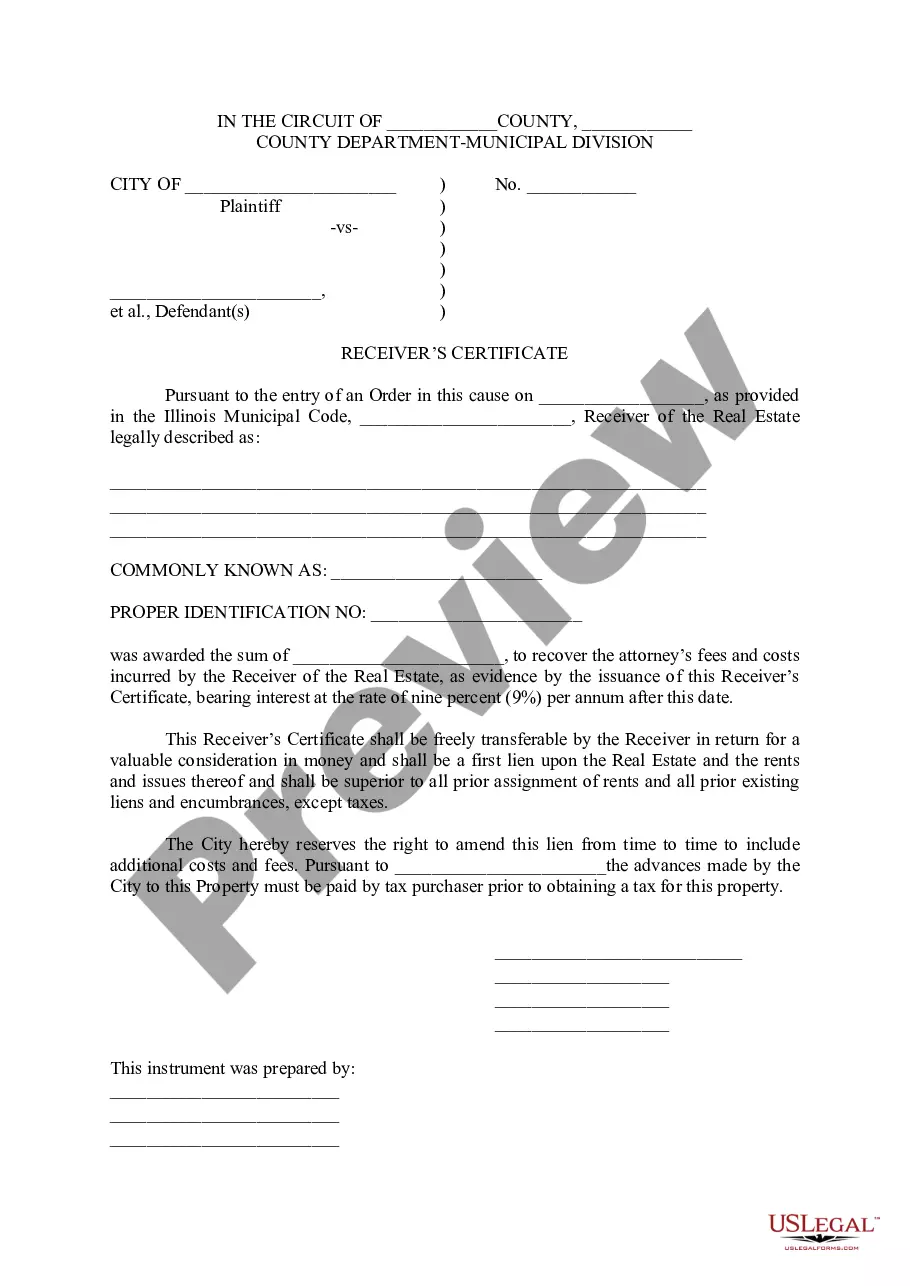

The Naperville Illinois Receiver's Certificate is a legal document issued by the government of Naperville, Illinois, which certifies the authorized receiver of specified funds or properties. This certificate serves as proof of entitlement and offers legal protection to the receiver. The main purpose of the Naperville Illinois Receiver's Certificate is to ensure transparency and accountability in financial transactions involving the city and its residents. It signifies that the designated person or organization has been authorized by the relevant authorities to receive funds, assets, or any other form of payment on behalf of the city. The Naperville Illinois Receiver's Certificate is commonly used in various scenarios such as tax refunds, insurance claims, real estate transactions, and government grants. It acts as a reassurance to financial institutions, businesses, and individuals that the receiver's claim is valid and recognized by the city. Different types of Naperville Illinois Receiver's Certificates may include: 1. Tax Receiver's Certificate: This document is issued to authorize the designated person or entity to receive tax refunds on behalf of the city of Naperville. It ensures that the funds are distributed to the rightful recipients and adhere to the city's tax regulations. 2. Estate Receiver's Certificate: This type of certificate is used when a deceased person's estate needs to be transferred to the designated receiver. It ensures that the assets and properties of the deceased are transferred lawfully, following the guidelines outlined by the city. 3. Grant Receiver's Certificate: When the city of Naperville receives a grant, especially from the government or external organizations, this certificate is issued to establish the authorized receiver of the grant funds. It ensures that the funds are utilized as intended and in accordance with the terms and conditions of the grant. 4. Property Receiver's Certificate: In real estate transactions, this certificate is issued to authorize the receiver to obtain ownership or possess specific properties on behalf of the city. It serves as proof of the receiver's right to manage the property and perform related actions such as collecting rent or making improvements. It is important to note that the specific types of Naperville Illinois Receiver's Certificates may vary depending on the circumstances and requirements outlined by the city's government. Therefore, individuals or organizations seeking such certificates should closely follow the guidelines provided by the appropriate authorities to ensure a smooth and lawful process.

Naperville Illinois Receiver's Certificate

Description

How to fill out Naperville Illinois Receiver's Certificate?

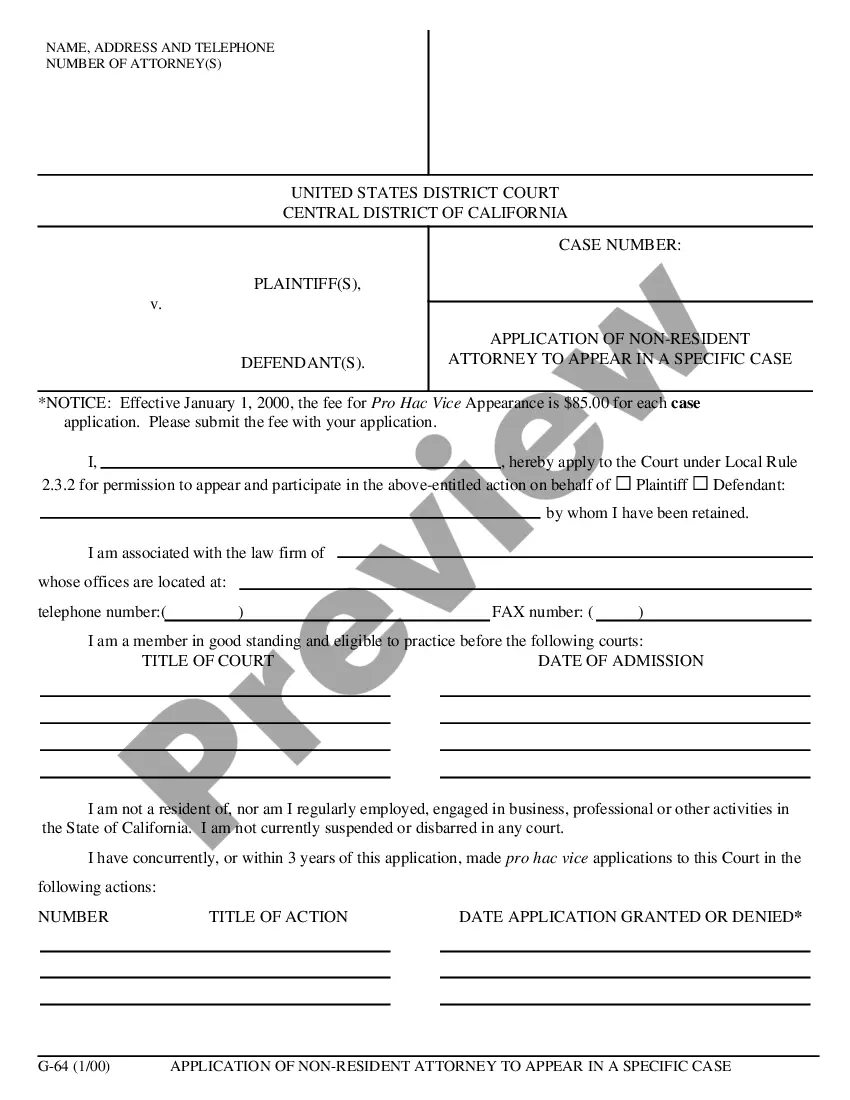

If you are looking for a valid form, it’s extremely hard to choose a more convenient platform than the US Legal Forms site – one of the most comprehensive online libraries. With this library, you can get thousands of document samples for business and individual purposes by categories and regions, or key phrases. Using our high-quality search function, discovering the newest Naperville Illinois Receiver’s Certificate is as elementary as 1-2-3. In addition, the relevance of each file is proved by a team of skilled lawyers that on a regular basis review the templates on our website and revise them based on the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Naperville Illinois Receiver’s Certificate is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the form you need. Check its explanation and utilize the Preview function (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the appropriate document.

- Affirm your decision. Click the Buy now button. Following that, pick the preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Get the template. Choose the format and download it to your system.

- Make changes. Fill out, modify, print, and sign the acquired Naperville Illinois Receiver’s Certificate.

Each template you save in your user profile has no expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you need to receive an extra duplicate for enhancing or printing, you can come back and export it again anytime.

Make use of the US Legal Forms professional library to gain access to the Naperville Illinois Receiver’s Certificate you were seeking and thousands of other professional and state-specific samples in a single place!

Form popularity

FAQ

Retail Sales Tax Taxing BodyGeneral MerchandiseFood for Immediate ConsumptionState of Illinois7.00%7.00%Naperville (HRST)0.75%0.75%Naperville (Food & Beverage Tax)0.00%1.00%Total7.75%8.75%

Zip code 60540 is located in Naperville, Illinois. The 2022 sales tax rate in Naperville is 7.75%, and consists of 6.25% Illinois state sales tax, 0.75% Naperville city tax and 0.75% special district tax.

Who needs to purchase a transfer tax stamp? Buyers of residential or commercial properties in Naperville located within city limits are responsible for purchasing the tax stamp by City ordinance.

Taxes in Naperville, Illinois The sales tax rate in Naperville, Illinois is 8.3%. Last year, the average property taxes paid was 2.2% Naperville, Illinois. The state income tax in the state of Illinois is 4.95%.

138 and House Bill 367, that the DuPage County Board hereby imposes a. tax upon the privilege of transferring title to real estate as represented. by the deed that is filed for recordation at a rate of 25 cents per each. $500 of value or fraction thereof, stated in the declaration required by.

Property Taxes Tax Levy Year20172019Average Home Value$393,000$409,000EAV of Home$131,000$136,400City Property Tax0.68150.6937Property Tax Paid to the City of Naperville by Average Homeowner$817.71$869.241 more row

6.25 percent on general merchandise, including items required to be titled or registered by an agency of Illinois state government; and.

Tax Rate: $5.25 per $500.00 of the transfer price, or fraction thereof, of the real property or the beneficial interest in real property. In general, The Buyer is responsible for $3.75 and the Seller is responsible for $1.50.

Dupage County has no county-level sales tax, and all sales in Dupage County are also subject to the 6.25% Illinois sales tax. Cities, towns, and special districts within Dupage County collect additional local sales taxes, with a maximum sales tax rate in Dupage County of 10.5%.

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.