Rockford Illinois Loan Modification Agreement is a legal contract designed to provide a solution to homeowners in Rockford, Illinois, who are facing financial hardships and struggling to meet their mortgage payment obligations. This agreement brings about a modification in the terms and conditions of the existing mortgage loan to make it more affordable for borrowers. The primary objective of a Rockford Illinois Loan Modification Agreement is to prevent foreclosure by adjusting the mortgage terms, such as interest rate, loan duration, or monthly payment amount. The goal is to create a repayment plan that suits the homeowner's financial situation, enabling them to afford their mortgage payments while keeping their homes. There are several types of Loan Modification Agreements available in Rockford, Illinois, depending on the specific needs and eligibility criteria of homeowners. Some of these types include: 1. Interest Rate Modification: This type of modification involves lowering the interest rate on the existing mortgage loan, thereby reducing the monthly payment amount. It makes the loan more affordable for homeowners and helps them avoid foreclosure. 2. Principal Reduction: In certain cases, a principal reduction modification may be available, which involves reducing the outstanding balance of the mortgage loan. This modification is typically offered to borrowers who owe more on their homes than their current market value. 3. Loan Term Extension: This modification extends the loan term by increasing the number of years to repay the loan. By extending the term, the monthly payments become more manageable for homeowners facing financial difficulties. 4. Forbearance Agreement: A forbearance agreement is a temporary solution that allows homeowners to temporarily suspend or reduce their mortgage payments for a specific period. It is often useful for borrowers facing short-term financial setbacks such as job loss or medical emergencies. 5. Trial Modification: This type of modification is usually offered as a trial period before the final Loan Modification Agreement is executed. The trial period allows homeowners to demonstrate their ability to make the modified payments and fulfill the requirements outlined in the agreement. It's important for homeowners in Rockford, Illinois, to understand that Loan Modification Agreements are negotiated with their lender or service. Homeowners should consult with a qualified attorney or a HUD-approved housing counselor to determine the best course of action and explore if they qualify for any of these loan modification types. Applying for a loan modification can be a complex process, and professional guidance can significantly increase the chances of success.

Rockford Illinois Loan Modification Agreement

State:

Illinois

City:

Rockford

Control #:

IL-LR114T

Format:

Word;

Rich Text

Instant download

Description

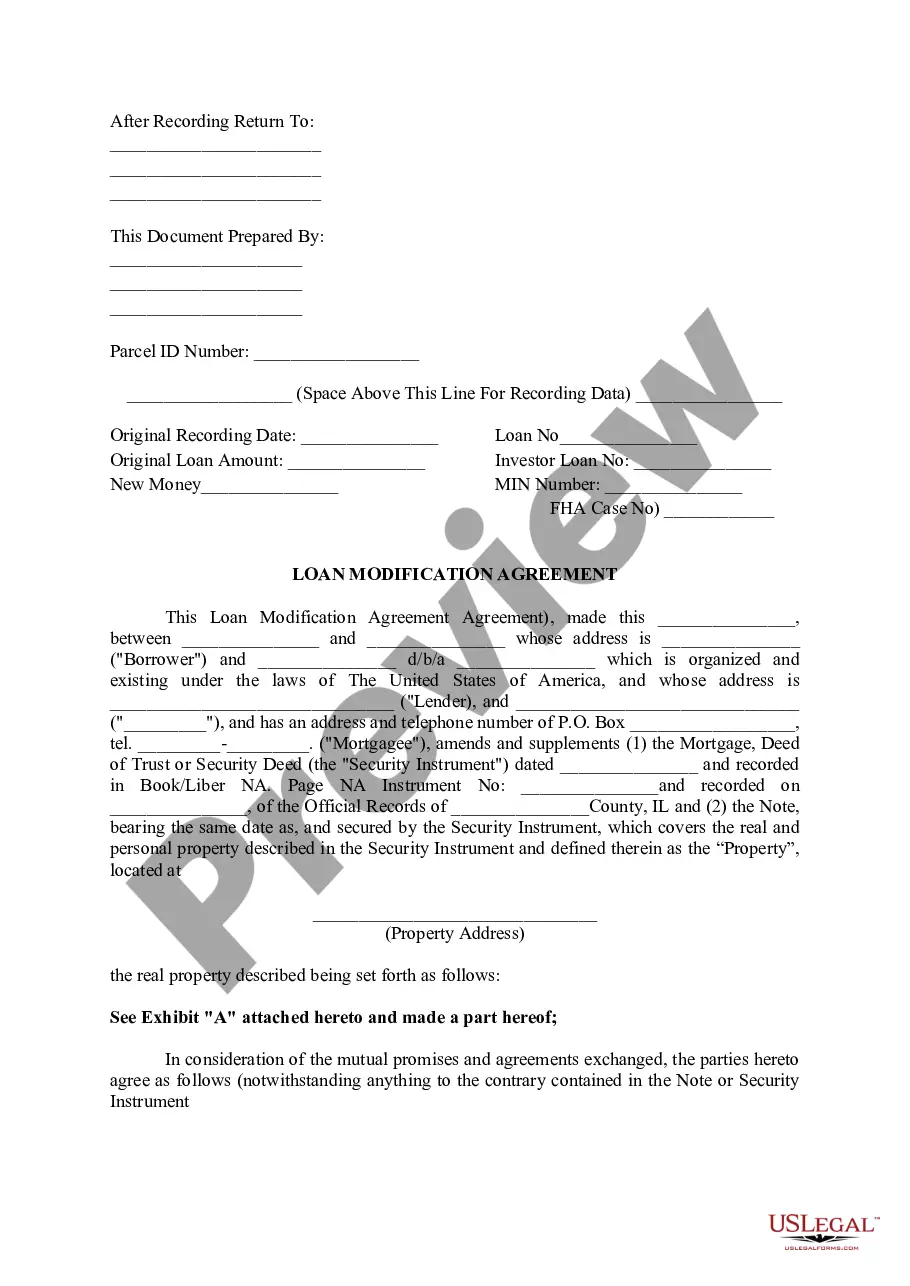

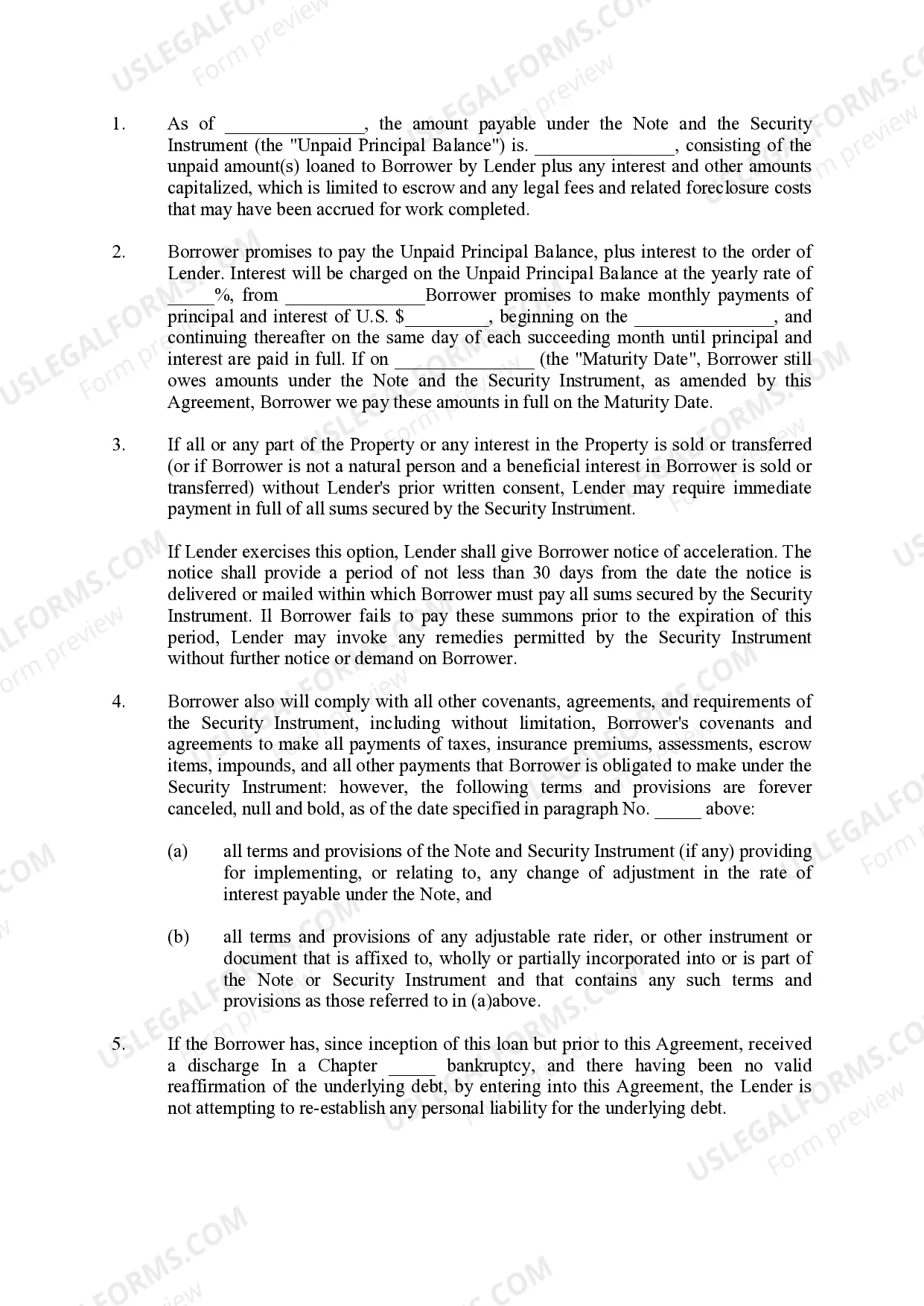

This document allows for the borrower and the lender to amend and supplement the mortgage, Deed of Trust or Deed to Secure Debt concerning the real and personal property described in the document.

Rockford Illinois Loan Modification Agreement is a legal contract designed to provide a solution to homeowners in Rockford, Illinois, who are facing financial hardships and struggling to meet their mortgage payment obligations. This agreement brings about a modification in the terms and conditions of the existing mortgage loan to make it more affordable for borrowers. The primary objective of a Rockford Illinois Loan Modification Agreement is to prevent foreclosure by adjusting the mortgage terms, such as interest rate, loan duration, or monthly payment amount. The goal is to create a repayment plan that suits the homeowner's financial situation, enabling them to afford their mortgage payments while keeping their homes. There are several types of Loan Modification Agreements available in Rockford, Illinois, depending on the specific needs and eligibility criteria of homeowners. Some of these types include: 1. Interest Rate Modification: This type of modification involves lowering the interest rate on the existing mortgage loan, thereby reducing the monthly payment amount. It makes the loan more affordable for homeowners and helps them avoid foreclosure. 2. Principal Reduction: In certain cases, a principal reduction modification may be available, which involves reducing the outstanding balance of the mortgage loan. This modification is typically offered to borrowers who owe more on their homes than their current market value. 3. Loan Term Extension: This modification extends the loan term by increasing the number of years to repay the loan. By extending the term, the monthly payments become more manageable for homeowners facing financial difficulties. 4. Forbearance Agreement: A forbearance agreement is a temporary solution that allows homeowners to temporarily suspend or reduce their mortgage payments for a specific period. It is often useful for borrowers facing short-term financial setbacks such as job loss or medical emergencies. 5. Trial Modification: This type of modification is usually offered as a trial period before the final Loan Modification Agreement is executed. The trial period allows homeowners to demonstrate their ability to make the modified payments and fulfill the requirements outlined in the agreement. It's important for homeowners in Rockford, Illinois, to understand that Loan Modification Agreements are negotiated with their lender or service. Homeowners should consult with a qualified attorney or a HUD-approved housing counselor to determine the best course of action and explore if they qualify for any of these loan modification types. Applying for a loan modification can be a complex process, and professional guidance can significantly increase the chances of success.

Free preview

How to fill out Rockford Illinois Loan Modification Agreement?

If you’ve already utilized our service before, log in to your account and save the Rockford Illinois Loan Modification Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Rockford Illinois Loan Modification Agreement. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!