Cook Illinois Deed In Trust is a legal document that allows property owners in Cook County, Illinois to transfer ownership of their property into a trust. This trust, known as a Cook Illinois Deed In Trust, provides various benefits and protections to the property owner and their beneficiaries. By understanding the concept of Cook Illinois Deed In Trust, one can better navigate the complexities of real estate transactions in Cook County. When a property owner decides to utilize a Cook Illinois Deed In Trust, they transfer the legal title of the property to a trustee, who holds the property on behalf of the beneficiary. The trustee can be an individual or a corporate entity designated by the property owner. This transfer of ownership creates a separation between the legal title and the equitable interest of the property. As a result, the property owner retains control and benefits of the property while minimizing certain risks and enjoying potential tax benefits. There are various types of Cook Illinois Deed In Trust that property owners can choose from based on their specific needs and goals. One type is the "revocable Cook Illinois Deed In Trust," which allows the property owner to maintain control over the property and make changes or even revoke the trust at any time. This type of trust is commonly used for estate planning purposes, as it allows the seamless transfer of assets upon the property owner's death, avoiding probate and potential challenges to the estate. Another type of Cook Illinois Deed In Trust is the "irrevocable Cook Illinois Deed In Trust." As the name suggests, this type of trust cannot be altered or revoked once it is established, providing a higher level of asset protection. By placing the property in an irrevocable trust, the property owner may be able to protect it from potential creditors, lawsuits, or from being considered an asset in Medicaid eligibility calculations. Additionally, there is a type of Cook Illinois Deed In Trust called the "land trust." This trust allows for anonymity as the beneficiaries' identities are not publicly disclosed, maintaining the privacy of the property owner. The land trust also streamlines the transfer of property interests, making it easier to buy or sell real estate without having to change the title of the property. In summary, a Cook Illinois Deed In Trust is a valuable legal tool for property owners in Cook County, Illinois. It offers a range of benefits, including probate avoidance, asset protection, tax advantages, and privacy. By understanding the different types of Cook Illinois Deed In Trust, property owners can choose the trust that best suits their individual circumstances and goals.

Cook Illinois Deed In Trust

State:

Illinois

County:

Cook

Control #:

IL-LR171T

Format:

Word;

Rich Text

Instant download

Description

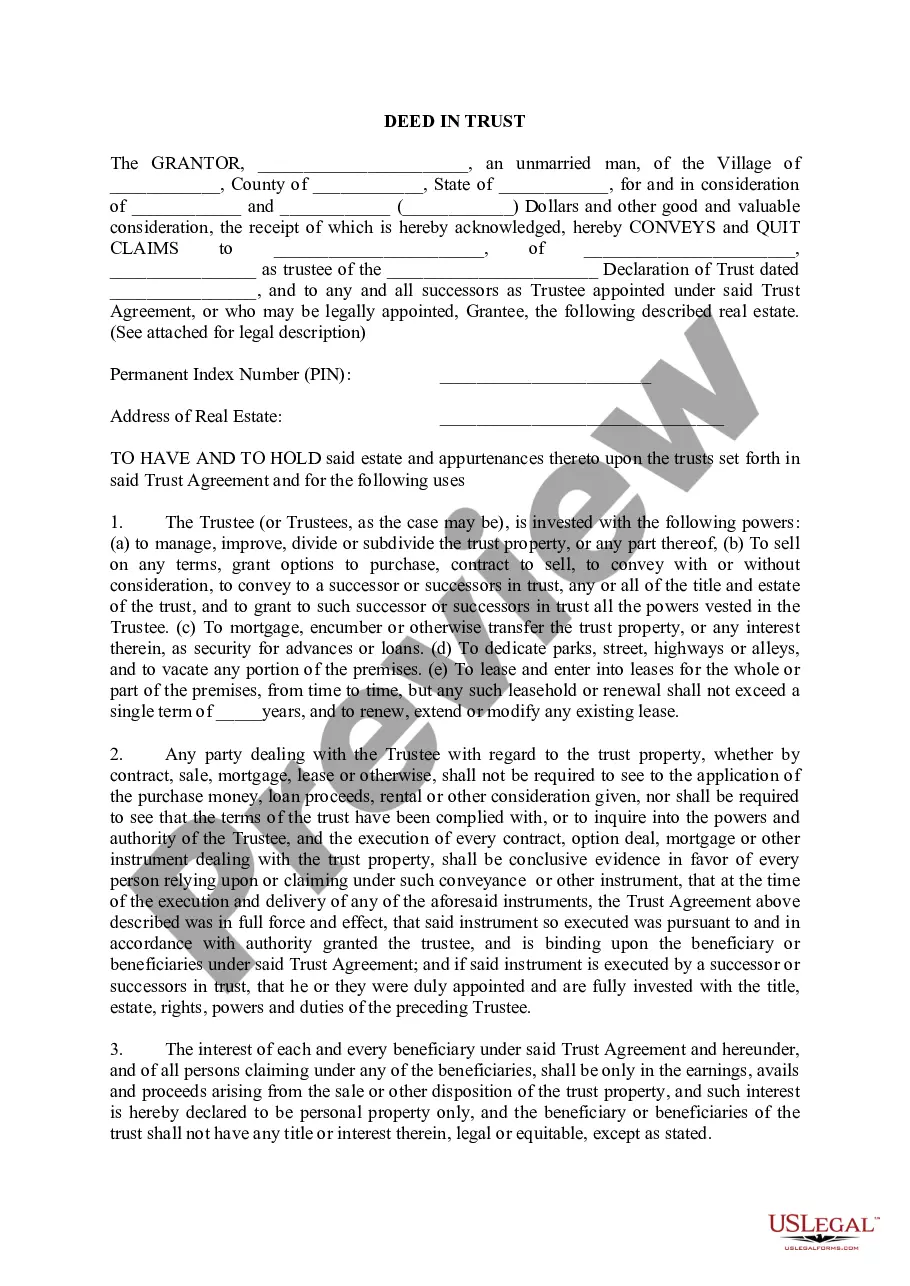

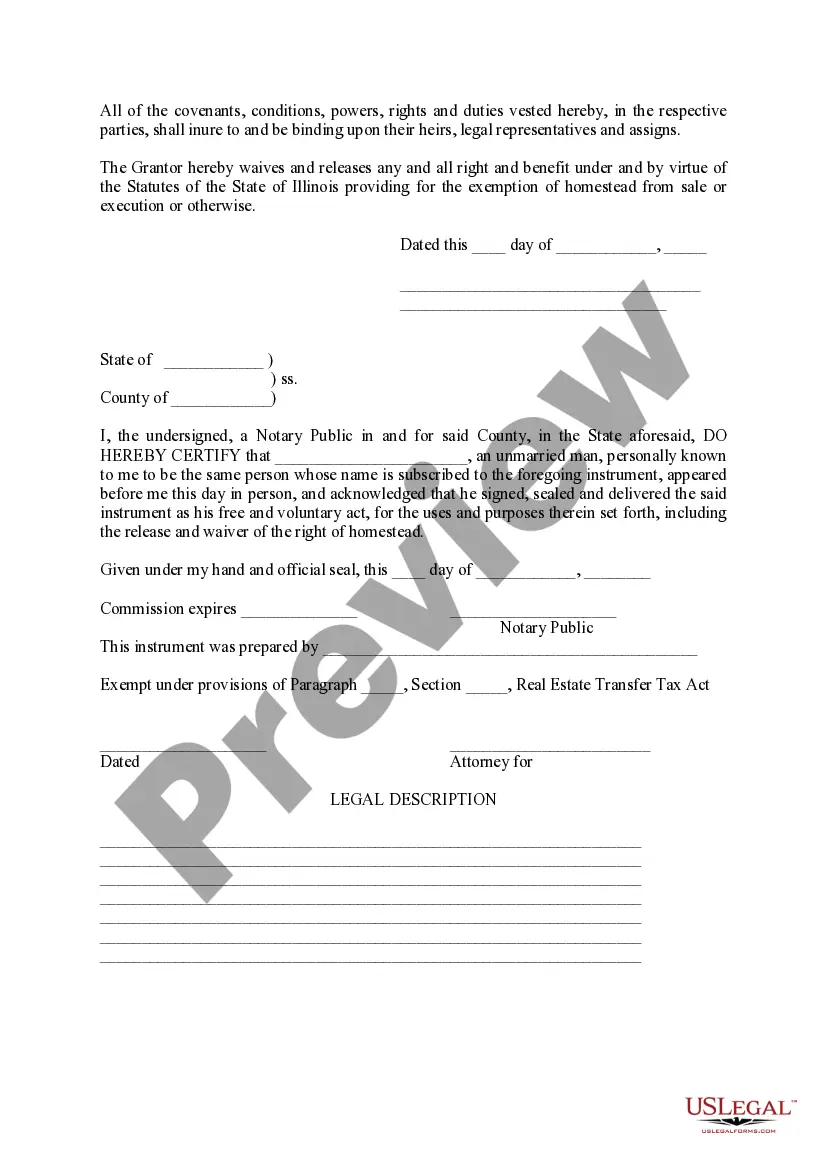

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee.

Cook Illinois Deed In Trust is a legal document that allows property owners in Cook County, Illinois to transfer ownership of their property into a trust. This trust, known as a Cook Illinois Deed In Trust, provides various benefits and protections to the property owner and their beneficiaries. By understanding the concept of Cook Illinois Deed In Trust, one can better navigate the complexities of real estate transactions in Cook County. When a property owner decides to utilize a Cook Illinois Deed In Trust, they transfer the legal title of the property to a trustee, who holds the property on behalf of the beneficiary. The trustee can be an individual or a corporate entity designated by the property owner. This transfer of ownership creates a separation between the legal title and the equitable interest of the property. As a result, the property owner retains control and benefits of the property while minimizing certain risks and enjoying potential tax benefits. There are various types of Cook Illinois Deed In Trust that property owners can choose from based on their specific needs and goals. One type is the "revocable Cook Illinois Deed In Trust," which allows the property owner to maintain control over the property and make changes or even revoke the trust at any time. This type of trust is commonly used for estate planning purposes, as it allows the seamless transfer of assets upon the property owner's death, avoiding probate and potential challenges to the estate. Another type of Cook Illinois Deed In Trust is the "irrevocable Cook Illinois Deed In Trust." As the name suggests, this type of trust cannot be altered or revoked once it is established, providing a higher level of asset protection. By placing the property in an irrevocable trust, the property owner may be able to protect it from potential creditors, lawsuits, or from being considered an asset in Medicaid eligibility calculations. Additionally, there is a type of Cook Illinois Deed In Trust called the "land trust." This trust allows for anonymity as the beneficiaries' identities are not publicly disclosed, maintaining the privacy of the property owner. The land trust also streamlines the transfer of property interests, making it easier to buy or sell real estate without having to change the title of the property. In summary, a Cook Illinois Deed In Trust is a valuable legal tool for property owners in Cook County, Illinois. It offers a range of benefits, including probate avoidance, asset protection, tax advantages, and privacy. By understanding the different types of Cook Illinois Deed In Trust, property owners can choose the trust that best suits their individual circumstances and goals.

Free preview

How to fill out Cook Illinois Deed In Trust?

If you’ve already utilized our service before, log in to your account and save the Cook Illinois Deed In Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Cook Illinois Deed In Trust. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!