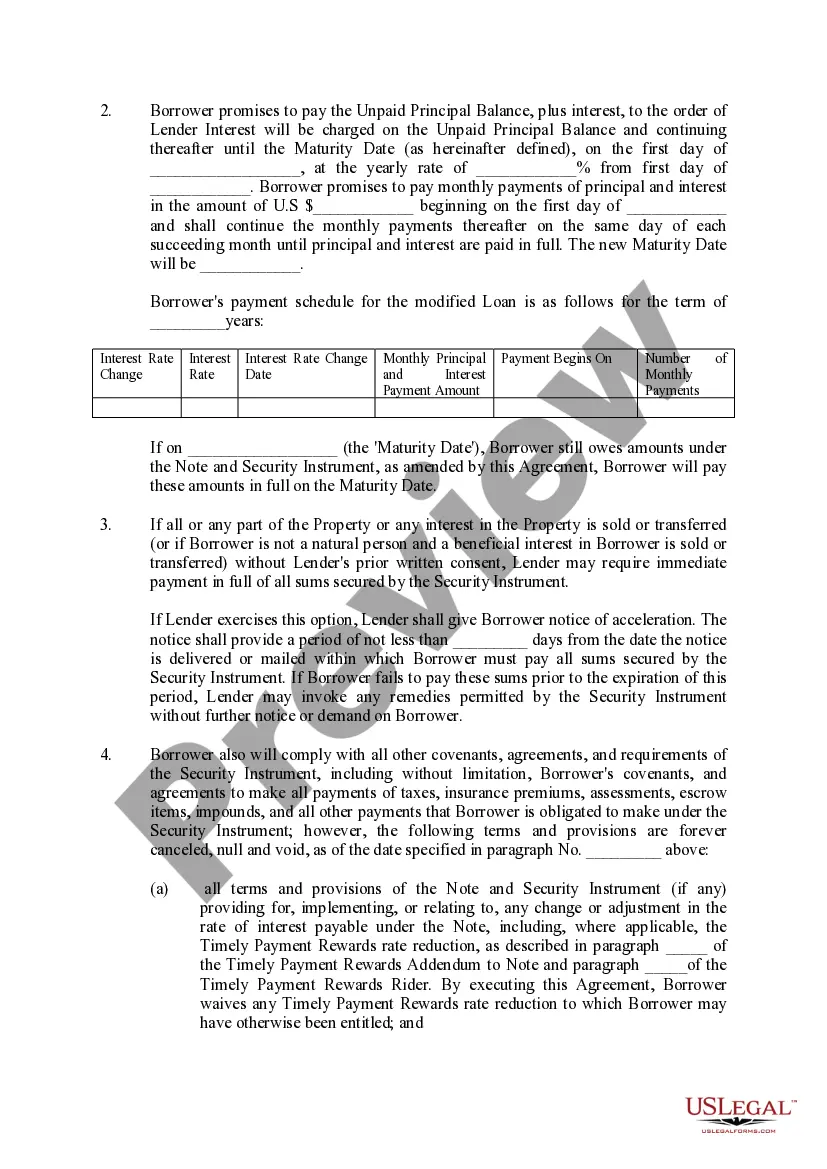

A Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate) is a legal contract between a borrower and a lender that aims to modify the terms of an existing loan agreement to provide a fixed interest rate. This agreement is specific to the state of Illinois, particularly the city of Chicago, and is governed by the applicable laws and regulations. The primary objective of this agreement is to help borrowers facing financial hardships, such as difficulties in meeting mortgage payments, by providing more favorable terms and conditions. By converting an adjustable interest rate to a fixed interest rate, borrowers can stabilize their monthly mortgage payments and potentially avoid foreclosure. The Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate) typically includes several key components. First, it identifies the parties involved, including the borrower and the lender, along with their respective contact details. It may also reference the original loan agreement and its terms. The agreement then outlines the specific modification being made, namely changing the interest rate from an adjustable rate to a fixed rate. This fixed interest rate is typically expressed as a percentage and remains constant throughout the modified term of the loan. Furthermore, the agreement may address other factors related to the modified loan terms. This can include adjusting the loan repayment period, reducing late fees or penalties, or even forgiving a portion of the outstanding principal balance. The purpose of these modifications is to help the borrower manage their mortgage payments more comfortably. It's important to note that there may be variations of the Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate) based on the specific circumstances and requirements of the borrower and lender. These variations may stem from differences in the initial loan agreement, financial hardship types, or negotiations between the parties involved. In conclusion, a Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate) is a legally binding document that facilitates the modification of an existing loan agreement in order to establish a fixed interest rate. By stabilizing monthly mortgage payments, this agreement aims to assist borrowers in overcoming financial difficulties and maintaining homeownership.

Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate

Description

How to fill out Chicago Illinois Loan Modification Agreement (Providing For Fixed Interest Rate?

Take advantage of the US Legal Forms and obtain immediate access to any form you require. Our useful platform with thousands of documents makes it easy to find and get virtually any document sample you require. It is possible to export, fill, and sign the Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate in just a couple of minutes instead of browsing the web for several hours looking for a proper template.

Using our catalog is an excellent way to raise the safety of your form filing. Our professional lawyers on a regular basis check all the records to ensure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate? If you already have a subscription, just log in to the account. The Download option will be enabled on all the samples you look at. Additionally, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Find the form you need. Ensure that it is the template you were hoping to find: examine its headline and description, and take take advantage of the Preview option if it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Save the document. Pick the format to get the Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy form libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the Chicago Illinois Loan Modification Agreement (Providing for Fixed Interest Rate.

Feel free to make the most of our platform and make your document experience as efficient as possible!