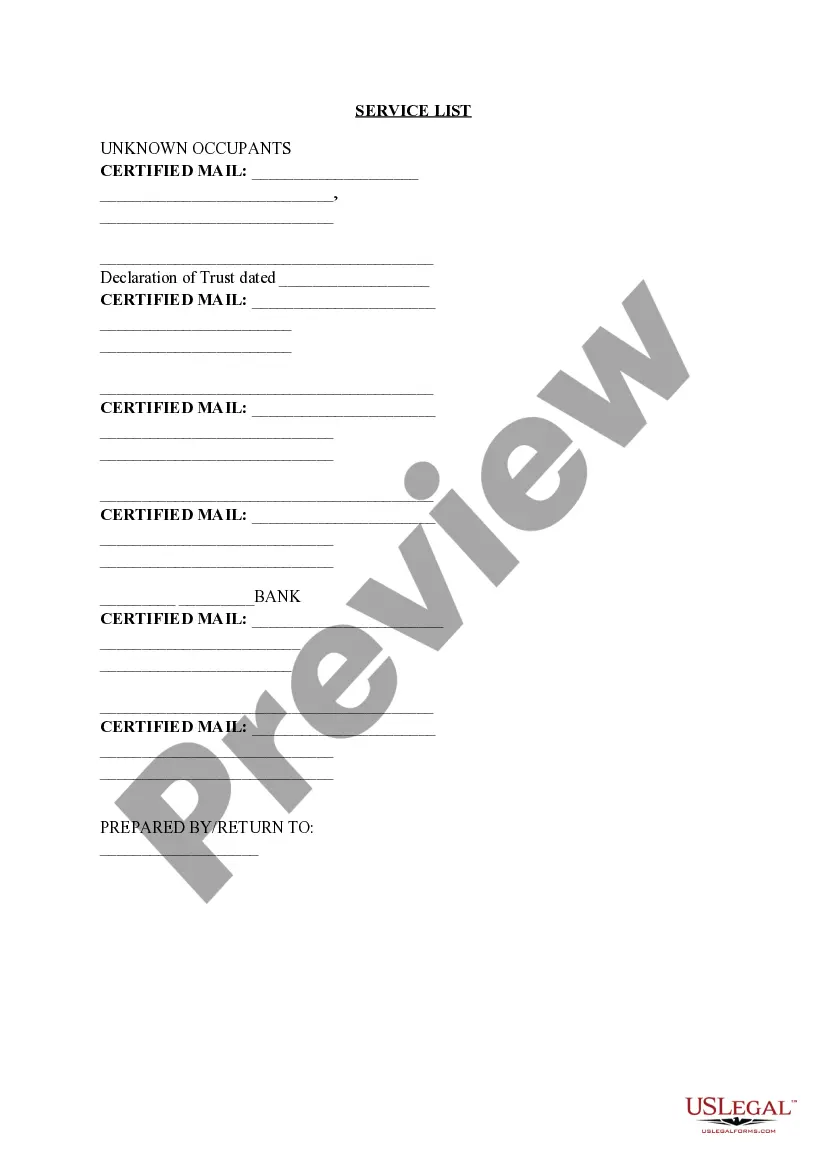

Naperville, Illinois Notice of Default and Foreclosure Sale is a legal process initiated by a lending institution or mortgage lender when a property owner fails to meet their mortgage payment obligations. This process allows the lender to legally repossess the property in order to recover the outstanding debt. Here, we will provide a detailed description of this process, outlining its key components, stages, and different types that may exist in Naperville, Illinois. The Notice of Default is the first crucial step in the foreclosure process. It is a formal notification sent to the property owner, informing them that they have fallen behind on their mortgage payments and are in default. This notice specifies the amount of delinquent payments and also highlights the actions required to cure the default. Typically, the Notice of Default will stipulate a specific timeframe within which the property owner must bring their payments up to date, or the foreclosure process will proceed. Once the Notice of Default period expires without the default being cured, the next stage is the Notice of Foreclosure Sale. This notice indicates that the lender has scheduled a public auction to sell the property and recover the outstanding debt. The Notice of Foreclosure Sale will specify the date, time, and location of the auction, as well as the minimum bid required. It is typically published in local newspapers and may be posted on the property or at the county courthouse. In Naperville, Illinois, there might be different types of foreclosure sales, each with its own distinct characteristics: 1. Judicial Foreclosure Sale: This type of foreclosure requires the lender to file a lawsuit against the borrower, seeking a court order to proceed with the sale. The court oversees the entire foreclosure process, ensuring that all legal requirements are met. 2. Non-judicial Foreclosure Sale: In some cases, the mortgage contract may include a power of sale clause, which grants the lender the authority to sell the property without court involvement. This streamlined process typically requires the lender to follow specific procedures outlined in the mortgage contract or state statutes. 3. Sheriff's Sale: In certain cases, the court may appoint a sheriff or another official to conduct the foreclosure sale. This type of sale may occur in judicial or non-judicial foreclosure processes, with the specific sale procedures varying based on local regulations. It is important to note that foreclosure laws and procedures can vary by state and even within different municipalities. Therefore, it is essential for property owners in Naperville, Illinois, facing potential foreclosure, to seek professional legal advice to understand their specific situation and available options. Understanding the Naperville, Illinois Notice of Default and Foreclosure Sale process can help property owners make informed decisions and potentially work towards resolving their financial difficulties.

Naperville Illinois Notice of Default and Foreclosure Sale

Description

How to fill out Naperville Illinois Notice Of Default And Foreclosure Sale?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone with no law education to draft such papers from scratch, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform provides a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you want the Naperville Illinois Notice of Default and Foreclosure Sale or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Naperville Illinois Notice of Default and Foreclosure Sale quickly employing our trusted platform. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps prior to downloading the Naperville Illinois Notice of Default and Foreclosure Sale:

- Be sure the template you have found is specific to your location considering that the regulations of one state or area do not work for another state or area.

- Preview the form and read a quick description (if provided) of cases the paper can be used for.

- If the one you picked doesn’t meet your requirements, you can start again and look for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the Naperville Illinois Notice of Default and Foreclosure Sale as soon as the payment is through.

You’re good to go! Now you can go ahead and print out the form or fill it out online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.