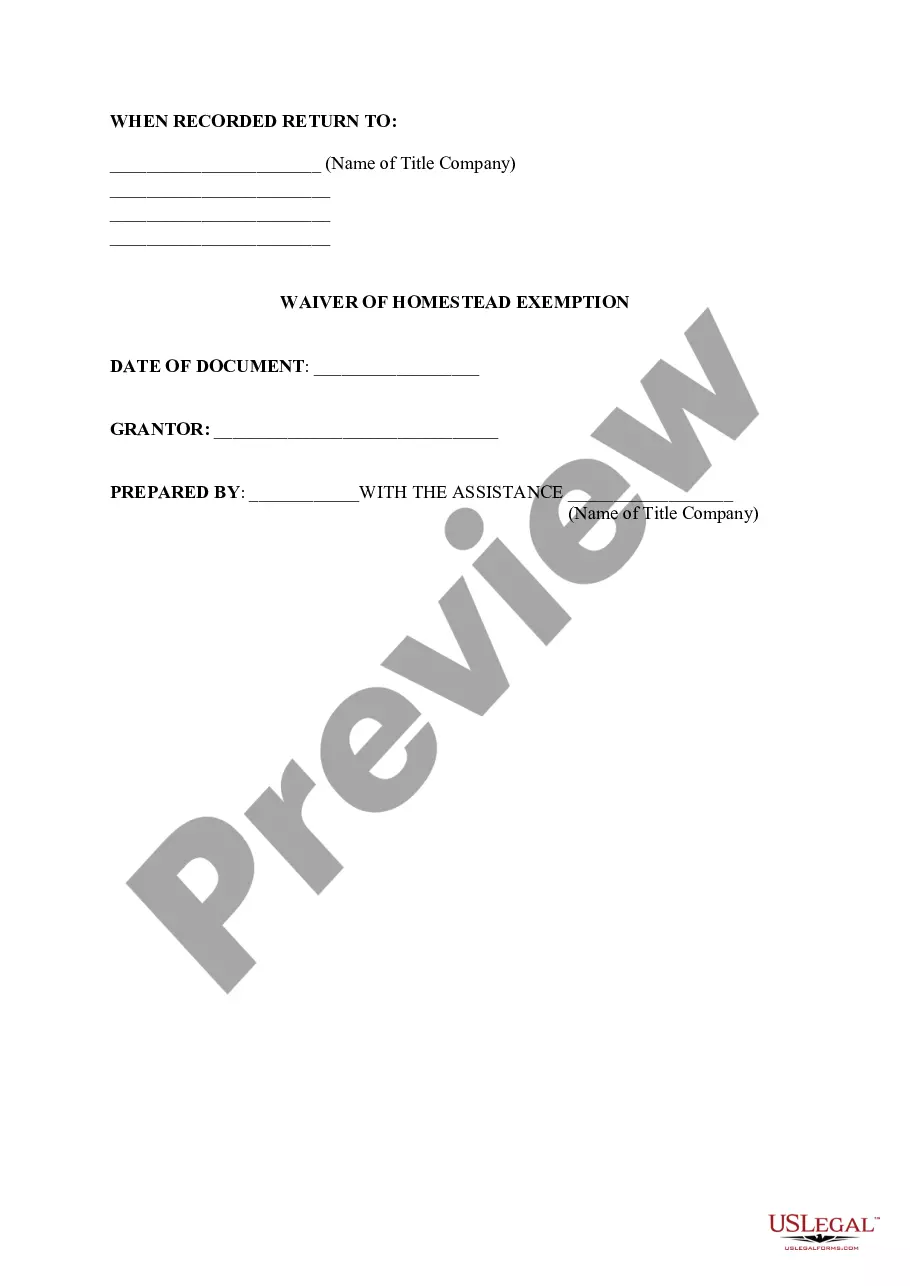

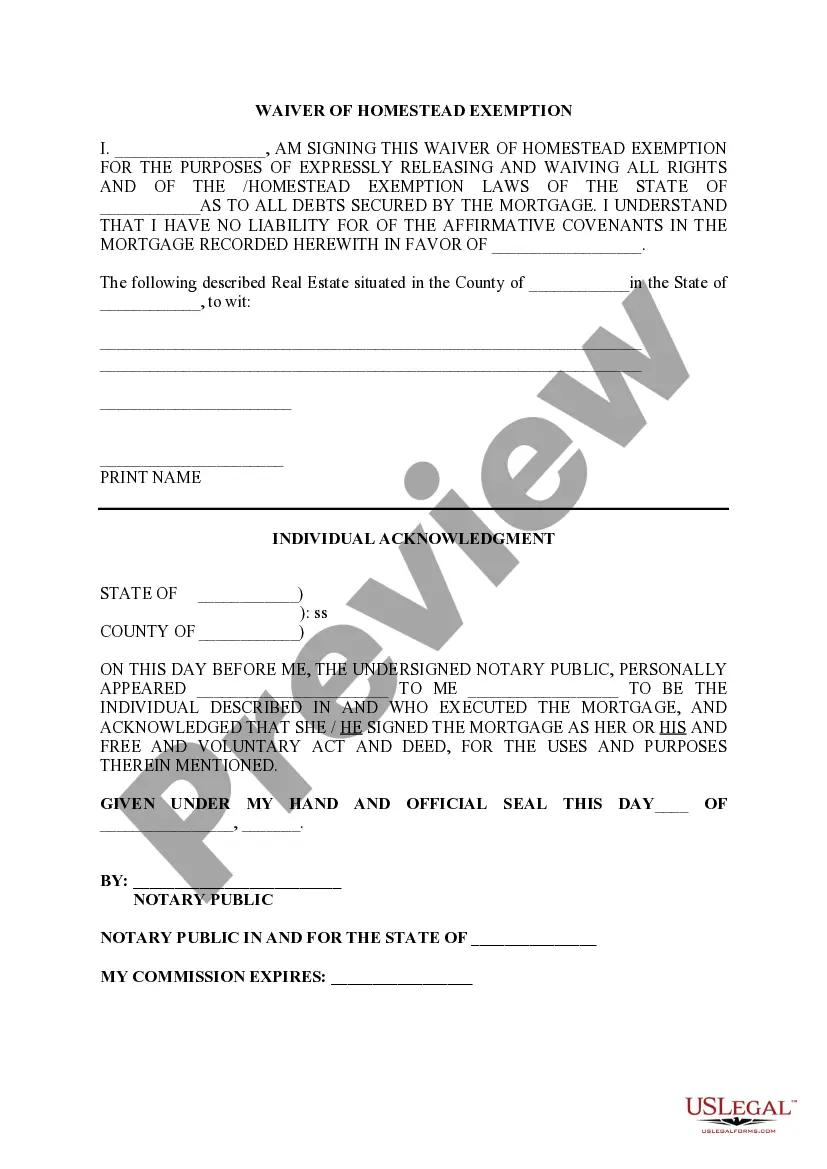

Where statutes specify the manner in which a homestead may be

released or waived in a particular jurisdiction, such statutes must

be strictly followed.

The Joliet Illinois Waiver of Homestead Exemption is a legal document that allows homeowners in Joliet, Illinois to waive their homestead exemption, thereby relinquishing certain property tax benefits associated with the exemption. Homestead exemptions typically provide property tax relief to homeowners by reducing the assessed value of their primary residence, thereby lowering their property taxes. The Joliet Illinois Waiver of Homestead Exemption is often utilized in situations where the homeowner may no longer qualify for the exemption, or they choose to waive it for various reasons. It is important to note that homeowners should consult with a qualified attorney or tax professional before making any decisions regarding the waiver, as it can have financial implications. There are two common types of Joliet Illinois Waiver of Homestead Exemption: 1. Full Waiver: This type of waiver completely relinquishes the homeowner's right to the homestead exemption. By signing this document, the homeowner effectively forfeits any property tax benefits associated with the exemption. 2. Partial Waiver: In certain cases, homeowners may choose to partially waive their homestead exemption. This allows them to retain a portion of the exemption while giving up the remaining benefits. It could be helpful in situations where the homeowner wants to reduce their property tax burden but still wants to retain some level of exemption. It is essential for homeowners to understand the potential consequences of waiving their homestead exemption, as it can vary depending on individual circumstances. Some common reasons for seeking a waiver may include the sale or transfer of a property, changes in occupancy status, or changes in the homeowner's financial situation. In conclusion, the Joliet Illinois Waiver of Homestead Exemption is a legal document that allows homeowners in Joliet, Illinois to waive or partially waive their homestead exemption for property tax benefits. It is crucial for homeowners to seek professional advice in order to make informed decisions regarding the waiver, as it can have financial implications.