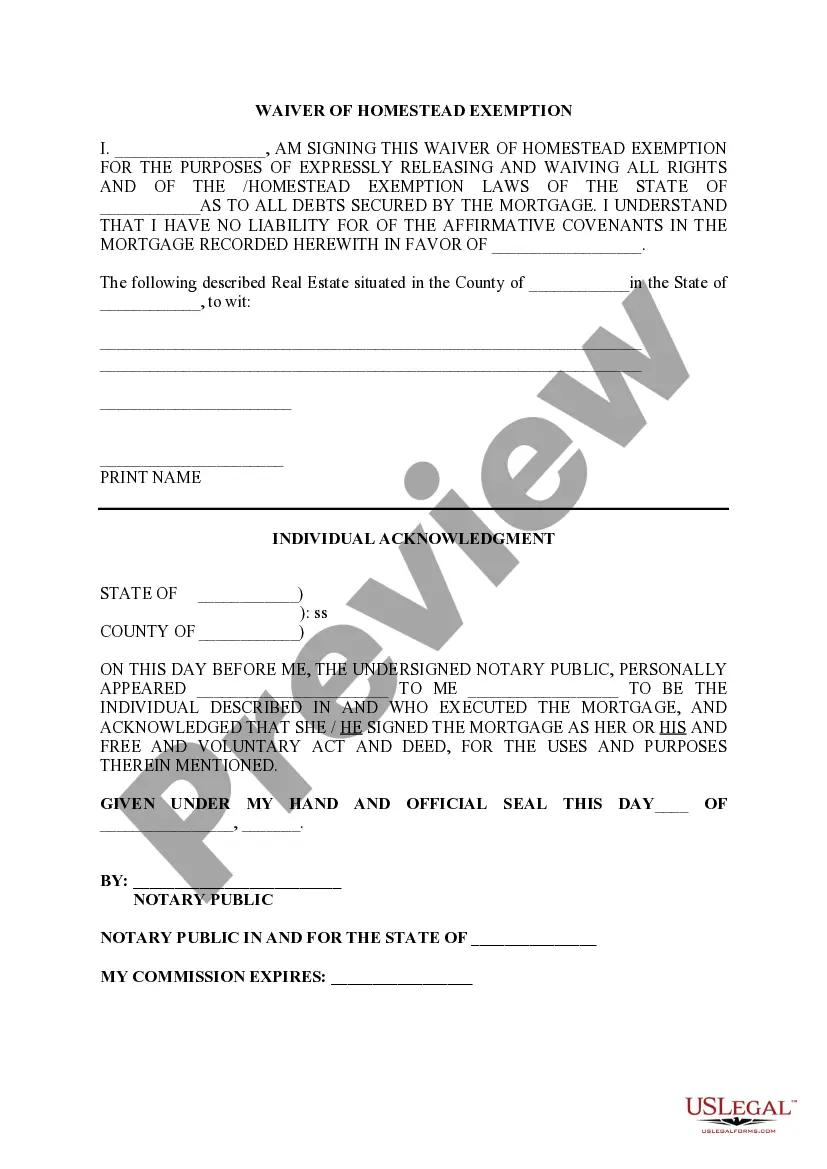

Title: Understanding the Elgin Illinois Waiver of Homestead Exemption: Types and Detailed Description Introduction: The Elgin Illinois Waiver of Homestead Exemption is an essential aspect of property ownership in the state. This waiver allows homeowners to claim an exemption on a portion of their property's assessed value for property tax purposes. In this article, we will delve into the intricacies of the Elgin Illinois Waiver of Homestead Exemption, exploring its definition, purpose, and different types available. 1. Definition of Elgin Illinois Waiver of Homestead Exemption: The Elgin Illinois Waiver of Homestead Exemption is a legal provision that permits homeowners in Elgin, Illinois, to reduce the taxable value of their primary residences for property tax assessment purposes. Eligible homeowners can apply for this waiver to decrease their property taxes and potentially save a significant amount of money each year. 2. Purpose of the Elgin Illinois Waiver of Homestead Exemption: The primary purpose of the Elgin Illinois Waiver of Homestead Exemption is to provide financial relief to homeowners, especially those residing in their primary residences. By reducing the assessed property value subject to taxation, this waiver aims to alleviate the tax burden on qualified homeowners, making housing costs more manageable and fostering homeownership stability. 3. Different Types of Elgin Illinois Waiver of Homestead Exemption: a) General Homestead Exemption: The General Homestead Exemption is available to all homeowners who reside in their primary residences in Elgin, Illinois. This exemption provides a reduction in the assessed value of the property, offering potential tax savings. b) Senior Citizen Homestead Exemption: The Senior Citizen Homestead Exemption is specifically designed for homeowners aged 65 and older. This exemption provides additional tax relief on top of the General Homestead Exemption, recognizing the unique financial circumstances older individuals may face. c) Disabled Persons Homestead Exemption: The Disabled Persons Homestead Exemption caters to homeowners who have a qualifying disability as recognized by the state of Illinois. This exemption offers a further reduction in assessed property value, aiding disabled individuals in managing their financial obligations. d) Longtime Occupant Homestead Exemption: The Longtime Occupant Homestead Exemption is available to homeowners who have lived in the same property for a period of ten years or longer. This exemption provides an additional reduction in property taxes, helping to reward long-term residents' commitment to their community. Conclusion: The Elgin Illinois Waiver of Homestead Exemption is an important tool for homeowners in Elgin, Illinois, to alleviate their property tax burden. With various types of exemptions available, such as the General Homestead, Senior Citizen Homestead, Disabled Persons Homestead, and Longtime Occupant Homestead Exemption, eligible homeowners can explore different avenues for reducing their property taxes and enjoying increased financial stability while maintaining their cherished homes. Applying for the appropriate waiver can lead to significant long-term savings, ensuring the sustainability of homeownership in Elgin, Illinois.

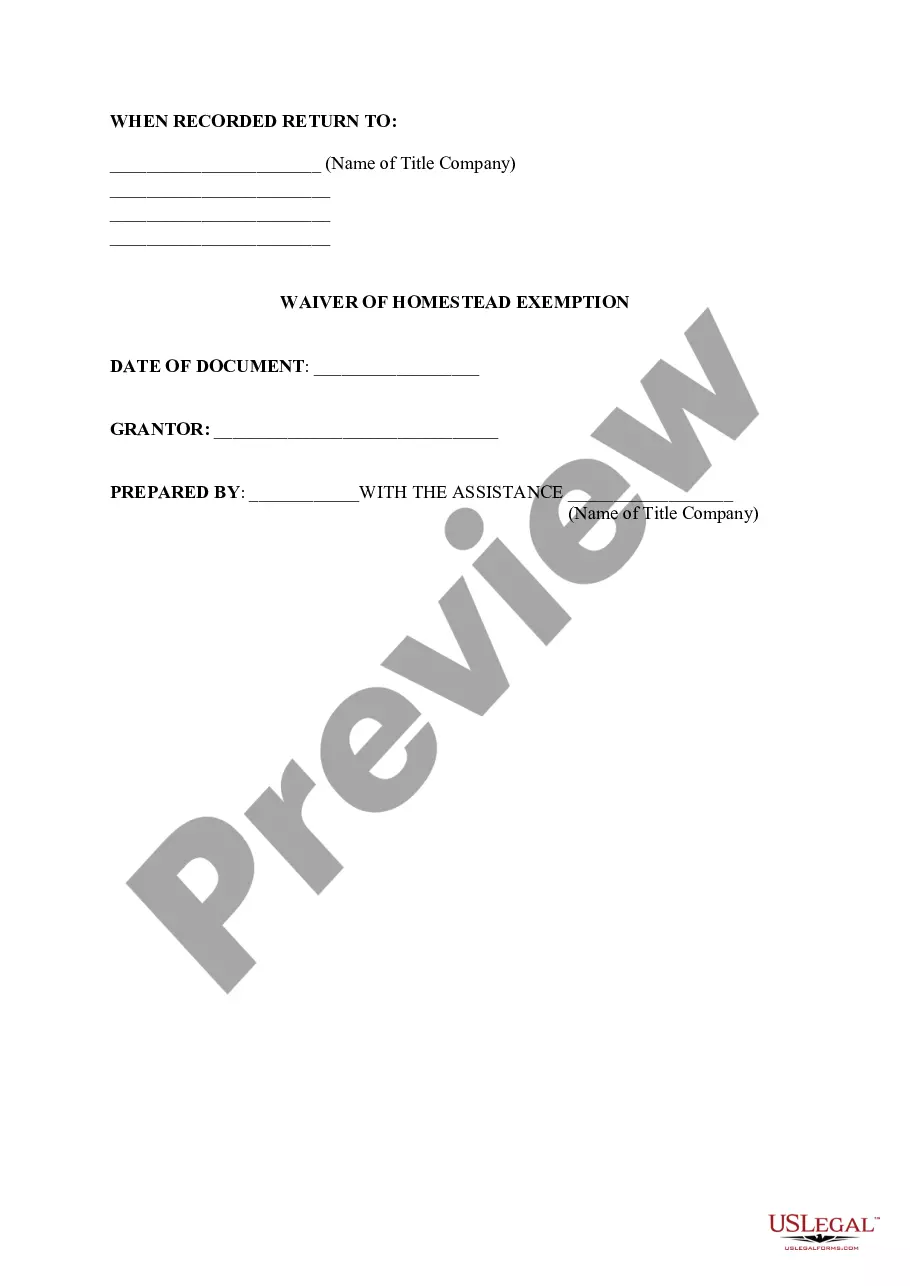

Elgin Illinois Waiver of Homestead Exemption

Description

How to fill out Elgin Illinois Waiver Of Homestead Exemption?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Elgin Illinois Waiver of Homestead Exemption? US Legal Forms is your go-to solution.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of specific state and area.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Elgin Illinois Waiver of Homestead Exemption conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the document is good for.

- Restart the search in case the form isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Elgin Illinois Waiver of Homestead Exemption in any available format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online once and for all.