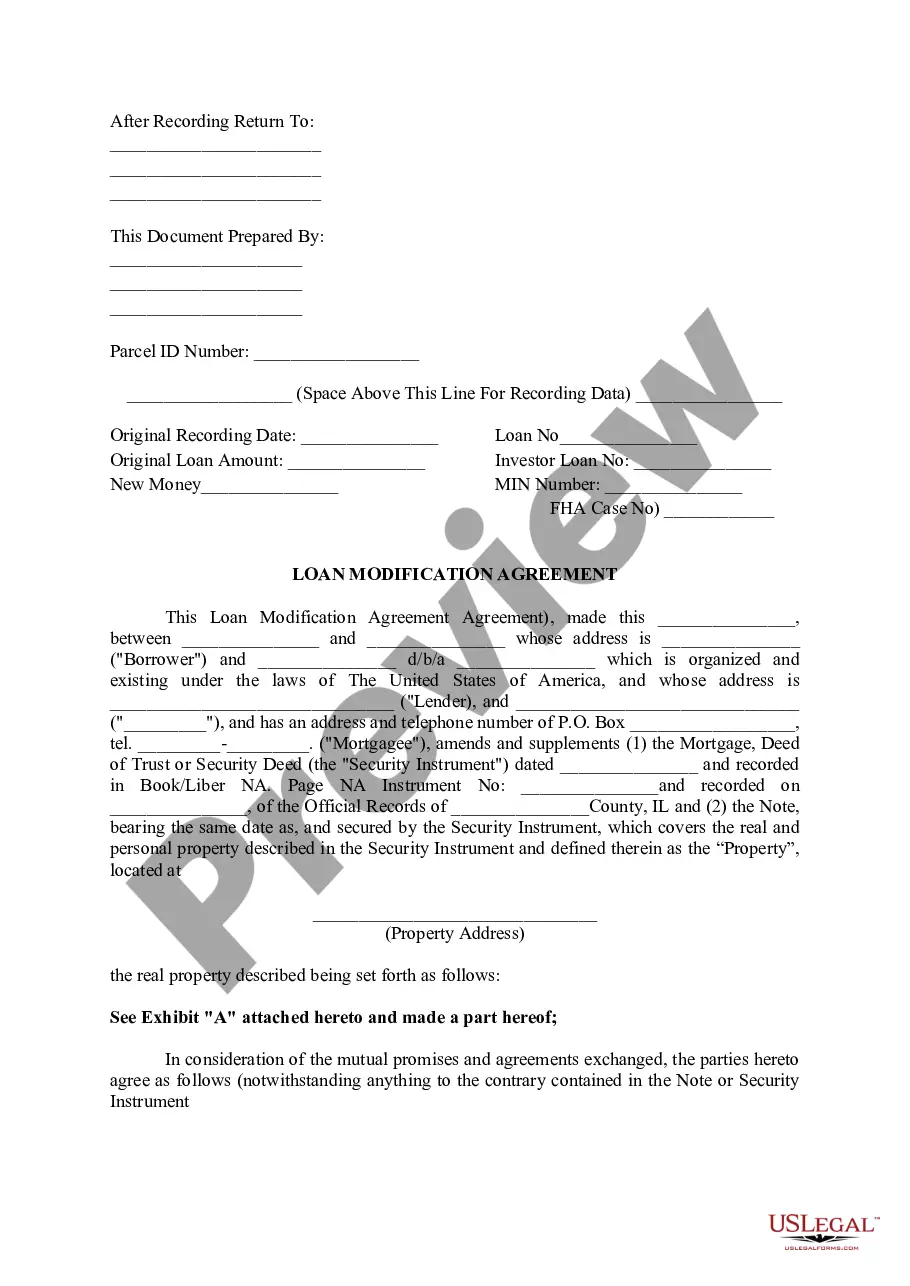

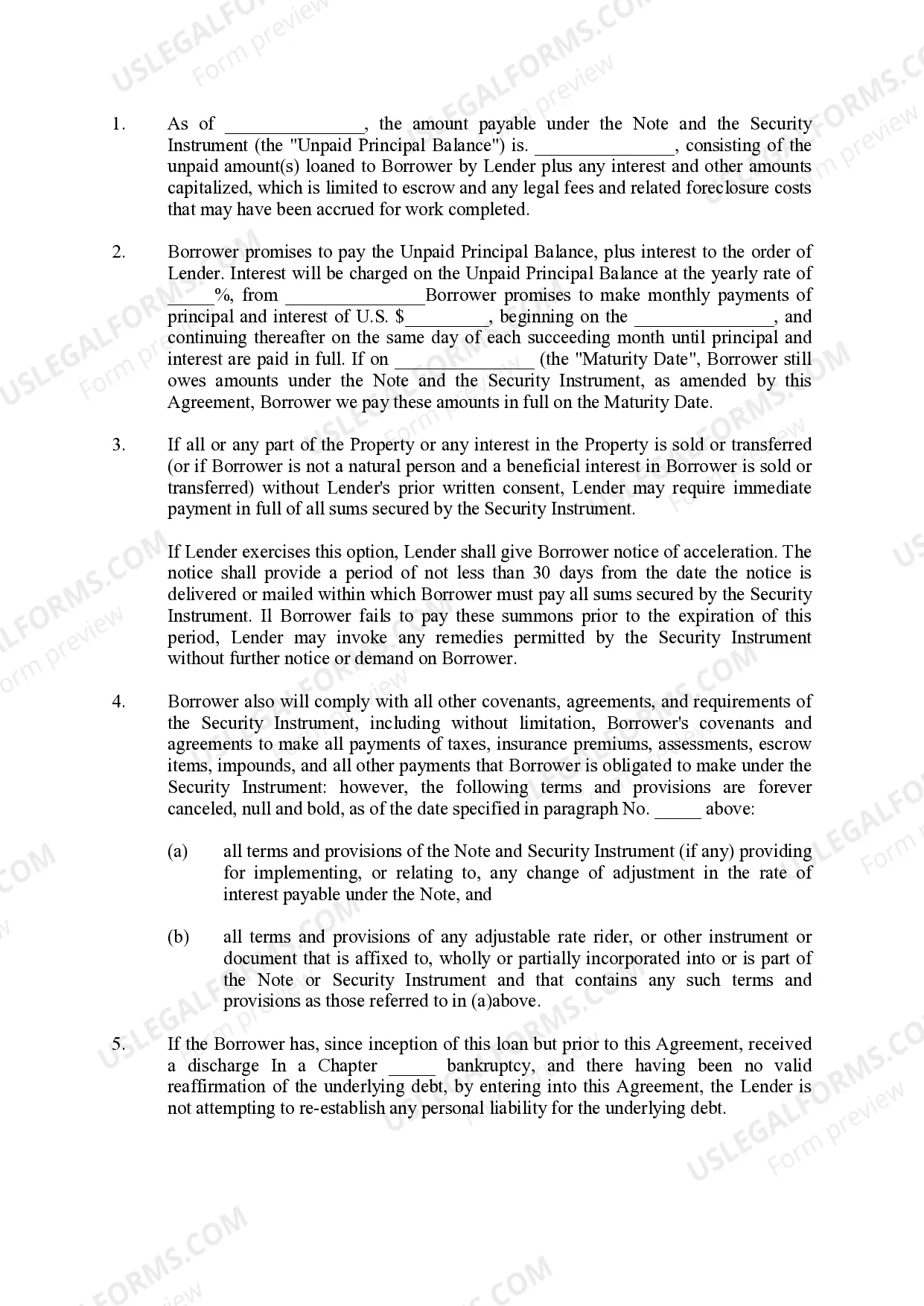

A Naperville Illinois Loan Modification Agreement is a legally-binding contract entered into between a lender and a borrower to modify the terms of an existing loan, typically a mortgage, in order to make it more affordable for the borrower. This agreement can be a useful tool for borrowers who are facing financial hardships or struggling to keep up with their loan repayments. Loan modification agreements are designed to provide borrowers with alternatives to foreclosure or defaulting on their loan. They aim to provide a temporary or permanent solution by adjusting aspects of the loan, such as the interest rate, loan duration, or principal balance, to make monthly payments more manageable for the borrower. Some crucial elements that may be addressed in a Naperville Illinois Loan Modification Agreement include: 1. Interest rate adjustment: The agreement may propose a reduction in the interest rate to make the monthly payments more affordable for the borrower. 2. Loan term modification: The loan's repayment duration may be extended to spread out the remaining principal balance over a longer period. This can result in smaller monthly payments. 3. Principal balance reduction: In certain cases, lenders might agree to reduce the principal balance of the loan to make it more affordable for the borrower. This is less commonly offered by lenders but can provide significant financial relief. 4. Revised payment plan: The agreement may propose a revised payment schedule, installment plan, or the inclusion of missed payments at the end of the loan term. This helps borrowers who have fallen behind to catch up gradually. 5. Waiving penalties or fees: To further alleviate the borrower's financial burden, lenders may consider waiving late payment fees, penalties, or other incurred charges. It is essential to note that different types of loan modification agreements exist, depending on individual circumstances and the cooperation of the lender. Some common types include: 1. Temporary loan modification agreements: These agreements provide short-term relief by modifying loan terms for a specific period, such as six months or a year. At the end of the agreed-upon period, the loan terms may revert to the original terms or undergo further modification. 2. Trial period plans (TPP): Tips are often offered by lenders to assess a borrower's ability to make modified payments regularly. During this trial period, the borrower must demonstrate their ability to adhere to the agreed-upon terms. Upon successful completion, the modification can be made permanent. 3. Government-backed loan modification programs: The government, through agencies like the Federal Housing Administration (FHA) or the Home Affordable Modification Program (CAMP), provides loan modification options for eligible borrowers. These programs might have specific requirements, guidelines, and benefits specific to Naperville, Illinois. Naperville Illinois Loan Modification Agreements offer an avenue for struggling borrowers to secure financial stability and avoid the potential consequences of foreclosure. However, it is crucial for borrowers to understand their rights and obligations under such agreements and seek legal or financial advice to ensure the best outcome for their unique situation.

Naperville Illinois Loan Modification Agreement

Description

How to fill out Naperville Illinois Loan Modification Agreement?

Make use of the US Legal Forms and have instant access to any form sample you want. Our useful website with thousands of documents simplifies the way to find and obtain almost any document sample you require. You are able to download, complete, and certify the Naperville Illinois Loan Modification Agreement in just a couple of minutes instead of surfing the Net for several hours trying to find a proper template.

Utilizing our collection is a wonderful way to raise the safety of your record submissions. Our professional legal professionals regularly check all the documents to make sure that the templates are relevant for a particular region and compliant with new laws and polices.

How can you get the Naperville Illinois Loan Modification Agreement? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. Moreover, you can get all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the template you require. Make certain that it is the template you were seeking: verify its headline and description, and take take advantage of the Preview option when it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading process. Select Buy Now and select the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Export the document. Select the format to obtain the Naperville Illinois Loan Modification Agreement and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the Naperville Illinois Loan Modification Agreement.

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!