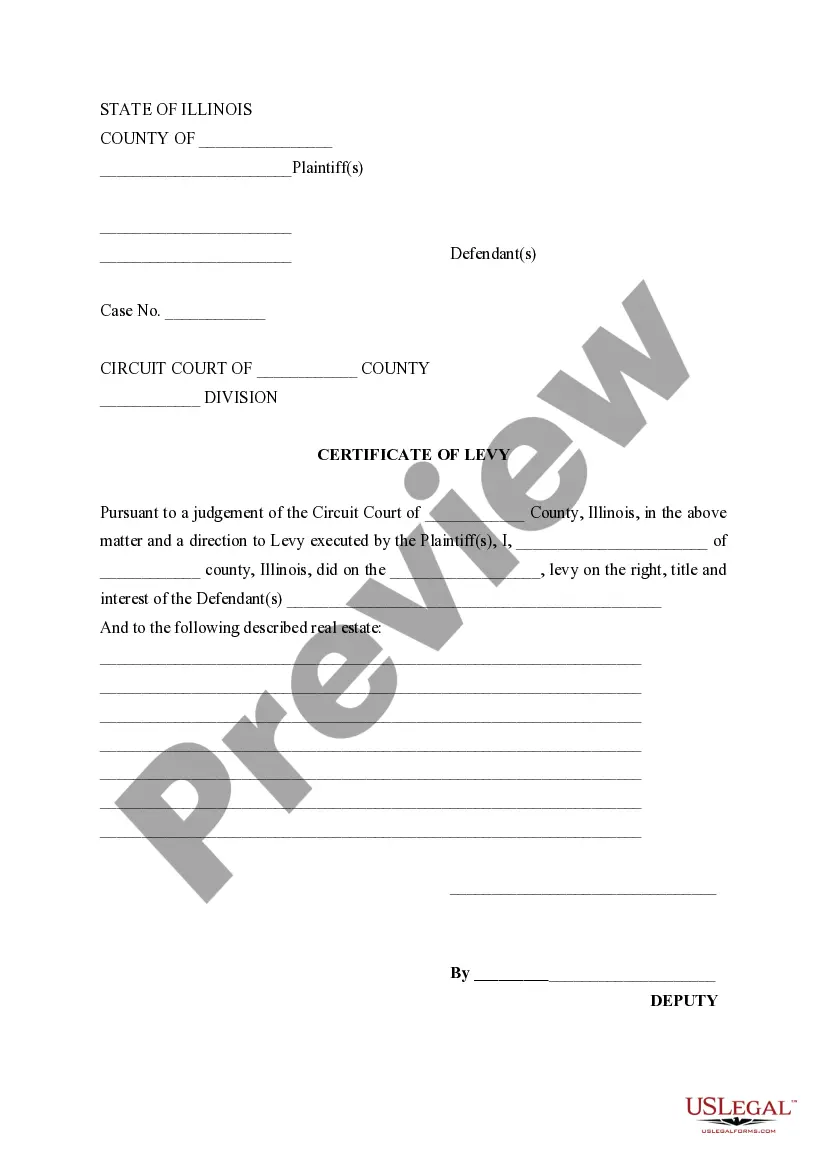

Elgin Illinois Certificate of Levy is a legal document issued by the Elgin City Council as a means to levy taxes on properties located within the city's jurisdiction. This certificate serves as a notification to property owners about the amount of taxes they owe based on their property's assessed value. The Elgin Illinois Certificate of Levy is an essential tool for the city to generate revenue necessary to fund various public services such as schools, infrastructure development, public safety, and other community initiatives. It plays a crucial role in maintaining and improving the quality of life for Elgin residents. Different types of Elgin Illinois Certificate of Levy include: 1. General Property Tax Levy: This is the most common type of certificate issued by the Elgin City Council. It outlines the tax obligations for residential, commercial, and industrial properties within the city limits. 2. Special Assessments: These certificates are specific to properties that require additional charges for special projects or improvements in a particular neighborhood or area. Examples of special assessments may include street repairs, sidewalk installations, sewer system upgrades, or beautification projects. 3. TIF (Tax Increment Financing) District Levy: TIF districts are designated areas where property taxes are utilized to finance redevelopment projects. The Elgin Illinois Certificate of Levy for TIF districts specifies the tax obligations for properties within these districts and how the revenue will be used for economic revitalization efforts. 4. Bond & Interest Levy: This certification is associated with the repayment of bonds issued by the city to fund major capital projects like constructing new facilities, improving infrastructure, or acquiring properties. The Elgin Illinois Certificate of Levy for bond and interest outlines the tax obligations to cover the costs of servicing the outstanding debts. The Elgin Illinois Certificate of Levy is an important component of the city's financial management system. It ensures transparency and accountability by providing property owners with a comprehensive breakdown of their tax obligations and how the funds will be allocated for the betterment of the community.

Elgin Illinois Certificate of Levy

Description

How to fill out Elgin Illinois Certificate Of Levy?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no legal background to create such papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service provides a massive library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Elgin Illinois Certificate of Levy or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Elgin Illinois Certificate of Levy quickly employing our reliable service. In case you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Elgin Illinois Certificate of Levy:

- Be sure the template you have found is good for your area since the regulations of one state or area do not work for another state or area.

- Preview the document and read a brief description (if provided) of cases the document can be used for.

- If the one you selected doesn’t suit your needs, you can start over and look for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account login information or create one from scratch.

- Choose the payment method and proceed to download the Elgin Illinois Certificate of Levy once the payment is done.

You’re all set! Now you can proceed to print the document or complete it online. In case you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

The tax rate in Elgin, Illinois, is approximately 2.3%, but it can vary based on local educational and municipal funding needs. Every property owner should be aware of the specific tax rates that affect their property. You can use an Elgin Illinois Certificate of Levy to obtain detailed information about property tax obligations in your area. Staying updated on these rates ensures you can budget adequately.

In Illinois, there is no definitive age at which you stop paying property taxes altogether. However, seniors over the age of 65 may qualify for certain exemptions that reduce their property tax burden. Utilizing the Elgin Illinois Certificate of Levy can provide clarity on available exemptions and how they might benefit you. It's always wise to consult local guidelines to explore these options further.

In Kane County, the property tax rate is generally similar to Elgin's, fluctuating around 2.3% to 2.5% depending on the specific municipality. It is essential for property owners to check the most current rates to ensure accurate budgeting. Utilizing the Elgin Illinois Certificate of Levy can help you understand how your tax obligations are calculated and what exemptions might apply. Keeping informed about local tax regulations will keep you ahead.

A tax levy in Illinois is a legal action taken by the government to collect unpaid taxes from individuals or businesses. This process can lead to the seizure of assets, including wages and bank accounts, to satisfy tax debts. If you are dealing with an Elgin Illinois Certificate of Levy, it is crucial to act swiftly to rectify your tax situation. By seeking guidance and understanding your options, you can mitigate the impact of such actions.

A tax levy on your paycheck occurs when the government takes a portion of your wages to settle unpaid taxes. This action can happen unexpectedly, often related to unresolved tax liabilities. If you find yourself facing an Elgin Illinois Certificate of Levy, consider taking steps to address your tax obligations. Resources like the US Legal Forms platform can guide you through the required steps to resolve these issues.

Levying a tax refers to the government's legal process of asserting a claim against property to collect unpaid taxes. This action can involve seizing assets or garnishing wages. If you are facing the possibility of an Elgin Illinois Certificate of Levy, it's important to understand your rights and possible resolutions. Consulting with professionals can help you navigate this situation smoothly.

In Elgin, Illinois, the current tax rate is influenced by various factors, including local government budgeting and taxing authorities. Homeowners should expect to see a property tax rate that generally aligns with state averages, often between 2 and 3 percent. It's beneficial to track any changes in tax rates to prevent receiving an unwanted Elgin Illinois Certificate of Levy. Being proactive can safeguard your financial health.

The average property tax rate in Elgin, Illinois, typically ranges around 2 to 3 percent of the property's assessed value. This rate can vary based on local government needs and assessment practices. Stay informed about your property’s value and tax obligations to avoid complications like an Elgin Illinois Certificate of Levy. Regularly checking your tax information can help ensure you stay ahead.

When you receive a tax levy, it means the government has legally claimed your property to satisfy unpaid tax debts. This action can lead to your wages being garnished, bank accounts being frozen, or property being seized. Understanding how this process works is crucial, especially if you are dealing with an Elgin Illinois Certificate of Levy. Taking timely action can help you resolve the situation before it escalates.

Having a tax levy means that the government has taken legal action to collect outstanding taxes by seizing assets or income. This process can impact your financial health, so it is crucial to address it without delay. For residents in Elgin, Illinois, understanding the implications of a tax levy and utilizing resources like US Legal Forms can facilitate a smoother resolution to your tax issues.

More info

United States. Congress. The levy reflects a 4.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.