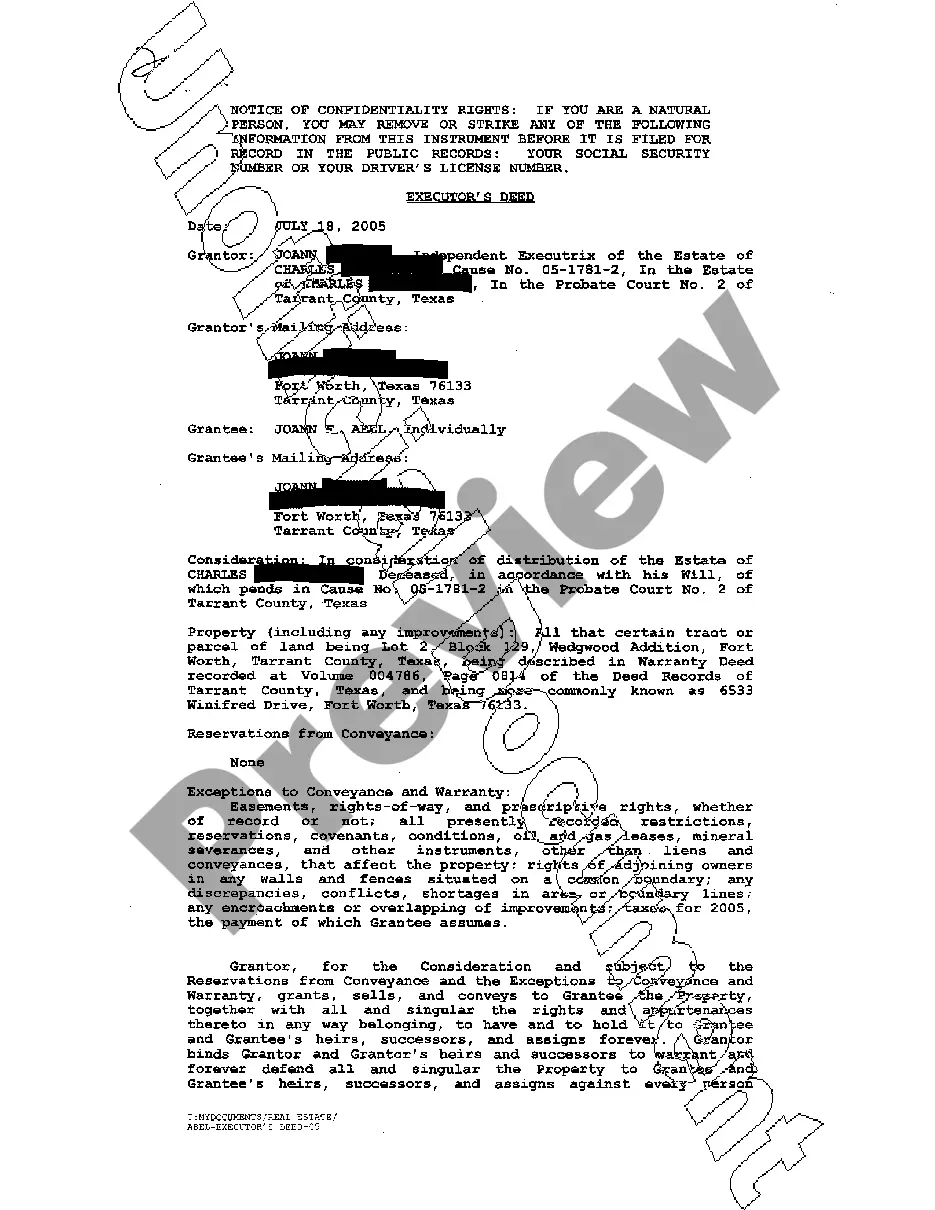

The Chicago Illinois Waiver of Homestead Exemption refers to a legal document and process that homeowners in Chicago, Illinois may go through to waive or remove the homestead exemption on their property. The homestead exemption is a benefit offered to homeowners that allows them to reduce the taxable value of their property, resulting in lower property taxes. In some cases, homeowners may choose to waive this exemption for various reasons. They may decide to do so when they no longer qualify for the exemption, such as when they rent out their property or change its use. Additionally, homeowners who are in financial distress may consider waiving the exemption to increase the chances of selling the property or otherwise addressing their financial situation. It's important to note that the specifics of the Chicago Illinois Waiver of Homestead Exemption process may vary depending on the local authorities and applicable laws. However, generally, the process involves submitting a written request to the Cook County Assessor's Office or the appropriate local authority responsible for administering property taxes. Keywords: Chicago Illinois, waiver, homestead exemption, legal document, process, homeowners, property, taxable value, property taxes, waive, remove, benefit, reduce, rental, change of use, financial distress, selling, Cook County Assessor's Office, local authority

Chicago Homestead Exemption

Description

How to fill out Chicago Illinois Waiver Of Homestead Exemption?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any law background to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our service provides a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Chicago Illinois Waiver of Homestead Exemption or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Chicago Illinois Waiver of Homestead Exemption quickly using our reliable service. In case you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, if you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Chicago Illinois Waiver of Homestead Exemption:

- Ensure the form you have chosen is good for your location considering that the regulations of one state or county do not work for another state or county.

- Preview the document and read a brief description (if available) of cases the document can be used for.

- If the form you chosen doesn’t meet your requirements, you can start again and look for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Select the payment method and proceed to download the Chicago Illinois Waiver of Homestead Exemption once the payment is done.

You’re all set! Now you can proceed to print out the document or fill it out online. In case you have any problems getting your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.