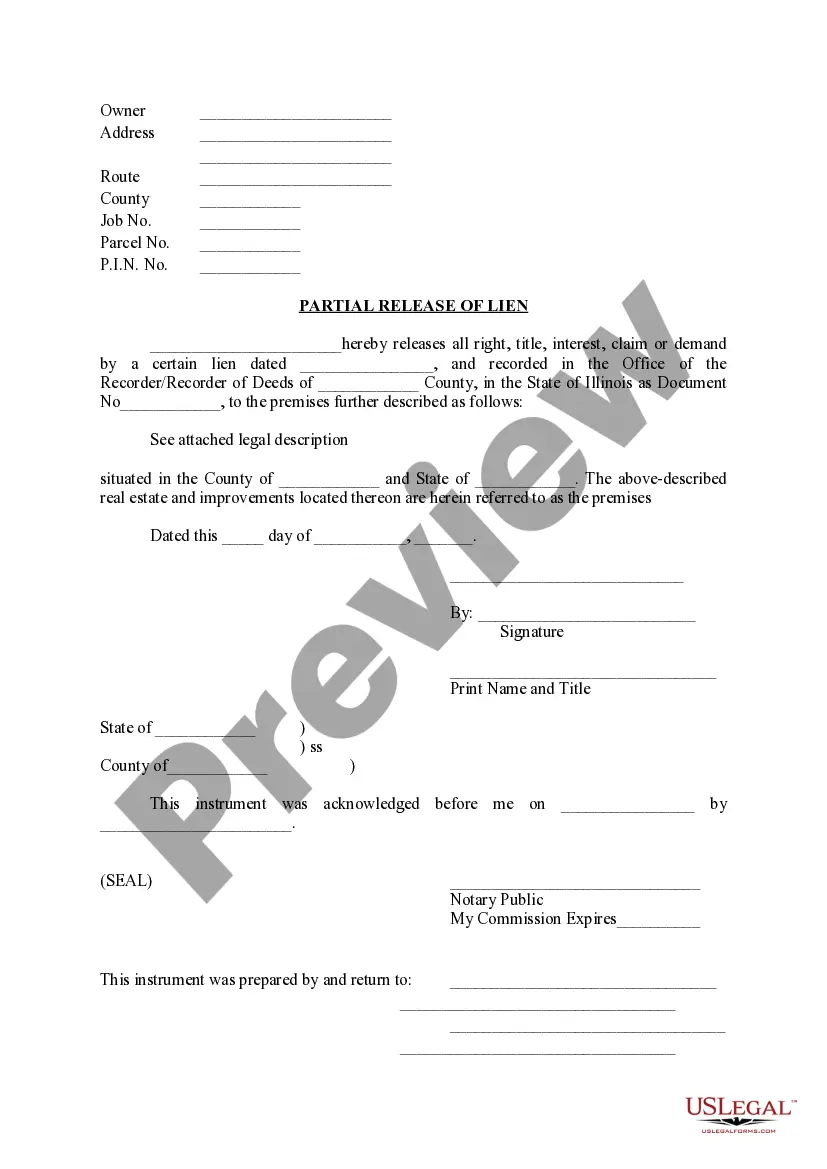

A Cook Illinois Partial Release of Lien refers to a legal document issued in Cook County, Illinois, that releases a portion of a property's lien. This release is typically requested when a property owner has made partial payments to a contractor or construction company for work completed but wants to release a portion of the lien that corresponds to the amount already paid. The Cook Illinois Partial Release of Lien plays a crucial role in protecting the rights of both the property owner and the contractor involved. By providing a partial release of the lien, the property owner can ensure that they are not burdened by the entire lien amount while still acknowledging the outstanding balance. At the same time, the contractor can secure their rights to claim remaining payments by retaining a portion of the lien. There are different types of Cook Illinois Partial Release of Lien based on the specific circumstances involved: 1. Partial Release of Lien for Partial Payment: This type of release is most commonly requested when a property owner has made partial payments to the contractor but still has an outstanding balance. It allows the property owner to release a portion of the lien equivalent to the amount already paid. 2. Partial Release of Lien for Progress Payments: In situations where a construction project involves regular progress payments, a property owner may request a partial release of lien corresponding to each payment made. This ensures that the contractor receives necessary payments while ensuring that the lien only covers the unpaid balance. 3. Partial Release of Lien for Disputed Amount: If a property owner and a contractor are involved in a payment dispute, they may enter into an agreement to release a portion of the lien corresponding to the undisputed amount. This type of release helps resolve disagreements while still protecting the rights of both parties. 4. Partial Release of Lien for Release Period: When a property owner and a contractor agree on a set period during which the lien will be released partially, they enter into a release of lien for a specific duration. This allows the property owner to sell or refinance the property within the agreed-upon period while acknowledging the outstanding balance. In conclusion, a Cook Illinois Partial Release of Lien is an important legal document that enables property owners and contractors to manage their financial obligations while protecting their respective interests. By utilizing various types of partial releases of lien, both parties can ensure a fair resolution in payment disputes and maintain the necessary financial security during construction projects.

A Cook Illinois Partial Release of Lien refers to a legal document issued in Cook County, Illinois, that releases a portion of a property's lien. This release is typically requested when a property owner has made partial payments to a contractor or construction company for work completed but wants to release a portion of the lien that corresponds to the amount already paid. The Cook Illinois Partial Release of Lien plays a crucial role in protecting the rights of both the property owner and the contractor involved. By providing a partial release of the lien, the property owner can ensure that they are not burdened by the entire lien amount while still acknowledging the outstanding balance. At the same time, the contractor can secure their rights to claim remaining payments by retaining a portion of the lien. There are different types of Cook Illinois Partial Release of Lien based on the specific circumstances involved: 1. Partial Release of Lien for Partial Payment: This type of release is most commonly requested when a property owner has made partial payments to the contractor but still has an outstanding balance. It allows the property owner to release a portion of the lien equivalent to the amount already paid. 2. Partial Release of Lien for Progress Payments: In situations where a construction project involves regular progress payments, a property owner may request a partial release of lien corresponding to each payment made. This ensures that the contractor receives necessary payments while ensuring that the lien only covers the unpaid balance. 3. Partial Release of Lien for Disputed Amount: If a property owner and a contractor are involved in a payment dispute, they may enter into an agreement to release a portion of the lien corresponding to the undisputed amount. This type of release helps resolve disagreements while still protecting the rights of both parties. 4. Partial Release of Lien for Release Period: When a property owner and a contractor agree on a set period during which the lien will be released partially, they enter into a release of lien for a specific duration. This allows the property owner to sell or refinance the property within the agreed-upon period while acknowledging the outstanding balance. In conclusion, a Cook Illinois Partial Release of Lien is an important legal document that enables property owners and contractors to manage their financial obligations while protecting their respective interests. By utilizing various types of partial releases of lien, both parties can ensure a fair resolution in payment disputes and maintain the necessary financial security during construction projects.