The Cook Illinois Waiver of Homestead Exemption refers to a specific legal process in Cook County, Illinois, that allows property owners to waive or give up their homestead exemption. The homestead exemption is a tax benefit provided to homeowners to reduce their property taxes by exempting a portion of their property's assessed value. The Cook Illinois Waiver of Homestead Exemption is usually utilized by homeowners who wish to sell or transfer their property without losing the homestead exemption for the remaining tax year. This waiver allows them to transfer the exemption rights to a new property or simply remove the exemption altogether. There are different types of Cook Illinois Waiver of Homestead Exemption available, each catering to specific circumstances. These include: 1. Waiver for Property Transfer: This waiver is commonly used by homeowners who are selling their current property and purchasing a new one within Cook County. By waiving the homestead exemption on the old property, they can transfer it to the newly purchased property, thereby preserving the tax benefits. 2. Waiver for Renting Property: Homeowners who plan to rent out their property temporarily can use this waiver to remove the homestead exemption for the period it is rented. This exemption removal ensures fair taxation based on the property's usage. 3. Waiver for Change in Ownership: In cases where there is a change in property ownership, such as due to divorce or inheritance, this waiver allows the new owner to benefit from the existing homestead exemption without interruption. It helps in minimizing potential tax increases that would occur without the waiver. 4. Waiver for Relocation: Homeowners who are relocating outside of Cook County and would like to maintain the homestead exemption can utilize this waiver. It enables them to preserve the exemption on their property even if they are no longer residing there. 5. Waiver for New Construction: This waiver is applicable when a homeowner constructs a new property or substantially improves an existing one. By waiving the homestead exemption on the old property, they can transfer it to the newly built or improved property, ensuring the tax benefits continue to apply. In summary, the Cook Illinois Waiver of Homestead Exemption provides property owners in Cook County with flexibility and options when it comes to transferring, removing, or maintaining their homestead exemption based on their specific circumstances. It is essential for homeowners to understand the different types of waivers available to make informed decisions regarding their property taxes.

Cook Illinois Waiver of Homestead Exemption

Category:

State:

Illinois

County:

Cook

Control #:

IL-LR090T

Format:

Word;

Rich Text

Instant download

Description

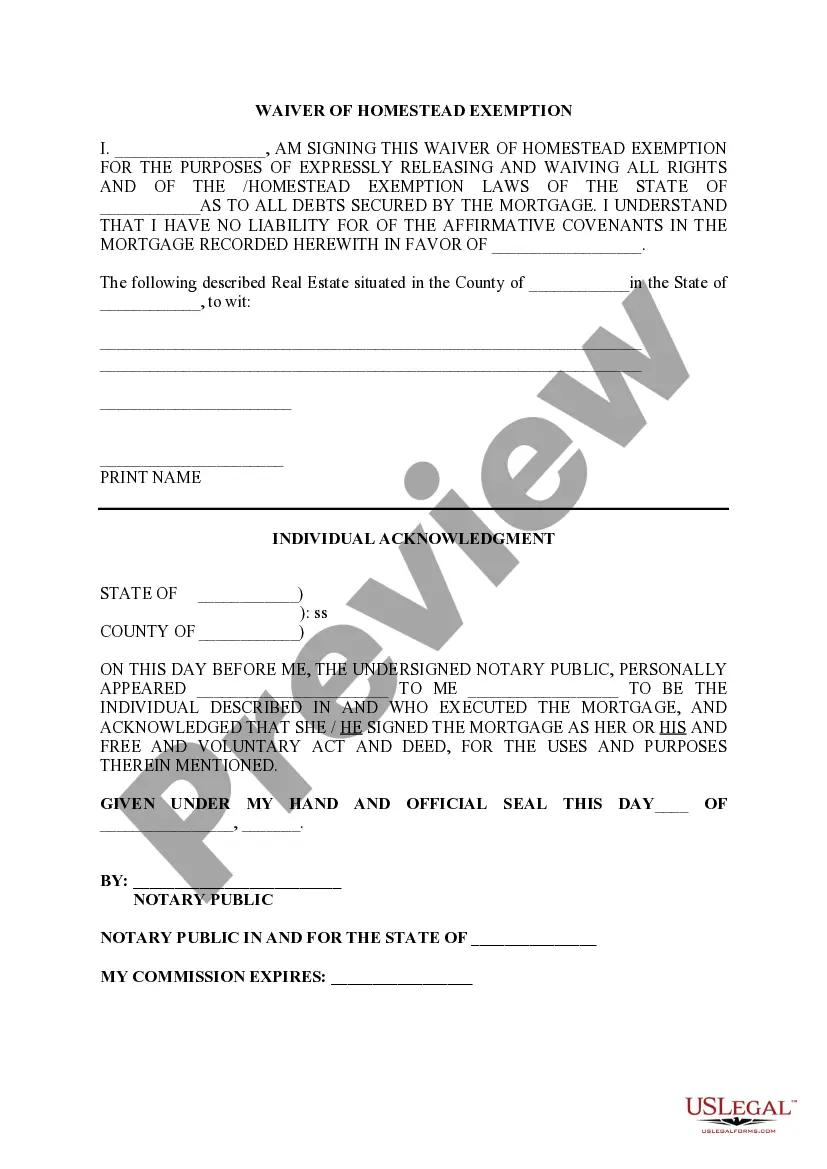

Where statutes specify the manner in which a homestead may be released or waived in a particular jurisdiction, such statutes must be strictly followed.

Where statutes specify the manner in which a homestead may be

released or waived in a particular jurisdiction, such statutes must

be strictly followed.

The Cook Illinois Waiver of Homestead Exemption refers to a specific legal process in Cook County, Illinois, that allows property owners to waive or give up their homestead exemption. The homestead exemption is a tax benefit provided to homeowners to reduce their property taxes by exempting a portion of their property's assessed value. The Cook Illinois Waiver of Homestead Exemption is usually utilized by homeowners who wish to sell or transfer their property without losing the homestead exemption for the remaining tax year. This waiver allows them to transfer the exemption rights to a new property or simply remove the exemption altogether. There are different types of Cook Illinois Waiver of Homestead Exemption available, each catering to specific circumstances. These include: 1. Waiver for Property Transfer: This waiver is commonly used by homeowners who are selling their current property and purchasing a new one within Cook County. By waiving the homestead exemption on the old property, they can transfer it to the newly purchased property, thereby preserving the tax benefits. 2. Waiver for Renting Property: Homeowners who plan to rent out their property temporarily can use this waiver to remove the homestead exemption for the period it is rented. This exemption removal ensures fair taxation based on the property's usage. 3. Waiver for Change in Ownership: In cases where there is a change in property ownership, such as due to divorce or inheritance, this waiver allows the new owner to benefit from the existing homestead exemption without interruption. It helps in minimizing potential tax increases that would occur without the waiver. 4. Waiver for Relocation: Homeowners who are relocating outside of Cook County and would like to maintain the homestead exemption can utilize this waiver. It enables them to preserve the exemption on their property even if they are no longer residing there. 5. Waiver for New Construction: This waiver is applicable when a homeowner constructs a new property or substantially improves an existing one. By waiving the homestead exemption on the old property, they can transfer it to the newly built or improved property, ensuring the tax benefits continue to apply. In summary, the Cook Illinois Waiver of Homestead Exemption provides property owners in Cook County with flexibility and options when it comes to transferring, removing, or maintaining their homestead exemption based on their specific circumstances. It is essential for homeowners to understand the different types of waivers available to make informed decisions regarding their property taxes.

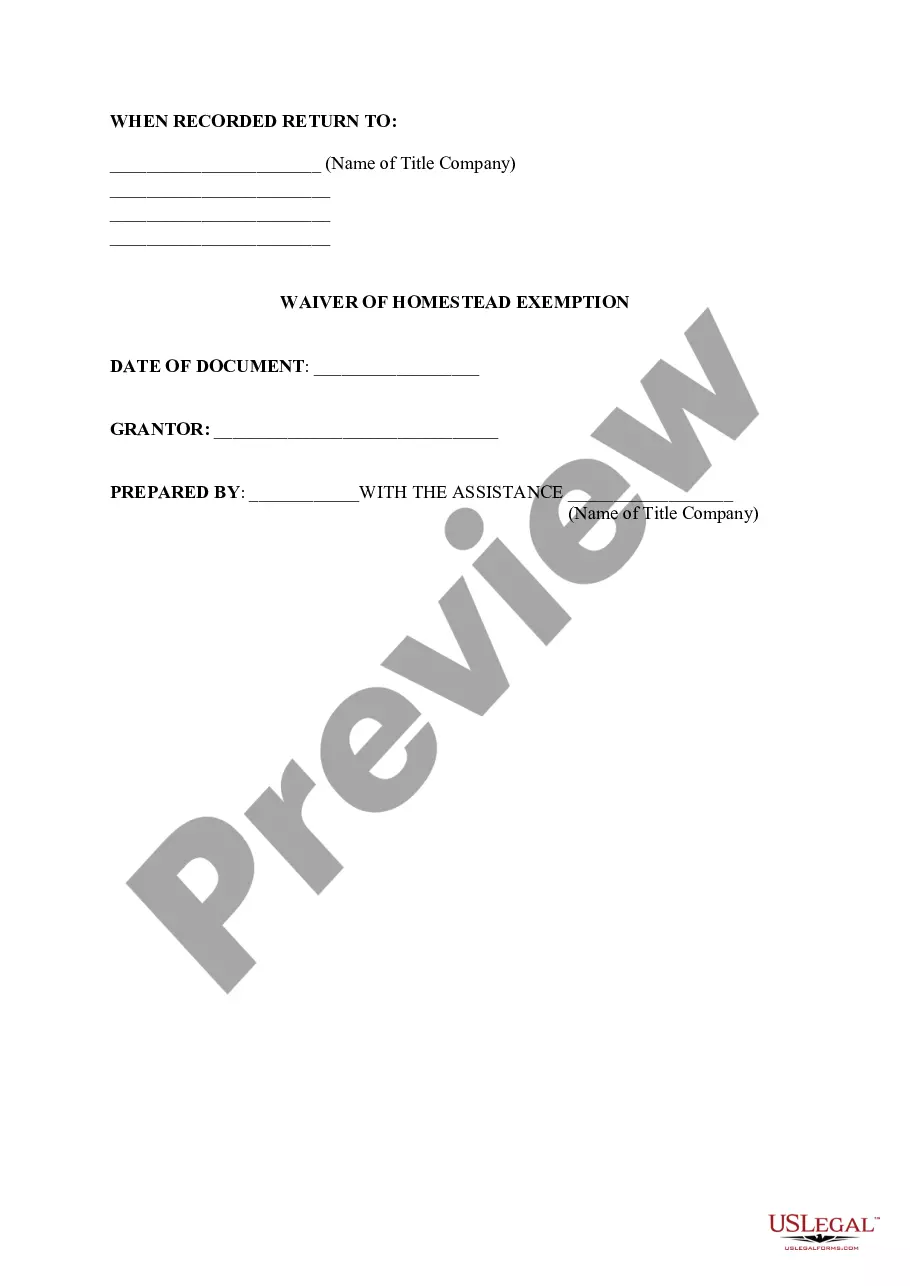

Free preview

How to fill out Cook Illinois Waiver Of Homestead Exemption?

If you’ve already used our service before, log in to your account and download the Cook Illinois Waiver of Homestead Exemption on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Cook Illinois Waiver of Homestead Exemption. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!