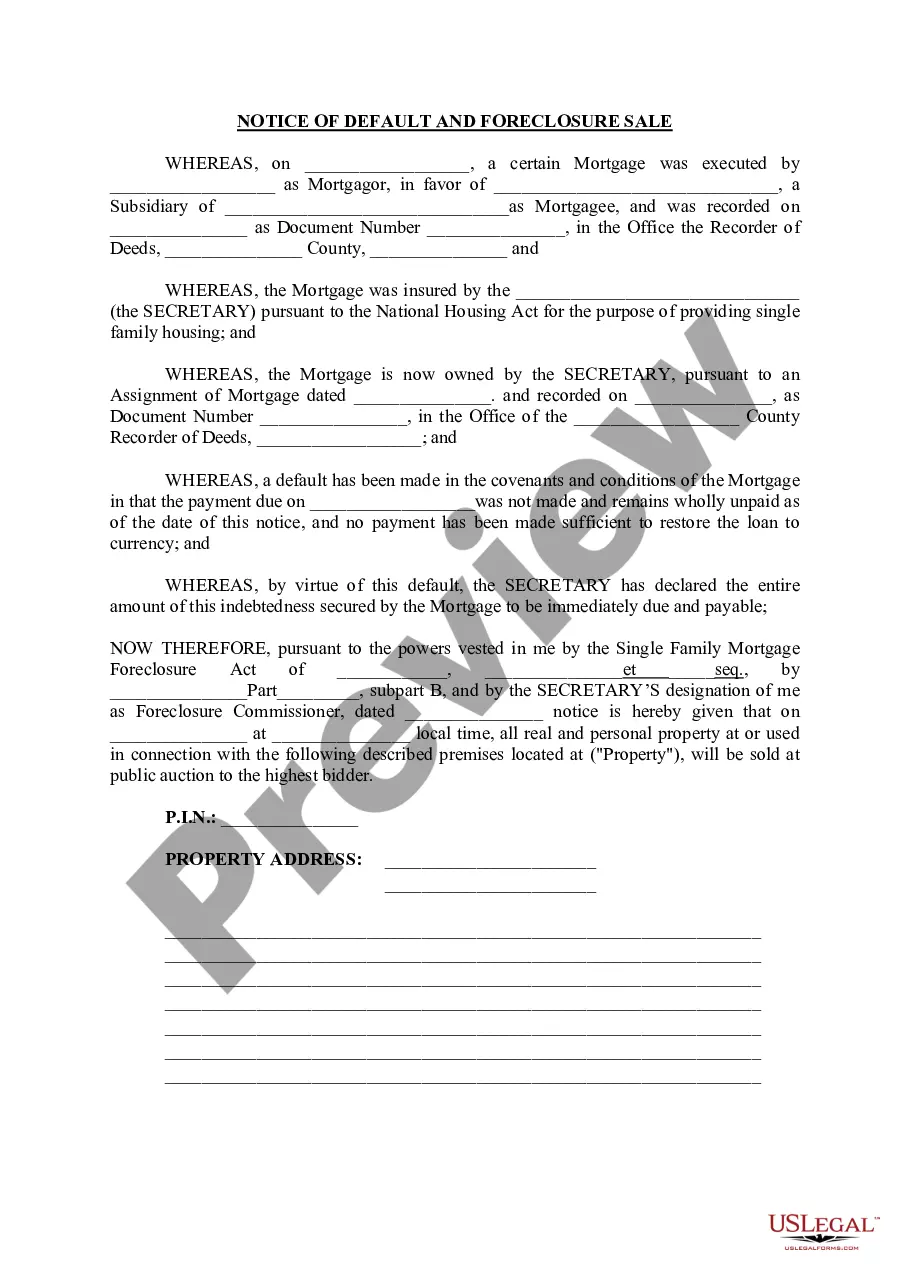

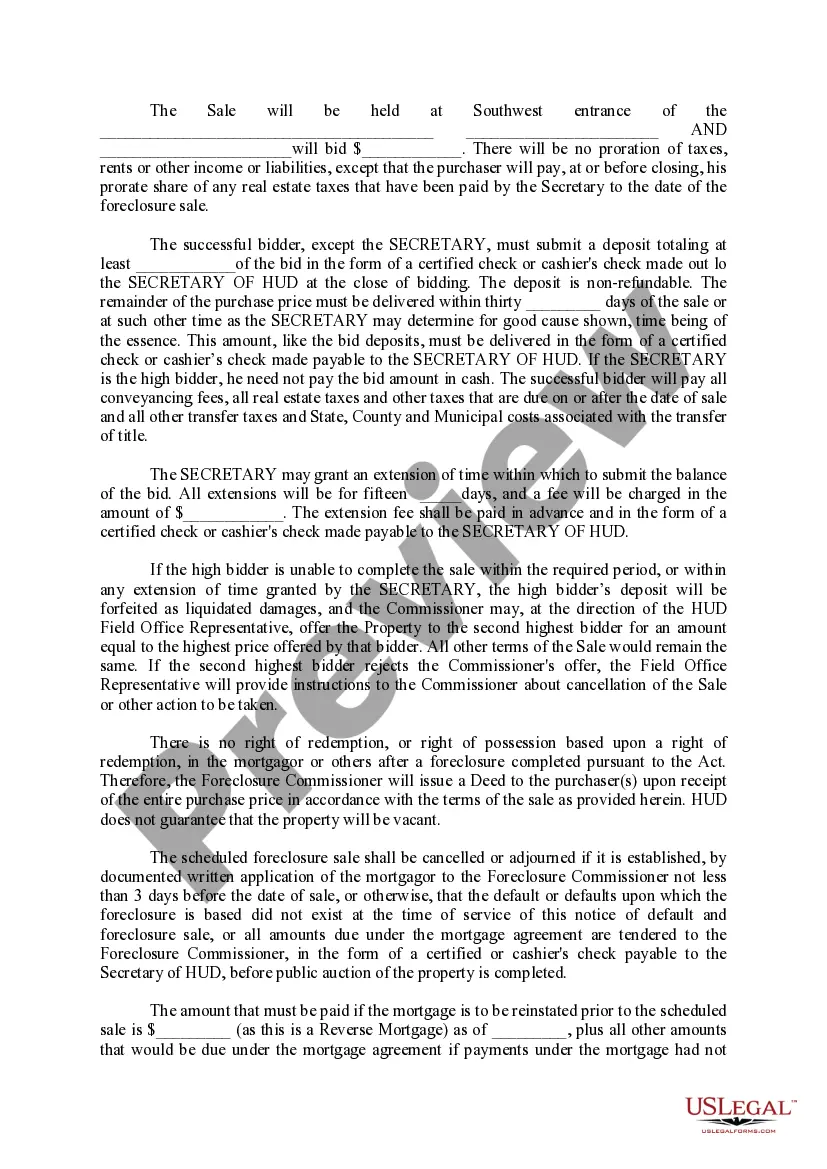

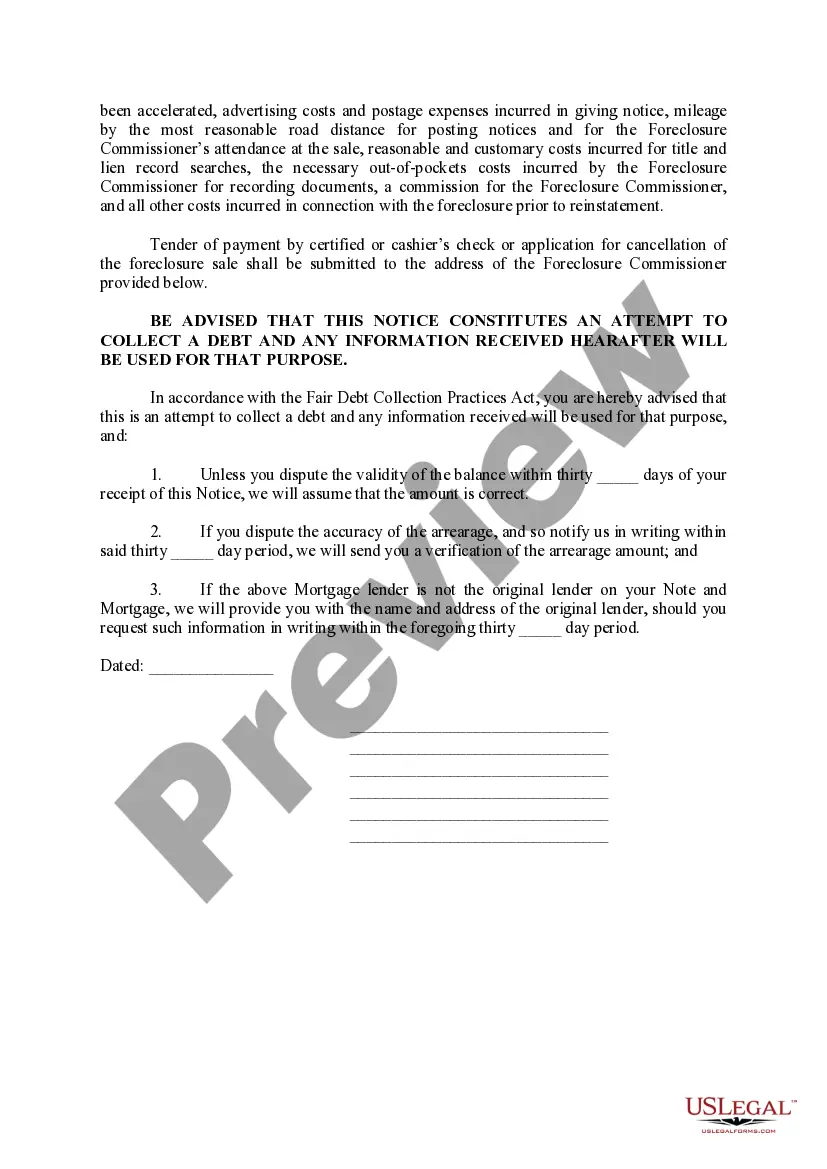

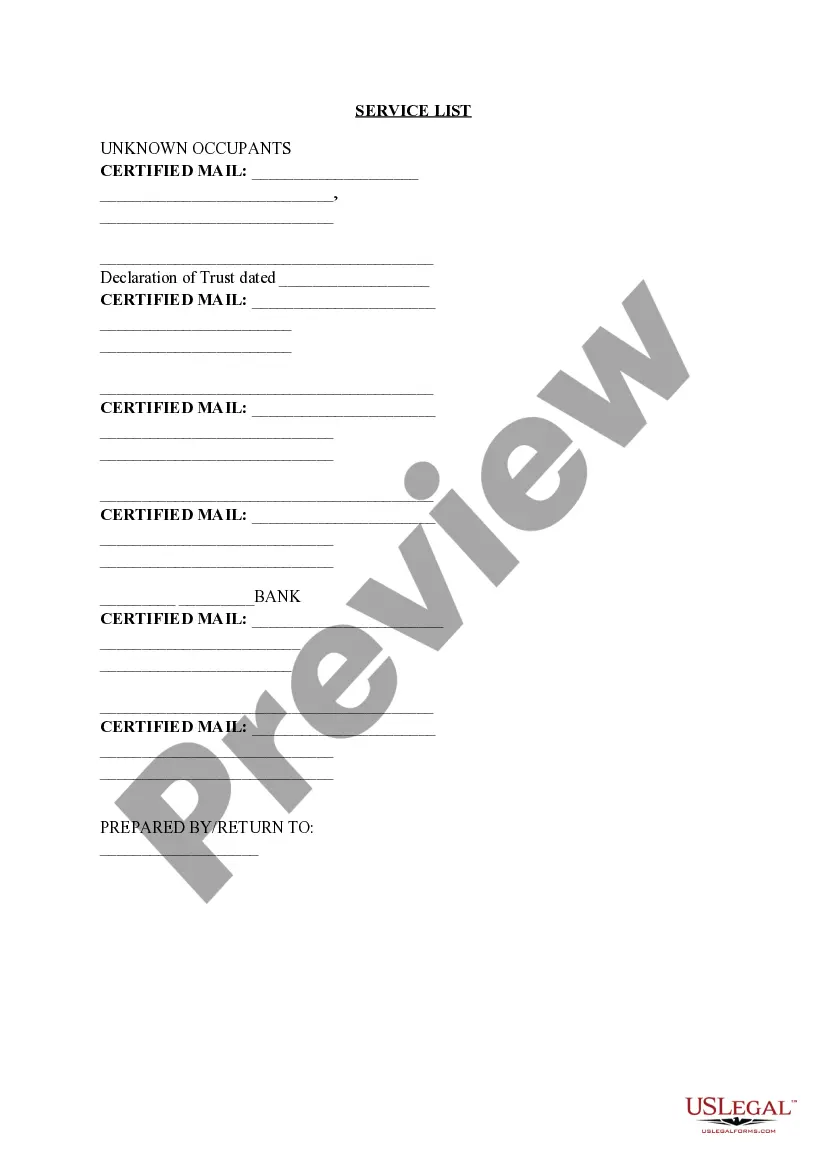

Joliet, Illinois Notice of Default and Foreclosure Sale is a legal process initiated by a lender when a homeowner fails to make timely mortgage payments. This detailed description will delve into what this notice entails, how it impacts homeowners, and the various types of notices related to default and foreclosure sales in Joliet, Illinois. The Notice of Default (NOD) is the initial step before foreclosure proceedings. It serves as an official communication, typically delivered via certified mail, notifying the homeowner that they have breached the terms of their mortgage agreement by defaulting on their payments. The NOD includes essential details such as the outstanding amount, the deadline for repayment, and the consequences of further delinquency. Following the expiration of the time period specified in the NOD, if the homeowner fails to bring their mortgage payments up to date, the lender proceeds with a Notice of Foreclosure Sale. This notice officially informs the homeowner that the property will be sold at a public auction or trustee sale to recover the outstanding debt. In Joliet, Illinois, there are three primary types of notices associated with default and foreclosure sales: pre-foreclosure notice, notice of sale, and notice of redemption. 1. Pre-Foreclosure Notice: As a homeowner begins to fall behind on mortgage payments, the lender commonly sends a pre-foreclosure notice. This notice acts as an early warning to prompt the homeowner to address the delinquency, either through payment of the outstanding amount or by seeking alternatives like loan modification or refinancing. 2. Notice of Sale: Following the Notice of Default and the expiration of the given grace period, if the homeowner fails to rectify the defaulted payments, a Notice of Sale is issued. This legal document details the date, time, and location of the foreclosure auction where the property will be sold to the highest bidder. 3. Notice of Redemption: In some cases, homeowners in Joliet, Illinois, have the right to redeem their property even after the foreclosure sale. The Notice of Redemption informs the homeowner about the provided period within which they can reclaim their property by paying the full amount owed plus interest and associated costs. This notice typically specifies the redemption deadline and the necessary procedures to exercise this right. It is important for homeowners in Joliet, Illinois, to be aware of these different types of notices related to default and foreclosure sales. Staying informed about their rights, options available to avoid foreclosure, and the specific requirements set by the lender can help homeowners navigate this challenging process and potentially find the best resolution for their financial situation.

Joliet Illinois Notice of Default and Foreclosure Sale

Description

How to fill out Joliet Illinois Notice Of Default And Foreclosure Sale?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any legal education to create this sort of paperwork from scratch, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform provides a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Joliet Illinois Notice of Default and Foreclosure Sale or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Joliet Illinois Notice of Default and Foreclosure Sale in minutes using our trustworthy platform. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

However, if you are new to our library, make sure to follow these steps prior to downloading the Joliet Illinois Notice of Default and Foreclosure Sale:

- Ensure the template you have chosen is specific to your area considering that the regulations of one state or area do not work for another state or area.

- Review the document and read a short description (if available) of scenarios the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your login information or create one from scratch.

- Pick the payment method and proceed to download the Joliet Illinois Notice of Default and Foreclosure Sale once the payment is done.

You’re all set! Now you can proceed to print the document or complete it online. If you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.