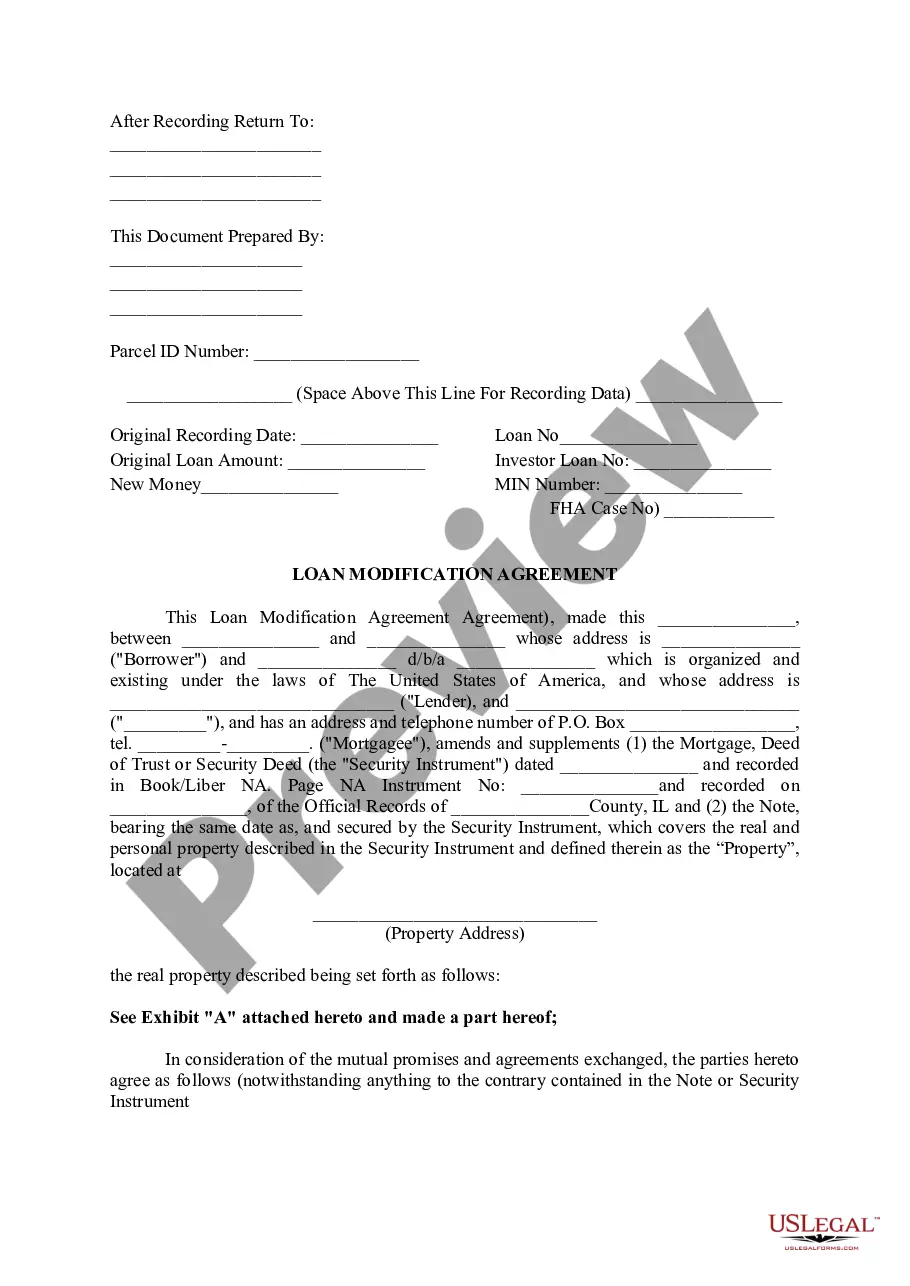

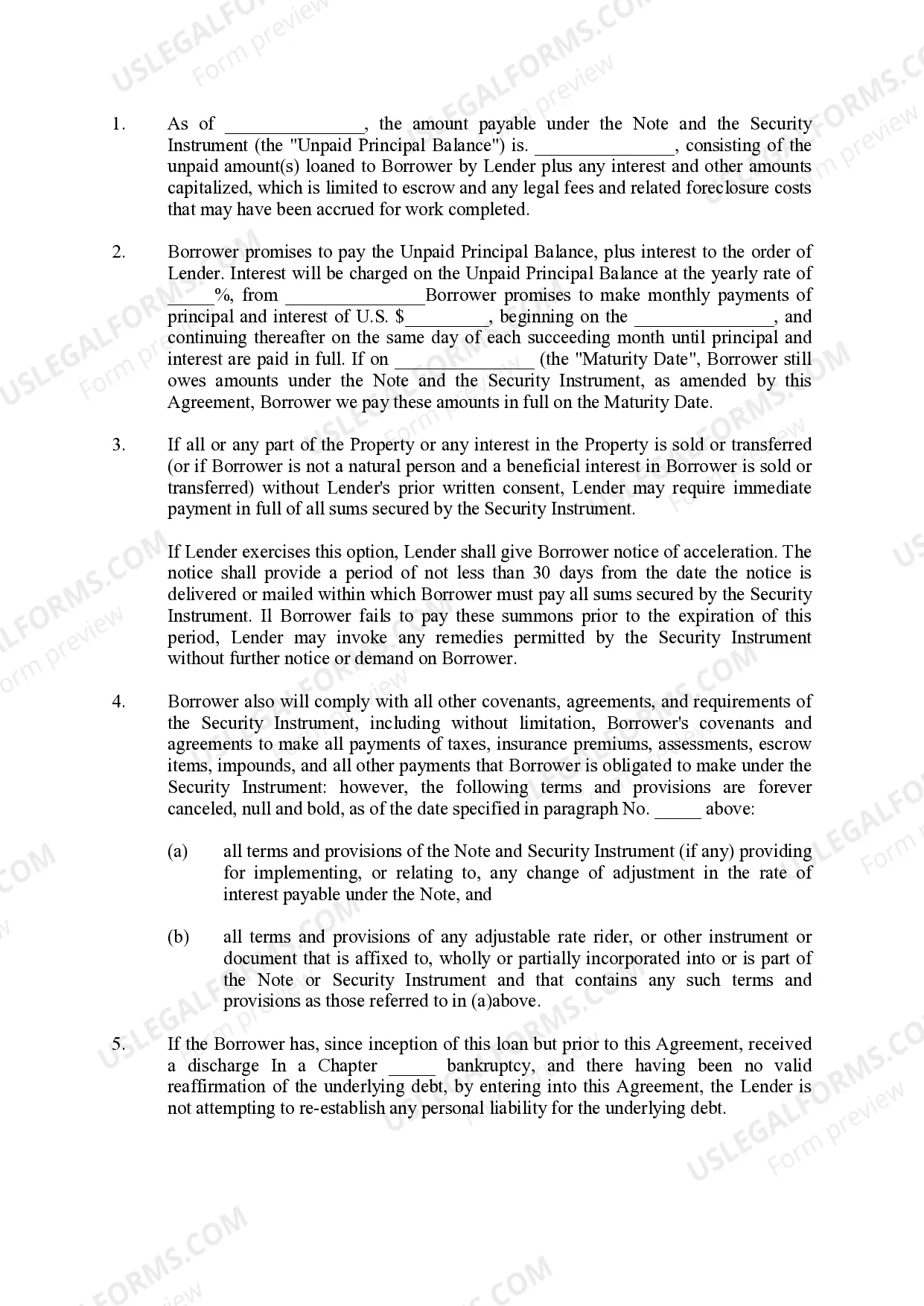

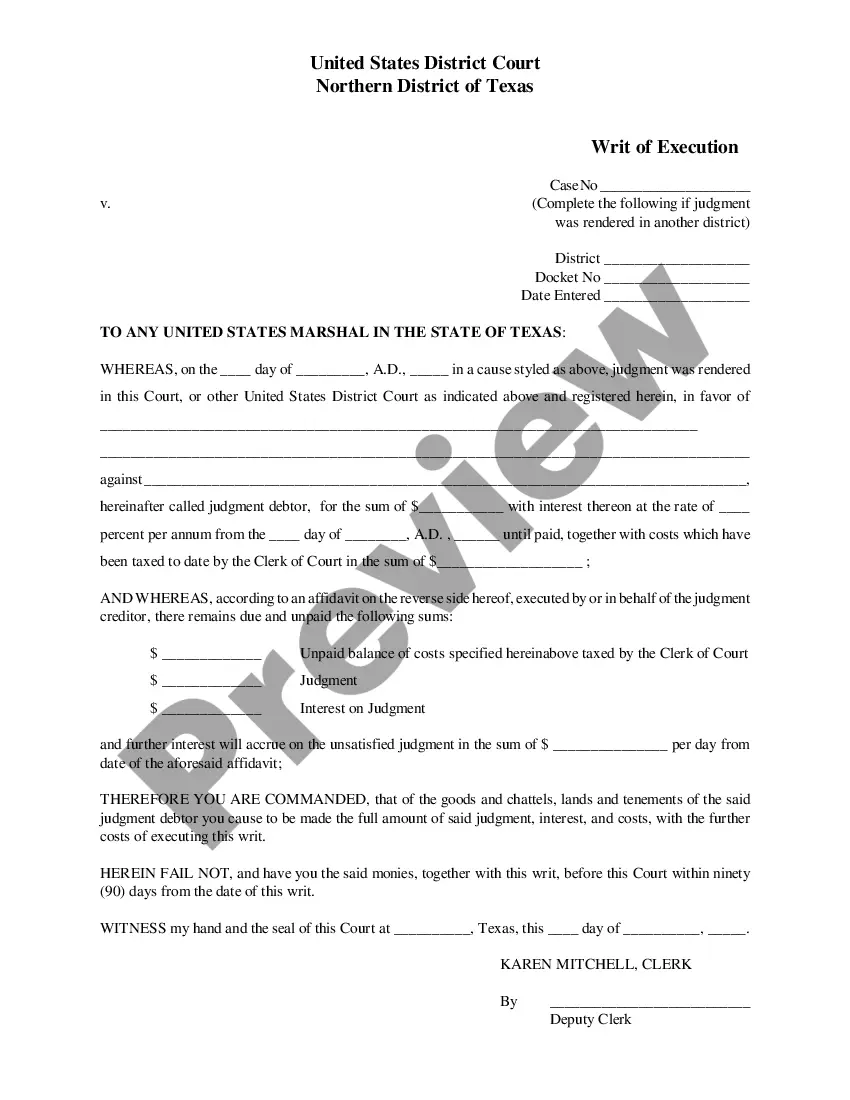

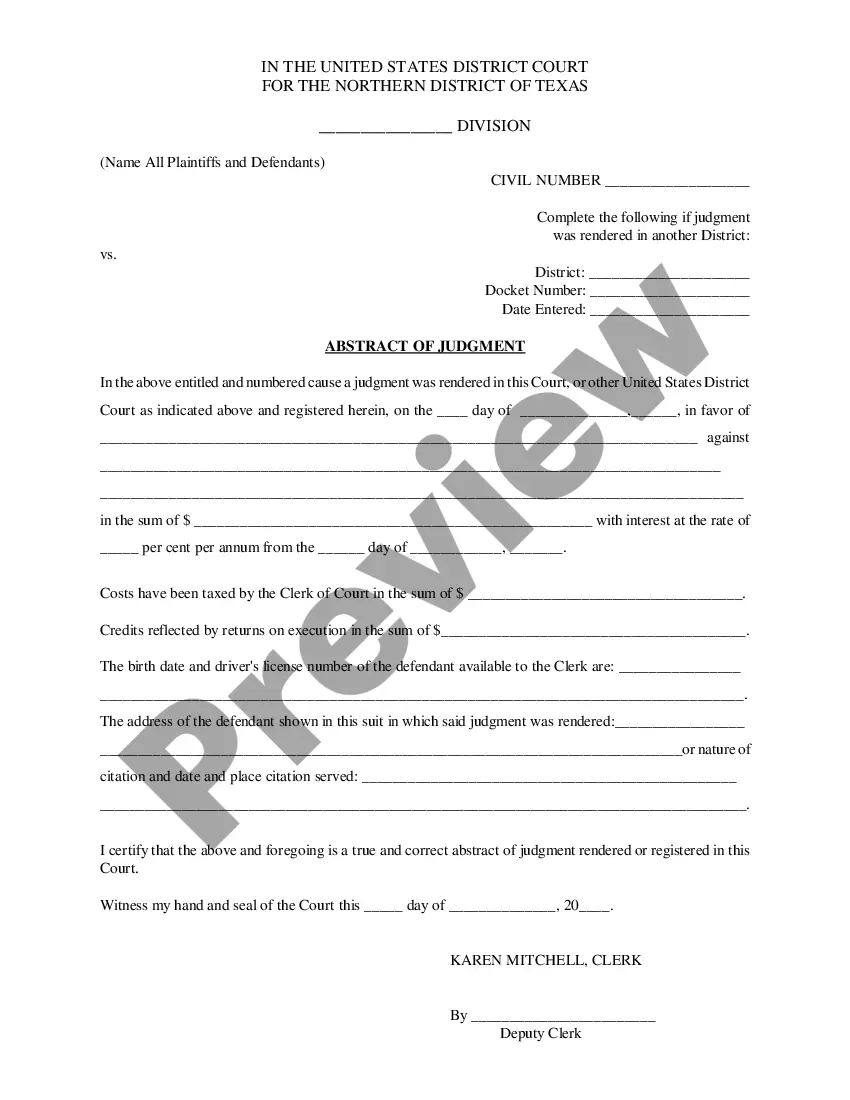

The Chicago Illinois Loan Modification Agreement is a legal document that outlines the terms and conditions for modifying an existing loan in the state of Illinois, specifically in the city of Chicago. This agreement is entered into by the lender and borrower to make changes to the original loan terms in order to provide more favorable terms to the borrower and prevent foreclosure. A loan modification agreement typically occurs when a borrower is struggling to make their mortgage payments and is at risk of defaulting on their loan. It offers the borrower an opportunity to renegotiate the terms of their loan in order to secure a more affordable monthly payment that fits within their financial capability. The Chicago Illinois Loan Modification Agreement covers various aspects of the loan, including the interest rate, loan term, and monthly payment amount. It may also address other loan terms such as a reduction in the principal amount owed, an extension of the loan term, or the addition of late fees to the loan balance. The agreement aims to provide a mutually beneficial solution for both the lender and the borrower, allowing the borrower to remain in their home while ensuring the lender receives regular payments. It is important to note that there may be different types of Loan Modification Agreements in Chicago, Illinois, depending on the specific circumstances of the borrower and the lender's policies. Some common types of loan modification agreements include: 1. Interest Rate Reduction: This type of modification involves lowering the interest rate on the loan, which can result in a decrease in the borrower's monthly payment. 2. Term Extension: With a term extension modification, the loan's repayment term is extended, which spreads the remaining payments over a longer period and reduces the monthly payment amount. 3. Principal Reduction: In certain cases, lenders may agree to reduce the principal amount owed on the loan, providing relief to the borrower by lowering the overall loan balance. 4. Forbearance Agreement: A forbearance agreement allows the borrower to temporarily suspend or reduce their loan payments for a specific period, providing them with temporary financial relief. 5. Repayment Plan: This type of modification involves establishing a repayment plan by adding the delinquent amount to the borrower's current loan balance and spreading it over a set period, allowing them to catch up on missed payments. Each type of loan modification agreement may have its own set of requirements, eligibility criteria, and processes to follow. It is crucial for borrowers in Chicago, Illinois, to consult with a professional, such as a housing counselor or attorney specializing in loan modifications, to understand their options and ensure the agreement meets their needs while complying with Chicago and Illinois laws and regulations.

Chicago Illinois Loan Modification Agreement

Description

How to fill out Chicago Illinois Loan Modification Agreement?

We consistently aspire to minimize or evade legal complications when handling intricate law-related or financial issues.

To achieve this, we enroll in legal services that are typically quite expensive.

Nonetheless, not all legal concerns are equally complicated.

Many of these can be managed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Chicago Illinois Loan Modification Agreement or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our collection empowers you to handle your issues independently without the assistance of an attorney.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

Your eligibility for a modification is determined by the investor's set of guidelines?not everyone will qualify.

There are many reasons why a loan modification application may be denied. Some common reasons include: -The borrower failed to provide all of the required documentation. -The borrower's income was not sufficient to support the modified payment amount.

The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay. Using an updated appraisal report the modification underwriter will confirm the current market value of the property as security for the loan.

You could receive your mortgage loan modification in as little as 30 days. Or you could be left waiting upwards of 90 days for everything to go through. It really comes down to the individual lender and their ability to quickly process mortgage modifications.

Why Was I Denied for a Loan Modification? An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment. ?Lack of hardship,? or ability to pay the current mortgage payments without issue. You have already received the maximum number of loan modifications the lender allows.

The success rate for streamlined modifications was 64.1 percent in the first 36 months after modification, compared with a 68.9 percent success rate for standard modifications, a 4.8 percentage-point difference.

To qualify for a loan modification, a borrower usually must have missed at least three mortgage payments and be in default. ?Sometimes, a borrower who has experienced financial setbacks, which makes a default imminent, can qualify for a loan modification.

You can only appeal when you're denied for a loan modification program. You can ask for a review of a denied loan modification if: You sent in a complete mortgage assistance application at least 90 days before your foreclosure sale; and. Your servicer denied you for any trial or permanent loan modification it offers.