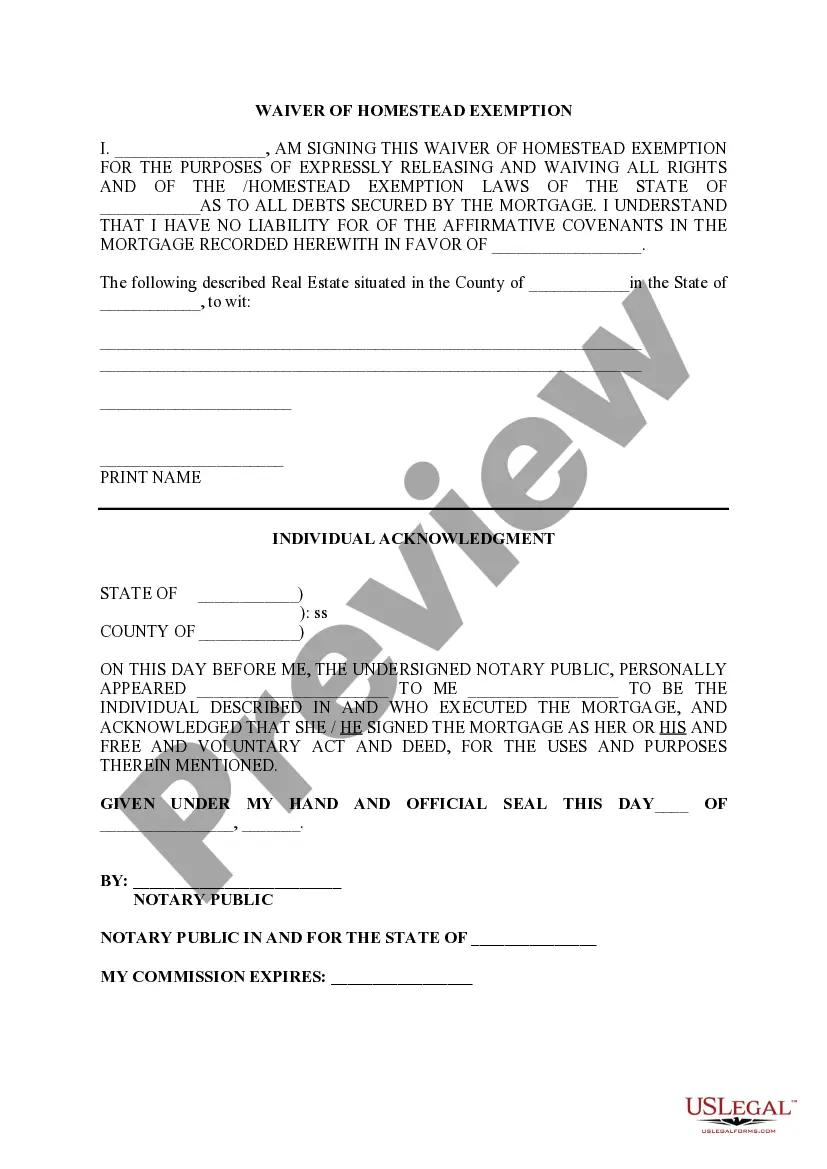

The Rockford Illinois Waiver of Homestead Exemption is a significant legal process that homeowners should be aware of. This waiver enables homeowners in Rockford, Illinois to relinquish their homestead exemption rights temporarily or permanently for specific purposes. By waiving this exemption, individuals and families can undergo certain transactions involving their residential properties, such as refinancing or selling, without the limitations of the homestead exemption. The Rockford Illinois Waiver of Homestead Exemption has various types tailored to different situations. The most common forms include: 1. Temporary Waiver of Homestead Exemption: This type of waiver allows homeowners to temporarily suspend their homestead exemption for a specific period. People may opt for this waiver when they need to refinance their property or obtain funds for renovations and repairs while maintaining their primary residence status. 2. Permanent Waiver of Homestead Exemption: Homeowners choosing this waiver permanently give up their homestead exemption rights. This is typically done when individuals plan to relocate or change their primary residence permanently. By waiving their homestead exemption permanently, homeowners can effectively sell their property or transfer ownership to another person without the encumbrance of the exemption. 3. Partial Waiver of Homestead Exemption: In certain cases, individuals may only want to waive a portion of their homestead exemption. This type of waiver allows homeowners to protect a specific value or area of their property while freeing up the rest for various purposes. 4. Waiver for Property Tax Purposes: Homeowners who are experiencing financial hardship or significant property value fluctuations might consider a waiver for property tax purposes. This form of waiver allows homeowners to reduce or eliminate their property tax burden temporarily or permanently, depending on their circumstances. 5. Waiver for Debt Settlement: When facing financial challenges, homeowners may opt for a waiver to settle outstanding debts. This type of waiver may involve negotiating with creditors using the value of the property, potentially leading to debt relief or restructured payment plans. It is important to note that each type of Rockford Illinois Waiver of Homestead Exemption has specific eligibility criteria and requirements. Homeowners should consult with a qualified legal professional or the local authorities to understand which waiver type is most suitable for their situation.

Rockford Illinois Waiver of Homestead Exemption

Description

How to fill out Rockford Illinois Waiver Of Homestead Exemption?

If you are looking for a relevant form, it’s extremely hard to find a better service than the US Legal Forms website – one of the most comprehensive libraries on the web. Here you can find a huge number of templates for organization and personal purposes by types and regions, or key phrases. With our advanced search feature, finding the most up-to-date Rockford Illinois Waiver of Homestead Exemption is as elementary as 1-2-3. In addition, the relevance of each and every file is confirmed by a group of professional lawyers that on a regular basis check the templates on our website and update them according to the latest state and county requirements.

If you already know about our system and have a registered account, all you should do to get the Rockford Illinois Waiver of Homestead Exemption is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the sample you require. Read its information and use the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to find the appropriate document.

- Affirm your choice. Select the Buy now option. After that, choose your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the form. Pick the format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the acquired Rockford Illinois Waiver of Homestead Exemption.

Each form you save in your account has no expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to get an additional copy for enhancing or creating a hard copy, you can return and export it again whenever you want.

Make use of the US Legal Forms professional collection to get access to the Rockford Illinois Waiver of Homestead Exemption you were looking for and a huge number of other professional and state-specific templates on a single website!