and first option to purchase

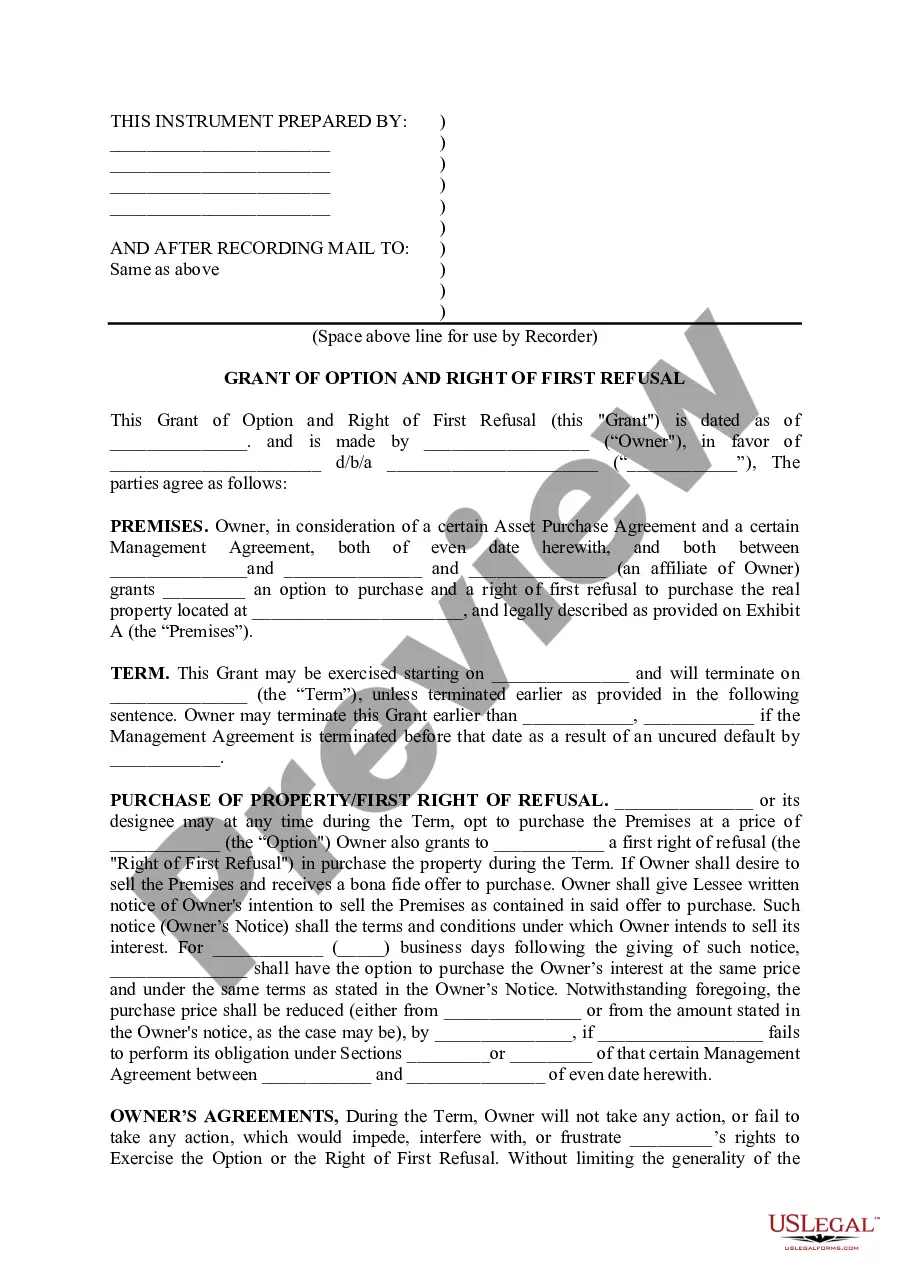

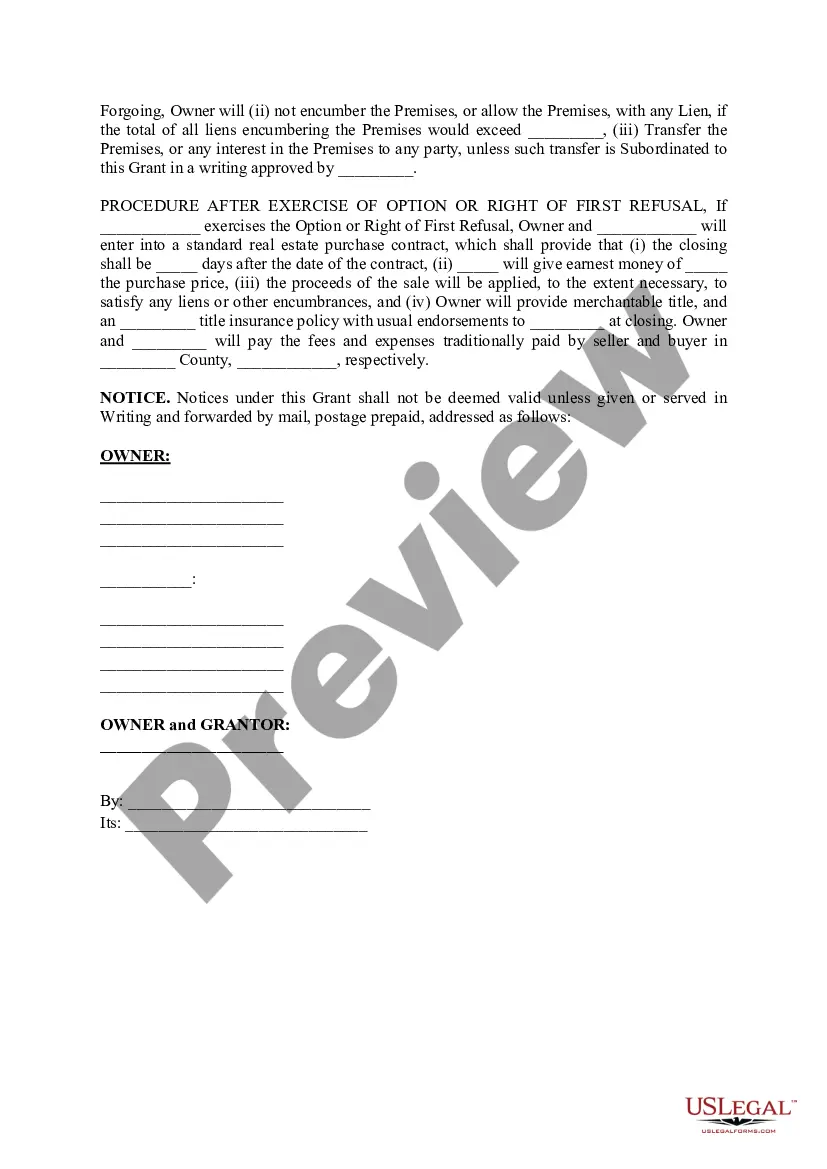

The Chicago Illinois Grant of Option and Right of First Refusal refers to a legal agreement or provision that grants someone the option to purchase or the first opportunity to buy a particular property or asset in the city of Chicago, Illinois. This agreement is often used in real estate transactions or business deals. The Grant of Option gives a specific individual or entity the right, but not the obligation, to purchase a property at a predetermined price within a specified period of time. This option is usually granted in exchange for a fee, known as an option fee, paid by the person granted the option. The option holder can choose to exercise the option and proceed with the purchase or let it expire without any further obligation. On the other hand, the Right of First Refusal gives a person or entity the first chance to purchase a property or asset before the owner accepts an offer from any other third party. If the property owner decides to sell, they are legally required to offer the property to the holder of the right of first refusal before entertaining other potential buyers. The holder of the right of first refusal then has the option to purchase the property on the same terms and conditions offered by the third party. In Chicago, the Grant of Option and Right of First Refusal can apply to various types of properties, including residential, commercial, and even vacant land. Different types of grants of option and right of first refusal can exist depending on the specific terms and conditions agreed upon by the parties involved. For example, there may be variations in the duration of the option period, the purchase price, or any specific conditions that need to be met for exercising the option. Overall, the Grant of Option and Right of First Refusal provides a legal mechanism for individuals or entities to secure the opportunity to purchase a property or asset in Chicago, Illinois. It ensures that the holder of the agreement has a certain level of control and priority in the transaction, providing a safeguard against potential competing offers and ensuring fairness in the buying process.