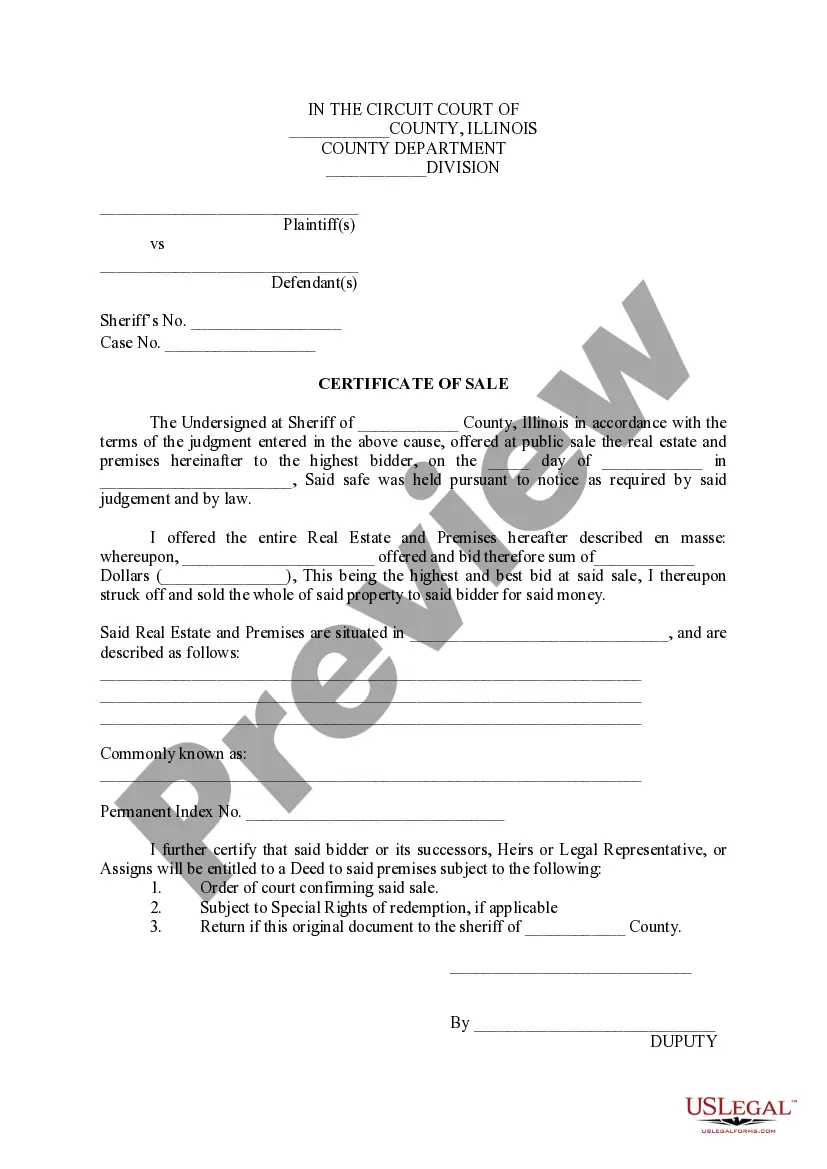

The Cook Illinois Certificate of Sale is a legal document that signifies the transfer of ownership of a property from the previous owner to a new buyer through a public auction. This document is commonly used in Cook County, Illinois, as a means to enforce the collection of delinquent property taxes. The Cook Illinois Certificate of Sale serves as evidence that the property has been sold to satisfy outstanding tax debts owed to the county government. When property owners fail to pay their property taxes for a specified period, the county places a tax lien on the property. If the taxes remain unpaid, the county may then conduct a tax sale, also known as a tax lien auction or certificate sale. During this auction, potential buyers bid on the tax liens of delinquent properties. The highest bidder at the auction is granted a Cook Illinois Certificate of Sale, which represents their claim on the property and their right to receive the outstanding tax debt, along with any accrued interest and penalties. This certificate is typically issued to the successful bidder shortly after the auction concludes. The Cook Illinois Certificate of Sale contains essential information about the sale, including the legal description of the property, the amount of the winning bid, the name of the purchaser, and the date of the sale. It is a crucial legal document that protects the rights of both the county government and the buyer. There are different types of Cook Illinois Certificate of Sale, depending on the specific circumstances of the sale. These may include: 1. Tax Lien Certificate: This type of certificate is issued when a buyer purchases the tax lien on a property but does not gain immediate ownership rights. Instead, the buyer holds a lien against the property and has the opportunity to collect the unpaid taxes, interest, and penalties from the property owner. If the property owner fails to redeem the tax lien within a specified redemption period, the buyer may proceed with foreclosure and acquire the property. 2. Tax Deed Certificate: In certain cases, if the property owner fails to redeem the tax lien within the designated redemption period, the buyer may request a tax deed, also known as a tax sale deed. This certificate grants the buyer direct ownership of the property, allowing them to take full possession and control. 3. Assignment of Certificate: When the original buyer of a Cook Illinois Certificate of Sale wishes to transfer their rights to another party, they may execute an assignment of certificate. This document legally transfers the buyer's claim on the property to the assignee, enabling them to pursue redemption or foreclosure. In summary, the Cook Illinois Certificate of Sale is a critical document that encompasses various types, including tax lien certificates, tax deed certificates, and assignments of certificates. These certificates facilitate the sale of properties acquired through tax auctions, ensuring the collection of delinquent property taxes and providing the necessary legal framework for property ownership transfers in Cook County, Illinois.

Cook Illinois Certificate of Sale

Description

How to fill out Cook Illinois Certificate Of Sale?

Make use of the US Legal Forms and get instant access to any form you want. Our helpful platform with thousands of document templates makes it simple to find and get almost any document sample you need. You are able to download, fill, and sign the Cook Illinois Certificate of Sale in just a couple of minutes instead of browsing the web for many hours attempting to find a proper template.

Utilizing our library is a superb way to raise the safety of your document submissions. Our professional legal professionals regularly check all the records to make certain that the forms are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Cook Illinois Certificate of Sale? If you have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Open the page with the template you need. Make certain that it is the form you were seeking: verify its title and description, and take take advantage of the Preview option if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the downloading process. Select Buy Now and choose the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the file. Choose the format to obtain the Cook Illinois Certificate of Sale and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable template libraries on the internet. Our company is always ready to assist you in any legal case, even if it is just downloading the Cook Illinois Certificate of Sale.

Feel free to take advantage of our form catalog and make your document experience as straightforward as possible!

Form popularity

FAQ

Any business intending to sell or lease taxable goods or services in the state of Illinois is required to obtain a Certificate of Registration or License, sometimes referred to generically as a seller's permit.

To register as a reseller, you may choose one of the following options: Register electronically using MyTax Illinois. Complete and mail Form REG-1, Illinois Business Registration Application. Visit a regional office.

Illinois sells property tax liens at public auctions, and you can start buying Illinois Tax Liens and make big profits if you know the rules and do your homework.

To register as a reseller, you may choose one of the following options: Register electronically using MyTax Illinois. Complete and mail Form REG-1, Illinois Business Registration Application. Visit a regional office.

File a petition for a tax deed. If the redemption period expires and the owner has not paid the delinquent property taxes, start a lawsuit in the circuit court where the property is located. Ask the judge to order the county clerk to issue a tax deed in your name.

Delinquency lists in electronic format will be available for purchase online at as of October 7, 2022 via an ACH debit to a checking or savings account for the following amounts: Delinquent General Real Estate Tax List $250.

It is free to apply for a sales tax permit in Illinois. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business. 6.

Registration for the Annual Tax Sale begins October 7, 2022. Registration is completed online at . You may register at any time between October 7, 2022 and November 4, 2022.

In order to become a business that is authorized to purchase merchandise that is exempt from tax, you will need to obtain either a retailer account ID number or a reseller resale number. Once you have obtained your number, you will need to complete the State of Illinois Form CRT-61 Certificate of Resale.

Apply for any additional statewide license(s) you need. Apply for the Certificate of License or the Certificate of Registration from the Illinois state government website. This seller's permit is required if you are selling or leasing taxable goods or services in the state of Illinois.